- Recurring payments offer benefits for both businesses and customers, such as predictable cash flow for businesses and convenience for customers.

- Recurring payments can lead to increased customer retention and loyalty, as customers are more likely to continue using a service if payments are automated and hassle-free.

- Recurring payments can also benefit businesses by reducing administrative costs associated with manual payment processing including following up on missed payments.

Recurring services and recurring payment solutions are on the rise—and for all the good reasons. Subscription-based models give you more for less, generate profit for companies, and make customers happy.

You don’t have to take my word for it, data shows it too. According to Zuora’s The Subscription Economy Index, subscription businesses grew 4.5 times faster than S&P 500 companies, and they also continued to thrive when everyone else was recovering from the pandemic lows.

This shows that, despite the ebbs and flows of the subscription economy, the model is here to stay. Does that mean it’s the model you should adapt for your business? And does that mean you should implement recurring payments too?

In this article, we’re talking a closer look at the benefits of recurring payments—so read on if you want to see if this pricing model is right for you.

What is recurring billing?

Recurring billing is a payment model where customers are automatically charged at regular intervals for a product or service. This system is commonly used by subscription-based businesses such as streaming services, software providers, and membership organizations. Recently, a lot of agencies have also switched to this type of pricing model. By setting up recurring billing, companies ensure a steady revenue stream and customers enjoy uninterrupted access to their services without the hassle of manual payments.

Recurring billing benefits both businesses and consumers by providing convenience and predictability. For businesses, it reduces administrative overhead and enhances customer retention, while consumers appreciate the ease of consistent, automatic transactions.

How billing affects customer experience

Before I jump into the types and benefits of recurring payments, let’s first talk about the customer experience. Think about the last time you had to pay for a service, was it a pleasant experience?

It probably wasn’t because:

it’s needlessly complicated and inflexible

your payment failed for an unknown reason and

you had to contact the merchant to fix the problem.

Not off to a great start, especially if it’s a new company you’re dealing with. But even if you know the business, a negative billing related experience can have long-term effects on how you perceive the company in the future. And this is the reason why every business should invest in making sure that their recurring payment plans are set up and the billing works seamlessly (including recovering failed payments and informing clients why payments didn’t go through).

Invoice and collect payments automatically and on time.

Fortunately, there are many recurring billing options to choose from, as per this Younium subscription management guide. These range from freemium pricing to tiered pricing.

Recurring payment vs one time payment

Recurring payments provide predictable revenue streams, reducing financial uncertainty. They also encourage customer loyalty and retention through regular billing cycles. In contrast, one-time payments offer upfront income but lack the stability of recurring revenue. Businesses must weigh these factors when deciding which payment model best suits their needs.

Advantages | Disadvantages | |

Recurring payments | Predictable revenue Increased customer retention Reduced administration Improved cash flow Enhanced relationship building | Higher risk of non-payment Fees for recurring transactions Contractual obligations |

One-time payments | Predictable upfront income Flexibility for customers No long-term obligations Suitable for low-value transactions | Variable revenue streams Increased administration Risk of missed opportunities Limited cash flow visibility Lack of customer retention data |

Top 7 recurring payment benefits for businesses

If you’re wondering why everything seems to be centered on recurring services these days, it’s because there’s a very good reason behind it—or (at least) seven reasons, to be more specific.

A more predictable revenue

Although a recurring billing model is not the equivalent of a fortune-teller, it can help you plan your finances more accurately. When customers opt for an ongoing billing cycle, they agree to pay the same fee at a predefined schedule. All you have to do is charge their saved payment method.

