“How do I keep track of invoices without Excel?”

Replace spreadsheets with automated invoice tracking

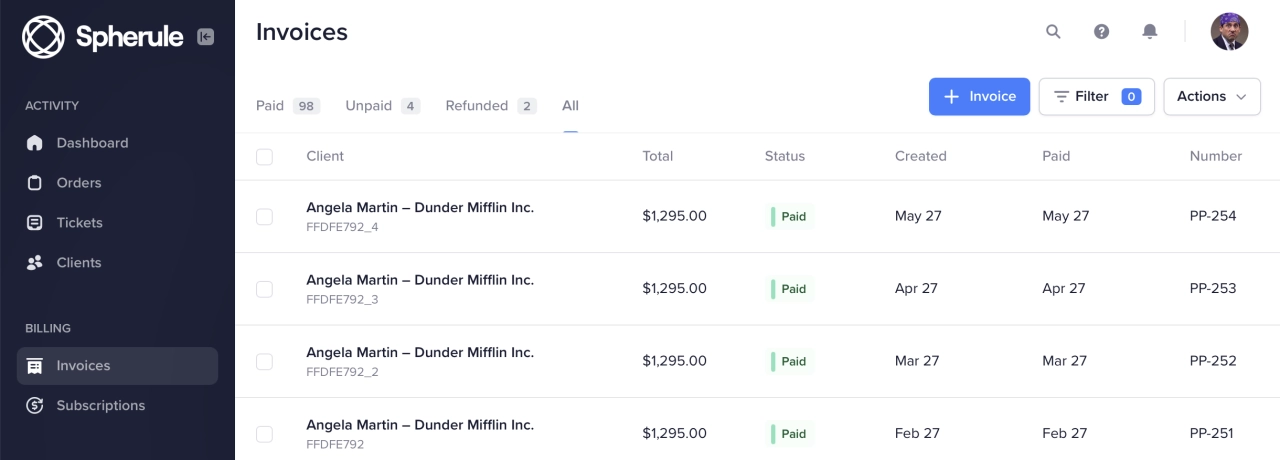

Invoice Tracking & Payment Follow-Up Software

Stop manually tracking which invoices are paid. Automate your entire invoice-to-payment workflow.

Automatic invoice status updates

Overdue invoice alerts

Payment follow-up automation

Complete payment audit trail

SPP.co does a lot of the heavy lifting we used to do manually saving us a ton of time & effort. It's fantastic and I recommend it all the time. The way I explain it is that it's kind of like the Shopify for service businesses!Watch the case study →

Complete payment tracking platform

Everything you need to manage client payments and invoices.

