- 2025 EBITDA multiples range from 3-5x for standard agencies to 8-12x for premium ones, and we’ll show you exactly what puts agencies in the premium category.

- Most successful agency sales take 18-24 months of preparation, not the 6 months most owners think they need.

- Red flags that mean you should wait, and the specific metrics that tell you it’s time to move forward.

If you’re running a marketing agency, there’s a good chance you’ve hit that wall. You know the one—where every client demand feels overwhelming, every team meeting drains your energy, and you’re wondering if this is really what you signed up for when you started your agency business.

You’re not alone. Research from IA Valuations and Ohio Insurance Agents shows that 90% of agency owners under 55 who sell their agencies cite stress and burnout as the primary reason. It’s the quiet epidemic nobody talks about at industry events.

But here’s what’s interesting: while burnout might be driving the decision, the agencies that sell for premium valuations aren’t the ones scrambling to escape. They’re the ones who’ve been building with an exit strategy in mind all along.

Whether you’re feeling the weight of constant client demands or you’re simply ready for your next chapter, selling your agency is one of the most significant decisions you’ll make. The difference between a fire sale and a strategic exit that sets you up for life? Preparation, timing, and understanding what buyers actually want in 2025.

When it’s time to sell your agency

You always have the option to keep pushing hard and the option of letting someone else acquire you, pour in more resources and accelerate growth. So when you find yourself in a situation where you need to choose between the two, how do you know which one to choose?

The numbers tell a clear story. According to the aformentioned study IA Valuations and Ohio Insurance Agents, those selling their agency cite stress and burnout as the primary reason. But burnout isn’t the only signal—sometimes it’s about recognizing when you’ve taken your agency as far as your current setup allows.

Let’s look at the three clearest signs it might be time to consider selling.

1. You’re no longer giving it 100%

As cheesy as it sounds, being self-aware and knowing when things aren’t at the core of your inner drive is crucial for an entrepreneur.

Not to say that you won’t evaluate the decision with numbers and logic, but look, as life changes sometimes you need to stop doing things that are draining your energy and sanity.

This is how Tommy Joiner felt when he was still running Content Pros with his partner, as he mentions in this podcast.

So, by the time I was ready to exit the business, I had navigated the entire entrepreneurial journey and it felt like I was already at the climax and was just ready for something else. It felt like I had achieved the goal of building the asset to the level that I wanted to, and I guess the other thing is—I didn’t have the motivation to grow it.

Tommy Joiner, CMO & Partner,

WordAgents

Tommy Joiner, CMO & Partner,

WordAgents

If you start to dread running your business, there’s something that needs to be fixed. And letting someone else run the show might be your best bet.

2. You’re limiting your agency’s growth

Entrepreneurs have great ambitions. Some break the 6-figure mark, then 7, and there’s always room for more.

It could be that your agency—and the way you set it up—is not enough to give you the financial rewards you desire.

It could be that your differentiation has vanished over the years, and you’d need some drastic changes to keep things growing, or otherwise you’ll have to compete for price. Both things that you might not be into.

It could also be that your team has grown so much that you simply don’t know how to manage them, as Kenny Schumacher mentioned in his interview with us.

It got to a point where I wasn’t sure I was adding so much value myself to the business. It was still growing, but nothing super crazy. My success so far has been growing smaller businesses.

Kenny Schumacher, Owner,

Appraisal Saver

Kenny Schumacher, Owner,

Appraisal Saver

That being said, an agency is a great vehicle for entrepreneurs. However, you might want to try your luck with another business model—say, an e-commerce brand, a tech business, or an audience-building/media company—that’s fine, too.

If you feel your growth is capped and other ventures would have a higher probability of getting you where you want to go, then selling is not out of the question.

3. You let your emotions take control

When you spend so many years working in your business, it’s easy to get emotionally attached to it. Even if you think you’re not emotionally attached at all, believe me, chances are you are.

As you start to evaluate options, you need to make a conscious effort to see things as they are.

Get out of your head and start thinking objectively whether this will be the best for you and your wellbeing into the future. A lot of people keep doing it just for the money—or the ego of all the years they’ve put into it. You don’t want that.

