- Client acquisition is crucial for marketing agencies as it allows them to grow their customer base, increase revenue, reduce client concentration risk.

- Successful client acquisition involves identifying, attracting, and converting potential clients into paying customers.

- The key components of client acquisition include lead generation, lead nurturing, and sales conversion.

Lead generation plays a mayor role in the art of client acquisition—but just generating leads will not lead to paying customers. Leads also need to be nurtured and scored.

If you’re running an agency and are constantly on the lookout for new clients, but your lead generation efforts remain fruitless, there might be a bigger issue in your process. It’s a common misconception that it’s more than enough to simply generate leads, and the rest will magically sort itself out.

This couldn’t be further from the truth, so let’s tip our toes into the topic of client acquisition and what it’s all about.

What is client acquisition?

Client acquisition is the lifeblood of any marketing agency. It refers to the process of identifying, attracting, and converting potential clients into paying customers. Without a steady stream of new clients, agencies cannot grow, and risk financial instability.

Successful client acquisition is crucial for several reasons:

Business growth: Acquiring new clients allows agencies to expand their customer base and increase revenue. This growth is essential for long-term sustainability and competitiveness in the market.

Diversification: By continuously acquiring new clients, agencies can diversify their client portfolio. This reduces dependence on a few key accounts and mitigates the risk of losing a significant portion of revenue if a major client leaves.

Brand reputation: Consistently attracting new clients enhances an agency’s brand awareness and market positioning. It demonstrates the agency’s ability to deliver value and excel in its services, which can lead to further growth through referrals and word-of-mouth marketing.

Key components of client acquisition

Client acquisition consists of three main components: lead generation, lead nurturing, and sales conversion.

Lead Generation: Involves attracting potential clients through various marketing channels. These channels may include: content marketing, search engine optimization, social media marketing, paid advertising, lead nurturing.

Lead nurturing: Once leads are generated, the next step is to nurture them. Lead nurturing involves building relationships with potential clients and guiding them through the sales funnel. This can be achieved through: email marketing, marketing automation, personal outreach.

Sales conversion: The final component of client acquisition is sales conversion. This involves turning qualified leads into paying clients. Key strategies for successful sales conversion include: consultative selling, demonstrating value, anticipating and addressing common objections.

Benefits of effective client acquisition

Investing in a robust client acquisition strategy offers numerous benefits for marketing agencies:

Increased revenue and profitability: By consistently acquiring new clients, agencies can grow their revenue and improve their bottom line. This increased financial stability allows for investments in talent, technology, and expansion into new markets.

Reduced client concentration risk: Diversifying the client portfolio through effective acquisition reduces the risk of over-reliance on a few key accounts. This helps protect the agency’s revenue stream and ensures greater stability in the face of client turnover or market fluctuations.

Enhanced brand reputation and market positioning: Successful client acquisition demonstrates an agency’s ability to attract and retain clients, which can enhance its brand reputation and market positioning. This, in turn, can lead to more inbound leads, referrals, and opportunities for partnerships or collaborations.

Opportunities for cross-selling and upselling: Acquiring new clients opens up possibilities for cross-selling and upselling additional services. By delivering exceptional results and building strong relationships, agencies can expand the scope of their work with existing clients, leading to increased revenue and client lifetime value.

Improved talent acquisition and retention: A growing client base and strong market position can help agencies attract and retain top talent. Skilled professionals are more likely to join and stay with an agency that demonstrates consistent growth and success in client acquisition.

Understanding the client acquisition process

Being aware of how client acquisition works is crucial for businesses to identify areas of improvement and optimize their sales strategy. It’s also crucial to understand the difference between lead generation and customer acquisition.

The process typically begins with lead generation, where potential clients are identified through various marketing channels such as social media, or email campaigns. Next, leads are qualified based on factors like demographics, needs, and budget.

The middle stage involves nurturing leads through engagement activities like webinars, demos, or consultations to build trust and establish relationships. This is followed by the proposal phase, where businesses present their solutions and pricing models to potential clients. Finally, hot leads are converted, and new customers are acquired.

By analyzing each step of this process, businesses can pinpoint inefficiencies and implement targeted improvements to reduce client acquisition cost. For example, they might realize that lead generation efforts need more focus on specific target markets or that nurturing leads requires a more personalized approach through content marketing or account-based sales initiatives.

With that said, let’s look at how you can build a funnel that helps you acquire customers.

How to think about customer acquisition costs

Let’s get one thing straight of the way, the basic customer acquisition formula is the following:

CAC = marketing & sales spent ÷ newly acquired customers

It’s an easy-looking formula, but calculating the first part, the spent, isn’t that straightforward. After all, what are the associated costs with marketing and sales?

