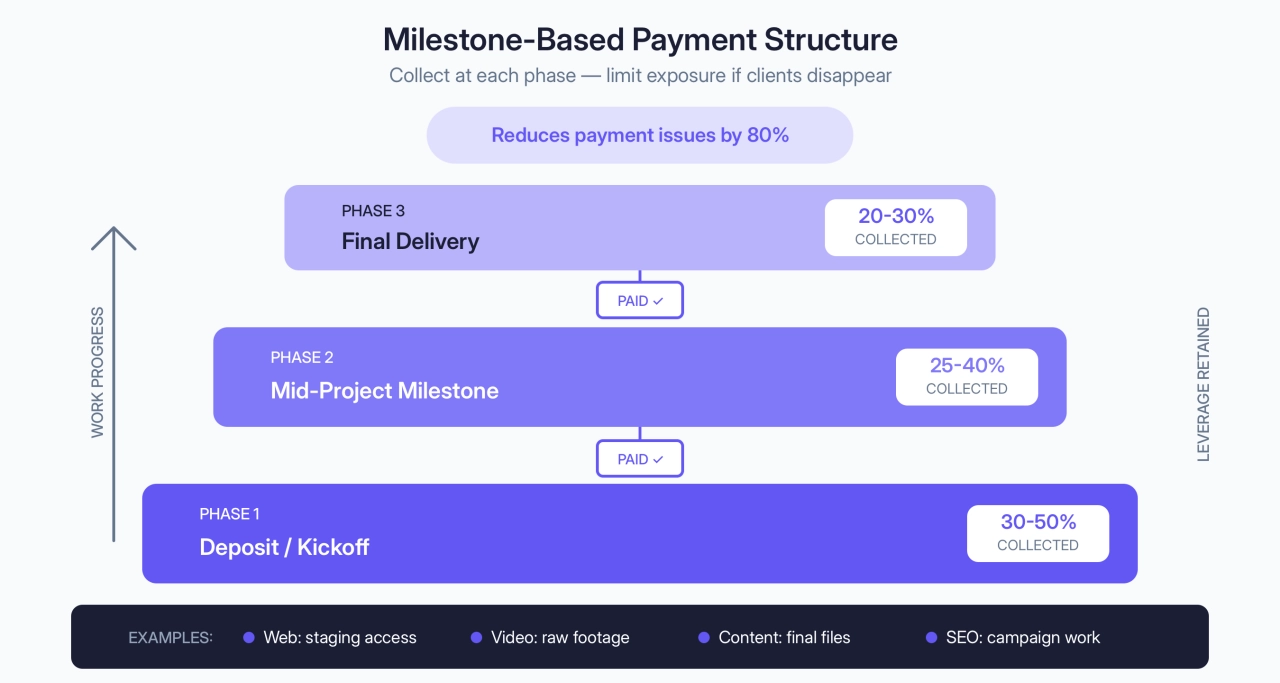

- Structure payments around milestones and collect before you deliver—agencies that do this report up to 80% fewer payment issues.

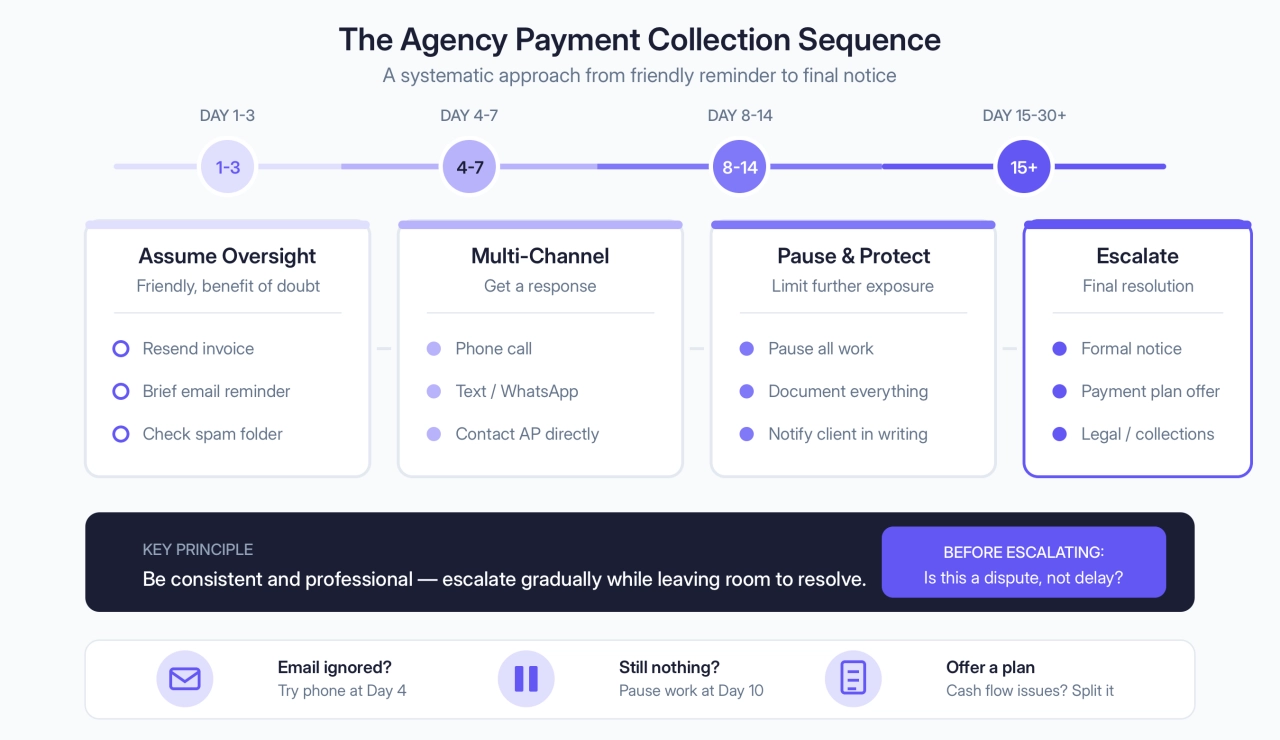

- Follow a consistent collection sequence: friendly reminder (day 1–3), multi-channel follow-up (day 4–7), pause work (day 8–14), then escalate.

- Automate your payment reminders so follow-up happens without you thinking about it—reserve personal calls for clients who actually need them.

I get it. You’ve done the work, the client’s happy with the results, and now you’re stuck sending awkward follow-up emails wondering why the invoice from three weeks ago is still sitting unpaid.