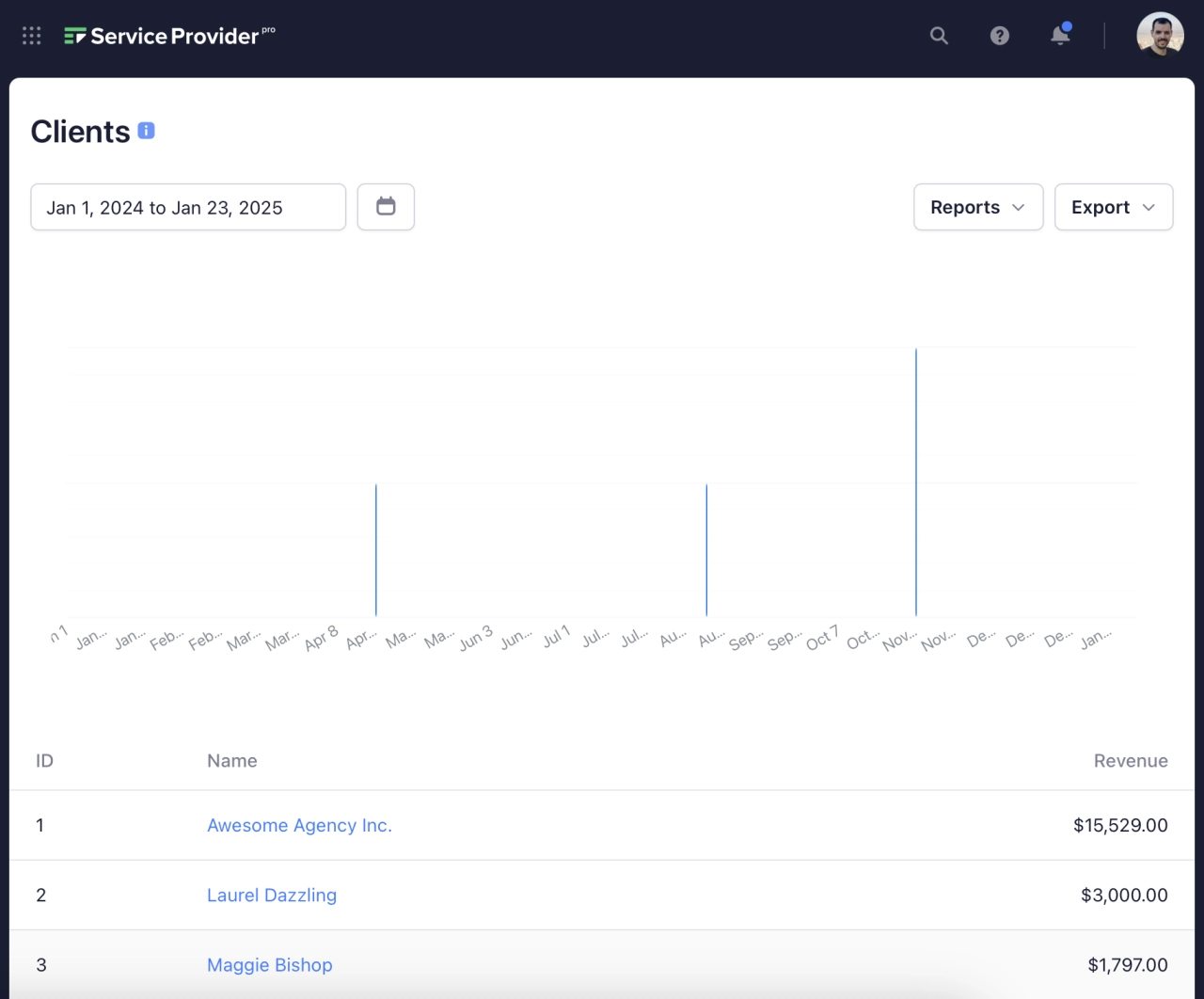

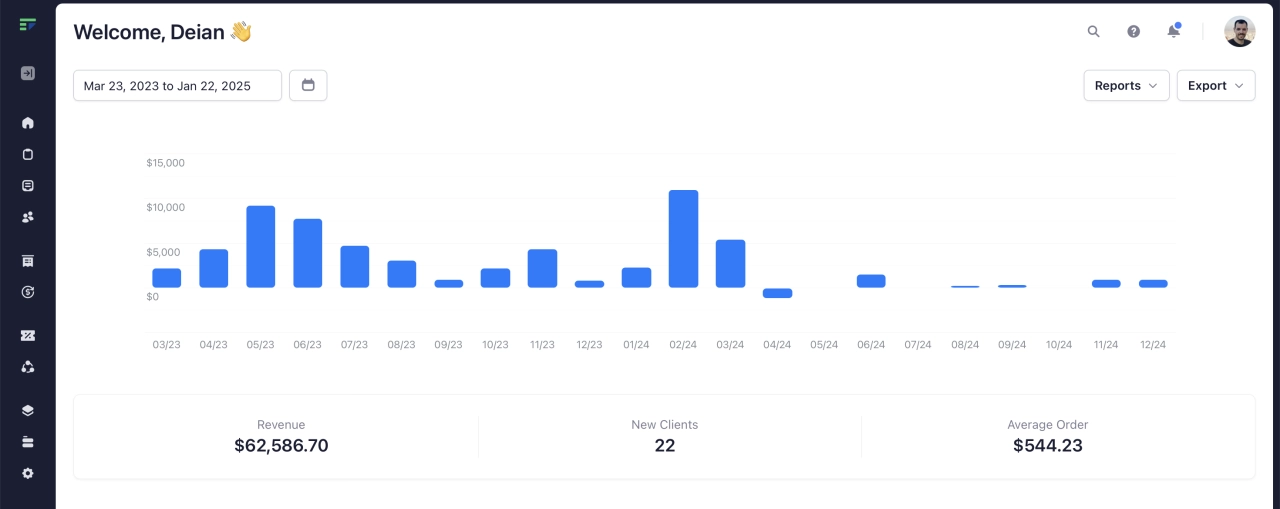

This can help you anticipate your cash flow more effectively and better manage it when it comes to budgeting expenses and investing in growth. It’s not a perfect way to predict your revenue, but it’s the closest you can get to accurate prognostics.

Boosted customer retention

When people opt for a recurring payment option, they don’t have to remember to renew their subscription or manually process a payment every time. Instead, the subscription is taken care of on its own. Even failed payments are handled, as modern payment processors retry them automatically. Chasing and collecting payments manually is a thing of the past. This creates a sense of convenience and security that encourages customers to stick around for longer, boosting customer retention significantly compared to one-time payments.

Less administrative pain

Fixed recurring payments are automated, which translates into a lot more time on your financial team’s hands—time they can use to focus on more important tasks, such as forecasting and planning.

Plus, you have the added benefit of not having to manually process payments anymore, making everyone’s life easier and removing human error from the equation. Nobody likes entering manual payment information on invoices, and recurring billing will save you from it.

Better customer experience

Recurring payments are easy to set up and manage for you and your customers. Customers don’t need to provide additional billing information every month, they don’t need to remember to send you money, and they don’t have to interrupt using your services. The only thing you require is to choose a recurring payment system that makes it easy for both parties.

Cost savings

When you focus on automatic recurring payments, you save money by focusing less on administrative tasks. With automated recurring billing, your team no longer needs to chase unpaid invoices.

Healthier cash flow

Better financial predictions come with a healthier cash flow. Due to the fact that you can plan your expenses more accurately (based on the recurring revenue), you won’t experience the same fluctuations in income as you would on a non-subscription model.

This also means you can pay your team and your service providers in time, get all the materials you need when you need them.

Increased revenue

Recurring payments are not necessarily a surefire way to boost your revenue. You can very much build a multi-billion empire without the subscription model. However, having a recurring payment model can help you gradually increase average order values and, subsequently, your revenue.

Top 7 recurring payment benefits for consumers

Making recurring payments a part of your business isn’t great just for companies. If consumers didn’t like paying for subscription services, this entire industry would’ve crumbled by now. Clearly, people enjoy it if payments are automatic (and businesses associated with them).

