- Most invoice disputes are preventable—clear scope documentation, upfront payment collection, and automated status updates eliminate the ambiguity that causes 90% of billing conflicts.

- When a dispute does come in, diagnose the type before responding: administrative errors need a quick fix, deliverable disputes need documentation, and relationship disputes need the right stakeholders in the room.

- If the client won’t pay despite your best efforts, small claims court handles amounts up to $10–25K depending on state—no lawyer required, and sometimes just filing is enough to prompt payment.

Your team delivered a website redesign on deadline. The project manager sent the final invoice. Three weeks later, the client’s CFO emails: “We need to discuss some concerns about this invoice before we can process payment.”

Sound familiar? Invoice disputes cost agencies more than money—they drain operational bandwidth and damage client relationships. Atradius reports that 55% of all B2B invoiced sales in the U.S. are overdue, costing companies an average of $39,406 annually in collection-related expenses.

After years helping agencies streamline their billing operations at SPP.co, I’ve seen how disputed invoices can spiral from minor miscommunications into relationship-ending conflicts. The good news? With the right systems in place, most disputes are preventable—and the rest become much easier to resolve.

In this guide, I'll walk you through a proven 3-step framework for handling invoice disputes—plus actionable strategies to prevent them from happening in the first place.

Understanding this topic involves several interconnected concepts:

- Payment Gateway

- Scope of Work (SoW)

- Client Portal

- Client Onboarding

- Productized Service

- Retainer Model

Each of these concepts plays a crucial role in the overall topic.

What is a disputed invoice?

A disputed invoice occurs when a client challenges an invoice’s validity, accuracy, or authenticity. For agencies, disputes typically fall into one of three categories—and knowing which you're dealing with determines how you respond.

Understanding the dispute spectrum

Invoice disputes typically fall into three categories:

TYPE | EXAMPLES | TYPICAL RESOLUTION APPROACH |

|---|---|---|

Administrative | Incorrect dates or amounts Tax calculation errors Missing PO numbers | Documentation review Correction and resubmission |

Deliverable | Quality concerns Scope interpretation (“I thought unlimited meant…”) Incomplete work claims Revision disputes | Client discussion |

Relationship | Contract term disagreements Payment term disputes Stakeholder misalignment (marketing approved, finance disputes) | Formal negotiation |

Dispute resolution priority guide

When a client questions an invoice, determine which type you’re facing:

Administrative disputes usually resolve quickly—someone entered the wrong PO number or the invoice went to the wrong email. Fix it and resend.

Deliverable disputes require documentation. Pull the SOW, show the approval timestamps, and walk through what was agreed vs. what was delivered.

Relationship disputes are the hardest. These often surface when the person who approved the work isn’t the person paying the bill. You may need to get both stakeholders on a call.

One pattern agencies see frequently: the marketing manager signs off on deliverables, but the CFO or finance team disputes the invoice weeks later because they weren’t looped in. When this happens, you need to get both stakeholders on a call. And next time, make sure finance is on the approval chain from the start.

Spotting dispute signals in Stripe

When clients challenge an invoice processed through Stripe, you need to act quickly. If you haven’t set up your payment gateway yet, that's step one.

Here’s how Stripe notifies you about potential disputes and what the signals look like:

Email notification: Stripe sends an immediate alert containing dispute details and deadline information

Dashboard alerts: A notification appears in your Stripe Dashboard

Webhooks: If configured, your system receives programmatic notifications

API events: Accessible via the Stripe API for automated handling

Stripe also provides pre-dispute signals that can help you address issues before they escalate:

Some card networks initiate a “preliminary phase” before creating a formal dispute. Stripe calls this an “inquiry” (sometimes also called a “retrieval” or “request for information”). American Express and Discover frequently use this phase, giving you a chance to resolve issues before they become formal disputes.

What you’ll see in the dashboard:

Pre-dispute inquiry: Labeled as “Inquiry” or “Dispute Inquiry”

Formal dispute: Clear dispute notification with reason code

Evidence collection period: Countdown timer showing your deadline

Dispute fee: $15 charged immediately (may be refunded in Mexico, but non-refundable elsewhere)

Pro tip: When Stripe notifies you of a dispute, you have the option to accept or challenge it through the Stripe Dashboard. For invoice disputes specifically, gather all documentation including communications, signed agreements, delivery confirmations, and usage logs.

