- SPP.co connects natively with Stripe for payment processing and Zapier for workflow automation, creating an integrated system designed specifically for digital service agencies.

- Must-have features of client billing software include native payment integrations with processors like Stripe and PayPal, automated late payment reminders, and integration with accounting software.

- Best suited for agencies with 30+ clients selling productized or recurring services rather than custom project work.

Most agencies reach a point where their client billing workflow becomes a bottleneck—herein lies the core challenge that separates growing agencies from those stuck in manual processes.In my 4 years at SPP.co, I’ve watched hundreds of agencies hit this same wall. Having conducted dozens of implementation case studies and led 200+ product demos, I’ve seen exactly where agencies struggle—and what separates those who succeed from those who don’t.

This guide covers the technical implementation and business considerations for agencies evaluating whether this integrated approach makes sense for their operations. Read on to find out how to set up these integrations and determine if they’re right for your agency’s current situation.

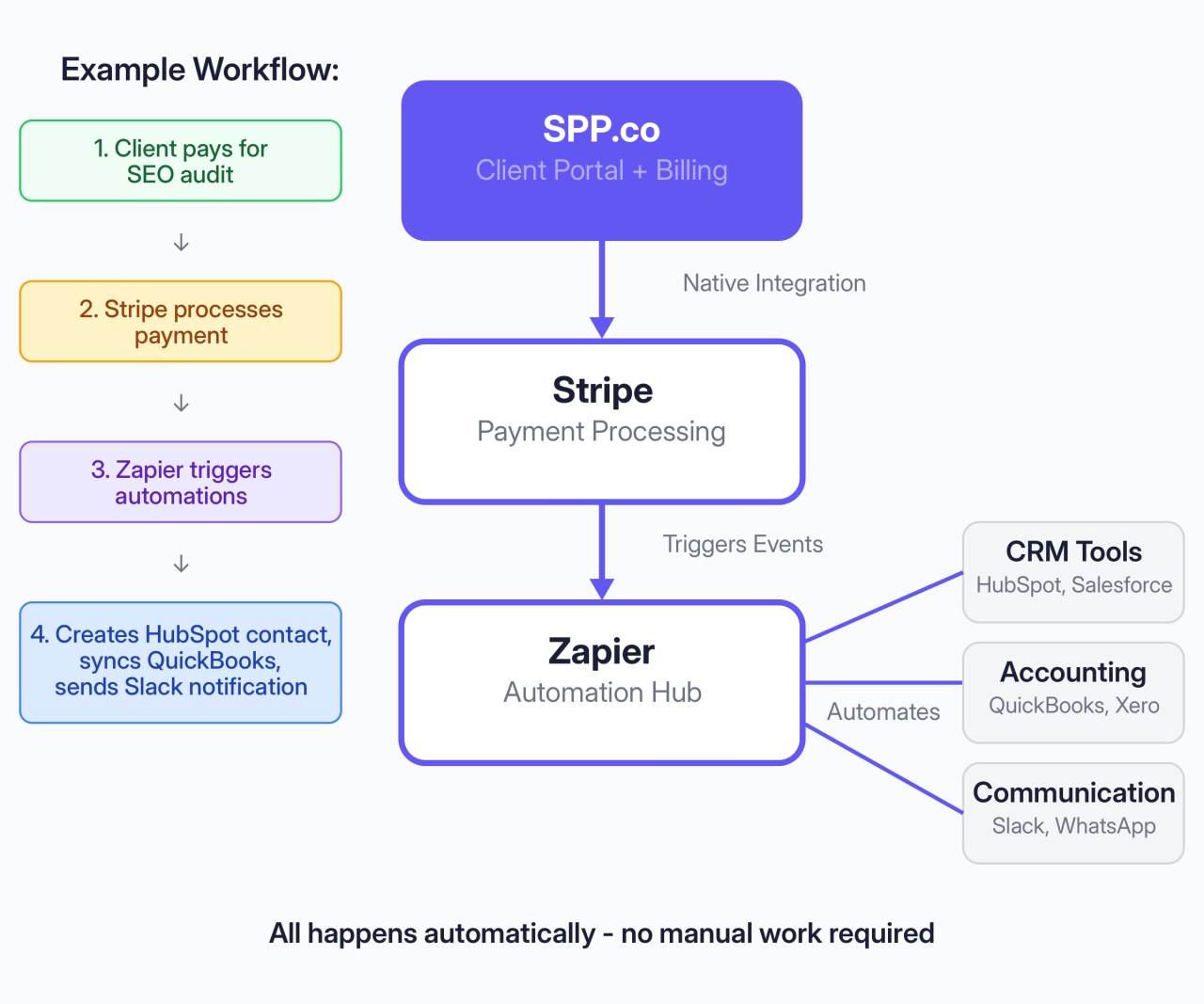

SPP.co’s approach differs from standalone billing solutions by combining client portal management with integrated payment processing and workflow automation. Let’s look at how this works in practice.

Understanding SPP.co’s integration architecture

SPP.co is built specifically for digital service agencies selling recurring services and productized offerings—not a generic platform with payment processing bolted on.

The key is understanding how these three systems work together. Rather than explaining this with dense paragraphs, let me show you exactly how the data flows:

As you can see in the diagram above, the Stripe integration handles payment processing, subscriptions, and invoicing with support for credit cards, ACH, SEPA, Google Pay, and Apple Pay. The Zapier integration connects SPP.co events to your existing CRM, project management, and communication tools.

The great thing about SPP.co’s newer Make.com integration is that it offers more powerful automation capabilities than Zapier for agencies needing advanced workflow options and better data transformations.

The result? Payment confirmations automatically kickoff delivery workflows, client onboarding triggers CRM updates, and billing events update project management—all without manual intervention. This visual flow happens dozens of times per day in busy agencies, saving hours of repetitive work.

