- Competitive pricing works when you have a cost advantage—through automation, standardized delivery, or operational efficiency. Without that, you're just selling at a loss.

- Matching market rates removes price as an objection, but you still need something else to win deals. Specialization, speed, or proof of results.

- Most agencies should treat competitive pricing as a phase, not a permanent strategy. Build your track record, then transition to value-based or premium pricing.

Your competitor charges $2,000/month. You price at $1,800 to win the deal. Six months later, you’re working harder for less money—and an offshore team just quoted your prospect $500.

This is where competitive pricing goes wrong for most agencies. They see competitive and think cheaper. So they keep cutting until there’s nothing left to cut.

But the agencies making competitive pricing work aren’t playing that game. They’re using competitor data to find positioning gaps—places where they can match market expectations on price while protecting their margins through efficiency, specialization, or smarter packaging.

That’s what this guide covers: how to use competitive pricing as a strategic tool, not a slow bleed. When it makes sense, when it backfires, and how to set it up so you’re not just racing to the bottom.

Understanding this topic involves several interconnected concepts:

- Churn Rate

- Scope Creep

- Retainer Model

- Value-Based Pricing

- Productized Service

- Profitability Analysis

- Client Onboarding

- Service Tier

Each of these concepts plays a crucial role in the overall topic.

What is competitive pricing?

Competitive pricing means setting your rates based primarily on what competitors charge rather than your costs or the value you deliver. You look at what the market is paying for similar services and position yourself somewhere in that range.

For product businesses, this is straightforward. Widgets are widgets. But agencies sell services that vary wildly in quality, depth, and results—even when they have the same name. Two SEO packages at $1,500/month can deliver completely different outcomes.

That’s the core tension with competitive pricing for agencies: you’re benchmarking against competitors whose work might look nothing like yours under the hood.

When competitive pricing works

Competitive pricing gets a bad reputation because most agencies use it badly. But under the right conditions, it’s a legitimate strategy—not a compromise.

You’ve productized your delivery

Competitive pricing works when you can deliver the same quality at lower cost than custom-service competitors. That usually means you’ve standardized your process.

If every client gets a different scope, timeline, and deliverable mix, you can’t predict your costs. Which means you can’t safely price against competitors who might be more efficient than you.

But if you’ve built a repeatable system—same onboarding, same workflow, same deliverables—you know exactly what each project costs. That predictability lets you price competitively without guessing whether you’ll make money.

Your margins come from efficiency, not markup

Some agencies charge $3,000 for work that costs them $2,800 to deliver. Others charge $3,000 for work that costs $1,200. Same price, completely different businesses.

The second agency can compete on price all day. They’ve built systems—automation, templates, trained specialists—that let them deliver quality work faster. Their margin comes from being good at operations, not from convincing clients to pay more than market rate.

If your profit depends entirely on premium pricing, competitive pricing will hurt. If your profit comes from running a tight operation, matching market rates is just math.

You’re entering a new market

When you’re launching a new service line or expanding into a new region, you don’t have the track record to justify premium rates. Nobody knows you yet. Competitive pricing—specifically penetration pricing—gives you a way in. Match the going rate to remove price as an objection, win some clients, build case studies. Just don’t get stuck there.

You compete on something other than price

Competitive pricing is less risky when price isn’t your main selling point. If clients choose you for your specialization, your responsiveness, or your guarantees, matching market rates just removes a potential objection.

A PPC agency that only serves ecommerce brands can price at market rate and still win against generalist competitors. The specialization does the selling. The price just needs to not get in the way.

This breaks down when you’re competing against agencies that offer essentially the same thing. If the only difference is price, competitive pricing becomes a race you probably can’t win.

Your target market is genuinely price-constrained

Some markets don’t support premium pricing. Early-stage startups, bootstrapped founders, local small businesses—they might want your services but literally cannot pay enterprise rates.

If that’s who you serve, competitive pricing isn’t a compromise, but alignment. You build a business model around their reality: lower touch, more automation, standardized packages. You make money on volume and efficiency rather than high-margin projects.