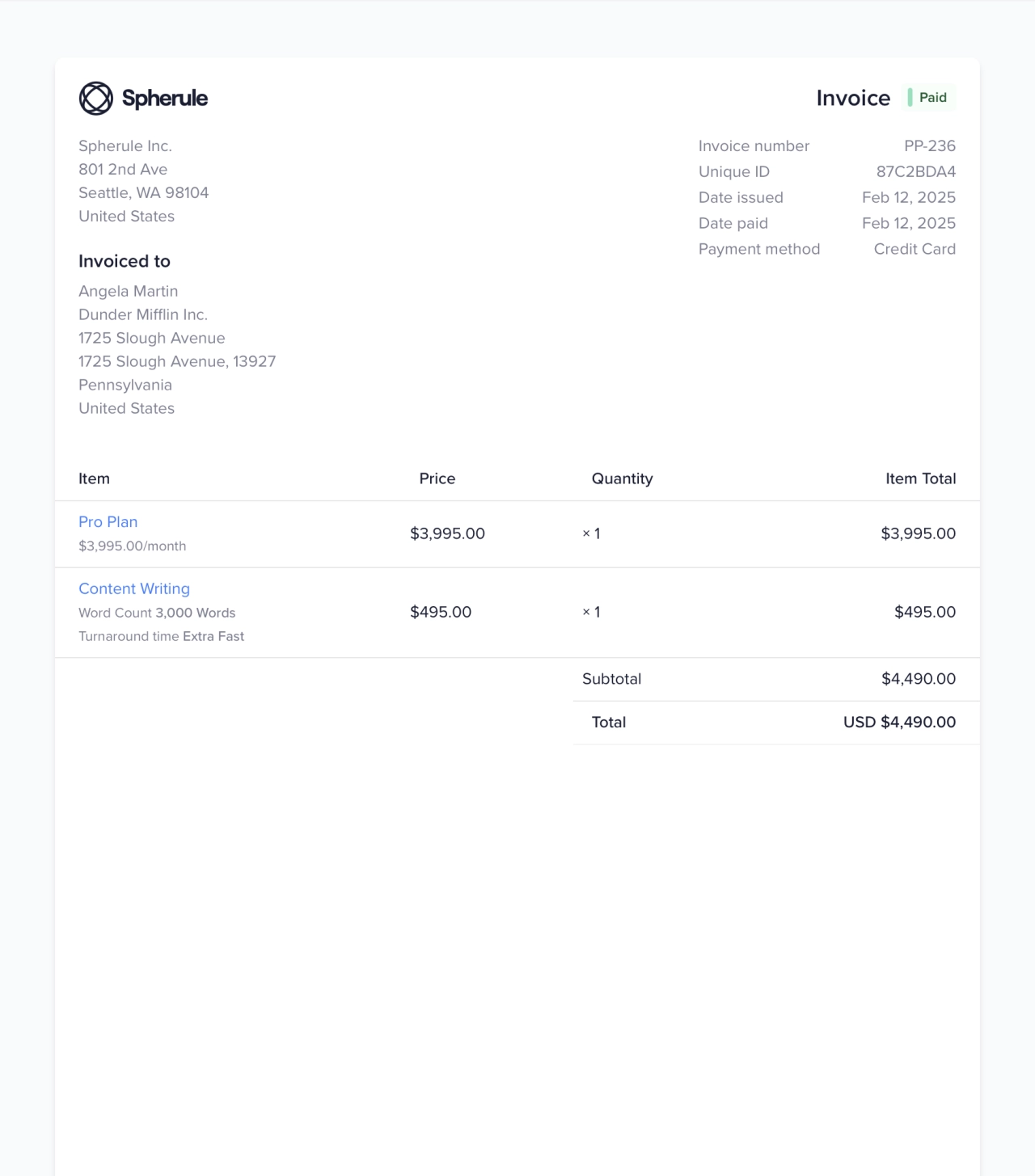

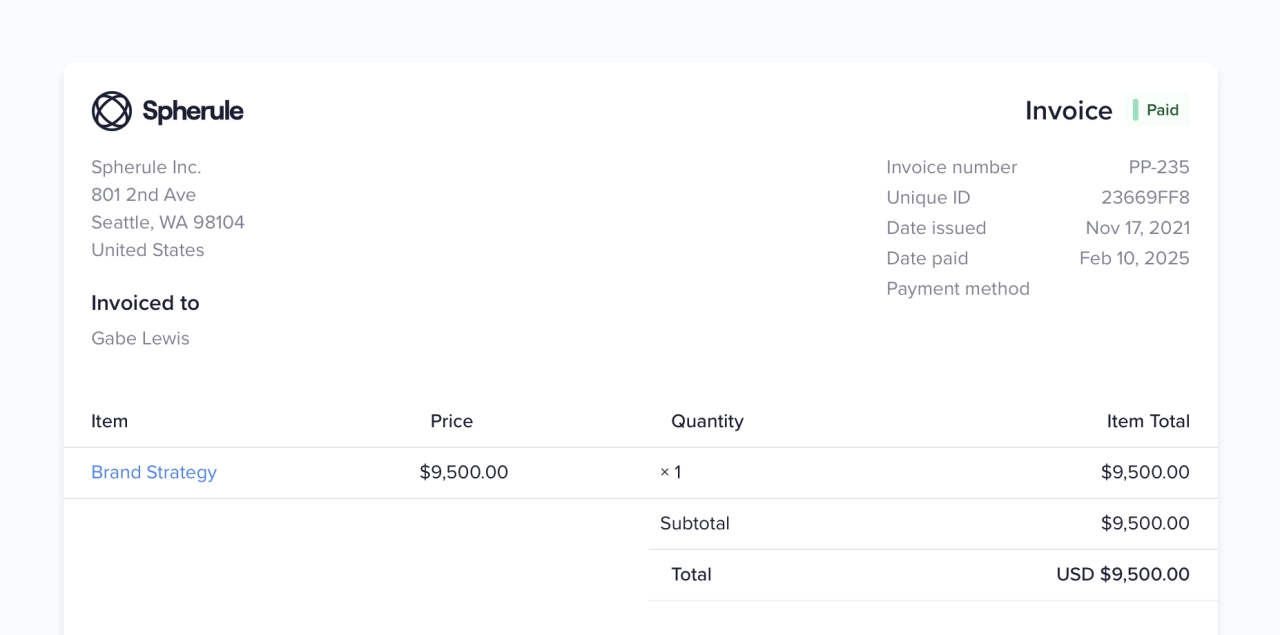

Invoice Generation

Create professional invoices with your branding and payment links.