Now that you understand how the systems connect, let’s walk through the actual setup process, starting with the foundation.

1. Setting up Stripe integration

The Stripe setup connects your existing account or creates a new one through SPP.co’s interface—no complex API work required.

Initial connection: Go to Settings → Integrations → Stripe in your SPP.co dashboard and click Connect. Select your existing Stripe account or create a new one. If your account is managed by another platform, use the API integration option instead.

Payment method configuration: SPP.co supports whatever payment methods you enable in Stripe—credit cards, ACH via Plaid, SEPA for European clients, Apple Pay, and Google Pay. European agencies should enable 3D Secure 2.0 for compliance.

Data import process: If you have existing Stripe customers or subscriptions, SPP.co’s import tool handles the migration automatically. Your clients keep their saved payment methods, and you just map subscription plans to SPP.co services.

Important: Disable receipt emails in Stripe to avoid duplicates—SPP.co does this for your automatically.

Let’s look at how this connects to your automation workflows through Zapier.

2. Configuring Zapier automation

Zapier connects SPP.co to your existing tools through automated workflows called “Zaps”—each has a trigger (what starts it) and actions (what happens next).

Setup process: Create a Zapier account, go to Connected Accounts, add Service Provider Pro, and authenticate with your SPP.co credentials. Test the connection to ensure data flows properly.

Key triggers: SPP.co can trigger automations when clients register, place orders, make payments, or submit data. Order status changes and support tickets also trigger workflows.

Available actions: Zapier can create clients, update information, change order status, send messages, add tags, and assign team members back in SPP.co.

The real power comes from connecting these triggers to your external tools—CRM updates, project management, accounting sync, and team notifications all happen automatically.

Fret not if this sounds complex initially. Start with one simple automation and expand as you see the time savings. Most agencies begin with basic client onboarding workflows before building sophisticated multi-step automations.

With the technical foundation covered, let me show you exactly what these automations look like in practice across different agency types.