Nobody starts an agency to chase payments. But here’s the reality: about half of all invoices issued by US businesses become overdue (PYMNTS, 2022), and the average small business spends 14 hours a week dealing with late payments, according to QuickBooks research. That’s almost two full days you could be spending on actual client work.

The good news? Most late payments aren’t malicious. Clients forget, their card fails, the invoice lands in spam, or they’re just overwhelmed with their own fires. A simple nudge usually does the trick. But when it doesn’t—when emails go unanswered and the excuses start piling up—you need a clear plan that protects your cash flow without torching a relationship you spent months building.

That’s what this guide is for. I’ll walk you through how to prevent payment issues before they start, what to do when invoices go overdue, and when it makes sense to escalate.

Everything here comes from agency owners who’ve actually dealt with this—including approaches that have reduced payment issues by 80% and recovered five-figure invoices without involving lawyers.

Understanding this topic involves several interconnected concepts:

Each of these concepts plays a crucial role in the overall topic.

Why agencies face unique payment challenges

Late payments hit agencies differently than other businesses.

When a plumber finishes a job, they hand over the invoice and move on. But you’ve probably spent weeks or months working alongside this client. You know their business, their team, maybe even their kids’ names. That relationship is worth something—future projects, referrals, a case study for your website. So when an invoice goes unpaid, you’re not just chasing money. You’re weighing whether pushing too hard might cost you more than the invoice is worth.

Agencies position themselves as partners, not vendors—and that makes payment conversations feel awkward in a way they wouldn’t for a one-off contractor. You’re not just chasing an invoice; you’re navigating a relationship you’ve invested in.

But here’s what most agency owners forget: you have leverage that other businesses don’t.

You’re likely sitting on deliverables the client needs. Ongoing campaigns they depend on. A staging site they can’t launch without you. Access to accounts and assets that keep their business running. Used thoughtfully, this leverage can resolve payment issues without a single uncomfortable phone call.

Overdue vs outstanding invoices

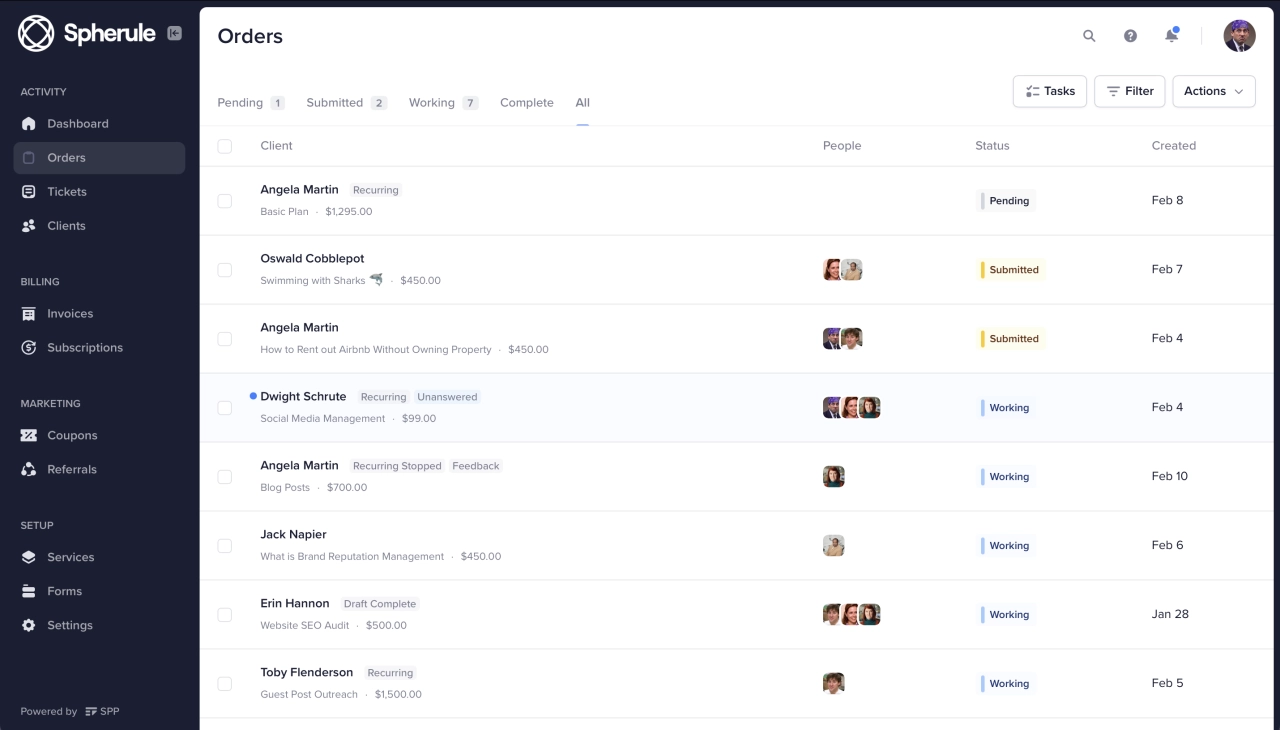

Before you start chasing, make sure you’re actually dealing with a late invoice—not just an outstanding one.

An outstanding invoice is simply a bill you’ve sent that hasn’t been paid yet. It might not even be due. If you invoice on net-30 terms and it’s been two weeks, you have an outstanding invoice—not a problem.

An overdue invoice is an outstanding invoice that’s past the agreed payment date. This is when you need to act.

The distinction matters because jumping on a client before payment is actually due makes you look disorganized—or worse, desperate. But waiting too long after the due date signals that you’re flexible on payment terms, which invites more of the same.

Invoice Status | Definition | Action Required |

|---|---|---|

Outstanding | Sent but not yet due | None—payment still within terms |

Overdue (1–7 days) | Just past due date | Friendly reminder, assume oversight |

Overdue (8–30 days) | Clearly late | Direct follow-up, consider pausing work |

Overdue (30+ days) | Significantly late | Escalation, formal notice, payment plan |

The clock starts when the invoice is due, not when you send it. If your contract says net-15 and you invoiced on the 1st, the payment is due on the 16th—and it’s overdue on the 17th.

One thing worth noting: some clients, especially larger companies, have internal policies that delay payment regardless of your terms. A marketing director might approve your invoice immediately, but their accounts payable department only processes payments on the 15th and 30th of each month. If you’re working with enterprise clients, ask about their payment cycle upfront so you’re not left wondering why a net-15 invoice takes 28 days to clear.