Using SPP.co alongside Stripe provides an additional layer of protection, as all client communications, agreements, and deliverables are documented in a central location, making evidence collection for disputes significantly faster.

The impact of disputed invoices

Disputes happen. You can reduce them, but you won’t eliminate them entirely. The goal is having a process so they don’t derail your operations.

The biggest hit is time. Instead of moving on to the next project, you’re digging through emails, pulling approval records, and documenting work you thought was done. That’s time your team could spend on billable work.

Then there’s the relationship damage. A client who disputes an invoice—even if you resolve it—may not come back. And if they do, the dynamic has changed. You’re starting from a defensive position instead of a collaborative one.

Finally, unresolved disputes create accounting headaches. Unpaid invoices sitting on your books throw off your revenue reporting and can cause problems if you ever get audited.

The bottom line: you need a resolution process and a prevention process. The rest of this guide covers both.

7 common causes of invoice disputes

If you’re wondering why you’re always chasing overdue payments, and they end up in disputes, let me introduce you to the most common reasons.

Overcharging or incorrect billing

incorrect quantity of services provided

excessive charges for services (e.g., setup fees)

Incorrect payment terms

failure to specify clear payment terms in the contract or agreement

Unapproved expenses or unauthorized charges

unrelated third-party payments made on behalf of the client without authorization

Changes to scope or specifications

alterations to project requirements that affect invoice amounts

Delayed delivery or poor quality services

failure to meet agreed-upon timelines, leading to rework, delays

Error in calculation or invoicing process

inaccurate calculations for taxes, discounts, or fees

Lack of transparency and clear communication

unclear expectations about billing procedures

lack of regular updates on the status of outstanding invoices

Switching to recurring payments removes the ambiguity of payment terms. Clients know exactly when they’ll be charged and for how much.

Handling disputed invoices in 3 steps

When a client disputes an invoice, your first instinct is probably to get defensive. Resist it. How you handle the next 48 hours determines whether this ends in payment or a burned relationship.

Here’s the framework I recommend.

Step 1: identify the core issue

Before you respond, figure out what you’re actually dealing with. Different dispute types need different approaches.