3. High-value automation examples

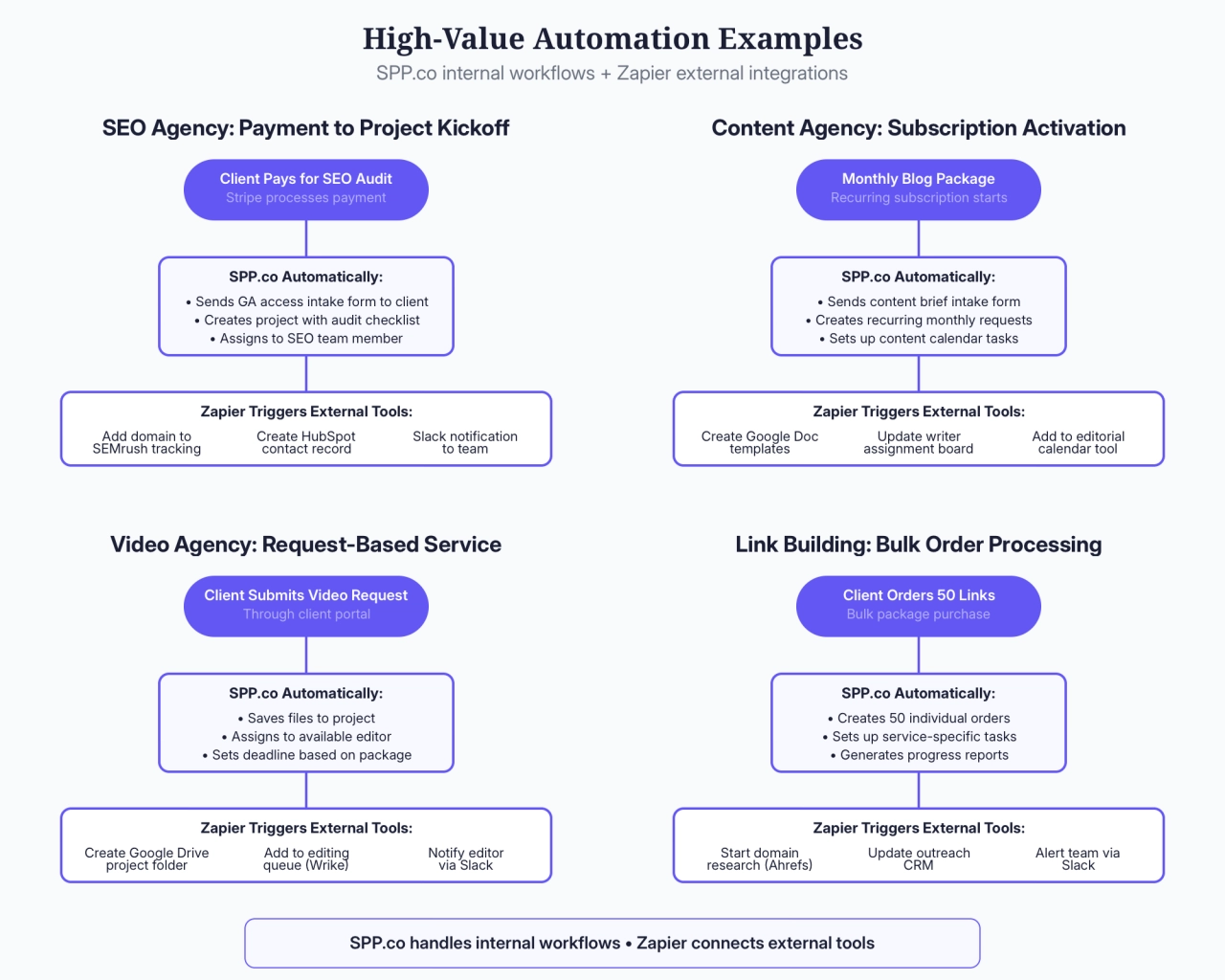

Here’s where the theory becomes practical reality. I’ve seen these exact automation workflows save agencies 10+ hours per week once properly implemented.

The workflows below show real examples from different agency types—notice how SPP.co handles internal processes while Zapier connects to your existing tools:

What you’re seeing above represents the difference between manual chaos and systematic growth.

