- Cost-based pricing offers simplicity of implementation, guarantees profit by covering production costs, and fosters transparency with customers.

- A hybrid approach combining cost-based foundations with value considerations can maximize profitability while maintaining pricing transparency.

- For agencies specifically, cost-based pricing works best for standardized services with predictable delivery costs and timelines.

Are you constantly second-guessing your project quotes? You're not alone. Finding the right agency pricing model can feel like searching for a needle in a haystack, and cost-based pricing offers a systematic approach to this common challenge.

For agency owners juggling multiple services and client types, the right pricing model isn’t just about profitability—it’s about creating sustainable operations that scale. While cost-based pricing provides a solid foundation, the most successful agencies I’ve worked with use it as a starting point, then strategically adjust based on client value and market position. This guide will show you exactly how to implement this balanced approach.

What is cost-based pricing?

In cost-based pricing, businesses set prices for their products or services based on the costs incurred during production. You determine the selling price by adding a fixed profit percentage to your production costs.

For example, let’s assume it costs your company $200 to make a piece of furniture. Adding a 20% margin means you’ll sell it for $240.

But unlike with competitor based pricing, this method ignores other essential factors like customer perceived value, average market price, or competition.

Its goal is to ensure you cover production costs and generate a profit on each sale. That makes it one of the most popular pricing models among manufacturing, retail, and construction companies.

Real-world agency applications

Let’s look at how three different agencies could implement cost-based pricing to strengthen their businesses.

Design agency: transparent pricing builds trust

A boutique design agency struggling with unpredictable profit margins implements cost-based pricing for their logo design service. They calculated their true costs (designer time, software, overheads) at $950 per project and added a 40% margin for a fixed price of $1,330.

Results: Client inquiries increase by 25% as potential customers appreciated the transparent pricing structure. The clear margin also helps the agency identify workflow inefficiencies, ultimately reducing delivery time by 15%.

Content marketing agency: hybrid model maximizes value

A content marketing agency using hourly billing switches to cost-based pricing for their blog post packages. They calculate baseline costs of $185 per 1,000-word post plus a 30% margin. However, for enterprise clients, they adjusted the margin up to 50% based on the increased value and complexity.

Results: Average project profitability increases by 35%, while their sales team reported easier closing conversations by focusing on production costs rather than arbitrary hourly rates.

SEO agency: scaling with confidence

An SEO agency moves from value-based to cost-based pricing for their local SEO packages after realizing they were sometimes undercharging for resource-intensive clients. By establishing a clear cost structure and consistent 45% margin, they create predictable profits.

Results: The agency grows from 15 to 45 clients in 12 months with complete financial predictability, allowing them to hire with confidence and scale their operations systematically.

Advantages of cost-based pricing

Let’s explore why cost-based pricing might be the straightforward solution your agency needs to bring predictability and transparency to your financial operations.

Simple to implement: With cost-based pricing, you don’t need any extensive competitor research, resources, or software to determine the selling price of your product or service. Simply add your desired profit margin to the manufacturing costs, and you’re good to go.

Guarantees profit: By strictly adhering to this pricing method, your company is guaranteed to earn profit. Adding a fixed markup to your manufacturing and overhead costs ensures you’ll generate profit despite rising production costs.

Enables transparency: According to Statista’s Importance of trustworthiness & transparency in marketing worldwide 2021-2022, 60% of consumers said they believed trustworthiness and transparency were the most important traits of a brand—and the reason isn’t far-fetched. Being transparent about your production costs helps customers understand why your product is priced the way it is. They can see how you arrived at the price and compare it with your competitors.

Easy for customers to understand: Whenever there’s an inevitable increase in the price of your products, customers may feel aggrieved and seek cheaper alternatives. But they are more likely to understand your decision if you cite a rise in production costs as a valid reason for the price increment.

Disadvantages of cost-based pricing

Despite its straightforward appeal, cost-based pricing comes with significant limitations that could be holding your agency back from reaching its full profit potential.

Ignores consumer demand and competitors: In a cut-throat market where pricing and consumer demand are essential to the success of any business, relying only on cost-based pricing isn’t a great strategy. It ignores competitors’ prices and customers’ perceived value, resulting in a different market price. This means that using cost-based pricing results in losing customers to lower-priced competitors or charging peanuts compared to rival companies.

No incentive to become cost-efficient: Relying on production costs to set prices for your products may result in a lack of incentive to reduce costs. A fixed profit margin means you focus more on returns than streamlining operations—a headache that can lead to inefficient operations and higher manufacturing costs in the long run. And if you keep increasing prices due to production costs, it’s only a matter of time before customers switch to your competitors.