It’s important that you make a decision—one that doesn’t necessarily need to be written in stone but has a certain degree of flexibility. Then start looking for gaps in your systems to maximize your business valuation and make sure you meet all necessary requirements.

You don’t need to sell tomorrow. Just make the decision that you’re going to. Because the best entrepreneurs know when it’s time to step out and are decisive about it.

Those who cling to it for too long and have that nagging doubt buzzing on their heads all the time are the ones who suffer the most.

The 2025 agency sale market

Before you can make smart decisions about selling your agency, you need to understand what’s actually happening in the market right now. The good news? 2025 is shaping up to be significantly better than 2024 for agency sales.

Let’s break down what you’re walking into.

Current market conditions

The agency mergers and acquisitions (M&A) market experienced a significant slowdown in 2024, with fewer deals closed compared to previous years. This decline was primarily attributed to higher interest rates, which increased the cost of capital and made financing more challenging. As a result, buyers became more selective, and agencies felt the squeeze as businesses tightened their spending. This trend was particularly evident in the marketing services sector, where M&A activity declined, and only a few large transactions occurred.

But here’s what’s encouraging: the agencies that did get deals done in 2024 didn’t see lower valuations. If anything, the best-performing agencies commanded premium prices because buyers recognized quality when they saw it.

Since the Fed started cutting rates in September 2024, we’ve seen M&A activity pick up. The agencies getting attention? Those serving recession-proof industries like healthcare and consumer staples, or providing mission-critical services like website development and core digital infrastructure.

What your agency could be worth

Here’s where it gets interesting. The range of agency valuations is massive, and understanding where you fall can mean the difference between a comfortable exit and a life-changing one.

Agency Type | Typical Valuation | Notes |

|---|---|---|

Standard | 3-5x EBITDA | Most marketing agencies |

Smaller | 2.2-3.5x SDE | Owner-operated agencies |

Larger | 4-6x EBITDA | Agencies $5M+ EBITDA |

Premium | 8-12x EBITDA | Top-tier agencies |

Strategic / Synergy | 15-20x EBITDA | Rare, high-value acquisitions |

What puts an agency in the premium category? Three main factors consistently drive higher multiples:

Three years of double-digit revenue growth - Buyers pay premiums for momentum

Low client concentration - No single client representing more than 15% of revenue

Extended client relationships - Average client lifespan exceeding 6.2 months

What buyers actually want in 2025

The buyers who are active right now—and there are more of them than ever—are looking for specific things. They’ve learned from previous acquisitions what works and what doesn’t.

Recurring revenue beats project work every time: A $2M agency with 80% recurring revenue will consistently get higher multiples than a $3M agency dependent on one-off projects.

Documented processes are non-negotiable: Buyers want to see that your agency can run without you. If your team needs to call you every time a client has a question, that’s a problem.

Team stability matters more than individual talent: A solid team that’s been together for two years is worth more than a superstar who might leave after the acquisition.

The agencies struggling to find buyers? Those with owner dependency, inconsistent revenue, or client concentration issues. These aren’t deal-breakers, but they’ll definitely impact your valuation and timeline.

Why 2025 looks promising

Several factors are aligning to make 2025 a better year for agency sales:

Interest rates are expected to continue dropping, making acquisitions cheaper to finance. Private equity firms have cash to deploy after sitting on the sidelines. Strategic buyers are looking to add digital capabilities and specialized expertise.

Most importantly, the market has separated the wheat from the chaff. Agencies that survived and thrived through 2022–2024’s challenges are being recognized as resilient, well-managed businesses worth premium valuations.

If you’ve been thinking about selling, 2025 might be your window.

What’s your agency actually worth?

This is probably the question that’s been bouncing around your head since you started reading. And honestly, it’s the right place to start—because everything else depends on whether the numbers make sense for your situation.

The short answer? Your agency’s value depends on way more than just revenue. But before we dive into the factors, let’s get you a ballpark number to work with.