The mistake is serving price-constrained clients with a cost structure built for premium ones. That’s not competitive pricing—that’s just a mismatch.

When competitive pricing backfires

The conditions above aren’t checkboxes. Miss one, and competitive pricing stops being a strategy and starts being a slow bleed. Here’s what that looks like.

You attract clients who only care about price

Low prices attract price-focused buyers. That sounds obvious, but agencies consistently underestimate what this means in practice.

Price-focused clients negotiate harder, expect more revisions, question every line item, and leave the moment they find someone cheaper. They’re not loyal to your work. They’re loyal to the number.

Maria Harutyunyan, Co-Founder at Loopex Digital, learned this early:

When you hire a ‘cheap’ client, they expect a freebie every two minutes and expect ‘a little change.’ I went through all that when I was just starting out and started charging higher prices—naturally, I started getting more quality leads.

Maria Harutyunyan,

Loopex Digital

Maria Harutyunyan,

Loopex Digital

The math can look right on paper and still be wrong. Ten clients at $1,500 sounds better than five clients at $2,500. But if those ten clients each require twice the management, revisions, and hand-holding, you’ve bought yourself a lower hourly rate and more stress.

You can’t out-price offshore competitors

An agency in the US or Western Europe will never win a price war against a team in Southeast Asia or Eastern Europe. The cost structures are too different.

If a prospect is comparing your $3,000/month retainer against a $500 quote from overseas, dropping to $2,500 won’t change anything. You’re still six times the price. Going lower just damages your margins without solving the competitive problem.

The agencies that survive offshore competition don’t compete on price. They compete on things offshore teams struggle to match: timezone overlap, cultural fluency, faster communication, accountability, and easier legal recourse if something goes wrong. Those advantages justify a premium. Trying to split the difference on price just leaves you underpaid and still not cheap enough.

Your cost structure doesn’t support market rates

Sometimes the market rate for a service is lower than what it costs you to deliver. That’s not a pricing problem—it’s a business model problem.

If competitors charge $1,500 for a service that costs you $1,400 to deliver, you have two options. Restructure your delivery to lower costs, or accept that this service isn’t where you’ll make money. Pricing competitively while hoping it works out is a third option, but not a good one.

This happens often when agencies try to offer everything. You might be efficient at SEO but bloated on web development. Pricing both competitively means your profitable service subsidizes your unprofitable one. Eventually the math catches up.