Unable to account for indirect costs: Manufacturing costs aren’t the only thing that makes up the total price of a product. There are other indirect costs to consider such as marketing, distribution, and labor expenses. As such, setting a price point that reflects the true cost of your products may be difficult to achieve and could lead to reduced profit.

Hinders innovation: With a cost-based strategy, you’re less likely to experiment with new products or services. There’s no motivation to innovate or improve on existing products, unlike value-based pricing where improving the perceived value of your product is the primary motivator. This makes it difficult to stand out and remain competitive in the industry.

Common mistakes in cost-based pricing

When calculating service costs, you’re likely focusing on the obvious: direct labor and software subscriptions. But herein lies the biggest mistake—overlooking the less visible expenses that quietly eat into your profits.

Four critical pricing mistakes to avoid:

Ignoring indirect costs: Administrative time and team meetings cost money but rarely factor into project pricing. Track these hours and incorporate them into your baseline.

Forgetting opportunity costs: Every hour spent on a client project is time you can't spend elsewhere. Could this time generate more value on another initiative?

Failing to budget for unexpected expenses: Build a 10–15% buffer to accommodate inevitable scope creep and revisions.

Neglecting efficiency improvements: Cost-based pricing can mask operational inefficiencies. Regularly audit your processes to identify automation opportunities.

With that said, don’t overcomplicate things. Start by tracking all costs, then refine your pricing as you gather more data. Your future self (and profit margins) will thank you.

Cost-based pricing strategies

Various industries use cost-based pricing to set or review the prices of their products and services. And they can choose from any of these two strategies: cost-plus pricing and break-even pricing. Let’s discuss both in detail.

1. Cost-plus pricing

In cost-plus pricing, you determine the selling price by adding a markup to the total production costs for one product unit.

Keep in mind that the costs take into account material, labor, and overhead costs. And the markup is a fixed percentage added to the total costs to get the selling price.

Cost-based pricing, also known as markup pricing, is a popular strategy among manufacturing, retail, e-commerce, and construction companies. It’s simple to implement and ensures businesses cover costs and generate a profit on each unit of product they sell.

Here’s the formula to determine your selling price using the cost-plus pricing strategy:

Selling price = (unit cost) + (markup × unit cost)

For example, let’s assume it costs $200 to deliver a 1,000-word blog post (including the writing, software used, and overhead costs) and your target profit margin is 30% on each unit.

To calculate the selling price:

Production costs = $200

Target profit = 30%

Selling price = (200) + (0.3 × 200) = $260

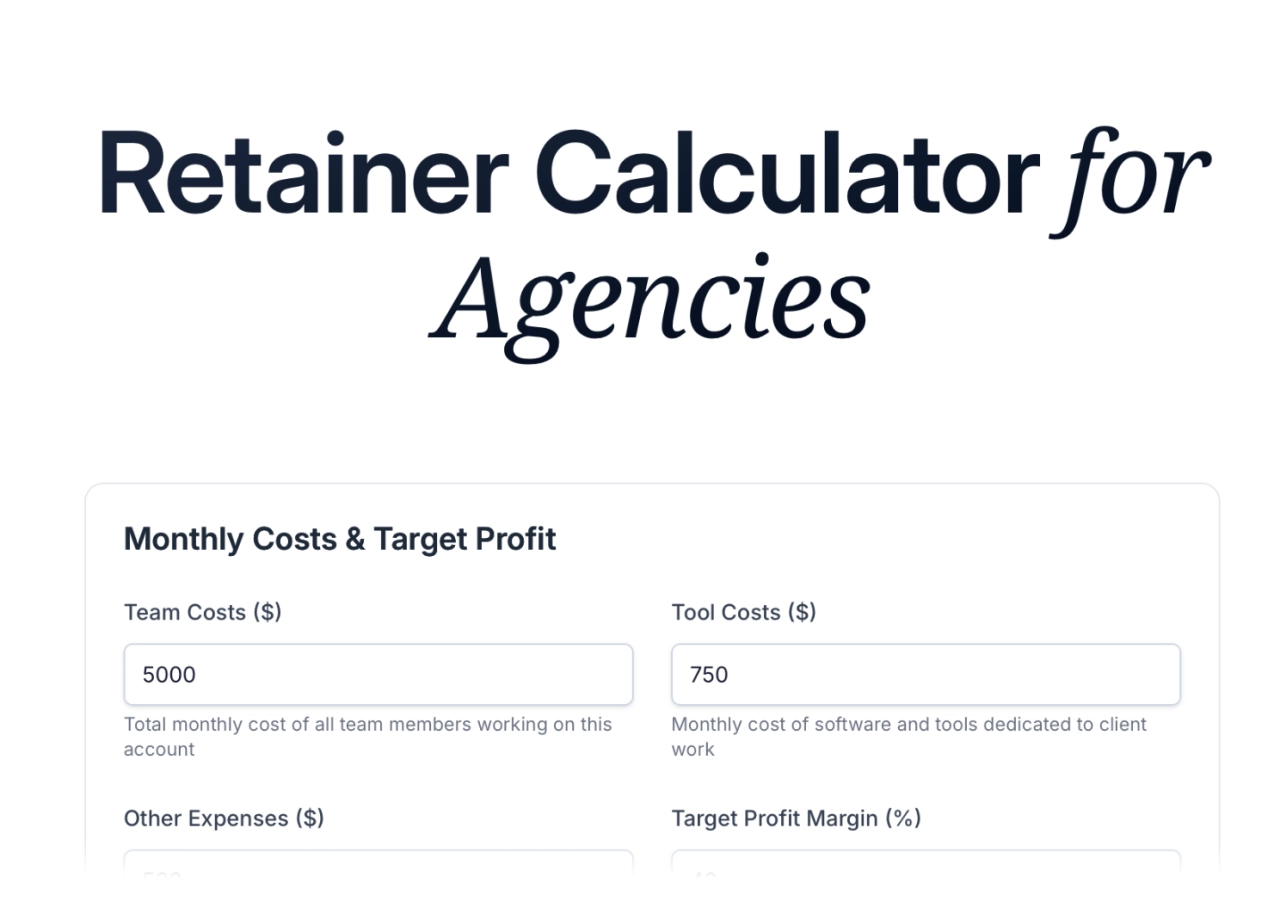

Use cost-plus pricing to calculate your retainer

Selling each blog post for $260 helps to cover your costs and generate a profit of $60 on each content piece sold.