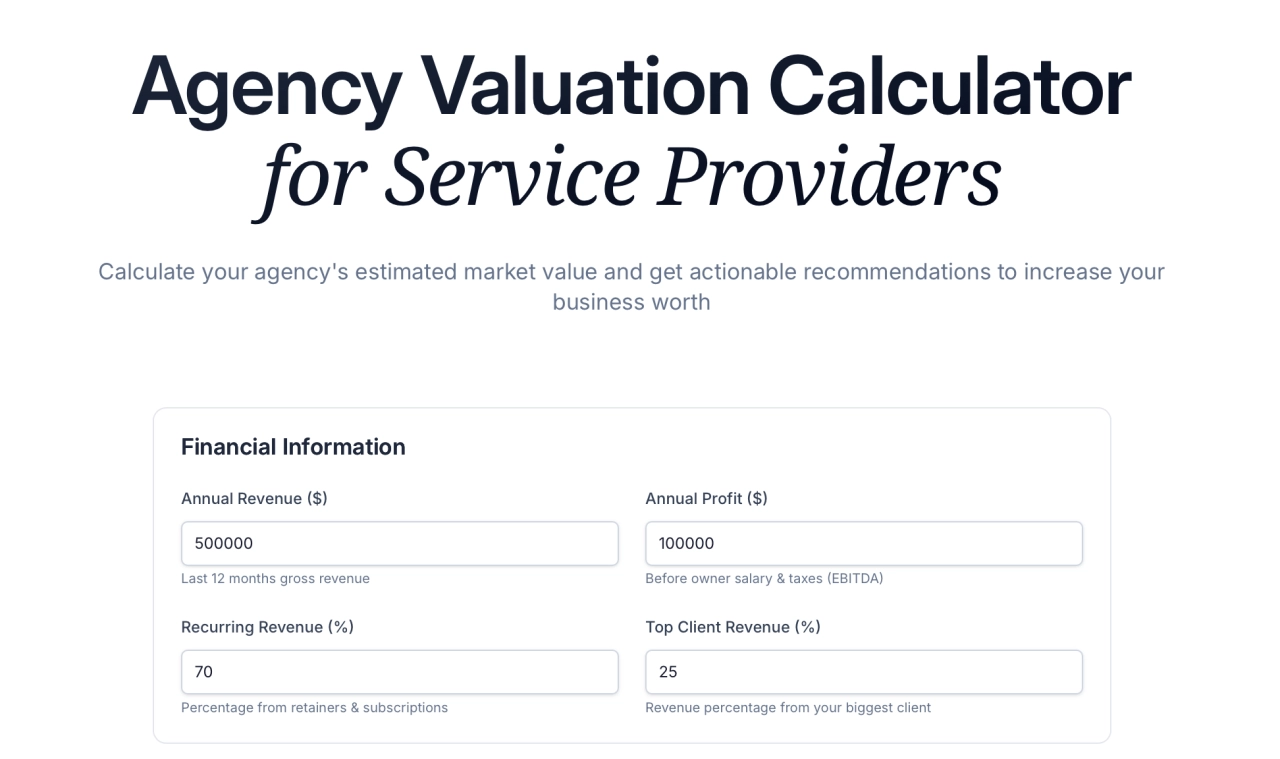

Calculate your agency's estimated market value.

Our calculator takes into account the key factors buyers actually care about: revenue type, growth rate, client concentration, and current market conditions. It’ll give you both conservative and optimistic ranges based on 2025 market data.

Understanding the 2 main valuation methods

Most agency valuations use one of two approaches, depending on the size and structure of your business.

EBITDA multiple for larger agencies

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s basically your profit before all the accounting stuff that varies by business structure and location.

Here’s how it works: Take your annual EBITDA and multiply it by the market multiple for agencies like yours. So if your agency has $500,000 in EBITDA and agencies in your category are selling for 4x EBITDA, your estimated value would be $2 million.

Seller’s Discretionary Earnings multiple for smaller agencies

SDE starts with your profit but adds back your salary and any personal expenses you run through the business. This gives a more accurate picture of what the business actually generates for an owner-operator.

For example, if your agency shows $200,000 in profit but you pay yourself $150,000 in salary, your SDE would be $350,000. Multiply that by the typical 2.5-3.5x multiple for smaller agencies, and you’re looking at $875,000 to $1.2 million.