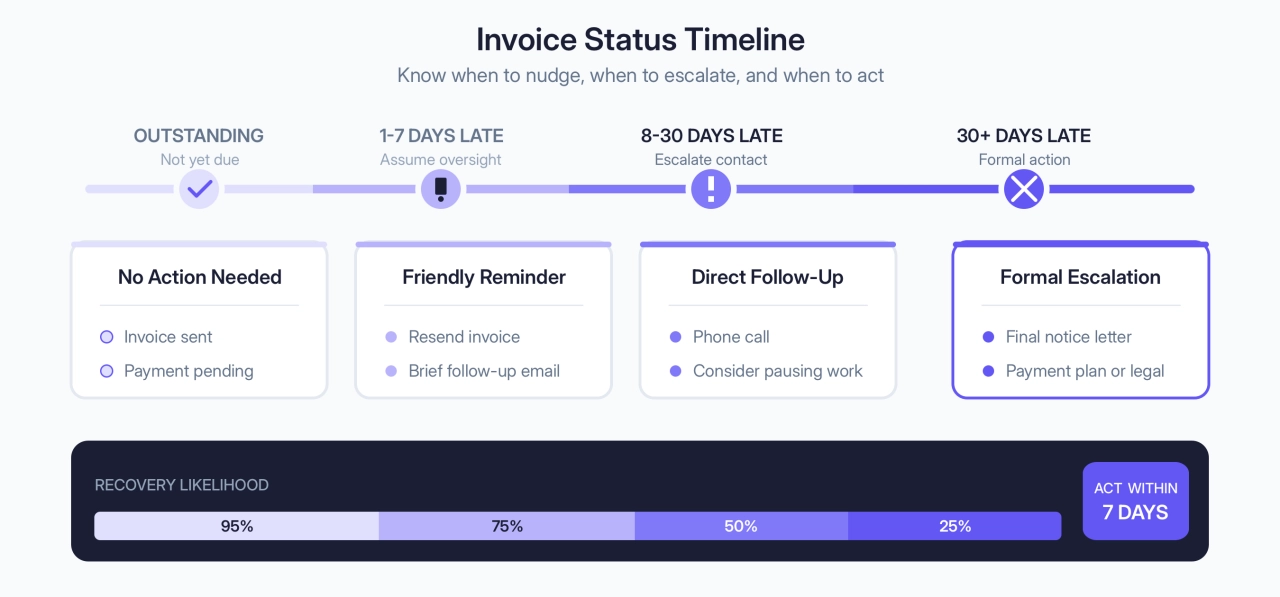

How agencies reduce payment issues by 80%

The best invoice collection strategy is not needing one.

Harmanjit Singh, founder and CEO at Origin Web Studios, put it simply:

We structure our payment terms like building blocks—each phase must be paid before beginning the next. This approach reduced our payment issues by 80%.

Harmanjit Singh,

Origin Web Studios

Harmanjit Singh,

Origin Web Studios

That’s not a typo. Eighty percent fewer payment issues, just by changing how you structure the engagement upfront.

Milestone-based payment structures

The agencies with the fewest payment problems don’t invoice after the work is done—they break projects into phases and collect at each stage. If a client disappears or refuses to pay, your exposure is limited to the current phase, not the entire project.

Here’s how this looks across different agency types:

Agency Type | Structure | What You Hold Until Payment |

|---|---|---|

Content | 50% upfront, 50% on delivery | Final files—deliver watermarked drafts until paid |

SEO | Monthly retainer due before work begins | Campaign work, reporting, optimizations |

Web Design | 30% deposit, 40% at design approval, 30% at launch | Staging site access, domain transfer, final files |

Video | 50% upfront, 50% before raw footage handoff | Raw footage, unwatermarked exports |

PPC/Ads | Retainer + ad spend due before month starts | Campaign management, pause ads immediately |

The pattern is the same regardless of what you sell: collect before you deliver, and keep something the client needs until they pay.

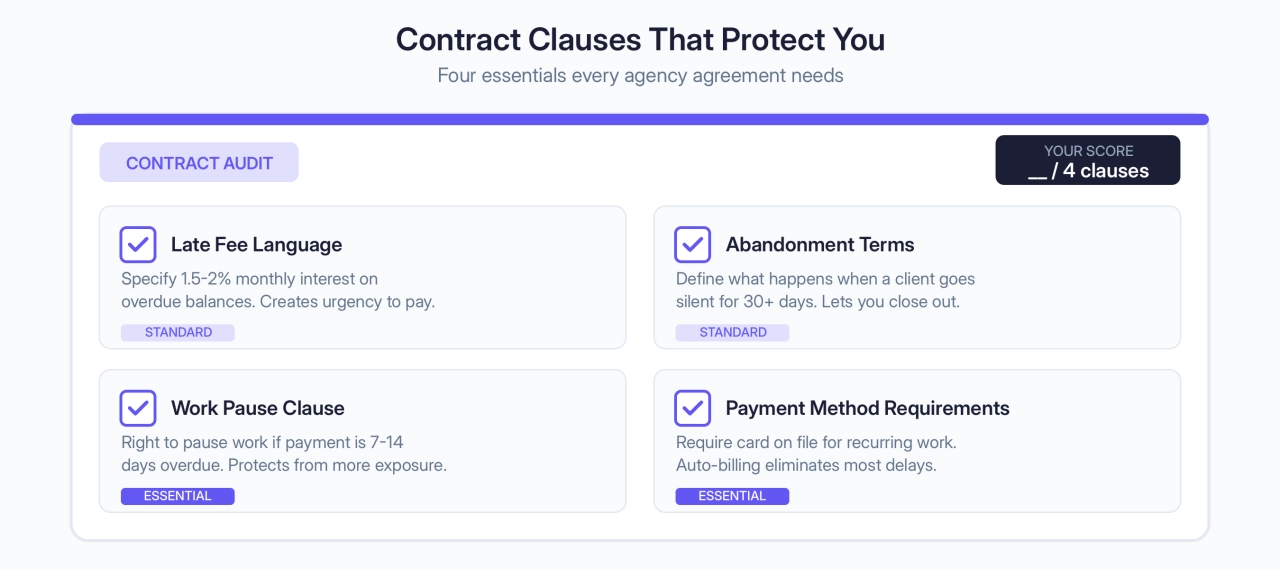

Contract clauses that protect you

Your contract is your first line of defense. But most agency contracts focus on scope and deliverables while treating payment terms as an afterthought. These clauses should be in every client agreement:

Late fee language: Specify exactly what happens when payment is late—typically 1.5% to 2% monthly interest on overdue balances. The point isn’t to make money on interest; it’s to give clients a reason to prioritize your invoice.