Competitive Pricing Readiness

Find out if competing on price is the right strategy for your agency

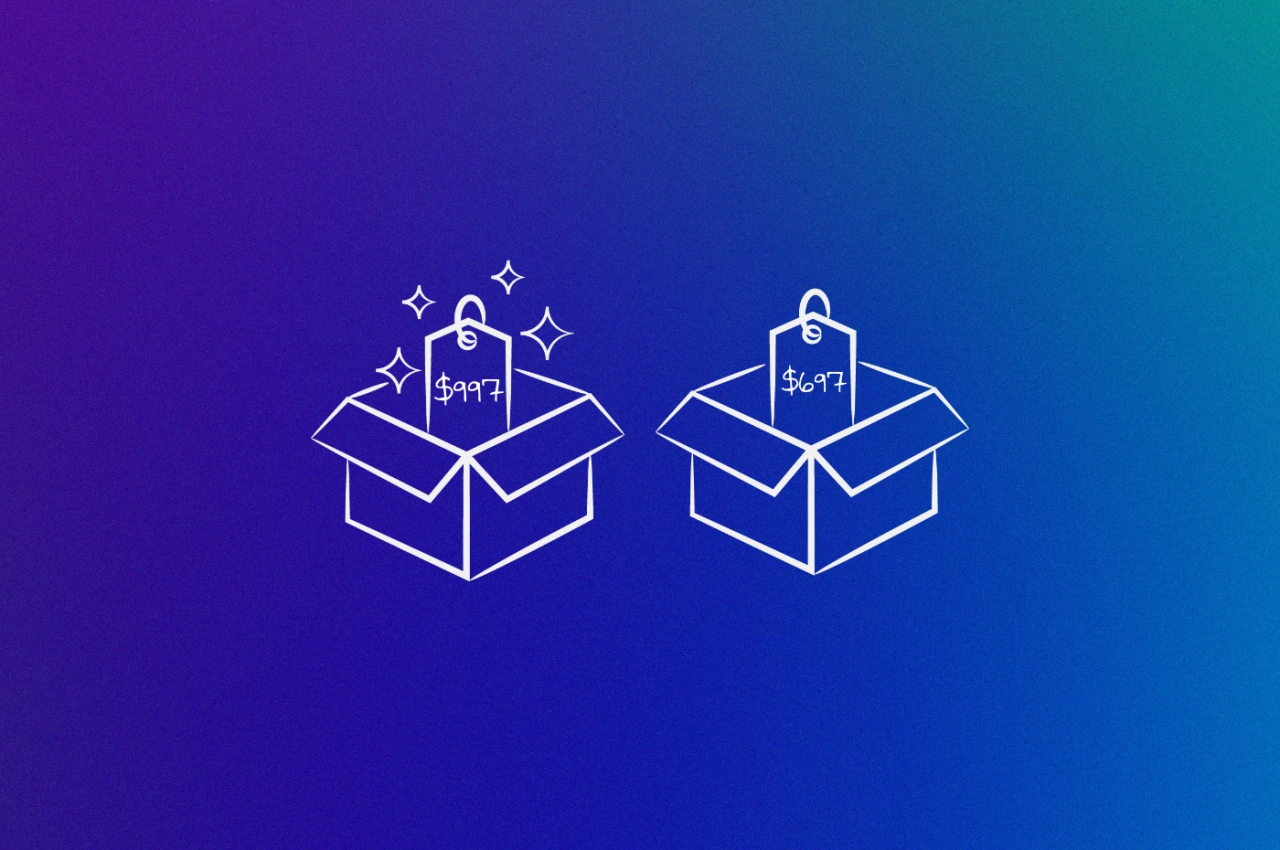

Types of competitive pricing strategies

Competitive pricing covers several different approaches. Some are aggressive, some are defensive, and they work in different situations.

Penetration pricing

You price below market rate to win clients quickly, then raise prices once you’ve established yourself. This is the “get in the door” strategy.

It works for new agencies, new service lines, or new markets where you don’t have the reputation to justify market rates yet. The low price offsets the risk clients take on an unproven provider.

The danger is getting stuck. If you never raise prices—or raise them so slowly you’re still underpriced years later—you’ve just built a low-margin business. Penetration pricing needs a timeline and a transition plan. Six to twelve months is typical before you start moving rates up.

Price matching

You set your rates at roughly the same level as competitors. Not cheaper, not more expensive—just in line with what the market expects.

This works when you want to remove price from the conversation entirely. If your SEO retainer costs the same as three other agencies the prospect is considering, the decision comes down to fit, expertise, and trust. You’re not asking them to pay a premium or take a risk on a discount provider.

The downside is that you need something else to differentiate. If your price is the same and your service looks the same, you’re hoping they just happen to pick you. Price matching makes sense when you have clear differentiators—a niche focus, better case studies, faster turnaround. Without those, you’re just one of several identical options.

Loss-leader pricing

You price one service below cost to win clients, then make money on upsells or ongoing work. The initial project is a loss you accept to land a profitable relationship.

Agencies use this with audits, strategy sessions, or small starter projects. A $500 website audit that costs you $800 to deliver makes sense if 40% of those clients convert to $3,000/month retainers.

The risk is obvious: if the upsell doesn’t happen, you’ve just done charity work. Loss-leader pricing requires a clear funnel and realistic conversion numbers. Track it closely. If your audit-to-retainer rate drops below the point where the math works, stop offering the audit or raise its price.

Price skimming

You start with high prices when demand is strong or competition is low, then lower them as the market matures. This is the opposite of penetration pricing.

For agencies, this applies when you’re early to a new service category. If you were offering TikTok advertising in 2019, you could charge a premium because few agencies had figured it out yet. As more competitors entered, you’d lower prices to stay competitive—or keep them high and accept a smaller share of a bigger market.

