- Prompt payment is important for any business, and payment reminders can be an effective tool to ensure clients pay on time.

- Payment reminder emails should be polite and professional, providing clear information about the payment due date and amount owed.

- It’s important to follow up consistently and in a timely manner, and to provide clients with multiple payment options to make it easy for them to pay.

There are many ways to bill your client, but what if they don’t pay? Naturally, you’ll want to collect your money—and there’s no better way than with a thoughtfully written client payment reminder email.

Nobody enjoys late payments, they cause you to be anxious, it worsens your cashflow, and you have to figure out how to clear the outstanding invoice. The easiest way is to set up invoice reminders that go out automatically. But how do you formulate them in a nice, yet effective way? That’s what I’ll teach you in this blog post.

Best practices for payment reminders

Payment reminders are important for preventing late payments. But, sending generic reminders that don't engage customers can be harmful. Here are five best practices you should follow.

Escalate effectively

In situations where payments are late or missing, follow these escalation steps:

Initial contact: Reach out to customers via phone, email, or mail to inquire about payment status and provide clear instructions.

Follow-up: Schedule recurring reminders at increasingly shorter intervals (e.g., weekly, bi-weekly) until the issue is resolved.

Account analysis: Review customer accounts for any potential issues or factors contributing to non-payment.

Segmenting customers

By categorizing customers according to their characteristics and payment behaviors, you can customize communication strategies to effectively engage each group.

Consider these factors when segmenting customers:

Payment history: Separate customers who have a history of timely payments from those who tend to be late or delinquent.

Communication preferences: Identify customers who prefer email reminders versus phone calls or text messages.

Behavioral patterns: Segment customers based on their behavior, such as frequent missed payments or changes in payment methods.

Use the right tone

Tone is essential when writing payment reminder emails. An effective tone can:

Demonstrate empathy and understanding

Avoid blame or aggression

Provide solutions and alternatives

Consider the following questions when composing a payment reminder email:

What is the main objective of this email?

Who is the recipient (customer name, title, company)?

Is there a specific call-to-action (CTA) to include?

Create effective CTAs

When crafting payment reminder emails, the call to action (CTA) is frequently overlooked. Nevertheless, it is crucial for boosting engagement and minimizing delinquency.

Consider these best practices for designing effective CTAs:

Clear and concise: Use simple language that clearly communicates the desired action.

Prominent placement: Place the CTA above or below the fold to maximize visibility.

Action-oriented verbs: Use action-oriented verbs like “Pay now” or “Make a payment.”

Maintain client relationships

Addressing non-payments can be challenging, but it’s important to maintain a positive relationship with customers:

Empathize: Recognize the situation and show understanding.

Provide support: Offer help in resolving payment issues or suggest alternative solutions.

Communicate effectively: Clearly explain expectations, deadlines, and any changes.

The psychology behind effective reminders

Understanding the psychological principles that drive payment behavior can help you craft more effective reminders:

Loss aversion: People respond more strongly to potential losses than gains. Instead of “Pay now to continue service,” try “Avoid service interruption by paying your invoice.”

Urgency principle: Adding a specific deadline creates action. “Please pay by Thursday” performs better than “Please pay soon.”

Reciprocity effect: Remind clients of value already delivered. “We’ve helped improve your rankings by 32% this quarter” reinforces the value exchange.

Social proof: Subtle references like “Join our other clients who maintain current accounts” can be effective for repeat late-payers.

How many reminders to send

When it comes to sending an invoice to a client, you expect it to be paid. But it happens for a variety of reasons—and you need to remind the client of the outstanding payment. Chasing clients for payment is never fun, though. So what is the solution? Sending automated reminders.