2. Break-even pricing

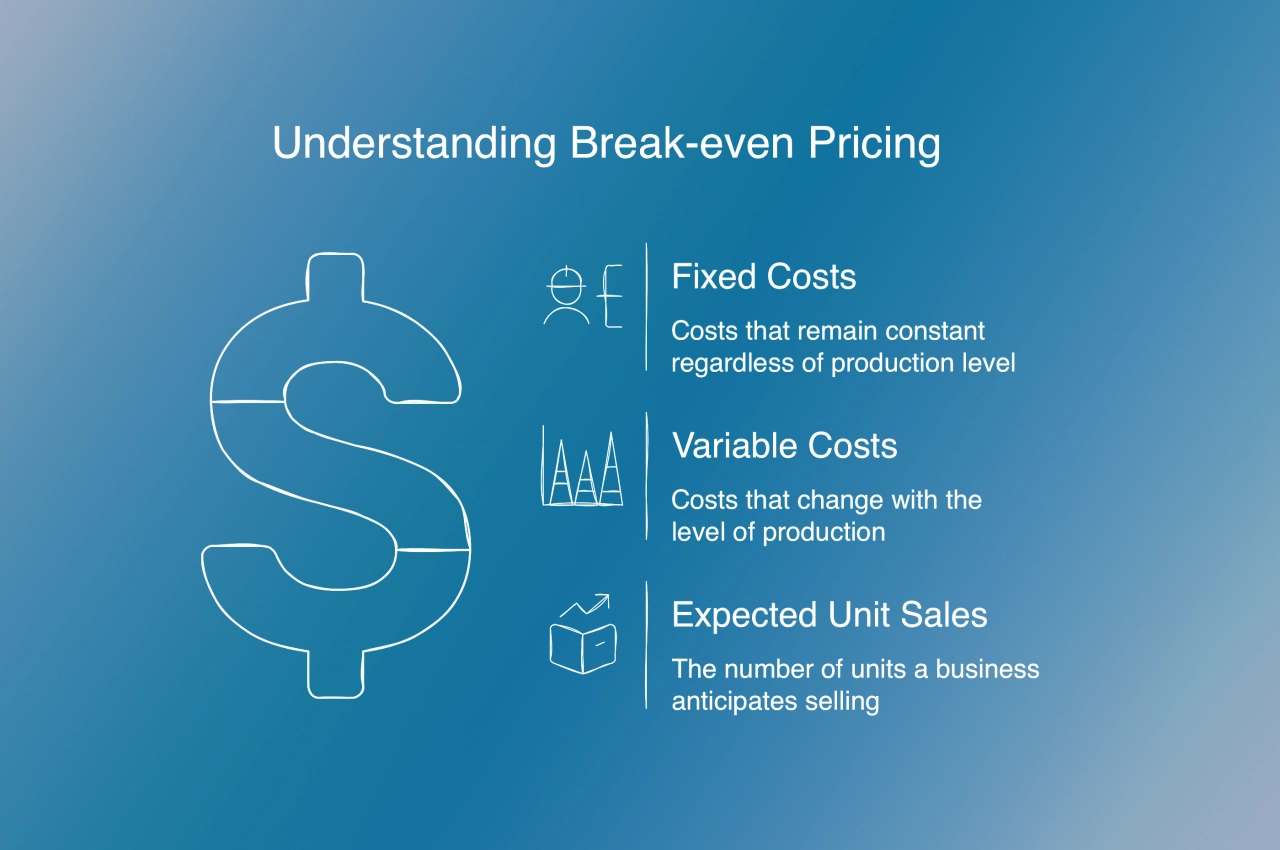

In break-even pricing, businesses solely rely on the cost of production, manufacturing, and distribution of a product to determine the selling point. The goal is to attain a specific profit target return or break even without adding a markup.

Also called target-return pricing, it helps companies know how many units of a product or service they must sell to cover costs without generating profit or incurring losses.

Here’s the formula for calculating the break-even price:

Break-even price = (total fixed costs ÷ expected unit sales) + variable cost per unit

The fixed costs represent expenses that don’t change with the level of production or sales. They remain constant regardless of whether the business produces or sells fewer or more units of a product. Examples include rent, salaries, insurance, and taxes.

While the variable cost per unit is the amount it costs to manufacture one unit of product, and it changes with the production level. Examples include raw materials, labor costs, sales commissions, and shipping.

Let’s look at an example of break-even pricing in action.

Assuming you run a design agency and the fixed cost for your monthly recurring design package is $800. The variable cost per unit is $850, and you expect to sell four subscriptions per month.

To determine the break-even selling point using the break-even pricing model:

Fixed costs = $700

Variable cost per unit = $800

Expected monthly sales = 4

Selling price = (700/4) + 800 = $975

This means the selling price you need to break even and cover total costs is $975 provided you can sell four subscriptions per month. You could price the subscription at $999 to ensure that you have a profit margin. But if you sell fewer subscriptions, you’d run at a loss.

Cost-based vs. value-based pricing

Is the cost-based method good compared the value-based one?

Cost-based pricing focuses on what it costs you to deliver a service, while value-based pricing centers on what the service is worth to your client

Let’s look at how they compare:

Aspect | Cost-based pricing | Value-based pricing |

|---|---|---|

Foundation | Your expenses | Client's ROI |

Profit Margin | Fixed percentage | Varies by project value |

Client Focus | Features delivered | Outcomes achieved |

Scalability | Limited by costs | Unlimited potential |

In practice:

Imagine you’re building an e-commerce website. With cost-based pricing, you might charge $10,000 based on 100 hours at $100/hour. With value-based pricing, knowing the site will generate $200,000 in first-year revenue, you might charge $20,000, reflecting the value delivered, not just your time invested.

The strategy you choose impacts everything from how you position your services to the clients you attract. Cost-based pricing is predictable but limiting, while value-based pricing requires more confidence but yields significantly higher profits.

Factors to consider before adopting cost-based pricing

When implementing cost-based pricing for your business, it’s important to keep the following factors in mind.

1. Competitor prices

If you operate a business in a highly competitive industry, it’s best to consider what your competitors are charging before you implement cost-based pricing. Though it may be a great way to penetrate the market and attract price-sensitive customers, this only works if you charge much lower than the average market price.

What’s more, customers who associate high prices with superior quality may consider your product a knockoff.

On the flip side, charging far higher than your competitors will attract high-value customers willing to pay for quality. But it can also scare away potential customers looking for cheaper alternatives.

So, your best bet is to research your competitors’ prices to determine a fair selling price.

2. Market demand

The law of supply and demand should be factored in when implementing cost-based pricing for your business.

If there’s high demand for a trending product, you can increase your profit percentage without losing customers.

Conversely, if there’s a low demand for your product or similar products in the market, you may need to lower your margins to attract customers and increase sales volume.

3. Production costs

Since this pricing method solely relies on production costs, this factor shouldn’t be overlooked.

Ensure you carefully calculate the unit cost of creating a product or service before setting a selling price. Any miscalculations can result in charging too little or too much, affecting your profit margins.

4. Profit margins

While it’s important to cover costs, ensure you’re making a reasonable profit on each sale. You may be tempted to set higher or lower margins, but it’s crucial to strike a balance between generating revenue and being competitive in the market.