Skimming works when you have a genuine head start. It doesn’t work when you’re just hoping clients won’t notice that competitors charge less. They will.

Premium pricing

You price above market rate and use the higher price as a signal of quality. This is competitive pricing in reverse—you’re still setting rates based on competitors, just deliberately higher.

Premium pricing works when you have proof to back it up. Strong case studies, recognizable client logos, documented results. The higher price filters out budget-focused clients and attracts ones who associate cost with quality.

The trap is pricing premium without delivering premium. If clients pay 50% more and get the same results they’d get elsewhere, they won’t stay. And they’ll tell others. Premium pricing requires premium delivery, which usually means higher costs. The margin advantage is smaller than it looks on paper.

Competitive pricing strategies overview

Here's a quick reference for how these strategies compare:

Strategy | How it works | Best for | Risk |

|---|---|---|---|

Penetration | Price below market, raise later | New agencies, new markets | Getting stuck at low rates |

Price matching | Match competitor rates | Agencies with clear differentiators | Blending in with competitors |

Loss-leader | Lose money upfront, profit on upsells | Audit-to-retainer funnels | Low conversion kills margins |

Price skimming | Start high, lower as market matures | Early movers in new service categories | Competitors catch up fast |

Premium | Price above market as quality signal | Agencies with strong proof and results | Must deliver premium to justify it |

How to run a competitive pricing analysis

Competitive pricing requires knowing what competitors actually charge. Agency pricing is opaque—most don’t publish rates, many customize for each client, and some quote wildly different numbers depending on who’s asking.

Start by listing who you actually compete against. Not aspirational competitors you’d like to be compared to. Agencies that show up in the same conversations when prospects are making decisions.

Gather pricing data

What actually works:

Clutch, Agency Spotter, and directories: Many include pricing ranges or minimum project sizes.

Request quotes: Use a realistic project brief and ask for a proposal. Feels awkward, gives you real numbers.

Ask your prospects: When you lose a deal, ask what the other agency quoted. Most will tell you.

Industry surveys: Reports from HubSpot, Credo, or Promethean Research publish aggregated agency rates by service type.

Organize by tier and find the gaps

Group competitors into budget, mid-market, and premium tiers. The gaps between tiers matter more than the tiers themselves.

If mid-market agencies charge $2,000–3,500/month and premium agencies charge $7,000+, there’s a gap between $3,500 and $7,000 where few competitors operate. That’s either an opportunity or a dead zone—you’ll need to test to find out.

Compare scope, not just price

A $2,000/month SEO retainer from one agency isn’t the same as $2,000/month from another. When you gather competitor pricing, note what’s included: deliverables, team seniority, reporting frequency. Two agencies at identical prices might offer completely different value.

Track the right metrics

Competitor prices are just one input. You also need internal data to know whether your pricing is working.

Win rate by price point: Are you closing more deals at $2,500 than $3,000? The difference tells you where price sensitivity kicks in. If you’re closing less than 20% of proposals, price may be the issue. Top agencies hit 30% or higher.

Profit per client: Revenue means nothing if delivery eats your margin. Track actual profit after all costs. The industry average is around 15% net margin. If competitive pricing drops you below that, your cost structure doesn’t support it.

Client lifetime value: A $1,500/month client who stays two years is worth more than a $3,000/month client who churns after four months.

Churn by pricing tier: If your lowest-priced clients leave fastest, your competitive pricing is attracting the wrong buyers. Retainer agencies should aim for under 20% annual churn. Above that, you’re likely pulling in price-focused clients who leave the moment they find someone cheaper.

Upsell rate: Clients who start small and grow are more valuable than those who stay at their entry price forever.

Review these quarterly at minimum. Markets shift, competitors adjust, and what worked six months ago might not work now.

If you’re using SPP.co, the built-in analytics dashboard tracks client LTV and revenue by service automatically—no spreadsheets required.

Economic factors and pricing adjustments

Competitive pricing doesn’t exist in a vacuum. Economic conditions affect what clients can pay, what competitors charge, and whether your current rates still make sense.

Pricing during downturns

When budgets tighten, clients shop harder on price. Your competitors might drop rates to maintain volume. The pressure to follow them is real.