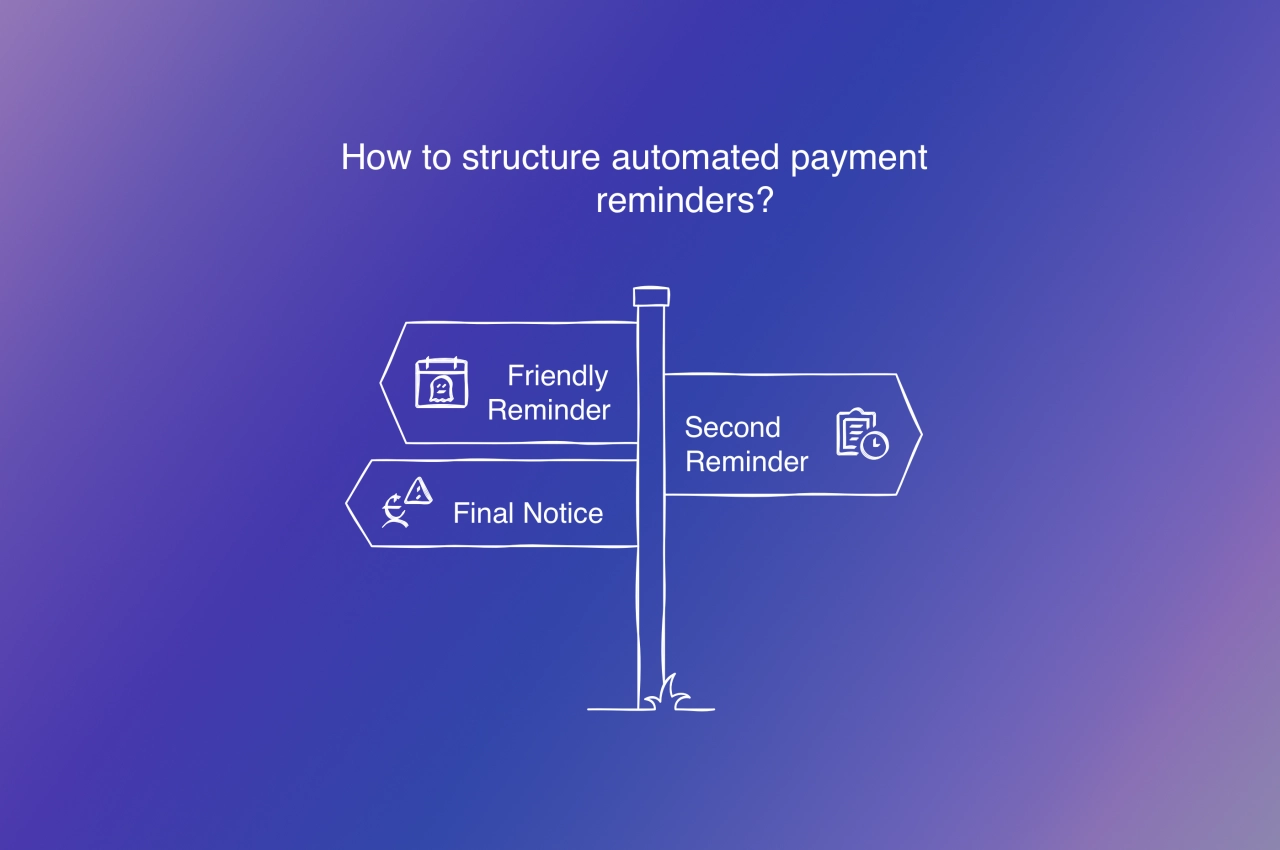

When and how many reminders should you send to increase your chances of receiving payment, though? While there’s no ideal number, about two or three automated reminders are a good rule of thumb.

Here’s what to keep in mind:

Keep the first reminder as friendly as possible. The client might have simply forgotten to make the invoice payment, and there’s no big urgency yet.

Remind the customer that the payment is already a week late, and attach/link to the original invoice to save time.

By this time, you need to be more strict and send a final notice that is clear about what happens if the invoice remains unpaid.

The exact timing of the emails should depend on your business activities and contracts between yourself and clients.

Is your reminder system working?