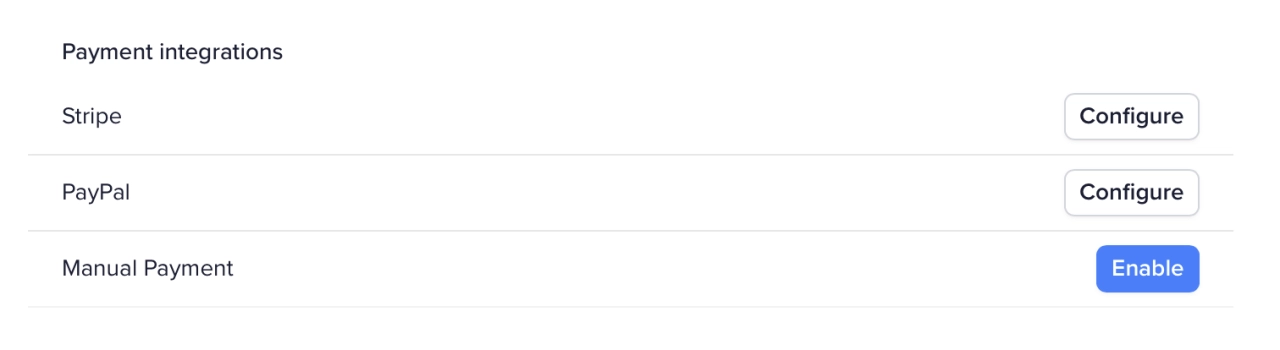

Payment Processing

Accept payments via Stripe, PayPal, or manual payment recording.

Automated Reminders

Send professional overdue payment reminders automatically.

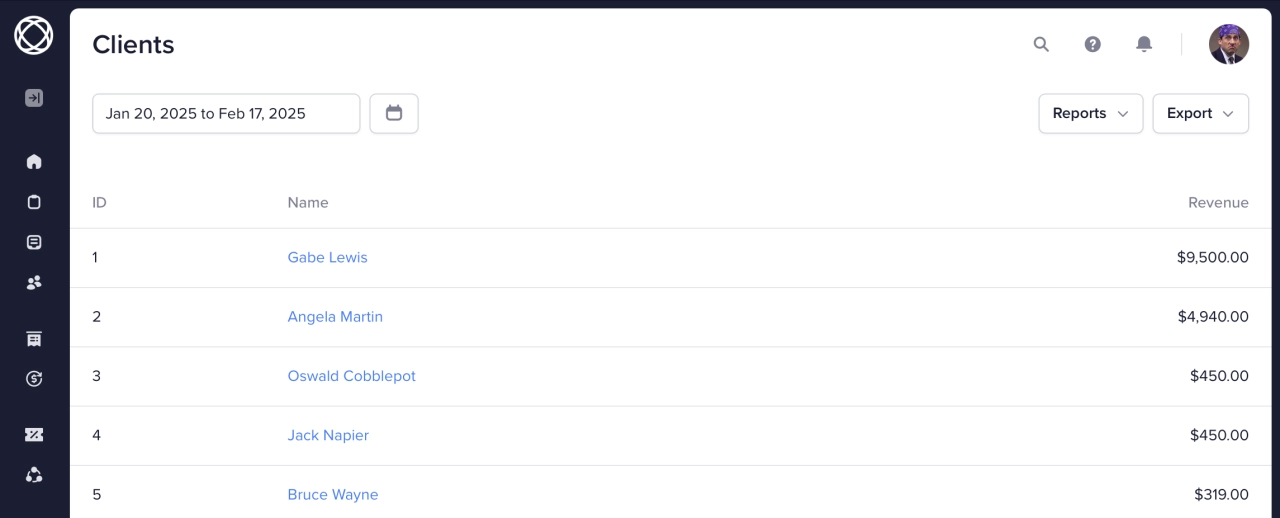

Payment Analytics

Track payment trends and identify your best paying clients.