Here’s what you should put into the spent category:

ad spent

content marketing costs

employee salaries

external collaborator invoices

marketing & sales software

And these are just to name a few.

Let’s say your spent in a given period is $5,000, and you acquired six new customers—your CAC would be $833.

Customer Acquisition Cost Calculator

Customer Acquisition Cost

€0.00

Here’s the problem with that number: you’ve just calculated your CAC without taking into account the actual marketing spent. How do you know if CAC for your ad investment is high or low? Should you focus on it or rather on content marketing?

As you can see, when it comes to customer acquisition cost, it’s a good idea to also look at it from multiple perspectives.

Measuring CAC based on LTV

Let’s involve another metric agencies should be tracking, the customer lifetime value (LTV). Most agencies choose a multi-year period for their LTV, for instance two years, to calculate how much value a customer brings in.

Let’s assume you’re a video editing agency and your customers are on average 18 months subscribed to your monthly recurring video editing service valued at $599. Your customer lifetime value would be $10,782.

Now, let’s use CAC and LTV to calculate LTV:CAC:

LTV:CAC = LTV ÷ CAC

In our case, $10,782 divided by $833 equals 13.

This is just your overall LTV:CAC ratio. I highly suggest calculating it based on different marketing and sales channels. Check it on your ad investments, content marketing, affiliate marketing, and sponsorships.

The higher the calculated LTV:CAC ratio, the more you should focus on it, as it gives you the best return on investment.

Optimizing CAC costs with segmentation

If measuring CAC isn’t already a challenge, digging deeper into the data and optimizing it poses more challenges. There are many perspective views you should consider, and one I haven’t mentioned yet is to look at segmented customer and lead groups.

After all, you should know if your best leads are coming from specific geographical locations, such as the United States and Canada, or if they hold a specific role in their company.

What can you do when it comes to segmentation?

split leads into groups based on location

enrich lead data with more information

attribute the spent value of the customer

check which customers need the least support

When you look at your leads, also calculate the cost per lead (CPL). This helps you eliminate lead generation channels that cost you too much money, and needlessly increase your CAC.