Here are the seven most common reasons consumers prefer recurring payments.

Convenience

Let’s face it: not having to enter their payment details every month is great. And people love easy for a billion (very good) reasons: from the fact that stress has a significant impact on one’s overall wellbeing, to it allowing customers to focus more of their energy and resources on things they care about.

Recurring payments help people save their time and energy for things that matter, rather than double-clicks and copy/paste. So, when you accept recurring payments, you give your customers the chance to spend their time more efficiently.

Predictability

Just as in the case of companies, recurring payments make financial predictability a little easier. People don’t have to keep track of payments, plan purchases, and set aside money for needed services. They can just set up a subscription and know that each month, a certain amount of money will be withdrawn from their account automatically.

Cost savings

Think of how many movies and TV shows you’ve watched this month on your favorite streaming service. If each movie/episode was $10, how much money would you have spent? Now, think of the costs for all of your monthly recurring payments.

It’s probably a lot less money than buying them individually, right? The sharing economy sounds like sorcery, but it’s pretty straightforward math: if 1,000 people pay $12/month for 100 movies, it’s a win-win for both companies and users. The former collects $12,000/month and the latter get to watch 1,000 movies.

Reduced risk for late payments

When you don’t have to actually remember to make payments, you’re less likely to forget or miss out on them. Recurring payments don’t give you an excuse to be forgetful, because your payment provider automatically takes care of it for you.

Broader access to products and services

Imagine you cannot really afford professional hiking boots, but you go on hikes about ten days every year. If you were to buy a $500 pair of hiking boots that would last you for five years, that means every hike would cost you $10. But if there’s a service that can rent those boots to you for $7/day on each of the ten days you hike every year, you have access to professional boots for a small price. That’s a win-win situation which is only possible thanks to recurring payments.