Work pause clause: State clearly that you reserve the right to pause all work if payment is more than 7 or 14 days overdue. This protects you from sinking more hours into a project while chasing payment for work already completed.

Abandonment terms: Define what happens when a client goes silent. Faiza Aijaz, co-founder at Ecazon E-commerce Solutions, includes this in every contract: “If we don’t hear from the client for more than 30 days, we consider the project abandoned.” This protects you from projects that drag on indefinitely and gives you clear grounds to close out and move on.

Payment method requirements: Specify acceptable payment methods and, if possible, require a card on file for recurring work. Automatic client billing eliminates most payment delays before they start.

Setting the tone from day one

How you communicate in the first week of a project sets expectations for the entire relationship.

This doesn’t mean being cold or formal. It means being clear. Send invoices promptly. Reference payment terms in your kickoff materials. Treat payment as a normal part of the working relationship—not something you’ll figure out later.

Speaking too casually early on can create a familiarity that hurts you down the line—clients may mistake your relaxed attitude for unlimited flexibility. Keep communication professional from the start, and you’ll find it easier to hold the line when payments slip.

Three collection mistakes that backfire

When invoices go unpaid, frustration builds. You’ve done the work, you’ve been patient, and now you’re wondering if this client ever intended to pay at all.

How you respond in this moment matters more than you might think. The wrong move can eliminate any chance of getting paid—and cost you more than just this one invoice.

Threatening the client

When someone owes you money and ignores your emails, threatening legal action feels satisfying. But threats rarely work, and they almost always make things worse.

If a client is struggling financially, threats just push them further into avoidance. If they’re unhappy with the work, threats escalate the dispute instead of resolving it. And if they simply forgot or got busy, you’ve just torched a relationship over something a phone call could have fixed.

Save the formal language for when you’ve actually decided to pursue legal action. Until then, firm and professional beats aggressive every time.

Posting negative reviews

When a B2B client refuses to pay, it’s tempting to warn others. They probably have a Google Business profile, a LinkedIn presence, maybe even a Trustpilot page. A few honest reviews about their payment practices might feel like justice.

Don’t do it—at least not yet.

Public complaints make you look unprofessional, even if you’re in the right. They can also expose you to defamation claims if you’re not careful with your wording. And they burn any remaining chance of salvaging the relationship or negotiating a settlement.

If you’ve exhausted every other option and the client is genuinely acting in bad faith, a factual review might be warranted. But it should be a last resort, not a first reaction.

Charging a saved payment method without consent

If you have a client’s card on file, you might be tempted to just charge it and be done with the whole ordeal. Technically, you can—especially if your terms of service allow it.

But here’s what happens next: the client disputes the charge with their bank. Credit card companies almost always side with the cardholder in these situations. You’ll spend hours submitting evidence, you’ll probably lose anyway, and the chargeback will ding your standing with your payment processor. Too many chargebacks and you could lose your merchant account entirely.

Even if you win the dispute, you’ve guaranteed that this client will never work with you again and will tell everyone they know about the experience.

The only time to charge a card on file is when you’ve explicitly discussed it with the client and they’ve agreed to the charge. A quick email confirming “I’ll process the $2,500 to the card we have on file tomorrow—let me know if you’d prefer a different method” protects you and keeps the relationship intact.

The agency payment collection sequence

When an invoice goes overdue, you need a system—not a series of awkward one-off emails. The sequence below gives you a clear path from friendly reminder to final notice, with specific actions at each stage.

The goal isn’t to be aggressive. It’s to be consistent and professional, escalating gradually while leaving room for the client to make things right.

Is the client disputing the invoice?

Before you escalate, make sure you’re dealing with a late payment—not a disagreement about the work.

Some clients don’t pay because they’re unhappy with what you delivered. Maybe they found an error on the invoice. Maybe the scope changed mid-project and they feel the final bill doesn’t reflect what was agreed. Maybe they expected different results and don’t think they should pay full price.

If that’s what’s happening, sending more payment reminders won’t help. You’re not dealing with a collection problem; you’re dealing with a client satisfaction problem that happens to be showing up as an unpaid invoice.

The tell is usually in how they respond—or don’t. A client who’s simply busy or forgetful will apologize and pay quickly once reminded. A client who’s disputing the work will either push back directly or go silent because they’re avoiding an uncomfortable conversation.

If you suspect a dispute, address it head-on. A quick call to ask “Is there anything about the work or the invoice that we should discuss?” opens the door for them to tell you what’s really going on. From there, you can resolve the underlying issue and work out payment together.

I’ve written a separate guide on handling disputed invoices if you’re dealing with that situation. For the rest of this post, I’ll assume the client isn’t questioning the work—they’re just not paying.

Day 1-3: assume it’s an oversight

Most late payments aren’t intentional. The email got buried, the card on file expired, or the client simply forgot. Start with that assumption.

Resend the invoice with a brief, friendly note. Don’t apologize for following up—just make it easy for them to pay.

At this stage, you’re not chasing. You’re reminding. Keep the tone light and give them the benefit of the doubt.

Day 4-7: multi-channel follow-up

If the first reminder didn’t work, the issue probably isn’t awareness—it’s attention. Your emails might be landing in a cluttered inbox or getting deprioritized behind more urgent fires.

Time to try different channels:

Phone call: A two-minute conversation often resolves what three emails couldn’t. Hearing your voice makes the invoice feel more real and harder to ignore.

Text or WhatsApp: For clients you have a more casual relationship with, a quick “Hey, just checking if you got my invoice email—want to make sure it didn’t land in spam” can prompt immediate action.

Contact accounts payable directly: If you’re working with a larger company, your main contact might not even handle payments. Stephanie Fehrmann, co-founder and content director at Redefine, recommends going straight to the source.

We first reach out to accounts payable directly. If they continue to be unresponsive, we copy our point of contact, and often, this escalates the issue and moves it closer to resolution.

Stephanie Fehrmann,

Redefine

Stephanie Fehrmann,

Redefine

The goal here is simple: get a response. Even a “sorry, paying Friday” gives you something to work with.

Day 8-14: pause work & document everything

If you’re still not getting anywhere, it’s time to protect yourself from further exposure.

Stephanie Fehrmann is direct about this: “The policy at our company is that we pause working on an account as soon as the account is late on 2 invoices.”