Before you cut prices, look at what’s actually happening to your business. Are you losing deals you used to win? Are prospects ghosting after they see your rates? Or is the pipeline just slower overall?

If prospects still convert at the same rate but there are fewer of them, the problem isn’t your pricing. Cutting rates won’t fix a demand problem—it’ll just mean less revenue from the deals you do close.

If you’re consistently losing to lower-priced competitors, you have options beyond blanket price cuts. Create a smaller scope offering at a lower price point. Offer payment plans. Build a self-service tier. These protect your core pricing while giving budget-conscious buyers somewhere to land.

Raising prices when costs increase

Your costs go up. Salaries, software, contractors, rent—none of it gets cheaper over time. If you hold your prices steady while costs rise, your margins shrink every year.

Competitive pricing makes this harder. You can’t just raise rates whenever you want if you’re positioning against competitors who haven’t raised theirs. But you can’t absorb cost increases forever either.

The answer is raising prices strategically rather than reactively. Annual increases of 5–10% are easier to absorb than a sudden 25% jump after years of flat rates. Give clients notice. Frame it around continued investment in quality. And accept that some clients will leave—often the ones who were most price-sensitive anyway.

Kiel Tredrea, President & CMO at RED27Creative, found this approach worked:

A case involved enhancing our clients’ SEO strategies, leading to a 30% traffic boost. This undeniable improvement in performance allowed us to implement a 10% price increase, which was well-received by customers due to the measurable results they experienced.

Kiel Tredrea,

RED27Creative

Kiel Tredrea,

RED27Creative

Communicating price changes to clients

Raising prices is one thing. Telling clients is another. How you communicate matters as much as the number itself.

Give adequate notice

Surprising clients with a price increase damages trust even if the new rate is reasonable. They feel blindsided. Some will leave out of principle.

Give at least 30 days notice; 60 is better. This gives clients time to adjust their budgets and shows you respect the relationship. Some agencies offer existing clients a grace period—honoring the old rate for an extra month or two—which softens the transition.

Lead with value, not apology

Don’t open with “I’m sorry, but we need to raise prices.” You’re not doing anything wrong. Prices go up. That’s business.

Instead, lead with what the client has gotten from working with you. Results you’ve delivered, problems you’ve solved, improvements you’ve made to your service. Then introduce the new rate in that context.

The framing matters. “We’re raising our rates to $3,500/month” lands differently than “Given the results we’ve achieved together—including the 40% increase in qualified leads—we’re adjusting our rate to $3,500/month starting next quarter.”

Both say the same thing. One sounds like you’re taking more money. The other sounds like you’re worth more money.

Offer options, not ultimatums

Some clients will push back. That’s fine. Have a plan for it beyond “take it or leave it.”

Josiah Roche, Fractional CMO at JRR Marketing, handles this with structured choices:

Some clients did push back. I handled it by offering structured choices: keep the old rate for a few months with a longer commitment, keep the budget but cut scope, or move to the new rate with full scope. If none of those fit, I was ready to wrap up cleanly and leave the door open.

Josiah Roche,

JRR Marketing

Josiah Roche,

JRR Marketing

This approach works because it gives clients control without you caving on price. They can choose what matters most to them—lower cost, same scope, or more flexibility. And if they choose to leave, they leave on good terms.

Handling price objections

Not every price conversation is about existing clients and rate increases. You’ll also hear objections from prospects comparing you to cheaper alternatives.

Your competitor is cheaper

When a prospect tells you another agency quoted less, your instinct might be to match or beat the price. Resist it.

First, figure out if you’re being compared fairly. What’s included in their quote? What’s the team’s experience level? What’s the contract length? A $2,000 quote with junior staff and no strategy isn’t the same as your $3,000 quote with senior strategists and monthly reporting.

If the comparison is apples to apples and you’re genuinely more expensive, own it. Explain what they get for the difference. Better results, faster communication, more experienced team, whatever makes your service worth more. Some prospects will still choose the cheaper option. Those weren’t your clients anyway.

Adjust scope, not price

When a prospect’s budget is genuinely lower than your rate, don’t discount. Reduce scope instead.