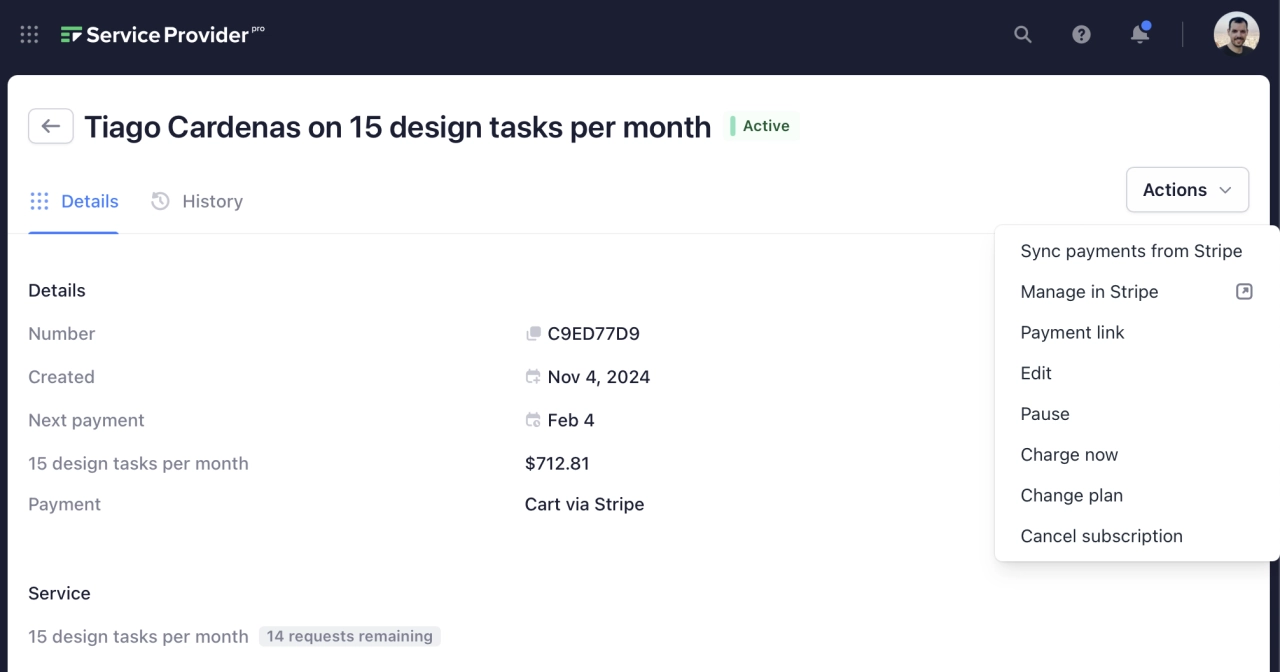

Flexibility

One of the best things about recurring payments is that they’re almost always flexible. You can cancel, pause, upgrade, or downgrade your subscription at any time.

That’s something that traditional services don’t really offer, so you can say that subscription payments adapt to your life and the changes that may occur in it.

Better credit scores

Consistent one-time payments can help people improve your credit score. While the Credit Bureau may not measure how much you pay for your streaming services or how often you pay for them, it does measure the fact that you pay your bills on time. And if you have a recurring payment set-up for your bills (such as electricity, phone, internet, and so on), you can acquire "brownie points" for your credit score.

How to set up recurring payments for customers

At this point you’re probably convinced that you should offer a type of recurring billing solution. But how do you collect recurring payments?