SEO agencies see GA access intake forms auto-sent, projects created with audit checklists, plus external domain tracking in SEMrush and HubSpot contact creation—all triggered by a single payment.

Content agencies get automated brief forms, recurring request setup, and content calendar tasks, while Zapier creates Google Doc templates and updates writer assignment boards.

Video agencies benefit from automatic file handling, editor assignment, and deadline setting, plus Wrike queue updates.

Link building agencies can process bulk orders into individual tracking, assign specialists automatically, and trigger domain research in Ahrefs—perfect for scaling operations.

Don’t just take my word for it—in my over 470 demos and onboardings, I’ve seen agencies achieve remarkable results. Case in point: 100 Pound Social grew their client base by 215% after implementing SPP.co.

These aren’t theoretical possibilities—they’re workflows running in successful agencies right now, handling everything from payment to project completion automatically.

Of course, seeing the potential and actually implementing it are two different challenges. Let’s tackle the practical side of making this happen in your agency.

4. Implementation & migration strategy

The key to successful implementation isn’t the technical setup—it’s managing the transition smoothly while getting your team on board.

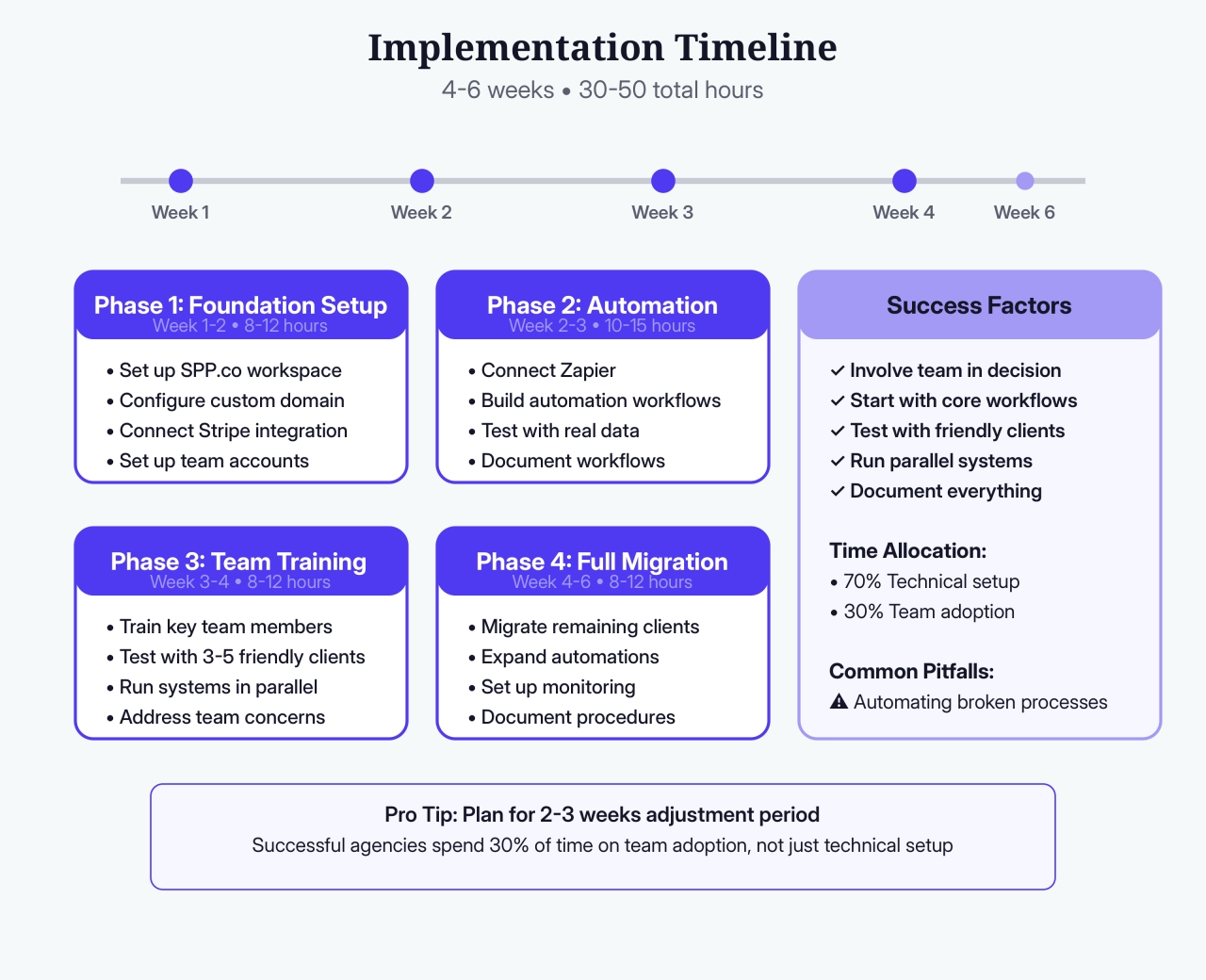

From my 470+ calls, I’ve seen this timeline work consistently across different agency sizes and complexities. Here’s exactly what successful agencies do:

The timeline above shows something crucial that most agencies miss—notice how 30% of the effort goes to team adoption, not just technical setup. This is where agencies succeed or fail.