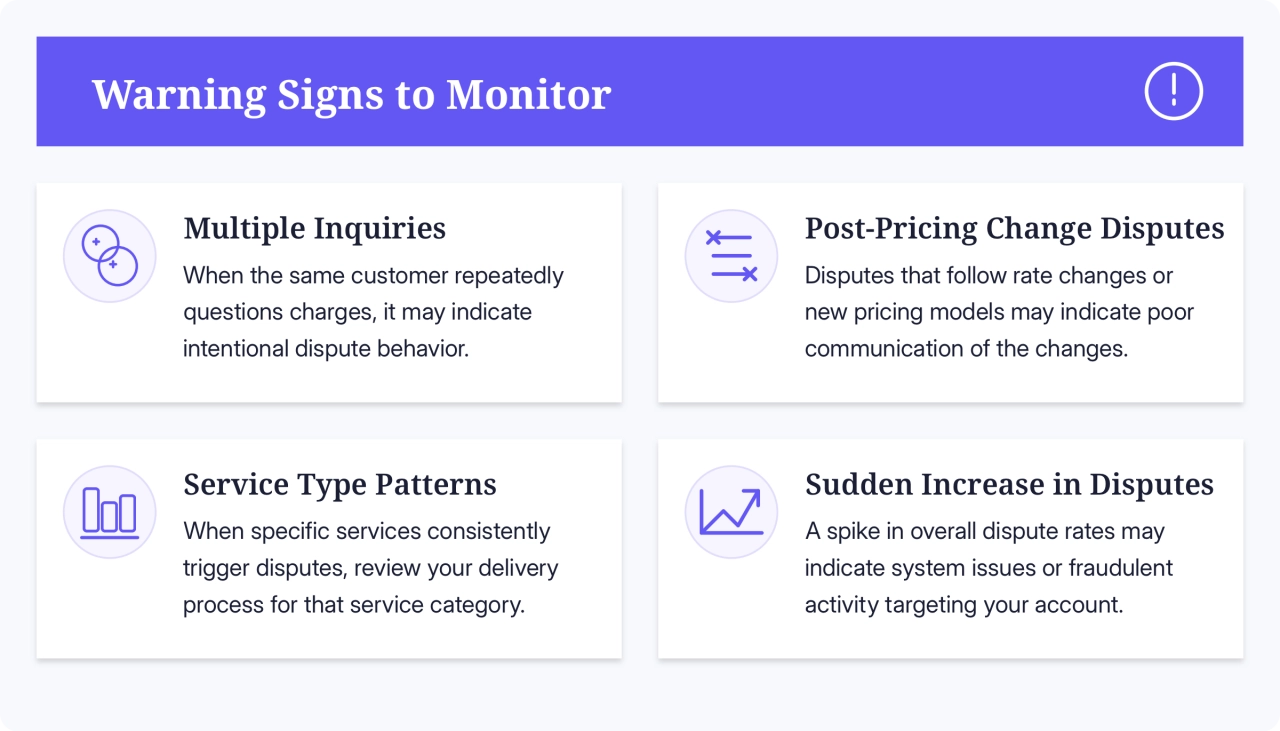

The dispute root cause analyzer

Use this decision tree to diagnose the dispute type:

Once you know the category, you know how to respond:

Administrative disputes are the easiest. Wrong amount, missing PO number, invoice sent to the wrong person. Fix it and resend.

Deliverable disputes require proof. Pull approval records, show what was agreed, walk through what you delivered.

Relationship disputes are the hardest. Usually means someone on the client side wasn’t aligned from the start. You’ll need to get the right people in a room.

Effective vs. ineffective client communications

Your first response sets the tone. Get it wrong and a minor issue becomes a major conflict.

Ineffective response:

I’m confused about why you’re disputing this invoice. We completed everything you asked for according to the contract you signed. Payment is due immediately as per our terms.

Why it fails: Defensive, accusatory, demands payment. This escalates instead of resolves.

Effective response:

Thank you for flagging this. I want to make sure we address the right issue—can you clarify which line items you’re questioning and why? Happy to pull our project records and walk through it together.

Why it works: Acknowledges the concern, asks for specifics, offers to review together. No defensiveness.