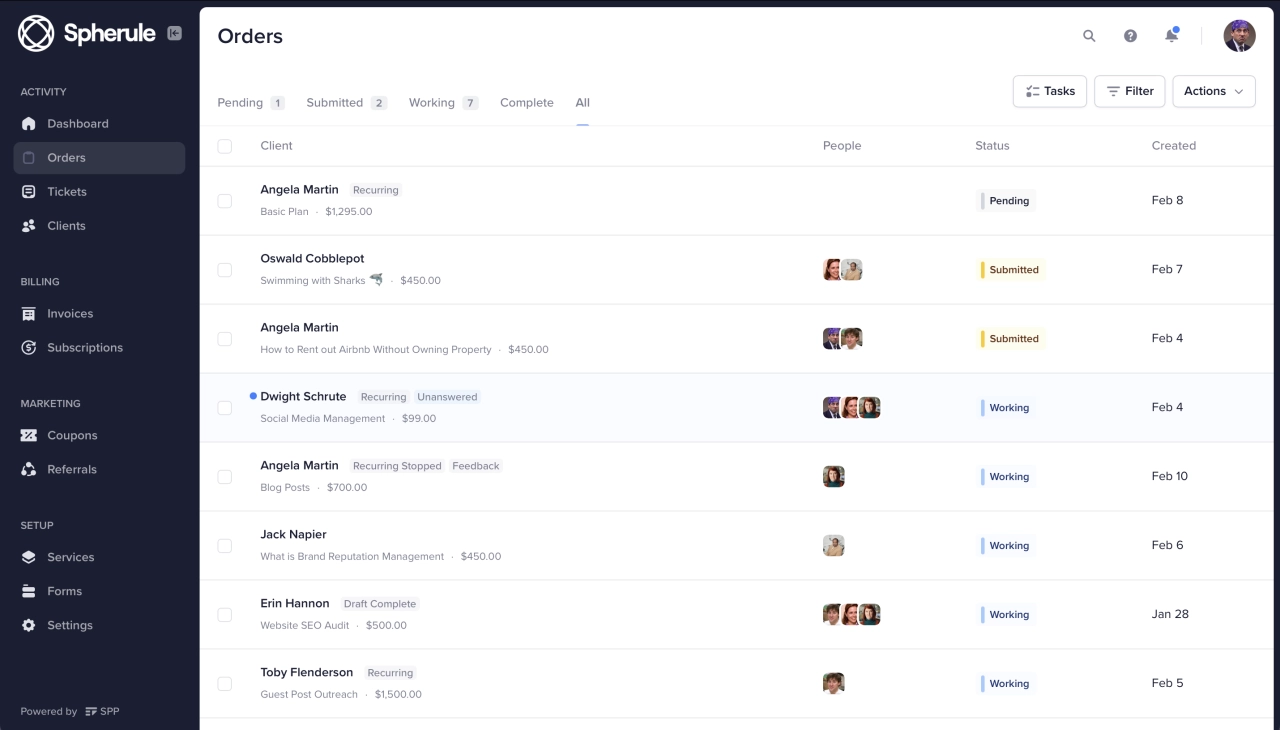

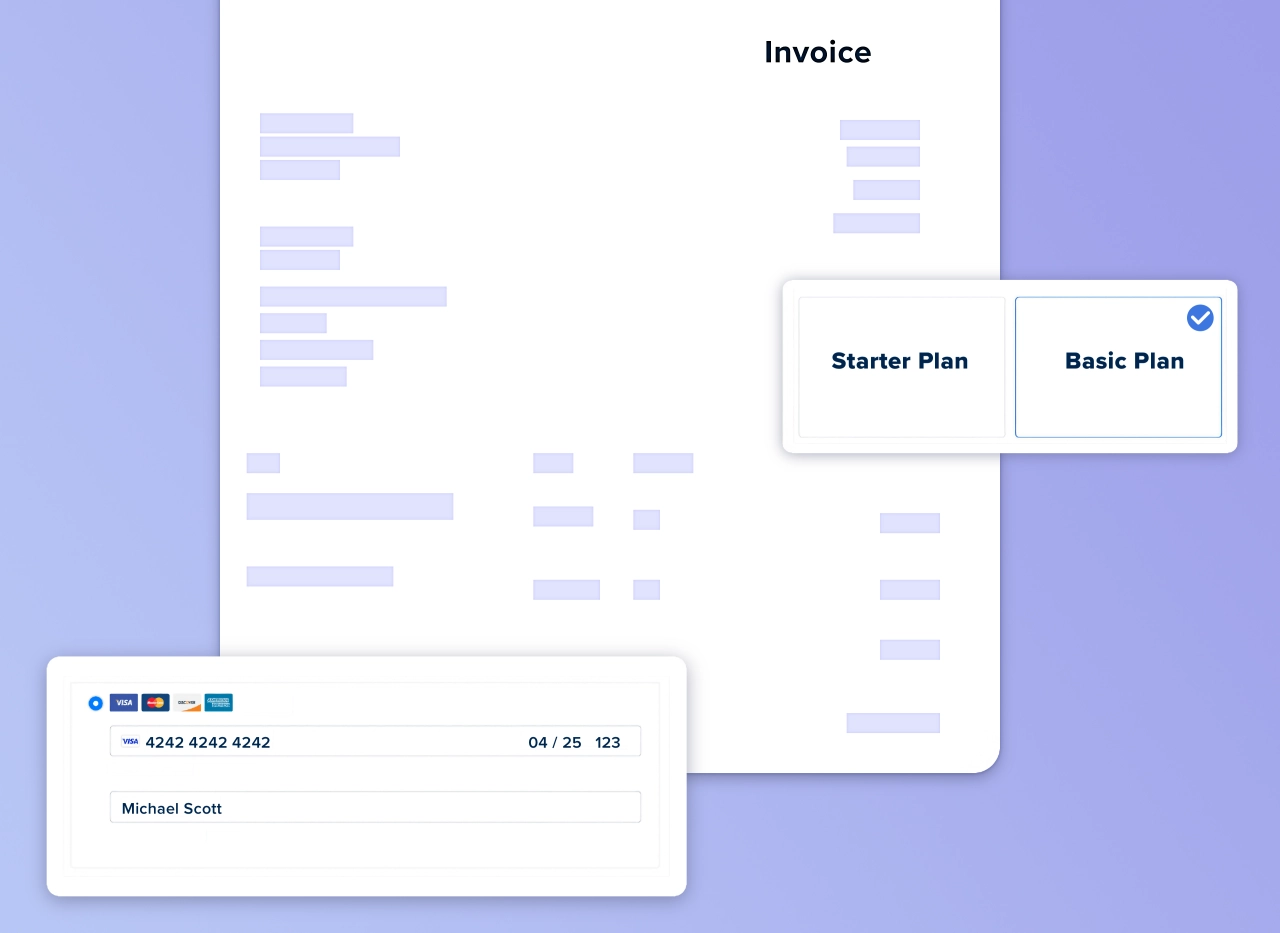

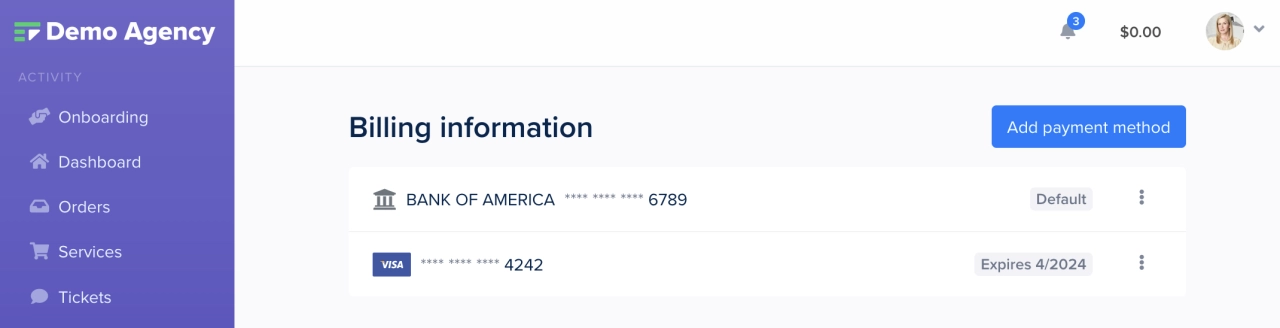

Luckily, it’s easier than you think thanks to payment gateways and software solutions such as Service Provider Pro. The latter integrates seamlessly with popular solutions such as Stripe and PayPal, making it easy to offer recurring billing for your product or service.

To get started:

sign up for an SPP trial

activate the Stripe or PayPal integration

connect to your payment processor

set up your order forms

test your setup

Once you’ve run a few tests, you can switch to the live mode, and enjoy recurring automatic payments.

Personalized Demo

Looking to make sure SPP is right for you? Get on a call with our customer success team.

Recurring billing benefits FAQ

What is a recurring subscription?

Many businesses prefer to charge regularly for their service or product, so they set up an automatic charge that is billed in certain intervals (monthly, quarterly, yearly). The advantage is that they can automatically get payments from customers without having to manually send invoices and wait for payment. Plus, modern payment solutions handle dunning, so failed payments are taken care of.

What is a recurring payment?

A recurring payment is an automatic transfer of funds. It’s often scheduled regularly, usually from a buyer to a seller. In most cases, recurring payments are set up for subscriptions, memberships, or bills, ensuring timely payments without manual intervention.

What does recurring billing mean?

Recurring billing is an automated process of charging a customer’s account or credit card at regular intervals for goods or services. Commonly used for subscriptions or memberships, it ensures continuous service without manual renewals, improving convenience and revenue predictability.

How does recurring billing work?

With the help of recurring billing software, the client’s payment method (often a credit card or bank account) are encrypted and saved. The payment method is used to automatically charge upcoming payments on a recurring basis basis, depending on the kind of plan they customer subscribed to.

Companies should use recurring payments

Recurring payments are an incredibly efficient way to receive and make payments. They are convenient, flexible, and cost-effective, and they can even help you improve your credit score/business cash flow.

In this post, I’ve taught you how to set up automatic payments for your business so that you can focus on more important tasks that require human input. Let your system take care of your payments—automatically.