Track these three simple metrics to optimize your payment collection:

Average days to payment: Total days between invoice due date and payment ÷ Number of invoices Target: Under 5 days after due date

Reminder success rate: Number of payments received within 48hrs of reminder ÷ Total reminders sent Target: Above 65%

Escalation percentage: Number of clients requiring final notice ÷ Total clients invoiced Target: Below 5%

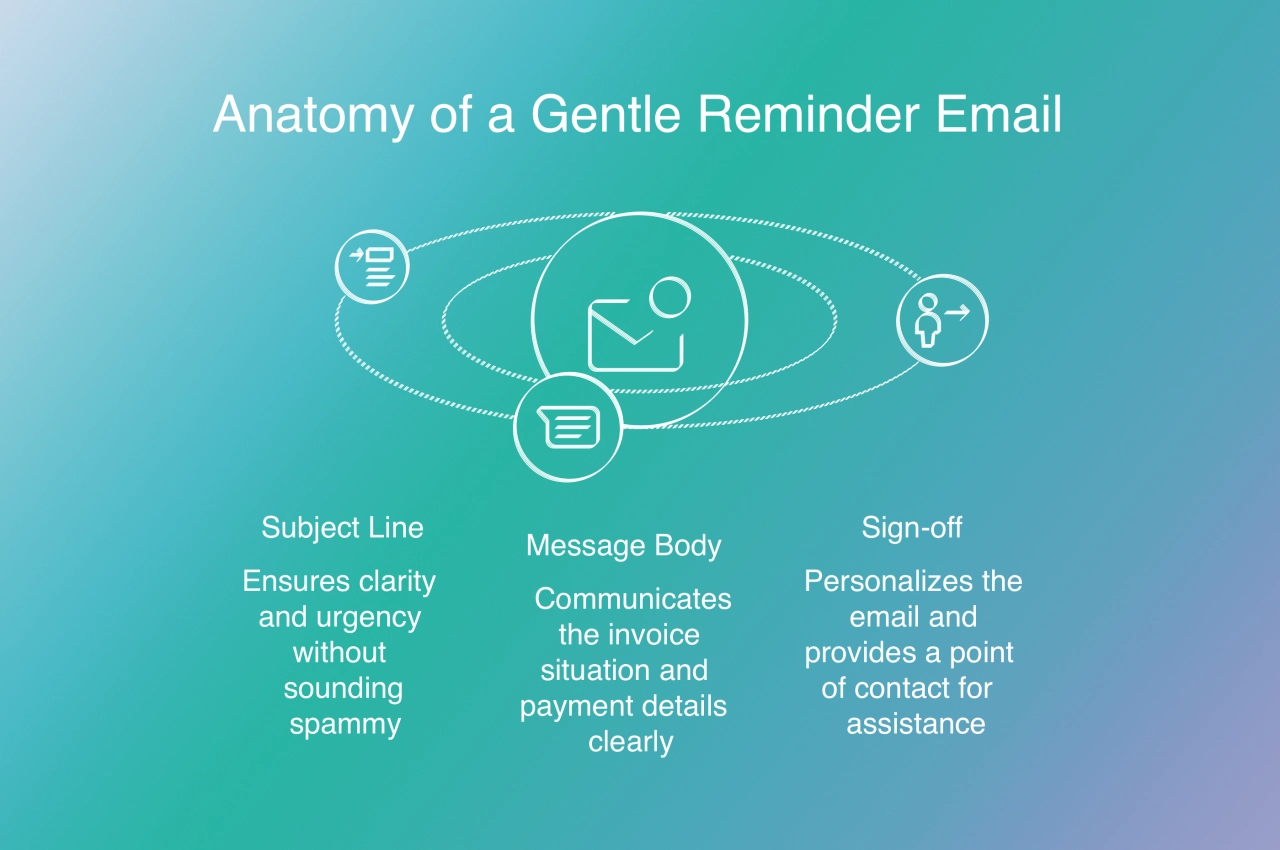

The structure of a gentle reminder email

Let’s look at how an email is structured, and what to keep in mind when writing it to ensure that it’s effective.

Subject line: Keep the subject line short, make it clear, and reference your company/invoice number. If a payment is very late, start the subject with “OVERDUE.” Avoid words like “URGENT” as they are often used by spammers, and might lead to your email being ignored.