What actually drives your valuation

The multiple you get—whether it’s 3x or 8x—depends on factors that buyers can measure and predict. Here are the big ones:

Revenue predictability: An agency with $1.5M in recurring monthly revenue will get a higher multiple than one with $2M in project-based revenue. Buyers pay premiums for predictability.

Client concentration: If your biggest client represents 30% of your revenue, that’s a risk. If your top 5 clients each represent 10–15%, that’s stability. The difference can be 2–3x in valuation multiples.

Growth trajectory: Three years of 20%+ annual growth tells buyers this agency has momentum. Flat or declining revenue suggests problems, even if current profits are strong.

Owner dependency: Can your agency run for a month without you? If not, buyers see that as a risk they’ll need to manage. Agencies with documented processes and strong teams get premium valuations.

Market position: A specialized agency serving a growing niche (like healthcare marketing) will get higher multiples than a generalist agency competing on price.

Real numbers from recent sales

To give you some context, here’s what agencies actually sold for in 2024:

Agency Acquired | Acquirer | Sale Price | Notes |

|---|---|---|---|

Interpublic Group (IPG) | Omnicom | $13 billion | |

Mars United Commerce (formerly Mars Advertising) | Publicis | ~$600 million | |

Influential Network | Publicis | ~$500 million | |

LiveIntent | Zeta Global | $250 million (plus up to $75 million earnout—total $325 million) | |

FGS Global (majority stake) | KKR | $775 million | |

Third Door Media | SEMrush | $6 million |

Not every agency deal needs to be massive. SEMrush’s $6M acquisition of Third Door Media shows small agencies can deliver strategic value, adding expertise, events, and content to complement existing tools. Meanwhile, bigger deals like Omnicom, Mars United Commerce, and LiveIntent highlight that stability, recurring revenue, and strategic fit drive the highest valuations.

How to prepare your agency for sale

You’ve done the math and decided selling makes sense. Now comes the real work—preparing your agency to attract premium buyers and maximize your valuation.

Most agency owners think this process takes 6 months. The reality? The agencies that sell for top dollar start preparing 18–24 months before they go to market. Here’s your roadmap.

1. Make your business truly sellable

This goes back to building an agency that doesn’t revolve around you. One of the most important things to keep in mind is that a business that couldn’t run without you isn’t sellable at any price buyers want to pay.

But it’s not just about you—think about your employees and contractors too. Would they even stick around if you sell?

“I wanted the employees and the contractors to go with the business and to be taken care of. That definitely was important to me because those people became like my family, and then, the others where there was a good fit as well were the ones that had very similar business models,” says Tommy Joiner.

Talk to your team about your plans to sell. Let them know you’ll do everything in your power to find the right buyer that values them. In many cases, offering retention bonuses for staying through the transition adds value for buyers and peace of mind for your team.

Key sellability factors:

agency operates effectively for 2+ weeks without owner involvement

key team members committed to staying post-acquisition

client relationships maintained by multiple team members, not just the owner

revenue generation continues without daily owner input

2. Strengthen your market position

If you’re running an agency like any other, it’s going to be hard to sell it for premium multiples. Buyers want to acquire something that’s already unique and has clear potential to become even better.

I’ve now made the decision to raise the Blogging Unlimited package by 35% to $2,700/m and the Everything Unlimited package by almost 43% up to $5,000/m. These price rises have been the result of much introspection about the value of what Scribly offers. Ultimately, I’ve come to realize that if I don’t place a value on the (exceptional) work that we produce, then no-one else will.

Dani Mancini, Founder,

Scribly

Dani Mancini, Founder,

Scribly

Price isn’t the only differentiator. You could focus on a specific niche or sub-category within your market. Specialization makes it easier for acquirers to understand exactly who to target when they invest in marketing.

Market positioning improvements:

Niche specialization with demonstrated expertise

Premium pricing that reflects unique value proposition

Clear competitive advantages that are difficult to replicate

Strong brand recognition within your target market

3. Document everything

Having a great team and client list is excellent, but often not enough. Buyers don’t want to set up processes to make your agency run smoothly—they want those systems already documented and proven.