Your 4-week implementation plan

Week 1-2: Foundation & setup (8–12 hours)

Set up your SPP.co workspace, configure your custom domain, and connect Stripe. Import existing customers using SPP.co’s built-in tool. Create 2-3 core services and connect Zapier with one simple automation to test the integration.

Week 3: Team training & testing (8–12 hours)

This is where most implementations succeed or fail. Train key team members on actual workflows, start with 3-5 friendly clients, and run both systems in parallel. Address concerns immediately and document new procedures.

Week 4: Full migration & optimization (8–12 hours)

Migrate remaining clients in batches, expand automation workflows, and optimize based on real usage patterns.

The success factors shown in the visual above aren’t theoretical—they’re based on analyzing which agencies had smooth rollouts versus those who struggled with team resistance and client confusion.

Universal migration approach

Regardless of your current tools: export data → recreate services in SPP.co → import clients → rebuild subscriptions → test thoroughly.

Tool-specific notes:

From Stripe-only: Use SPP.co’s built-in import tool—easiest migration

From FreshBooks/QuickBooks: Export to CSV, consider Zapier for ongoing sync

From Dubsado/HoneyBook: Most manual work but same process applies

With that said, plan to spend significant time on change management, not just technical configuration. The agencies that succeed are those where leadership actively supports the transition.

But before you dive into implementation, it’s worth stepping back to evaluate whether this integrated approach makes sense for your specific situation and agency type.