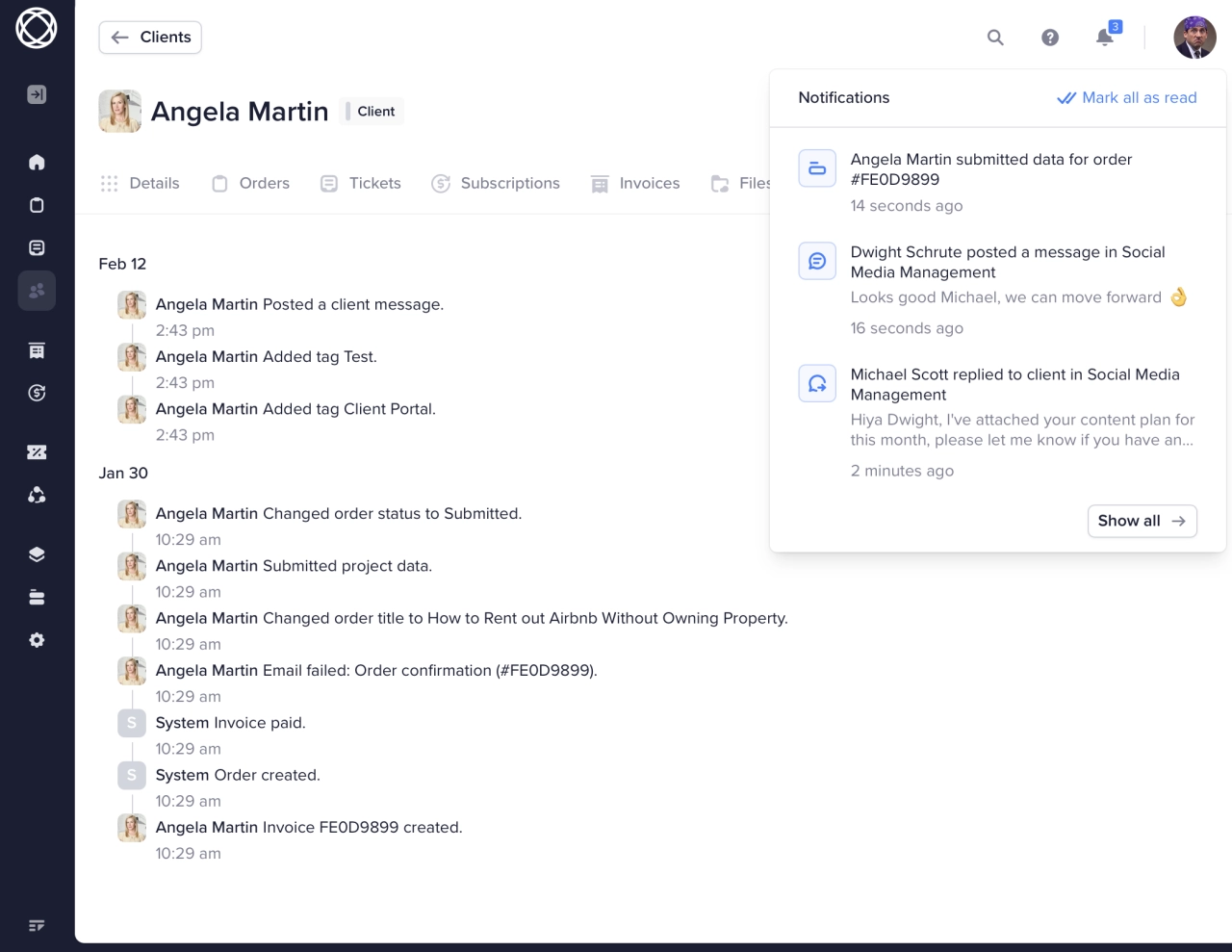

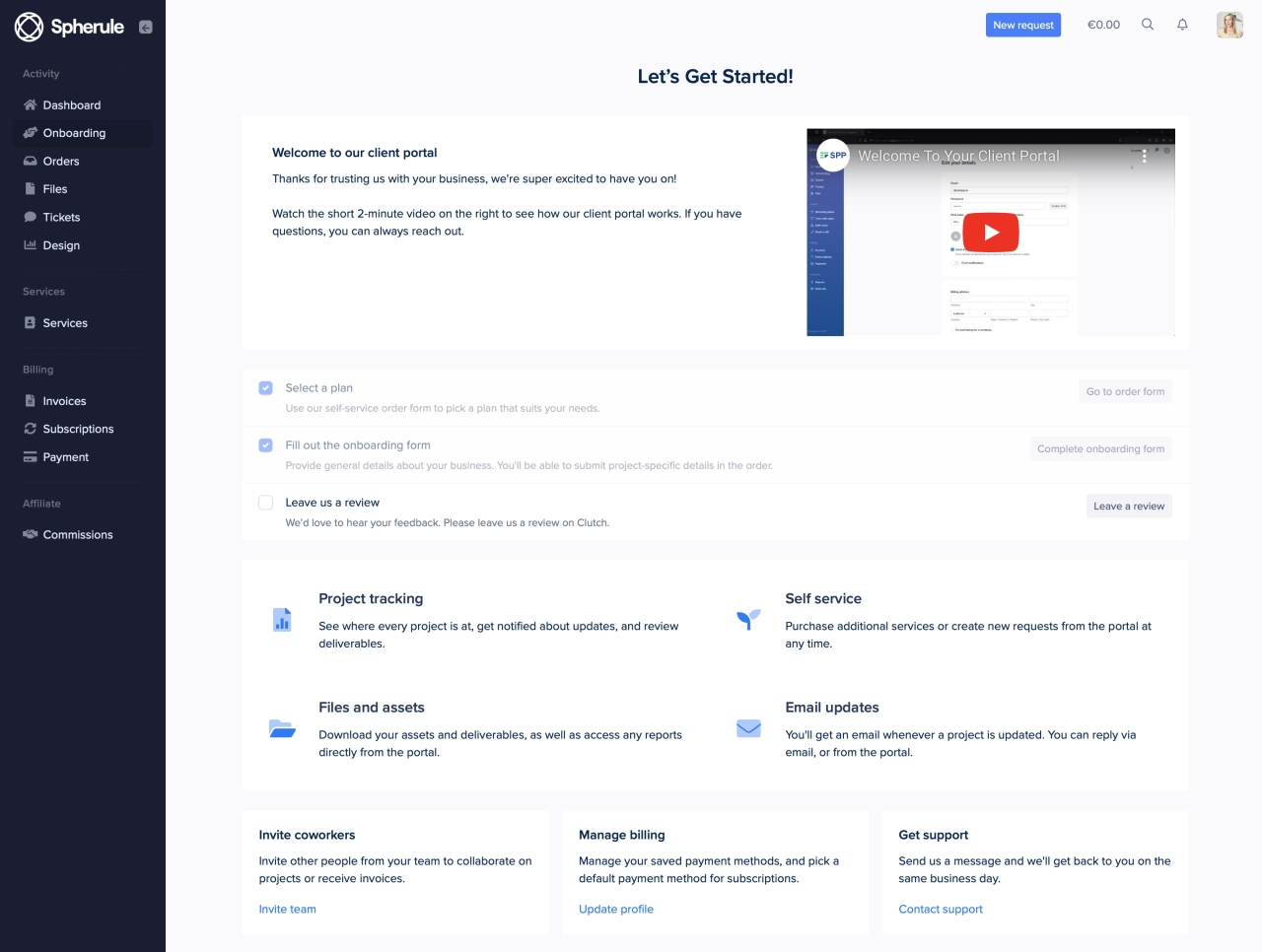

Client Portal Access

Give clients self-service access to view and pay invoices.