“I decided that, instead of calling my employees and telling them over the phone exactly what I wanted them to do, I would start by writing down every single thing that had to be done, making that as concise as possible. That ended up procedures and processes in place,” relates Kenny Schumacher.

The sooner you document your processes, the easier everything becomes. Modern tools like client portals linked to CRM and email marketing systems make this much more manageable than it used to be.

Documentation essentials:

Standard operating procedures for all core functions

Client onboarding and management workflows

Quality control and delivery processes

Team training and management procedures

Financial reporting and analysis systems

4. Build predictable revenue streams

When buyers evaluate agencies, profit margins matter, but they’re obsessed with recurring revenue. The agencies getting premium multiples have transformed from project-based to recurring revenue models.

According to Tommy Joiner “[…] your last 12 months of revenue history are what’s most important, and it’s basically just a simple calculation of multiplying EBITDA for a 12-month period by whatever the multiple is.” He learned from his broker that the major factors in agency valuation are growth, transferability, risk, and documentation. Recurring revenue addresses several of these directly.

Revenue optimization targets:

70%+ recurring revenue vs. project-based work

Average client lifespan exceeding 12 months

Annual contracts with predictable renewal rates

Multiple revenue streams reducing single-point-of-failure risk

5. Find the right M&A advisor

Unless your agency is generating $5M+ in revenue and you have M&A experience, trying to manage the sale process yourself is usually a mistake. The right advisor pays for themselves through better valuations, faster timelines, and smoother negotiations.

Not all M&A advisors understand agencies. You want someone who specializes in your space and has relationships with buyers who actually acquire agencies like yours.

Top agency-focused M&A advisors include:

Merge: Specializes in marketing, digital, and PR agencies

Capital A: Creative agencies, media, and e-commerce businesses

Generational Equity: Broad middle-market focus with agency experience

The best advisors will do a preliminary valuation and market assessment before you commit. This helps you understand realistic timelines and identify any issues that need addressing before going to market.

6. Prepare for due diligence

Due diligence can make or break your deal. Buyers will scrutinize everything, and being prepared speeds up the process while building confidence in your business.

Due diligence can be a massive bottleneck in the sales process. Make sure you get your numbers dialed in many months before you start shopping your agency for sale. You should be able to quickly and efficiently show all inflows and outflows of cash in one easy to follow spreadsheet.

Mark Whitman, Founder,

Contentellect

Mark Whitman, Founder,

Contentellect

Due diligence preparation:

3+ years of clean financial statements

Client contracts and retention data

Team employment agreements and retention plans

Process documentation and training materials

Legal compliance and intellectual property documentation

Timeline reality check: Plan for 6–12 months from first buyer meeting to closing. The agencies that try to rush this process often leave money on the table or kill deals entirely.

Start preparing now, even if you’re not planning to sell for another year. The agencies that sell for premium multiples didn’t get there by accident—they built sellable businesses from the ground up.

Tax planning for your agency sale

Here’s something most agency owners don’t think about until it’s too late: the structure of your sale can dramatically impact how much money you actually take home. We’re talking about differences of tens or hundreds of thousands of dollars depending on how your business is set up and how you plan the transaction.

Let’s walk through what you need to know for 2025 if you’re selling your agency in the U.S.

Understanding gains tax

When you sell your agency, the profit you make is typically treated as a capital gain, not ordinary income. This is good news because capital gains rates are much lower than regular income tax rates.

Filing Status | Income Threshold | Rate |

|---|---|---|

Single | Up to $47,025 | 0% |

Single | $47,026 – $518,900 | 15% |

Single | Over $518,900 | 20% |

Married Filing Jointly | Up to $94,050 | 0% |

Married Filing Jointly | $94,051 – $583,750 | 15% |

Married Filing Jointly | Over $583,750 | 20% |

The good news? These thresholds increased by about 2.8% from 2024, meaning more people will qualify for the lower 15% rate instead of the 20% rate.

Important note: These rates apply to your total income for the year, including the gain from your agency sale. So if you’re married, filing jointly, and your total income (including the sale proceeds) is $400,000, you’d pay 15% on the capital gains portion.