Message: Greet your client with a simple hello to keep it professional yet friendly. Don’t distract from unimportant things and get straight to the point by explaining the situation, namely that an invoice has been issued, and it was due for payment (some time ago). Make sure that all payment details are clearly visible, including next steps to pay. Ideally, include a link how to pay the invoice, such as a link to your client portal.

Sign-off: Even if your email is sent from a generic company email (support@ or billing@), it might be a good idea to sign it off with the name of a person responsible for invoices. It’s an easy way for clients to know who to address if they require assistance.

Payment reminder email templates

Overdue invoices can rarely be avoided. Sooner or later, someone will simply not pay the invoice when it’s due. Before that happens, you should have templates for overdue payments in place. But what should you write in your email?

Here are a few things you should make clear when asking clients for payment.

Before payment is due

Sending a reminder before the due date is not a must, but it can make sense. For instance, many of our customers rely on recurring subscriptions, so it can be a good idea to remind clients of an upcoming payment.

Make sure to highlight the payment due date in the email.

invoice outstanding {#invoice_number}

Hi, {first_name}

This is a quick reminder that invoice for {service_name} is due on {date}. You can access the invoice and pay it by clicking on the following link: {link}

{invoice_link}

Please reply to this email if you have questions or require assistance.

All the best,

When payment is due

If a payment is due today, you should let the client know in the subject line, but also attach a copy of the invoice (or allow them to download it easily).

invoice {#invoice_number} due now

Hi, {first_name}

This email is to remind you that invoice for {service_name} is due today. You can access the invoice and pay it by clicking on the following link {link}:

{invoice_link}

Please reply to this email if you have questions or require assistance.

All the best,

For overdue payments

If you’re yet to receive your payment, you need to send a reminder. Keep it professional and friendly though because there could be many reasons for your client not paying the invoice. Maybe they forgot, maybe their card didn’t work. With that said, if your payment terms include late fees, remind your client about them.

invoice overdue {#invoice_number}

Hi, {first_name}

This is a reminder that invoice for {service_name} was due on {date}. Please make the payment as soon as possible by accessing the following link: {link}

{invoice_link}

All the best,

For one month overdue payments

If a month has passed and your invoices are still outstanding, you need to make the subject line more urgent by including the new deadline. It might also help to include more information, such as the amount due.

Pay invoice {#invoice_number} by {deadline}

Hi, {first_name}

This is a friendly reminder that your payment for invoice # {invoice_number), dated {date}, was due on {due_date}.

As we have not received your payment yet, please find below some information:

- Outstanding amount: ${amount}

- Instructions: You can make a payment by clicking this link: {link}

To avoid any additional charges, please settle your outstanding balance as soon as possible.

Best regards,

For a last effort email

Consider this the last friendly, but stern reminder of an outstanding invoice. You need to make clear that you’ll take legal action if the invoice remains unpaid.

final notice for {#invoice_number}

Hi, {first_name}

This is our final notice regarding the outstanding balance for invoice # {invoice_number), dated {date}, that was due on {due_date}.

Despite previous reminders, we have not received your payment.

As a result, we will be forced to take further action to collect the debt. We kindly request that you settle this amount within 48 hours to avoid any additional charges or consequences.

Best regards,

Template customization by agency type

While the core templates above work for most situations, here are key elements to customize based on your agency type:

Agency Type | Key Reminder Elements | Example Language |

|---|---|---|

SEO | Mention ongoing campaign momentum | “To maintain your keyword ranking progress and ensure continued SEO improvements…” |

Content | Reference word credits or content calendar | “To keep your content calendar on track and maintain your current word credit allocation…” |

Web Design | Include milestone references | “This payment covers milestone #2 (responsive design implementation) as outlined in our agreement…” |

Video | Address footage storage/access | “To maintain access to your raw footage and ensure continued project progress…” |

Keep an eye on your process

Even if you think you’ve set up everything perfectly, that doesn’t mean your reminders will be successful. Keep an eye on them and check if they do indeed lead to overdue invoices getting paid. If not, try to understand why not.

Here are a few ideas:

Are your instructions unclear? Make it easy to understand how to pay the invoice.