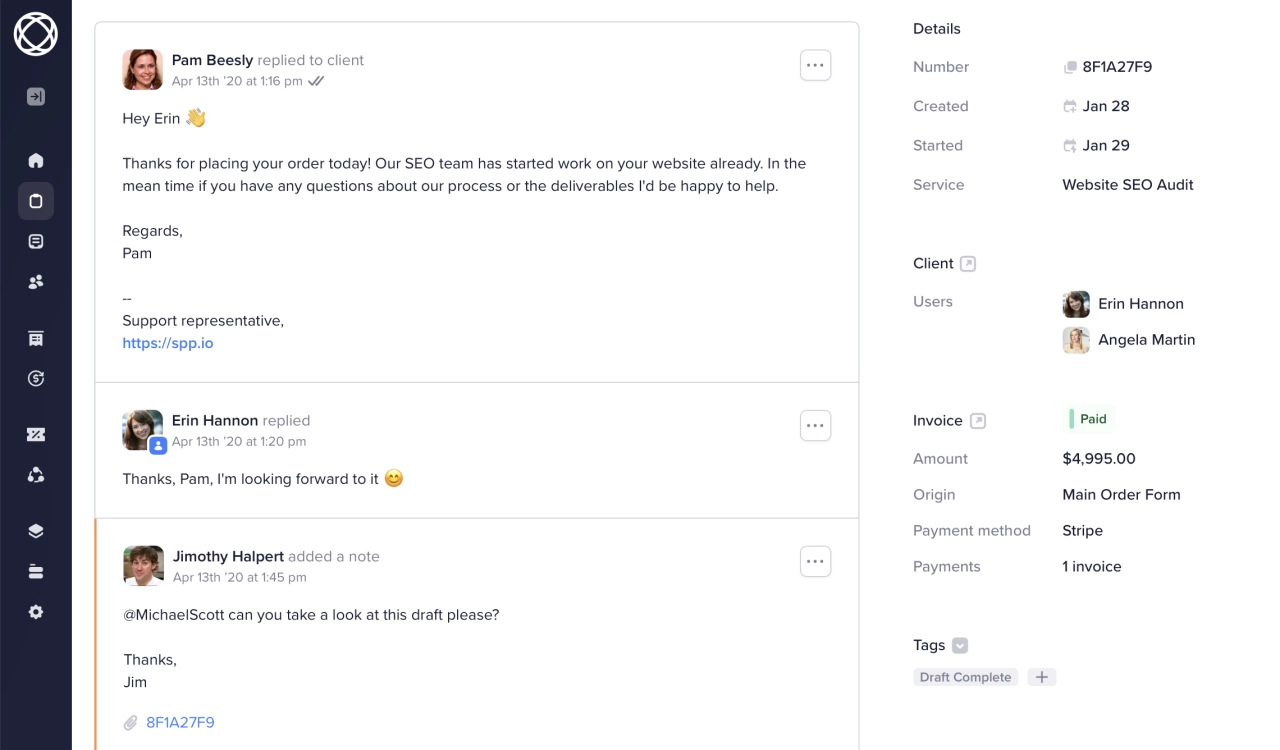

Leveraging SPP’s documentation system

SPP logs every client interaction with timestamps, which gives you evidence when disputes arise:

What gets documented:

client approvals with timestamps and IP addresses

payment history showing when and how much was paid

all messages between you and the client

file uploads and deliverables linked to the project

Stay on top of your projects and get your tasks done on time.

When you respond, be specific:

I’ve pulled our project history. On March 15th at 2:45 PM, you approved the final deliverable via the client portal (order ID #ABC457). The invoice was generated the same day per our agreed terms. I’ve attached screenshots of the approval for reference.

This is why documentation matters. You’re not relying on memory or arguing about what was said. You have records.

Pro tip: Gather your documentation before responding. Clients move faster toward resolution when they see you have detailed records.

Step 2: resolve billing conflicts

You’ve identified the dispute type and gathered your documentation. Now you need to actually resolve it.

The evidence escalation ladder

Match your response to the severity. Don’t dump your entire project history on a client who just needs a corrected invoice.

Dispute Level | Evidence Needed | Communication Channel |

|---|---|---|

Minor clarification | Invoice details only | Email or client portal message |

Factual disagreement | Reference materials + proof of delivery | Documented client portal thread |

Contract interpretation | Full project history + signed agreements | Video call followed by written summary |

Payment refusal | Complete documentation package | Formal written communication |

Start low and escalate only if needed.

Crafting an effective resolution email

Here's a template that works:

Subject: Re: Invoice #[Number]

Hi [Client Name],

Thanks for flagging this. I've reviewed the invoice and our project records.

Regarding [specific disputed item]:

- [Specific evidence point 1]

- [Specific evidence point 2]

- [Reference to documentation in client portal]

Based on our agreement dated [date], this work was completed per the specs you approved on [date].

To move forward, I propose:

[Clear, specific resolution proposal]

Let me know if that works, or if you'd like to hop on a call to discuss.

[Your Name]Short, factual, offers a path forward. No groveling, no defensiveness.

Negotiation strategies that preserve relationships

Sometimes the fastest resolution involves some compromise. Here’s how to handle each dispute type.

For administrative disputes:

If you made an error, fix it and move on:

You’re right—the invoice shows 4 revisions but we only did 3. I’ve updated it and reduced the total by $250. Corrected invoice is in your portal.

For deliverable disputes:

Focus on what was agreed vs. what was delivered:

I understand you’re concerned about mobile responsiveness. Our original spec mentioned iOS and Android compatibility. I can send testing results from 5 devices, or we can do a joint review session if that's easier.

For relationship disputes:

These usually come down to different interpretations of the agreement:

It looks like we have different understandings of “unlimited revisions.” Our terms define this as unlimited feedback during the 14-day revision window. We’re now at day 30, so additional changes would normally be billable. That said, I’m happy to include this round at no charge—any further changes after this would be at our standard rate.

Pro tip: Document every resolution in writing, even if you discussed it on a call. In SPP.co, log it in the order discussion thread so both sides can reference it later.

Step 3: prevent client payment issues

The best dispute is the one that never happens. Here’s how to prevent them.