Considering all the factors above will help you successfully implement a pricing strategy that works for your business.

Examples of industries using cost-based pricing

Manufacturing industry: cost-based pricing is widely used by manufacturing companies. They calculate the production costs including raw materials, labor, and overhead expenses, and add a profit margin to determine the selling price of their products.

Retail industry: most retail companies consider the cost of purchasing, transporting, and warehousing products before adding up a markup to set their prices.

Construction companies: with the numerous costs involved in a construction project, it’s easy to see why companies in this space employ cost-based pricing. They calculate the costs of labor, materials, equipment, and overhead expenses and add their markup to determine the project’s cost.

Catering businesses: companies that offer catering services often use cost-based pricing. After factoring in the costs of ingredients, staff, equipment, labor, and other related expenses, they add a markup to determine the pricing for their services.

Service providers: some service-based businesses like consultants and agencies often use cost-based pricing. They consider the costs associated with providing their services, such as salaries, rent, equipment, and other operational expenses, to set prices for their services.

Implementation guide: cost-based pricing for your agency

Ready to implement cost-based pricing? Follow this step-by-step framework to ensure a smooth transition.

1. Comprehensive aost audit

Start by tracking all costs associated with your services:

Direct costs: Team member hourly rates, software subscriptions, subcontractors

Indirect costs: Administrative time, sales calls, client management

Overhead: Office space, equipment, utilities, insurance

Hidden costs: Revision rounds, client communication, project management

Pro tip: Track time for everything for at least two weeks to identify hidden time costs that aren’t making it into your pricing calculations.

2. Service standardization

Break down your services into clearly defined deliverables:

document each service’s scope, deliverables, and typical timeline

identify common add-ons or variations and cost them separately

create service tiers based on complexity and resource requirements

3. Margin strategy

Determine appropriate profit margins for each service:

Baseline services: 30–40% margin

Complex/high-value services: 40–60% margin

High-volume/low-complexity services: 20–30% margin

4. Testing phase

Test your new pricing model before full implementation:

apply to new clients first while maintaining existing client pricing

monitor project profitability closely

adjust margins based on client feedback and profitability data

5. Client communication

Prepare to explain your pricing structure:

emphasize transparency and fairness

focus on the value delivered, not just the costs

prepare FAQs for common client questions about your pricing

Frequently asked questions

How do I handle scope creep with cost-based pricing?

Build buffer time into your cost calculations—typically 10–15% for most agency services. For clients who consistently request changes, consider implementing a change order process with transparent pricing for additional work.

What if my competitors charge significantly less?

Focus on articulating the value you deliver beyond just the deliverables. Highlight your quality standards, reliability, and the comprehensive nature of your service. Consider offering tiered packages to accommodate different budgets while maintaining your margins.

Should I disclose my margins to clients?

While transparency is valuable, sharing exact margins isn’t necessary. Instead, be open about your pricing methodology and the factors that influence your rates. This builds trust without potentially uncomfortable discussions about profit margins.

How often should I update my pricing?

Review your cost structure quarterly and update pricing at least annually. For agencies experiencing rapid growth, consider more frequent reviews as your operational efficiency and overhead structure may change significantly.

How do I transition existing clients to a new pricing model?

Implement changes gradually, with clear communication about the reasons for the pricing update. Consider grandfathering long-term clients at their current rates for a period or offering a phased transition to the new pricing structure.

Is cost-based pricing right for your agency?

Cost-based pricing offers a systematic approach to ensure profitability, but its suitability depends on your specific agency model and growth goals.

Cost-based pricing is likely right for your agency if:

you struggle with inconsistent profit margins across projects

your services have predictable delivery timelines and resource needs

your team frequently underestimates the time required for projects

you want to create more transparent relationships with clients

you’re looking to scale with financial predictability

Consider alternative pricing strategies if:

your services deliver exceptionally high ROI to clients

you offer highly specialized expertise not available elsewhere

your ideal clients focus more on outcomes than on costs

you’re positioned as a premium provider in your market

Most successful agencies I know start with cost-based pricing as their foundation, then strategically incorporate value-based elements as they grow. This hybrid approach ensures you never lose money while still capturing appropriate value from high-impact projects.

The key is starting with clarity about your true costs—something many agencies never fully achieve. Use the implementation guide above to establish your cost baseline, then experiment with your margin strategy to find the optimal balance between profitability and market competitiveness.

Disclaimer: This article provides general information about pricing strategies for service businesses. While we strive for accuracy, this content should not be considered financial advice. Every business has unique circumstances. We recommend consulting with a qualified financial professional or business advisor before making significant changes to your pricing strategy.