Do they end up in spam? If so, remove any fancy formatting and set plaintext emails.

Might clients prefer a different payment method? Offer alternative payment methods.

The last point is very important. Sometimes, clients might want to pay via a different method than what is mentioned on the invoice. This depends on your flexibility, but you should make it easy for them to make the payment.

By refining your process, you’ll decrease the work your team has to do manually in order to get these invoices; and that allows you to focus on more important tasks.

Automating payment reminders

Manually sending payment reminders is often a time-consuming and labor-intensive task, with limited room for error or flexibility. However, with automation technology, you can streamline these processes, saving valuable time and resources.

Automating payment reminders provides numerous benefits, including:

Enhanced efficiency: Automated systems can process numerous payments swiftly and precisely, minimizing the need for manual involvement.

Enhanced accuracy: Automated workflows reduce the likelihood of human error, ensuring timely and correct payment delivery.

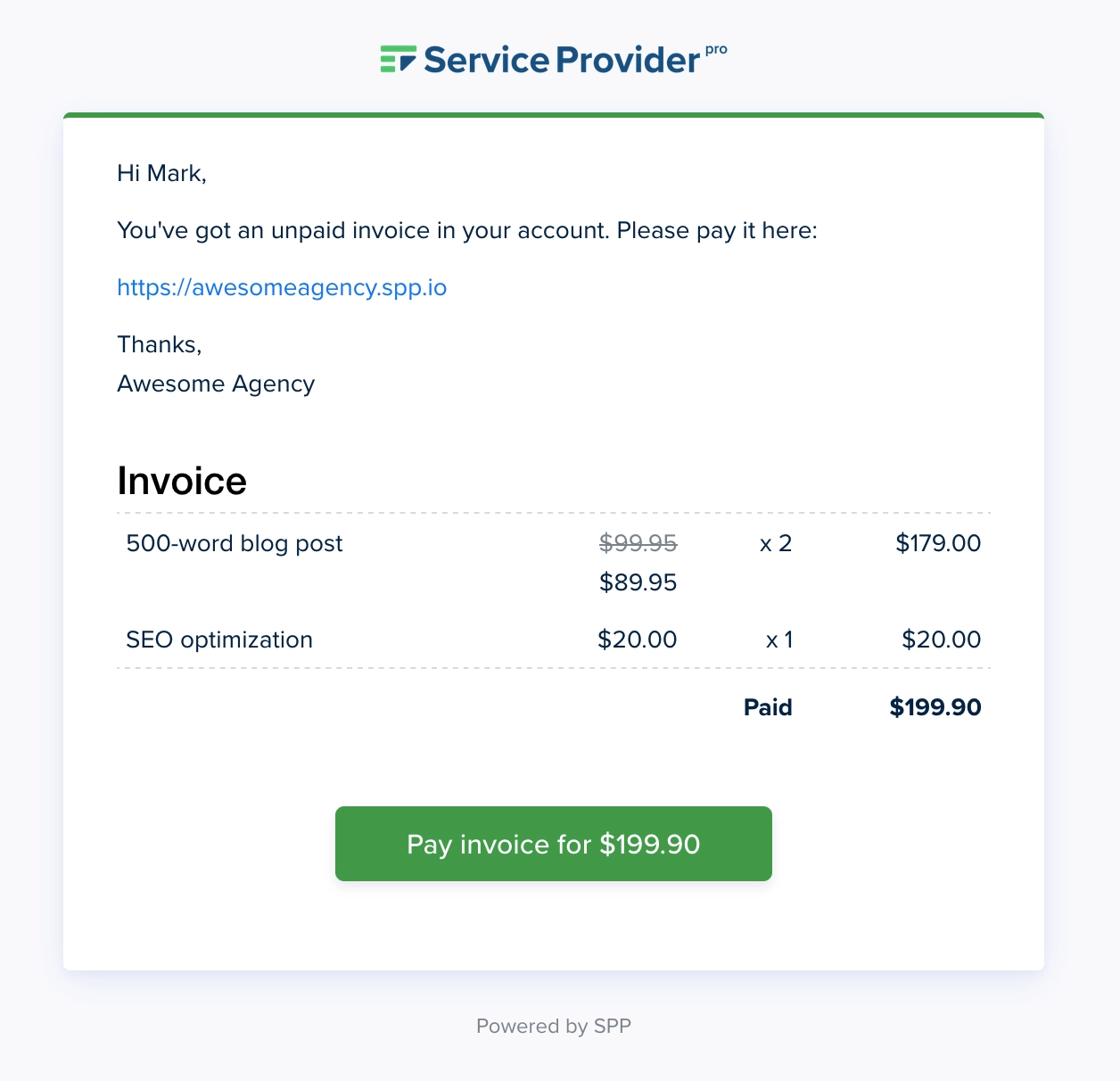

Luckily, Service Provider Pro takes care of payment reminders, so you don’t have to worry about them.

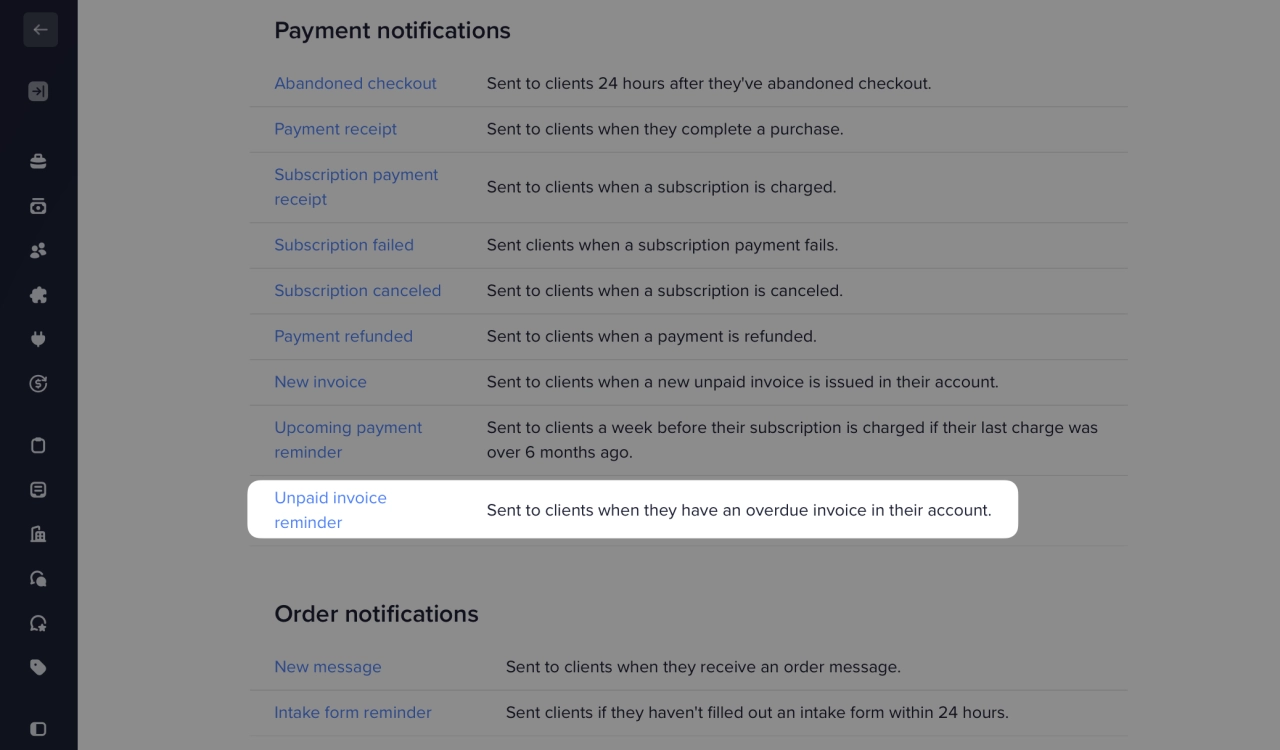

There are multiple transactional emails we send, and you can configure all of them in your client portal settings:

New invoice: Sent when you issue a new invoice manually.