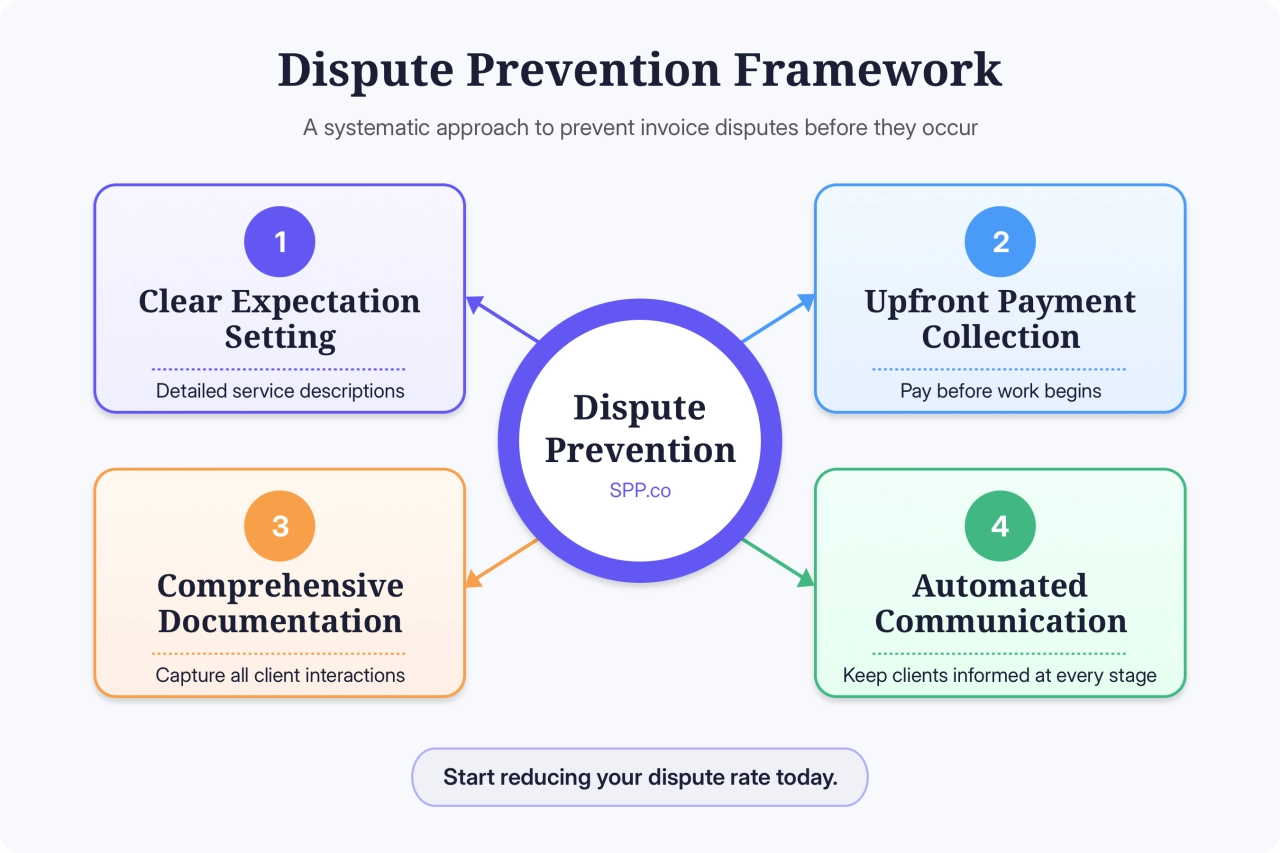

The dispute prevention framework

This framework covers the key prevention points:

The image maps out where disputes originate and how to cut them off. Justin Belmont, founder of Prose, sums up the approach:

Be proactive: over-communicate, automate where possible, and don’t be afraid to enforce boundaries—it's about respect, not just cash flow.

Justin Belmont,

Prose

Justin Belmont,

Prose

Clear expectation setting

Most disputes trace back to unclear scope. The client expected one thing, you delivered another, and now you’re arguing about the invoice.