You don’t need to wait for two invoices. If a client is 10+ days overdue and unresponsive, pausing work is reasonable—and often effective. Let them know clearly:

Hi [Name], I wanted to let you know that I’ve paused work on [project] until we can get the outstanding invoice sorted. Once payment comes through, I’ll pick right back up. Let me know if there’s anything on your end I can help with.

This isn’t a threat. It’s a boundary. You’re a business, not a charity, and continuing to work while chasing payment just digs you deeper into the hole.

At this stage, also make sure you’re documenting everything: emails sent, calls made, responses received. If this eventually becomes a legal matter, you’ll need a clear record of your attempts to resolve it.

Day 15-30: escalate with value framing

Now you’re firmly in overdue territory. The friendly reminders haven’t worked, and it’s time to be more direct.

Your email at this stage should:

acknowledge the situation directly (no more “just checking in”)

reference the specific work delivered and results achieved

state the outstanding amount and original due date

offer a payment plan if appropriate

set a clear deadline for response

If they’re struggling financially, this is often when they’ll admit it. That opens the door to a payment plan conversation, which is almost always better than escalating further.

Day 30+: last email before formal action

You’ve been patient. You’ve followed up through multiple channels. You’ve paused work and offered flexibility. If you’re still getting silence, it’s time for a final notice.

Faiza Aijaz, co-founder at Ecazon E-commerce Solutions, uses a simple two-sentence approach that often breaks through:

Since I haven’t heard from you on this, I have to assume your priorities have changed. All the best.

Faiza Aijaz,

Ecazon Ecommerce Solutions

Faiza Aijaz,

Ecazon Ecommerce Solutions

It’s not aggressive, but it’s clear: this is the end of the line. Clients who were simply avoiding the conversation often respond at this stage because they realize you’re about to walk away—or escalate formally.

If you’re prepared to pursue legal action or hand the debt to collections, this email should say so. Something like:

If I don’t hear from you by [date], I’ll need to explore other options for collecting the outstanding balance.

Don’t bluff. Only include this if you actually intend to follow through.

Phone scripts for agency owners

Email is easy to ignore. A phone call isn’t.

If you’ve sent multiple reminders without a response, picking up the phone often resolves things faster than another follow-up email ever could. The trick is knowing what to say—and staying professional even when you’re frustrated.

Scenario | Script | Why it works |

|---|---|---|

Opening | “Hi [Client Name], this is [Your Name] from [Company]. I’m calling about invoice #[Number] for $[Amount] that was due on [Date]. I wanted to reach out personally to see if there are any issues on your end.” | Direct without apologizing. You’re not doing anything wrong by following up. |

They forgot | “No problem, these things happen. Can you process the payment today? I can wait on the line while you handle it.” | Staying on the line creates gentle pressure to act now, not later. |

Cash flow issues | “I understand cash flow can be challenging. Would a payment plan work better? We could split this into two or three payments over 30-60 days.” | Opens the door they were afraid to walk through. Gets you paid faster than holding out. |

Disputing the work | “I want to make sure we resolve this properly. Can you walk me through your specific concerns? Let’s schedule time this week to review.” | Non-defensive. Surfaces real issues—or exposes excuses. |

Closing | “Great, so to confirm: [restate agreement]. I’ll send a follow-up email summarizing next steps.” | Written summary creates accountability. |

Voicemail | “Hi [Name], this is [Your Name] from [Company] calling about invoice #[Number] due on [Date]. Please call me back at [number]. Thanks.” | Short. Long voicemails get deleted. |

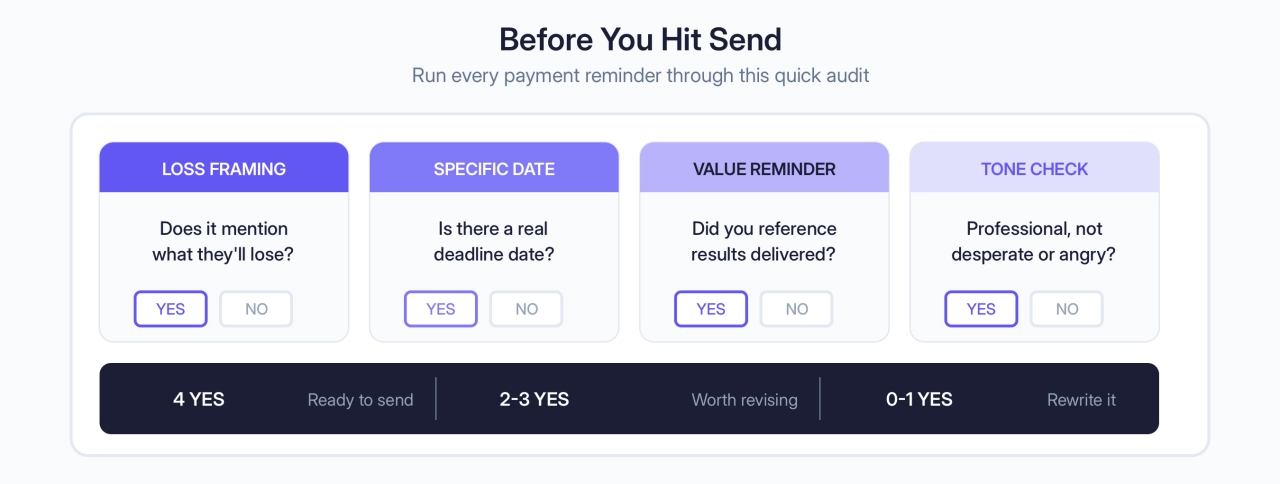

The psychology of getting paid

The words you use in payment reminders matter more than you might think. Small shifts in framing can mean the difference between an email that gets ignored and one that gets paid.

Loss aversion

People respond more strongly to avoiding loss than to gaining something of equal value. It’s why “don’t miss out” outperforms “get access to” in almost every context.

Apply this to payment reminders by framing around what the client might lose:

Instead of: “Pay now to continue receiving our services”

Try: “To avoid any interruption to your campaigns, please process this invoice by Friday”

You’re not threatening. You’re reminding them what’s at stake.

Urgency through specificity

Vague deadlines get vague responses. “Please pay soon” gives the client permission to define “soon” however they like—usually later than you’d prefer.

Specific dates create real urgency:

Instead of: “Please pay as soon as possible”

Try: “Please process this by Thursday the 14th”

A specific date feels like a real deadline. “As soon as possible” feels like a suggestion.

Reciprocity

When you’ve delivered real value, remind them of it. Not in a guilt-tripping way, but as context for why this invoice matters.