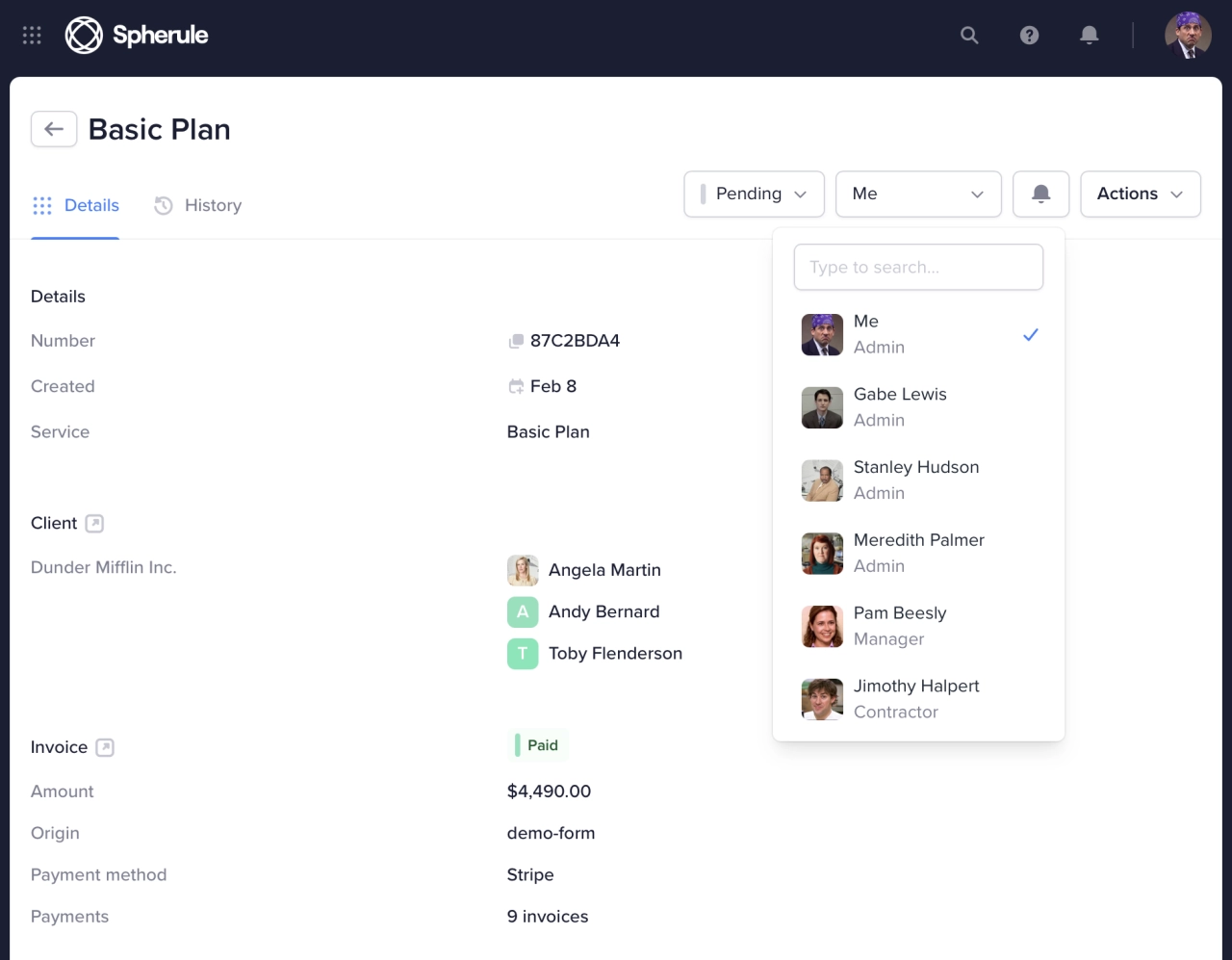

Team Collaboration

Share invoices with your team or allow them to download them.

Ready for your payment processor

Using Stripe or PayPal? Just connect your account and track payments automatically.

Frequently Asked Questions: Invoice Tracking & Payment Follow-Up

Use invoice tracking software like SPP to automatically monitor invoice status. Connect your payment processor (Stripe/PayPal) to mark invoices as paid automatically, set up overdue reminders, and view complete payment history in one dashboard.

The most efficient way is automated payment tracking software that integrates with your payment processor. This eliminates manual tracking and provides real-time payment status updates, overdue alerts, and client payment history.

Payment follow-up software automatically monitors invoice due dates and sends professional reminder emails to clients with overdue payments. You can configure the timing, frequency, and content of these automated reminders.

Yes, by connecting payment processors like Stripe or PayPal to your invoicing system. When clients pay invoices, the system automatically updates the status and records payment details including timestamps and amounts.

A payment tracker is a dedicated app or solution that automates payment tracking. For instance, if you use Stripe for payment processing, events can be sent to your invoicing software, and mark invoices as paid.

As a business, you want to ensure that you're paid for your services on time. Furthermore, you should be automating this process to reduce manual work.

A client portal software such as SPP.co allows you to fully track invoices. They are marked as overdue if the due date is missed, or as paid once a payment has been received via a payment processor (Stripe or PayPal).

You're in good company. We've helped agencies like yours sell $500M+ in services.