Asset sale vs. stock sale: Why it matters

About 90% of agency sales are structured as asset sales, and there’s a good reason for that. But depending on how your business is structured, this could create tax complications.

Asset Sale Benefits | Asset Sale Challenges |

|---|---|

Buyer can depreciate the purchase price | If you’re a C-corporation, you could face double taxation |

Buyer doesn’t inherit your company’s liabilities | S-corporations and LLCs typically have single taxation |

Usually preferred by buyers, which can mean better valuations |

Here’s where it gets tricky: if your agency is structured as a C-corp and you do an asset sale, the corporation pays tax on the gain, and then you pay tax again when you distribute the proceeds to yourself. This can eat up a huge chunk of your sale proceeds.

If you’re a C-corp considering a sale: Talk to your accountant about converting to S-corp status, but be aware of the 5-year waiting period to avoid the built-in gains tax at a flat 35% rate.

2025 tax law changes that could affect you

Several tax provisions are changing in 2025 that could impact your sale planning:

Research and Development Expenses: There’s movement toward allowing immediate expensing of R&D costs again (instead of the current 5-year amortization). If your agency has significant technology development costs, this could improve your EBITDA calculation.

Section 199A Deduction: The 20% qualified business income deduction for pass-through entities has been made permanent. This can significantly reduce your effective tax rate on business income.

Business Interest Limitations: Changes to how business interest deductions are calculated could improve your agency’s financial picture on paper.

State tax considerations

Don’t forget about state taxes. Some states don’t tax capital gains at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming.

If you’re in a high-tax state like California (13.3% on capital gains) or New York (8.82%), the difference in take-home pay can be substantial. Some agency owners establish residency in no-tax states before their sale, but this requires careful planning and genuine residency establishment.

Installment sales and earnouts

Many agency sales include earnout provisions where part of the purchase price depends on future performance. From a tax perspective, this can actually work in your favor.

Installment Sale Benefits | Earnout Considerations |

|---|---|

Spread the tax burden over multiple years | Only pay tax on money you actually receive |

Potentially keep yourself in lower tax brackets | Future payments taxed at future years’ rates |

Defer some tax obligations | Risk of rate changes affecting later payments |

Planning timeline and professional help

Tax planning for an agency sale isn’t something you want to figure out during negotiations. Start planning at least 12–18 months before you expect to go to market.

Essential professional team:

CPA with M&A experience: Not all accountants understand business sales

Tax attorney: For complex structures or large transactions

Financial advisor: For post-sale wealth management planning

Key planning questions to address:

Should you change your business structure before selling?

How should earnouts be structured for optimal tax treatment?

What’s your state residency strategy?

How will the sale impact your overall financial picture?

Action steps for selling your agency

If you’re planning to sell in the next 1–2 years:

Review your business structure with a CPA who understands M&A transactions

Calculate your estimated tax burden using different sale scenarios

Consider timing - spreading the sale across tax years might make sense

Document any business expenses that might reduce your taxable gain

Plan for quarterly estimated payments - you’ll owe taxes on the gain

The difference between good tax planning and winging it can easily be 10-15% of your sale proceeds. On a $2 million agency sale, that’s $200,000-$300,000. Worth spending some time and money to get it right.

Choosing the right M&A advisor

Unless your agency is doing $5M+ in annual revenue and you’ve sold businesses before, trying to manage this process yourself is usually a costly mistake. The right M&A advisor doesn’t just find buyers—they orchestrate the entire process, maximize your valuation, and handle the thousand details that can kill deals.

But here’s the thing: not all M&A advisors understand agencies. You want someone who speaks your language and has relationships with buyers who actually acquire businesses like yours.

When you actually need an advisor

Let’s be honest about when DIY makes sense versus when you need professional help.

You might be able to handle it yourself if… | You definitely need professional help if… |

|---|---|

Your agency is generating $5M+ in revenue | This is your first business sale |

You have M&A experience from previous exits | You need to find and vet buyers |

You already have interested buyers with serious offers | Your agency is under $3M in revenue |

You’re selling to a direct competitor or existing partner | You want to maximize valuation and terms |

You can’t dedicate 20+ hours per week to the sale process |

The math usually works out in favor of using an advisor. Yes, you’ll pay 5–10% in fees, but the better valuation, faster timeline, and smoother process typically more than offset the cost.