Chris Stott, director at Anything is Possible, uses this approach:

Remind the client of the specific work you’ve contributed and how it has been a cost-effective solution for them. This reframes the conversation from a focus on the debt to a mutual recognition of the ongoing business relationship.

Chris Stott,

Anything is Possible

Chris Stott,

Anything is Possible

In practice, this might look like:

This invoice covers the website redesign we launched last month, which has already driven a 24% increase in demo requests.

You’re not begging for payment. You’re reminding them that they got what they paid for—and more.

Social proof for repeat offenders

For clients who are consistently late, a subtle reference to how “most clients” behave can shift their perception of what’s normal.

Instead of: “Your invoice is overdue again”

Try: “Most of our clients pay within the first week. Let me know if there’s something on your end making that difficult.”

This works because it positions prompt payment as standard behavior—and late payment as the exception that needs explaining.

Email templates by stage

Having templates ready means you’re not drafting emails from scratch when you’re already frustrated. Customize these to fit your voice, but keep the structure—each one escalates slightly while staying professional.

Before payment is due

Use this for subscription clients or larger invoices where a heads-up helps.

Subject: Invoice #[number] due on [date]

Hi [First Name],

Quick reminder that your invoice for [service name] is coming due on [date]. You can view and pay it here: [link]

Let me know if you have any questions.

[Your Name]

Payment due today

Subject: Invoice #[number] due today

Hi [First Name],

Just a heads-up that invoice #[number] for [service name] is due today. You can access it and pay here: [link]

If you’ve already sent payment, please ignore this—and thank you.

[Your Name]

3 days overdue

Subject: Following up on invoice #[number]

Hi [First Name],

I wanted to check in on invoice #[number] for $[amount], which was due on [date]. It’s possible the email got buried or there’s an issue on your end—just let me know.

Here’s the invoice link again: [link]

[Your Name]

7 days overdue

Subject: Invoice #[number] — one week overdue

Hi [First Name],

Following up again on invoice #[number] for $[amount], now a week past due. I haven’t heard back from my previous emails, so I wanted to make sure everything’s okay.

If there’s an issue with the invoice or you need to discuss payment timing, I’m happy to talk it through. Otherwise, please process this as soon as you can.

[link to invoice]

[Your Name]

30 days overdue

Subject: Payment required — Invoice #[number]

Hi [First Name],

Invoice #[number] for $[amount] is now 30 days overdue. I’ve reached out several times without a response, and I’d like to get this resolved.

To recap, this invoice covers [brief description of work delivered]. If you’re facing cash flow constraints, I’m open to discussing a payment plan—but I do need to hear from you.

Please reply to this email or call me at [phone] by [specific date].

[Your Name]

Pausing work

When you’ve reached the point of stopping work, be direct but not hostile. This email does two things: protects you from further exposure and often prompts immediate payment.

Subject: [Project name] on hold — invoice #[number]

Hi [First Name],

I’ve paused work on [project/campaign] until we can resolve the outstanding invoice (#[number] for $[amount], due [date]).

I don’t take this step lightly—I know it affects your timeline. But I also can’t continue adding hours to a project with unpaid invoices outstanding.

Once payment clears, I’ll pick right back up. If there’s something going on that I should know about, I’m happy to talk it through.

[Your Name]

For retainer clients, adjust slightly:

Hi [First Name],

I’m pausing this month’s deliverables until the outstanding balance is resolved. Your account is currently [X] days overdue on invoice #[number] for $[amount].

I’d like to get this sorted so we can keep things moving. Let me know if you’d like to jump on a quick call.

[Your Name]

Final notice

Subject: Final notice — Invoice #[number]

Hi [First Name],

This is my final attempt to reach you regarding invoice #[number] for $[amount], originally due on [date].

I’ve followed up multiple times without a response. If I don’t hear from you by [date—typically 5-7 days out], I’ll need to pursue other options to recover this balance.

I’d prefer to resolve this directly. Please reply or call me at [phone].

[Your Name]

Customizing by agency type

The templates above work for any service business, but you can make them more effective by referencing specific deliverables or ongoing work. Here’s how to adjust the language based on what you do:

Agency Type | What to Reference | Example Language |

|---|---|---|

SEO | Campaign momentum, rankings | “To keep your SEO campaign running and protect the ranking progress we’ve made…” |

Content | Content calendar, word credits | “To keep your content calendar on track and ensure next month’s posts go out on schedule…” |

Web Design | Project milestones, launch timeline | “This invoice covers the design approval milestone. Once paid, we’ll move into development…” |

Video | Raw footage, project timeline | “Once this invoice is cleared, I’ll send over the raw footage and final exports…” |

PPC/Ads | Active campaigns, ad spend | “To keep your campaigns running without interruption and avoid losing momentum…” |

The principle is the same: connect the payment to something the client cares about continuing.

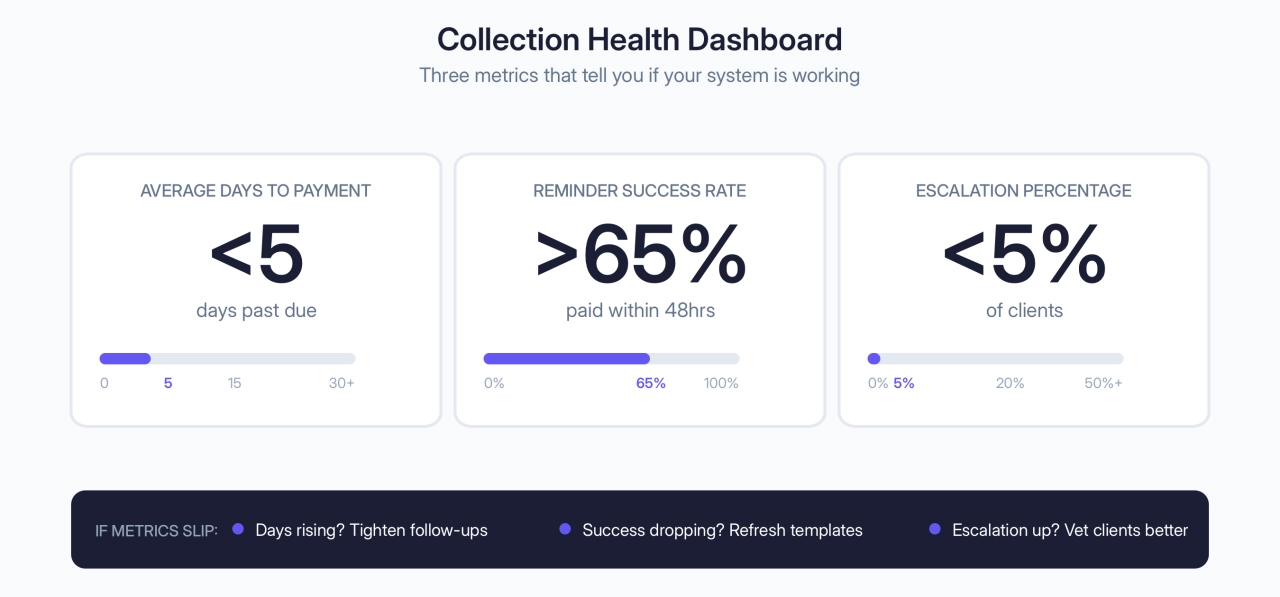

Measuring your collection success

If you’re not tracking how quickly you get paid, you’re flying blind. A few simple metrics tell you whether your system is working—or whether invoices are quietly slipping through the cracks.