Jack Johnson, Director at Rhino Rank, uses this approach:

We introduced a ‘build-your-own-bundle’ option. It gave them the flexibility to customize what they need and only pay for what they’d actually use. That one change led to a 28% increase in completed checkouts.

Jack Johnson,

Rhino Rank

Jack Johnson,

Rhino Rank

This works because it protects your rate while still giving the prospect a path forward. They get something at their budget. You get paid fairly for the work you actually do. And if they want more later, they know what it costs.

Know when to walk away

Some prospects will never pay what you charge. They’re not bad people—they’re just not your market.

Signs a prospect isn’t a fit:

they focus on price in the first conversation before understanding scope

they’ve already been burned by cheap providers but still want cheap prices

they compare your full-service offering to a freelancer or DIY tool

they negotiate hard before you’ve even sent a proposal

Walking away feels like losing. But taking on a client who resents your rates from day one is worse. They’ll question every invoice, resist every scope discussion, and leave a mediocre review when they eventually churn.

Better to refer them to an agency that fits their budget and spend your time on prospects who value what you do.

Competitive pricing vs. other strategies

Competitive pricing is one option. Not always the best one. Here’s how it compares to other approaches.

Strategy | You set prices based on | Works best when | Watch out for |

|---|---|---|---|

Competitive | What competitors charge | You have efficiency advantages or clear differentiators | Racing to the bottom without a structural advantage |

Your costs plus a margin | You’re new and need a pricing floor | Ignoring what the market will actually pay | |

Results you deliver for clients | You can tie your work to measurable outcomes | Clients who don’t track results or share data | |

Bundled scope at set prices | Your services are standardized and repeatable | Scope creep eating your margins | |

Hourly | Time spent on client work | Projects have unpredictable scope | Punishing yourself for getting faster |

The right strategy depends on where you are. Early-stage agencies often need competitive or cost-plus pricing just to get clients in the door. Established agencies with strong case studies can push toward value-based. There’s no permanent answer—just the approach that fits your current position and the clients you’re trying to attract.