Upcoming payment reminder: Sent when a payment is due soon for recurring subscriptions.

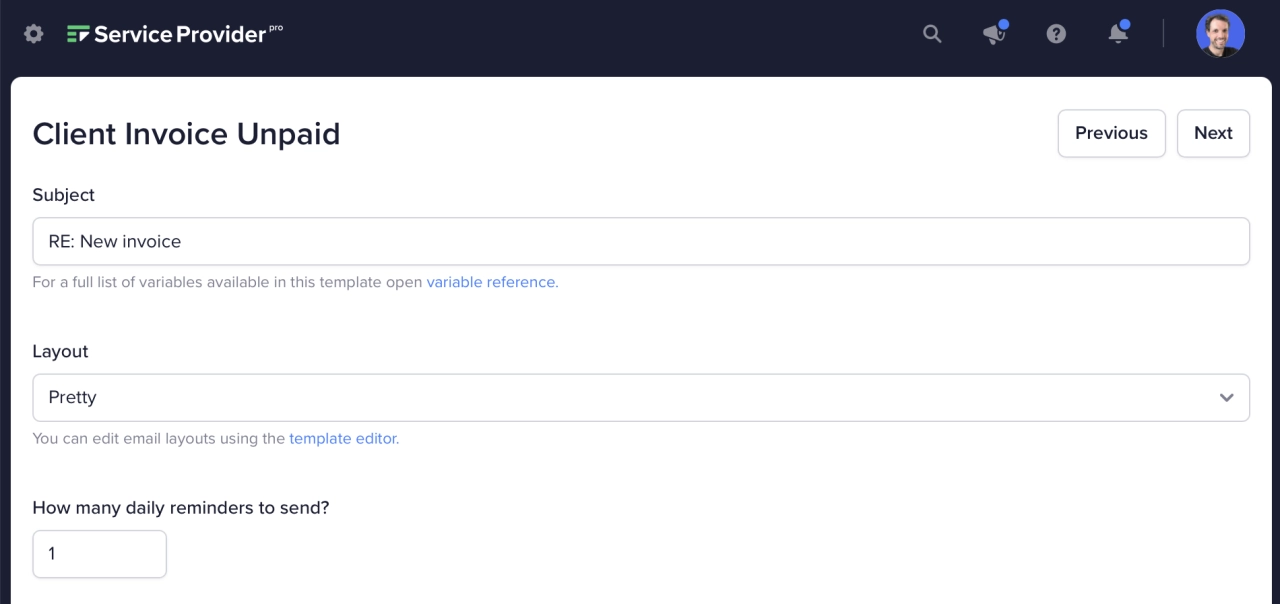

Unpaid invoice reminder: Sent when an unpaid invoice exists.

For the latter, you can also configure how often a reminder is sent on a daily basis. The email also includes information about the purchased items in case the client doesn’t remember what the invoice was for.

Setting up automated payment reminders in SPP

Here’s how to set up your own payment reminder system inside SPP in just a few minutes.

Step 1: access email templates

Navigate to Settings → Emails in your SPP dashboard. Locate the Unpaid invoice reminder template.

Step 2: configure your reminder schedule

Open the unpaid invoice reminder and choose how often to send it on a daily basis.

Step 3: customize your templates

Use these variables to personalize your emails:

{{ user.name_f }} - Client’s first name

{{ invoice.id }} - Invoice reference

{{ items.amount }} - Outstanding amount

{{ status.date_due }} - When payment was due

{{ link }} - Direct payment link

Pro tip: Testing is crucial! Send yourself test reminders to verify links and formatting before activating.

Personalized Demo

Looking to make sure SPP is right for you? Get on a call with our customer success team.

Conclusion

When it comes to payment reminder messages, setting up a system before you send the first invoice is a guaranteed success. Ideally, your client billing software of choice has this feature so you don’t have to set up an automation.

With that said, don’t even let it come to unpaid invoices, and if they do pop up, let your system take care of them automatically. Reaching out manually to clients should be an exception, not a rule.

Hopefully, with the templates provided in this post, you’re able to write a payment reminder that is effective.