Average days to payment

This is the simplest measure of collection health: how many days pass between the invoice due date and when payment actually arrives?

How to calculate: Total days late across all invoices ÷ number of invoices paid

Target: Under 5 days past due on average. If you’re consistently hitting 15 or 20 days, your reminder sequence isn’t working—or your payment terms aren’t being taken seriously.

Reminder success rate

What percentage of your payment reminders result in payment within 48 hours?

How to calculate: Invoices paid within 48 hours of reminder ÷ total reminders sent

Target: Above 65%. If most of your reminders aren’t prompting quick payment, look at the timing, channel, or language you’re using. A well-timed phone call often outperforms a third email.

Escalation percentage

How often do you need to go beyond friendly reminders—pausing work, sending formal notices, or involving legal?

How to calculate: Clients requiring formal escalation ÷ total clients invoiced

Target: Below 5%. If you’re escalating more than one in twenty clients, the problem is likely upstream: unclear payment terms, poor client vetting, or contracts that don’t protect you.

What these numbers tell you

Track these monthly and look for patterns:

Rising average days to payment might mean you’ve relaxed on follow-ups, or you’ve taken on clients with looser payment habits.

Dropping reminder success rate could signal that your templates have gone stale or you’re waiting too long to send the first nudge.

Climbing escalation percentage is a red flag for client quality or contract issues—fix those before they drain more of your time.

You don’t need fancy software for this. A spreadsheet that logs invoice date, due date, payment date, and whether escalation was needed gives you everything you need to spot problems early.

Payment plans that actually work

Sometimes clients want to pay but can’t—at least not all at once. When that’s the situation, a payment plan often gets you more money faster than holding out for the full amount or escalating to collections.

The key is structuring plans that protect you while giving the client a realistic path forward.

30-60-90 day plan

This is the most common structure and works well for mid-sized invoices.

Month 1: 50% of outstanding amount

Month 2: 30% of outstanding amount

Month 3: 20% of outstanding amount

Front-loading the payments protects you if the client defaults partway through. Getting half upfront also tests whether they’re serious about paying or just buying time.

Weekly payment plan

For smaller amounts—typically under $5,000—weekly payments can feel more manageable for a cash-strapped client.

Week 1: 40% of outstanding amount (due immediately)

Weeks 2-5: 15% each week

The immediate first payment is non-negotiable. If they can’t pay 40% right now, they’re probably not going to follow through on the rest either.

Project-based split

When you have ongoing work with the client, you can fold the outstanding balance into future payments.

Now: 60% of current outstanding invoice

Next project: 40% added as upfront deposit before work begins

This only makes sense if you actually want to continue working with this client. If trust is already broken, get your money and move on.

Payment agreement essentials

Never do a payment plan on a handshake. Get it in writing, and include:

Specific payment amounts and dates—not just percentages, but actual dollar figures and calendar dates

Late fees for missed installments—typically 2-3% of the missed payment

Acceleration clause—if they miss a payment, the full remaining balance becomes due immediately

Work suspension terms—you can pause services if they miss a payment

Contact requirements—they must notify you in advance if they’ll be late

Here’s sample language you can adapt:

Outstanding invoice #[number] totaling $[amount] will be paid as follows: $[amount] due [date], $[amount] due [date], $[amount] due [date]. A 2% monthly service charge applies to missed payments. If any payment is more than 7 days late, the full remaining balance becomes immediately due.

Red flags to avoid

Not every client deserves a payment plan. Watch out for:

Requests for plans longer than six months—these rarely get completed

No upfront payment or deposit—if they can’t pay anything now, they probably won’t later

Vague language about “when business picks up”—you’re not a bank

History of missing previous deadlines—patterns tend to repeat

If a client agrees to a payment plan and then misses the first installment, don’t extend it further. At that point, you’ve done what you can—time to escalate to collections or legal.

Automating payment collection

Everything I’ve covered so far works better when you’re not doing it manually. Chasing invoices by hand is tedious, easy to forget, and takes you away from billable work.

The fix is simple: automate your reminders so they go out consistently without you thinking about it.

Alex Freeburg, owner at Freeburg Law, made this switch and noticed the difference immediately:

When a payment is late it automatically sends a friendly reminder to the client with all the payment information they need. This way, I don’t have to worry about forgetting to send invoices or reminders, and there’s zero awkwardness in chasing down payments.

Alex Freeburg,

Freeburg Law

Alex Freeburg,

Freeburg Law

Most invoicing tools—including SPP.co—let you set up automatic reminders for upcoming and overdue invoices—this is sometimes called dunning management. You configure the timing (3 days before due, day of, 3 days after, etc.), customize the email templates, and let the system handle it from there.

A few things to get right:

Space out your reminders so they don’t feel like spam. One before due, one the day after, one at a week overdue is plenty before you pick up the phone.

Customize the templates to sound like you, not like a billing robot.

Test before you activate and send yourself reminders to make sure links work and the tone is right.

Invoice and collect payments automatically and on time.

The goal is to reserve your personal follow-ups for the situations that actually need a human touch—and let automation handle the routine nudges.