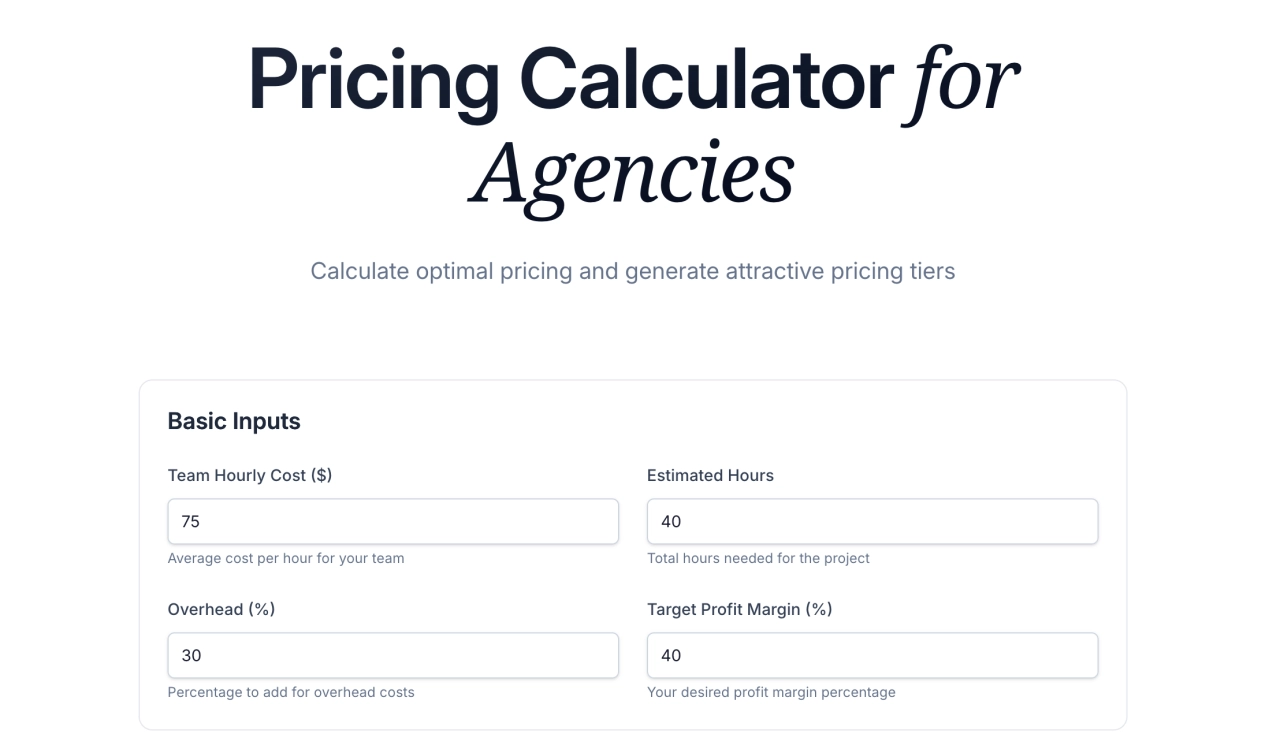

Calculate optimal pricing for your agency

Most agencies don’t pick one strategy and stick with it forever. They start with cost-plus or competitive pricing while they’re building a track record, then shift toward value-based or premium pricing as they establish proof and reputation.

When to move away from competitive pricing

Competitive pricing can be the right choice early on. It usually shouldn’t be permanent.

Signs you’ve outgrown it:

you’re winning most of your proposals and could charge more

your best clients came through referrals, not price comparisons

you’re turning down work because you’re at capacity

your case studies and results are strong enough to justify higher rates

you’re attracting too many price-focused clients who churn quickly

The transition doesn’t have to be sudden. Keep competitive pricing for new clients in price-sensitive segments. Raise rates for new clients in less price-sensitive segments. Gradually shift your mix until competitive pricing becomes one option rather than your default.

Frequently asked questions

What are the legal implications of competitive pricing?

Researching competitor prices is completely legal. What’s illegal is price fixing—coordinating with competitors on rates. The line is simple: gather intelligence, make your own decisions, don't collude.

What’s the difference between competitive pricing and a price war?

Competitive pricing uses market data to position your rates strategically. A price war is reactive—cutting prices because a competitor cut theirs, which triggers another cut, and so on. Competitive pricing is a strategy. Price wars are a race to zero margin.

How often should I review competitor pricing?

Quarterly at minimum. More frequently if you’re in a fast-moving market or seeing unusual patterns in your win rates. Set a calendar reminder—it’s easy to let this slide when you’re busy with client work.

Can small agencies use competitive pricing?

Yes, but only if you have a cost advantage. Small agencies with low overhead and efficient processes can compete on price effectively. Small agencies trying to match big-agency rates while carrying big-agency costs will struggle.

What if I can’t find competitor pricing data?

Ask your prospects what other agencies quoted. Ask clients what they paid before working with you. Check directories like Clutch for published ranges. Request quotes yourself using a realistic project brief. The data is out there—it just takes more effort than a Google search.

Is competitive pricing bad for profitability?

Not inherently. Competitive pricing with efficient operations can be highly profitable. Competitive pricing without cost discipline destroys margins. The strategy isn’t the problem—the execution is.

Should I tell clients I use competitive pricing?

No need to announce your pricing strategy. If a client asks why you charge what you charge, focus on the value you deliver and how your rates compare to the market. The mechanics of how you set prices aren’t relevant to them.

Make competitive pricing work for you

Competitive pricing has a reputation problem. Too many agencies use it as an excuse to undercharge, then blame the strategy when their margins disappear.

The agencies that make it work treat competitive pricing as intelligence, not instruction. They know what the market charges. They understand where they sit relative to competitors. And they use that information to make deliberate choices—not to blindly match whatever number shows up in a competitor’s proposal.

If you have the operational efficiency to deliver quality work at market rates, competitive pricing is a legitimate path to growth. If you don’t, no pricing strategy will save you from a cost structure that doesn’t work.

Know your numbers. Know your market. Price accordingly.