Top M&A advisors for agency sales

The agency M&A space has some specialized players who really understand the market. Here are the firms consistently getting premium valuations for their clients:

Firm | Focus / Specialization | Sweet Spot / Scale | Why They’re Good | Extras / Feedback |

|---|---|---|---|---|

Merge (GoMerge.com) | Marketing, digital, and PR agencies exclusively | $1M–$20M revenue agencies | Deep buyer relationships, understand recurring revenue models | Client feedback: “They guided me through the process with clarity and confidence…” |

Capital A | Creative agencies, media companies, e-commerce businesses | Strong UK & European presence | Tech-enabled platform (Agencies.co) for broader buyer exposure | Off-market deal sourcing, cultural fit evaluation |

Generational Equity | Lower middle market with strong agency experience | 250+ professionals across North America | Massive buyer network, proven process | Best for larger agencies seeking institutional buyers |

Sica / Fletcher | Broad lower middle market; ranked #1 since 2014 | $1M–$30M EBITDA businesses | High close rates, principal-level involvement in every deal | Track record: 40–70 deals per year with strong client satisfaction |

What to look for in an M&A advisor

Beyond specialization, here are the criteria that separate great advisors from mediocre ones:

Proven track record in your size range: Don’t hire someone who typically sells $50M companies to sell your $2M agency. The buyer networks, valuation methods, and processes are completely different.

Industry relationships: Ask for specific examples of buyers they’ve worked with in the past 12 months. The best advisors have ongoing relationships with 50+ potential acquirers in your space.

Realistic valuation approach: Be wary of advisors who promise unrealistic multiples to win your business. The best ones will give you honest market feedback upfront.

Full-service process management: Your advisor should handle everything from buyer identification to due diligence coordination to closing support. If they’re just “introducing you to buyers,” that’s not enough.

Principal involvement: Make sure a senior team member will be managing your deal. Ask who specifically will be your main point of contact throughout the process.

4 red flags to avoid

Business is business, and you don’t want to get less money that you could’ve. Watch out for these red flags:

Business brokers claiming agency expertise: General business brokers who “also do agencies” usually don’t understand the nuances of recurring revenue, client concentration risks, or agency-specific buyer concerns.

Upfront fees without clear deliverables: Most reputable M&A advisors work on success fees (5–10% of transaction value). Be cautious of large upfront retainers unless you’re getting specific, valuable deliverables.

Unrealistic timeline promises: Anyone promising to sell your agency in 3–4 months either doesn’t understand the process or is willing to accept below-market valuations. Quality deals take 6–12 months minimum.

Generic marketing materials: If their agency sale materials look like they could work for any business type, they probably don’t specialize in agencies.

What to expect from the process

Here’s what working with a quality M&A advisor typically looks like:

Phase | Timeline | Key Activities |

|---|---|---|

Initial Consultation | Week 1-2 | Business assessment, preliminary valuation, market timing discussion, process overview, fee structure explanation |

Preparation Phase | Month 1-2 | Detailed valuation analysis, marketing materials development, buyer identification and targeting, due diligence preparation |

Marketing Phase | Month 2-4 | Buyer outreach and screening, initial meetings and presentations, letter of intent negotiations, buyer selection |

Due Diligence and Closing | Month 4-6 | Information room setup, due diligence management, final negotiations, closing coordination |

Getting the Most from Your Advisor

Be Completely Transparent Your advisor can only help you if they understand the real situation. Hidden problems always come out during due diligence.

Stay Involved but Don’t Micromanage You should be updated weekly and involved in major decisions, but let your advisor manage the day-to-day process.

Prepare for Multiple Scenarios The first offer might not be the best one. Good advisors will present multiple options and help you evaluate trade-offs between price, terms, and fit.

Plan for Emotions Selling your business is emotional. Your advisor should help you stay objective during negotiations and decision-making.