5. Platform comparison guide

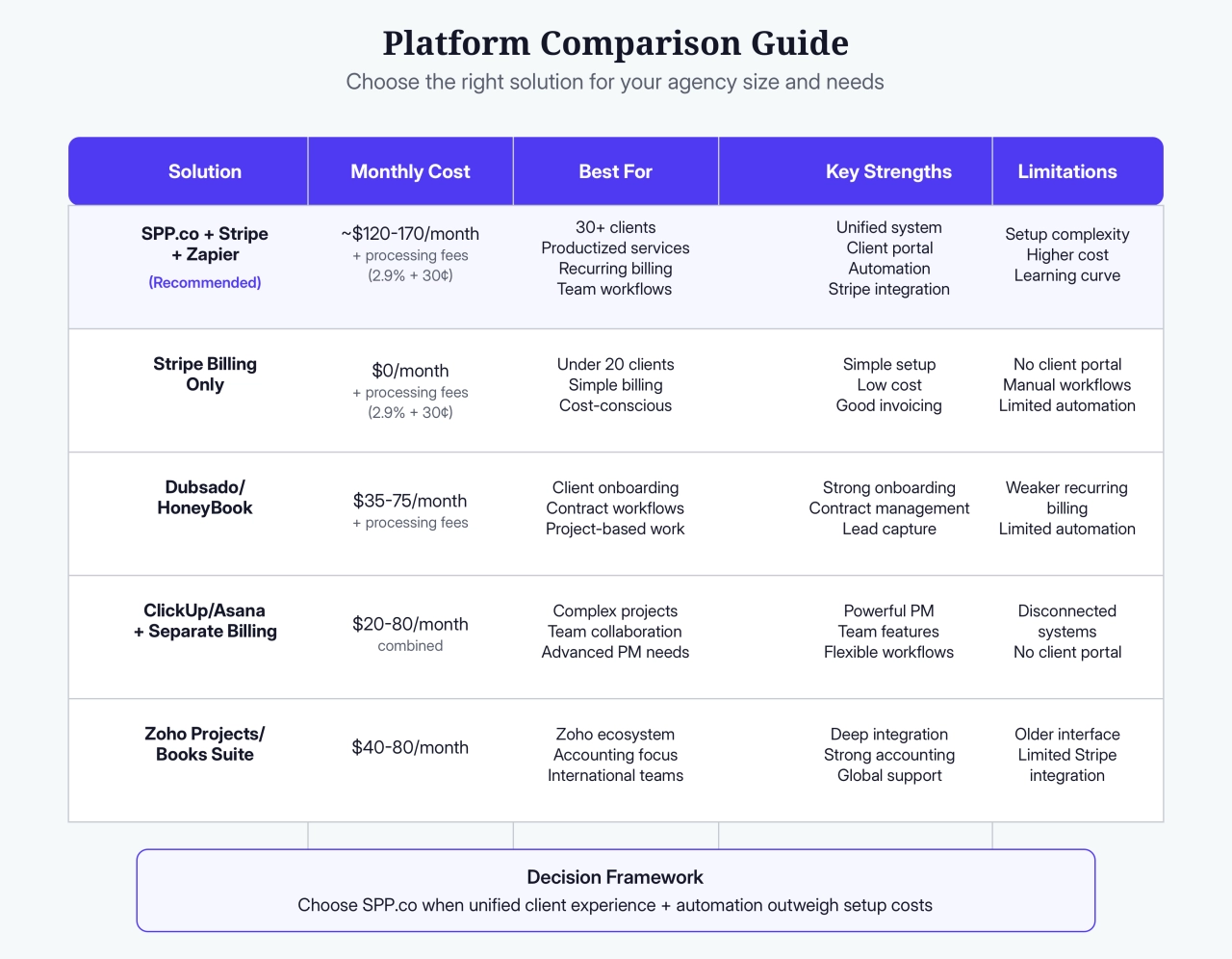

Let’s look at whether this integrated approach fits your agency’s situation. The tricky part is knowing when complexity outweighs benefits.

Rather than diving into lengthy comparisons, I’ve created a decision framework based on the most common agency situations I encounter:

The comparison above cuts through the marketing noise to show you real monthly costs, best-fit scenarios, and honest limitations. Notice how SPP.co isn’t always the right answer—particularly for smaller agencies where Stripe’s native billing might be more practical.

Agency size considerations: Small agencies (under 20 clients) might find Stripe’s native billing more practical initially. SPP.co makes sense when client management becomes complex.

Service type fit: SPP.co excels with productized services and repeatable processes. If you primarily handle completely custom project work, simpler tools might suit you better.

Technical comfort: Someone on your team needs to handle automation setup and troubleshooting. Factor in learning time if technical tasks typically create bottlenecks.

Let’s assume you’re a web design agency creating completely custom websites—you won’t benefit much from automated project workflows since each engagement needs individual attention from day one. The table above helps you avoid this mismatch before investing setup time.

Beyond general agency size and service type considerations, different verticals see varying levels of automation value based on their specific operational patterns.

6. Agency-type specific benefits

Let’s look at how different agency types see varying automation value based on their operational complexity:

SEO agencies benefit most from automation due to repetitive audit processes and multiple tool integrations (SEMrush, Ahrefs, Google Analytics). Automated keyword tracking setup and industry-specific audit checklists make the complexity worthwhile.