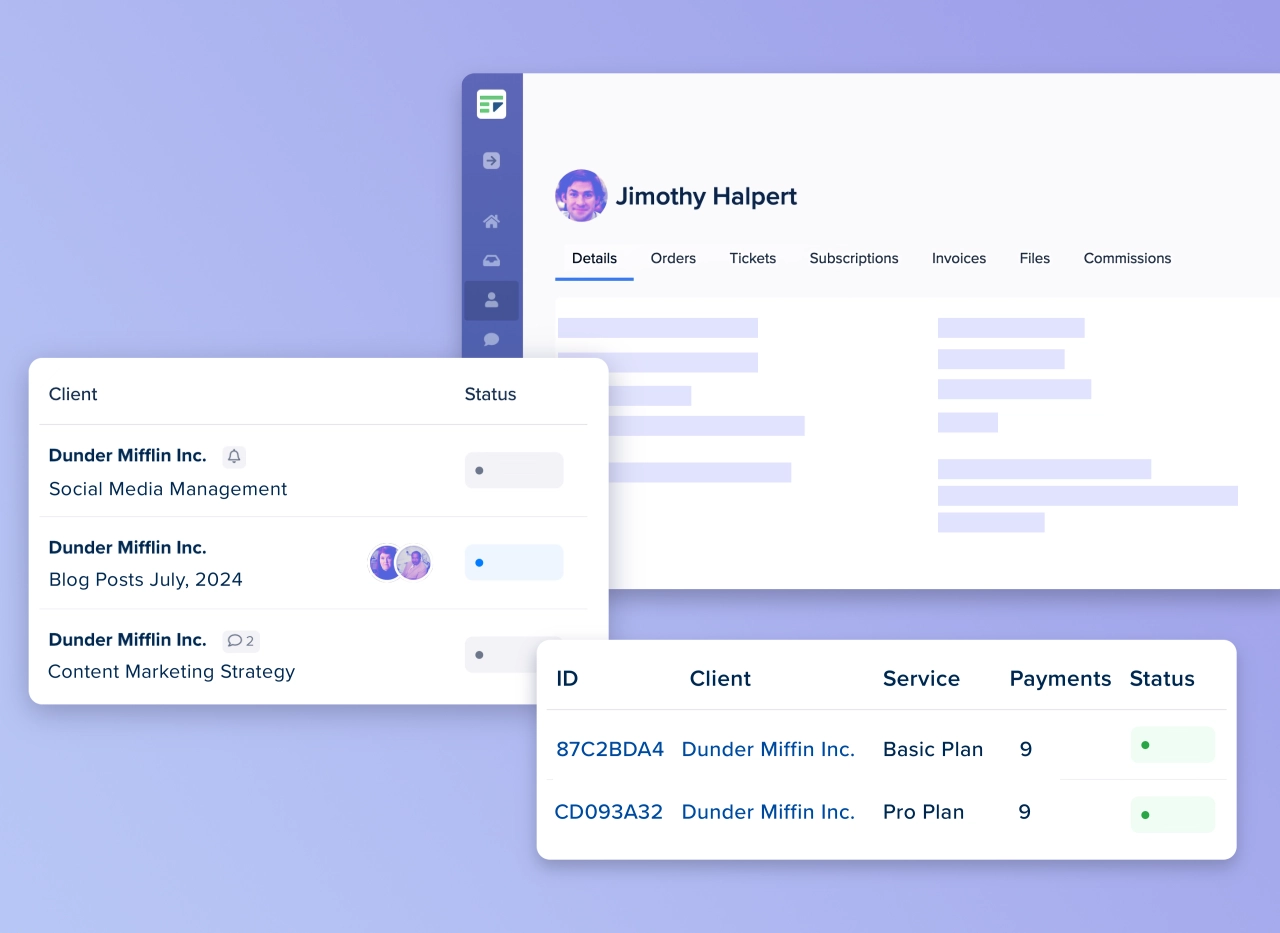

When it comes to processing the data, most of it you can easily hold in your agency CRM. For instance, add all your leads to SPP and update their profile with data from external tools, for instance the full name, LinkedIn profile, and position in their company.

Keep all your client data securely stored in one place.

Once they are a customer, you can see the spent value over time, assign a custom status, get an overview of the tickets they’ve created, and understand how valuable the customer is.

Reducing client acquisition expenses in 2025

At this point, you know how to calculate your CAC and check if you’re spending as much as other agencies. In any case, I’m sure you’ll want to lower the number as much as you can, here’s how:

Client acquisition tools

Use CRM systems: customer relationship management (CRM) systems can significantly streamline your client acquisition process. Import your leads and enrich the data to have everything in one central place.

Automate email campaigns: Automated email campaigns can reduce labor costs and increase engagement. Choose an email marketing platform such as Mailchimp and segment your leads and customers based on behavior. Analyze the results and optimize your campaigns.

Utilize chatbots: Chatbots can handle customer inquiries around the clock, freeing up your team for more complex tasks. Use them for specific use-cases, such as answering frequently asked questions from leads.

Outsourcing specific tasks

Identify high-cost and low-efficiency tasks your agency should outsource to keep costs low:

Analyze workflows: Perform a thorough review of your current processes. Document tasks and the time they take.

Calculate costs: Determine the internal cost of each task, including labor, technology, and management overhead.

Identify tasks: Focus on high-cost tasks that do not require in-depth company knowledge.

Building a customer acquisition funnel

Spending money on lead generation alone is not going to lead to fruitful results. Leads will trickle in, but they are often not ready to buy, unsure if your solution is the best for them, or need a little personal convincing first.

Let’s look at three stages you need to be aware of to build your funnel:

Map out your customer journey: understand your customer’s journey so you can identify touchpoints along the way.

Nurture leads with content: Deliver targeted content by segmenting leads and personalizing your content, be it whitepapers, case studies, or webinars.

Implement a lead scoring system: Assign points to leads based on actions they take, and prioritize warm leads that are almost ready to make a decision.

3 key client acquisition strategies for agencies

With your funnel set up, let’s look at strategies you can use to acquire clients.

Relationship building: Participate in industry events, webinars, and be active in closed and open communities (Slack, LinkedIn). You can also build relationships with non-competing agencies and send referrals to each other.

Leveraging case studies: Invite your best customers to participate in case studies, and ask them how your agency has elevated their business. Share concrete numbers, such as, since working with you, their revenue increased by 80%.

Offering free consultations: A quick 15-minute call can convince hot leads that you’re the right agency for the job. Free trials or foot-in-the-door services (such as GMB Gorilla’s one-time Google Business Profile optimization service).

Mastering the art of client acquisition

Client acquisition is the lifeblood of any thriving marketing agency. By identifying your ideal client profile, developing a multichannel lead generation plan, and optimizing your website for lead capture, you’ll build a solid foundation for attracting high-quality prospects. Mapping out your customer journey, nurturing leads with targeted content, and implementing a lead scoring system will help you create a high-converting sales funnel that consistently drives results.

Effective prospecting strategies, such as leveraging social media for targeted outreach, attending industry events, and implementing account-based marketing, will enable you to connect with decision-makers and build meaningful relationships. And by defining key performance indicators, conducting A/B testing, and continuously optimizing your efforts, you’ll ensure that your client acquisition strategies remain effective and adaptable in the ever-evolving business landscape.