The right M&A advisor becomes your advocate, project manager, and strategic counsel all rolled into one. Choose carefully—this decision alone can impact your final proceeds by hundreds of thousands of dollars.

Frequently asked questions

How do I calculate my agency’s value in 2025?

Use our free agency valuation calculator which factors in revenue type, growth rate, client concentration, and current market multiples. For manual calculation, take your EBITDA and multiply by 3-5x for standard agencies or 8-12x for premium agencies with strong growth and low client concentration.

What’s the difference between EBITDA and SDE for agency valuations?

EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization) is used for larger agencies and doesn’t include owner compensation. SDE (Seller’s Discretionary Earnings) adds back the owner’s salary and personal expenses, giving a better picture for smaller, owner-operated agencies. Most agencies under $2M revenue use SDE multiples of 2.2-3.5x.

How long does it actually take to sell an agency?

Plan for 18-–24 months total. This includes 12–18 months of preparation (documentation, process improvement, financial cleanup) and 6–12 months for the actual sale process (marketing, due diligence, closing). Agencies that try to rush this timeline typically get lower valuations.

What are the tax implications of selling my agency in 2025?

Capital gains rates are 0%, 15%, or 20% depending on your income level. Asset sales (90% of agency transactions) can create double taxation for C-corps but single taxation for S-corps and LLCs. State taxes vary dramatically—nine states have no capital gains tax. Start tax planning 12–18 months before your expected sale date.

What is an earn-out and should I accept one?

An earn-out ties part of your payment to future agency performance, typically 12-36 months post-sale. Benefits include potentially higher total value and tax deferral. Risks include dependency on new owner’s management and market changes. Generally acceptable if the base payment covers your minimum acceptable price and earn-out metrics are clearly defined and achievable.

Do I need an M&A advisor to sell my agency?

Unless your agency generates $5M+ revenue and you have M&A experience, yes. Quality advisors typically increase sale prices by more than their 5–10% fees through better buyer access, valuation optimization, and process management. Look for advisors specializing in agencies like Merge, Capital A, or Generational Equity.

What documents do I need for due diligence?

Essential documents include 3+ years of financial statements, client contracts and retention data, team employment agreements, process documentation, legal compliance records, and intellectual property documentation. Start organizing these 6-12 months before going to market to avoid delays during buyer due diligence.

How do I know if my agency is ready to sell?

Key readiness indicators include: business operates 2+ weeks without your daily involvement, 70%+ recurring revenue, no single client over 15% of revenue, documented processes for all core functions, clean financial records, and stable team committed to staying post-acquisition. If you’re missing these, focus on preparation before marketing.

What makes an agency attractive to buyers in 2025?

Buyers prioritize recurring revenue models, predictable growth (3+ years of consistent increases), low client concentration, documented processes, owner-independent operations, and specialized market positioning. Agencies serving recession-proof industries like healthcare or providing mission-critical services command premium valuations.

What’s the biggest mistake agency owners make when selling?

Starting the process too late and being unprepared. Most owners underestimate the time needed for preparation and try to sell within 6 months of making the decision. This leads to lower valuations, longer timelines, and deal failures. The agencies that sell for premium multiples start preparing 18–24 months in advance.

Closing thoughts

Selling your agency is one of the biggest decisions you’ll make as an entrepreneur. The difference between a successful exit and a disappointing one comes down to preparation, timing, and understanding what buyers actually want.

Here’s the reality: burnout is the prime reason for selling an agency, but the ones getting premium valuations aren’t scrambling to escape. They’re building sellable businesses from day one with documented processes, recurring revenue, and specialized positioning.

The market conditions for 2025 look more favorable than 2024. Interest rates are dropping, buyers have capital to deploy, and resilient agencies are commanding premium multiples of 8-12x EBITDA.

Whether you’re exploring the idea or ready to start preparing, remember this: the best time to build a sellable agency is when you don’t need to sell. The changes that make your business more valuable—documented systems, diversified clients, recurring revenue—also make it more enjoyable to run.

Don’t wait until you’re burned out to start thinking about your exit. Start with one step: document one process, diversify one client relationship, or have one conversation with your team about the future.