Content agencies with multiple writers see strong value in automated brief generation, writer assignment based on expertise, and deadline management. The subscription management features align well with monthly content packages.

Video editing agencies especially benefit from SPP.co’s large file upload capabilities (up to 5GB) and request-based subscription models. Automated folder creation and editor assignment work well for “unlimited revisions” packages.

Link building agencies find value in catalog-style service presentation and bulk order capabilities. Automated domain research triggers and outreach sequence initiation create significant efficiency gains.

The key question: Does your agency sell repeatable, packageable services with predictable workflows? If yes, this integration approach likely provides significant value. If your work is primarily custom projects with variable scopes, simpler billing tools might be more appropriate.

With that said, even agencies doing custom work often have recurring elements—maintenance packages, hosting services, or standardized add-ons—that benefit from automation.

Frequently asked questions

What’s the realistic ROI timeline for this setup?

From my experience with over 470 demos and onboardings, agencies typically see operational benefits within 2–4 weeks, depending on the number of services and team members involved. However, the setup investment (30-50 hours) means you need to be handling enough recurring billing and client management tasks for the time savings to justify the effort.

What’s the total monthly cost compared to alternatives?

SPP.co starts at $99/month, plus Stripe’s 2.9% + 30¢ per transaction, plus Zapier ($20-$50/month for meaningful automation). Compare this to Stripe alone (just processing fees) or FreshBooks ($19-$65/month) plus separate project tools. Don’t forget to factor in tax obligations as you scale.

How do I know when I’ve outgrown my current billing setup?

Key indicators: spending more than 10 hours/month on billing admin, manually sending the same emails repeatedly, losing track of project status across clients, or your team asking “where do I find…” questions daily.

What if this doesn’t work out for my agency?

SPP.co allows data export, and since Stripe remains your payment processor, client payment methods stay intact. The main switching cost is time spent on setup and team training, not vendor lock-in.

When should I definitely not do this?

If you’re primarily doing custom project work, have limited technical comfort on your team, or are satisfied with your current tools and growth trajectory, the complexity probably isn’t worth it.

With that said, even if you think SPP.co isn’t right for your current situation, tracking how much time you spend on billing admin monthly can help you make better decisions about when to revisit automation solutions.

You’ve got the technical knowledge, seen the agency examples, and understand the costs and considerations. The question now is: what’s your next move?

Your next steps

After more than 470 demos and onboardings, I’ve learned that agencies get paralyzed by too much analysis. So I’ve created a simple decision tree that gets you to action quickly.

Your path depends on just two factors: how many clients you have and how much billing admin pain you’re experiencing right now:

Follow the branches above and you’ll land on one of six clear outcomes—from “stick with current tools” to “full implementation.” What I like about this approach is it eliminates the endless “should I or shouldn’t I” internal debate.

The decision tree maps your path based on client count and current pain points. Whether you need to stick with current tools, test SPP’s capabilities, or dive into full implementation—there’s a clear next step for every agency situation.

The worst thing you can do is nothing. If billing admin is eating up your time, start somewhere - even one automation helps. The agencies in the “analysis paralysis” trap are the ones still doing everything manually a year from now.

Looking to make sure SPP.co is right for you? Get on a call with our customer success team.

Whether you choose SPP.co or optimize your current setup, the important thing is taking action on what you’ve learned here.

Closing thoughts

Setting up SPP.co with Stripe and Zapier creates an integrated billing system that handles the complexity most agencies face when scaling client operations. The key is understanding how the three systems work together rather than treating them as separate tools.

Start with the basic Stripe connection to handle payments, then add simple Zapier workflows for your most repetitive tasks. As you become comfortable with the system, you can build more sophisticated automations that connect your entire agency workflow.

The main advantage of this approach is consolidation - instead of managing separate billing, client portal, and automation tools, you get an integrated system designed specifically for service agency operations. I hope this post has been of help in understanding how to implement these integrations effectively for your agency’s specific needs.