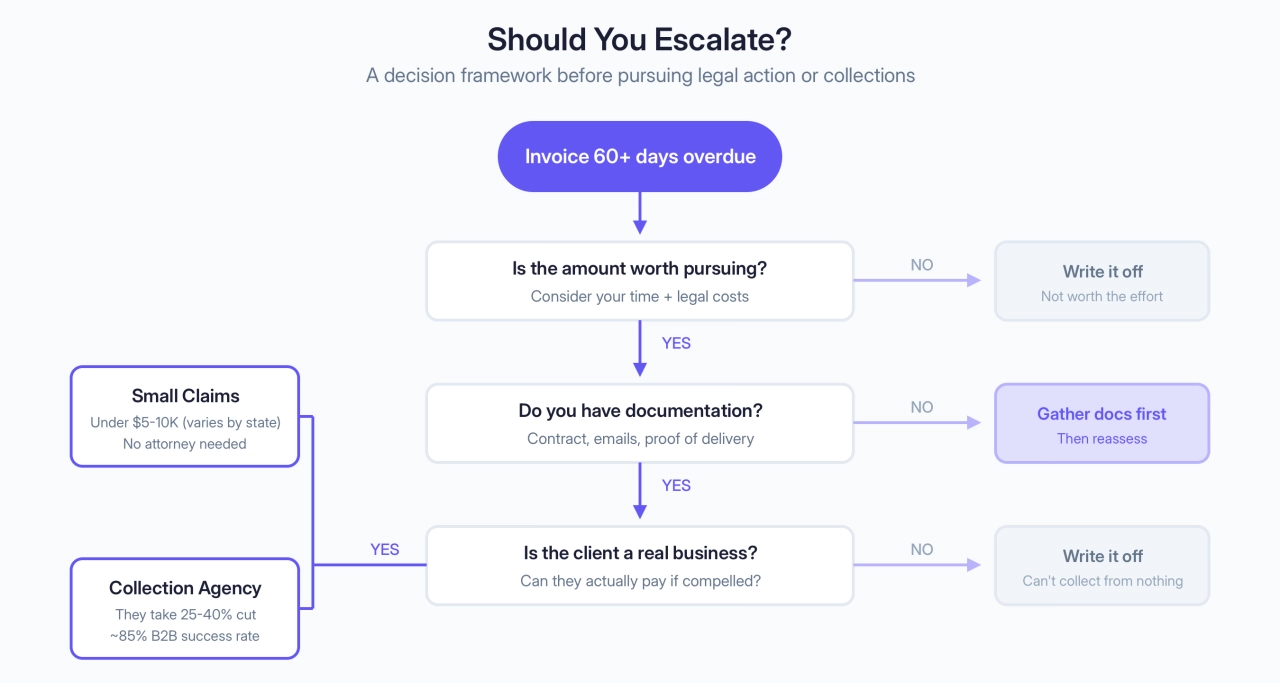

When legal action or collections make sense

Most payment issues get resolved before they reach this point. But sometimes a client is genuinely refusing to pay, and you’ve exhausted the friendly options.

Before you escalate, do the math.

The cost-benefit calculation

Legal action costs money and takes time. Hiring an attorney, filing in small claims court, preparing documentation—these aren’t trivial. If a client owes you $1,500 and you’ll spend $1,000 and 15 hours recovering it, you haven’t really won.

Ask yourself:

Is the amount significant enough to justify the effort?

Do I have documentation—contracts, emails, proof of delivery—to support my case?

Is the client a real business that can actually pay if compelled, or am I chasing an empty shell?

If the answer to any of these is no, you may be better off writing it off and tightening your contracts for next time.

Small claims court

For amounts under a certain threshold (typically $5,000-$10,000 depending on your state), small claims court lets you pursue the debt without an attorney. You file a complaint, present your case, and a judge decides.

The upside is lower cost. The downside is time—you’ll need to prepare documentation, possibly appear in court, and then still collect if you win. A judgment in your favor doesn’t mean the money magically appears.

Also worth noting: if your client is overseas, small claims court probably isn’t an option. International debt collection is a different beast entirely, usually not worth pursuing unless the amount is substantial.

Collection agencies

If you don’t want to deal with courts, a collection agency handles the recovery for you—for a cut of what they collect.

Expect fees of 25–40% of the recovered amount. That sounds steep, but it’s 25–40% of money you weren’t getting otherwise. For B2B debt, agencies often recover more than you’d expect. According to Kaplan Collection Agency, commercial debt collection can see success rates around 85% on larger accounts where the business is still operating.

The process typically works like this:

you hand over the debt with supporting documentation

the agency sends formal collection notices

they pursue through calls, letters, and escalating pressure

if successful, they take their cut and send you the rest

The relationship with that client is over at this point—but if you’re handing a debt to collections, it was probably over anyway.

A note on timing

Don’t wait too long to escalate. The older a debt gets, the harder it is to collect. If you’ve followed the sequence in this guide and hit 60–90 days with no resolution, it’s time to make a decision: write it off or hand it over to someone who can pursue it more aggressively.

Frequently asked questions

How long should I wait before chasing a late invoice?

Three to five days past due. The longer an invoice sits unpaid, the less likely it gets paid at all.

Can I charge interest on overdue invoices?

Yes, if it’s stated in your contract or invoice terms. Something like “2% monthly service charge on overdue balances” works. Apply it consistently.

Is it legal to stop work for unpaid invoices?

Yes. Include a pause clause in your contract and notify the client in writing when you’re stopping work and why.

Can I charge a credit card on file without permission?

Technically yes if your terms allow it, but expect a chargeback dispute you’ll probably lose. Always get explicit confirmation first.

What’s the success rate of collection agencies?

For B2B debt, agencies succeed on about 85% of accounts they pursue, but you’ll typically recover 15–28% of the original amount after their 25–40% cut.

How do I handle late payments without damaging the relationship?

Lead with curiosity, not accusation. Offer payment plans if they’re struggling. Most late-paying clients aren’t malicious—they’re overwhelmed.

What if the client is overseas?

International collections are rarely worth it for smaller amounts. Your options are persistent follow-up, flexible terms, or writing it off and requiring upfront payment going forward.

Should I offer early payment discounts?

Depends on your margins. A 2–3% discount for payment within 10 days can speed up cash flow, but you’re paying clients to do what they should do anyway. Test it.

Summary

Late payments won’t disappear entirely—but they don’t have to drain your time or threaten your cash flow.

The agencies that rarely chase invoices aren’t lucky. They’ve built prevention into how they work: milestone payments, clear contract clauses, automated reminders. When something does slip through, they follow a system instead of sending sporadic emails and hoping for the best.

Here’s what to do this week:

Review your contract for pause clauses and late fee language. If they’re missing, add them.

Set up automated reminders so follow-up happens without you thinking about it.

Pick a pause policy and stick to it. Two late invoices is a reasonable line.

The rest—collection calls, payment plans, legal escalation—you’ll figure out as needed. But most agencies never get there once the basics are in place.