In SPP, you can:

create service description templates with explicit inclusions and exclusions

set up Zapier automations that notify clients when order status changes

require clients to accept service agreements before work begins

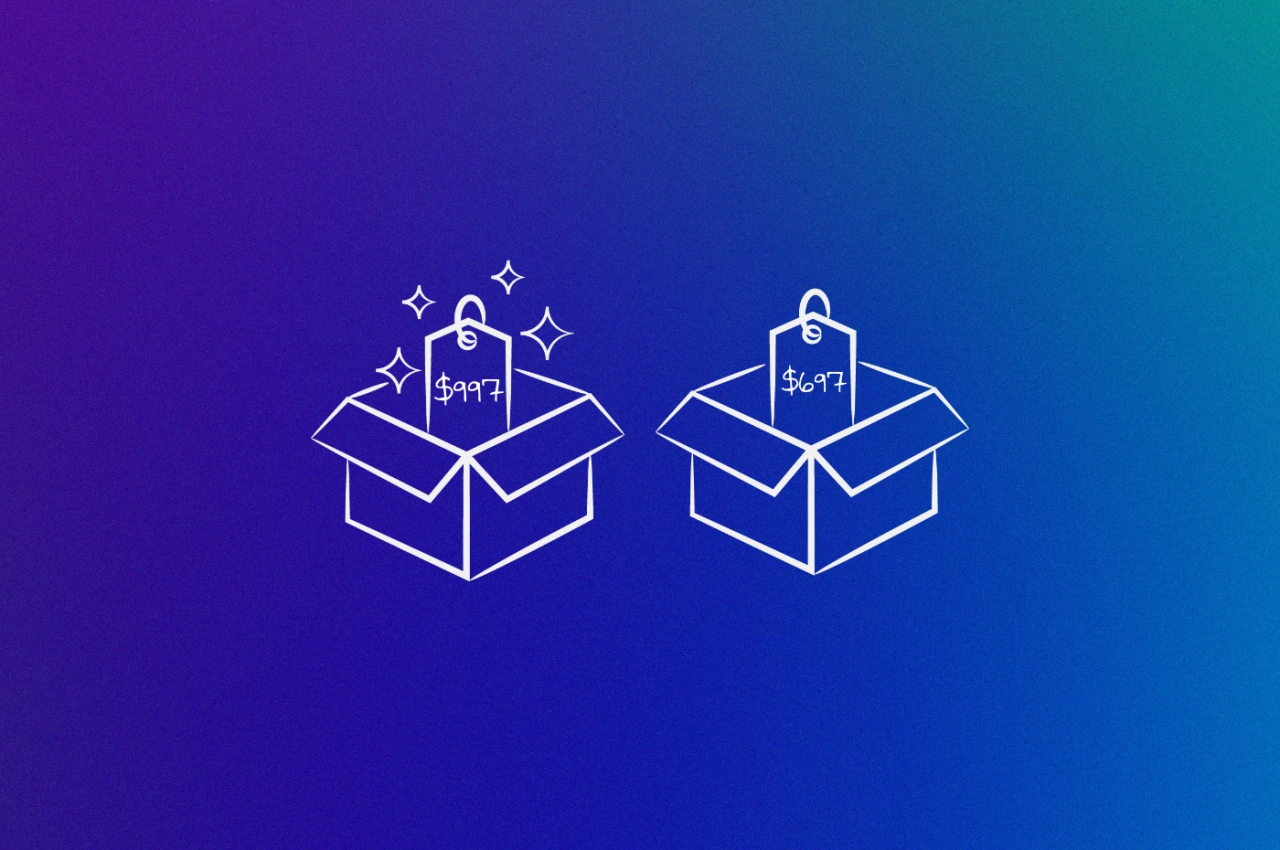

Compare these two service descriptions:

Vague: Website design package includes mockups and implementation.

Specific: Website design package includes: 2 initial concept mockups, 2 rounds of revisions, implementation of approved design, mobile responsiveness testing on iOS and Android, and 30 days of post-launch support. Does not include: content creation, custom illustrations, or ongoing maintenance beyond 30 days.

The second version leaves nothing to interpret.

Upfront payment collection

Collecting payment before starting work changes the dynamic entirely. Clients who’ve already paid are more engaged, respond faster, and rarely dispute after the fact.

We reduced payment issues by 80% by switching to milestone-based payments—clients pay before each phase begins, not after.

Harmanjit Singh,

Origin Web Studios

Harmanjit Singh,

Origin Web Studios

SPP is built around upfront payments for productized services. If you’re still billing after the fact, retainer pricing is worth considering—it gets cash in the door before work starts and reduces disputes by default.

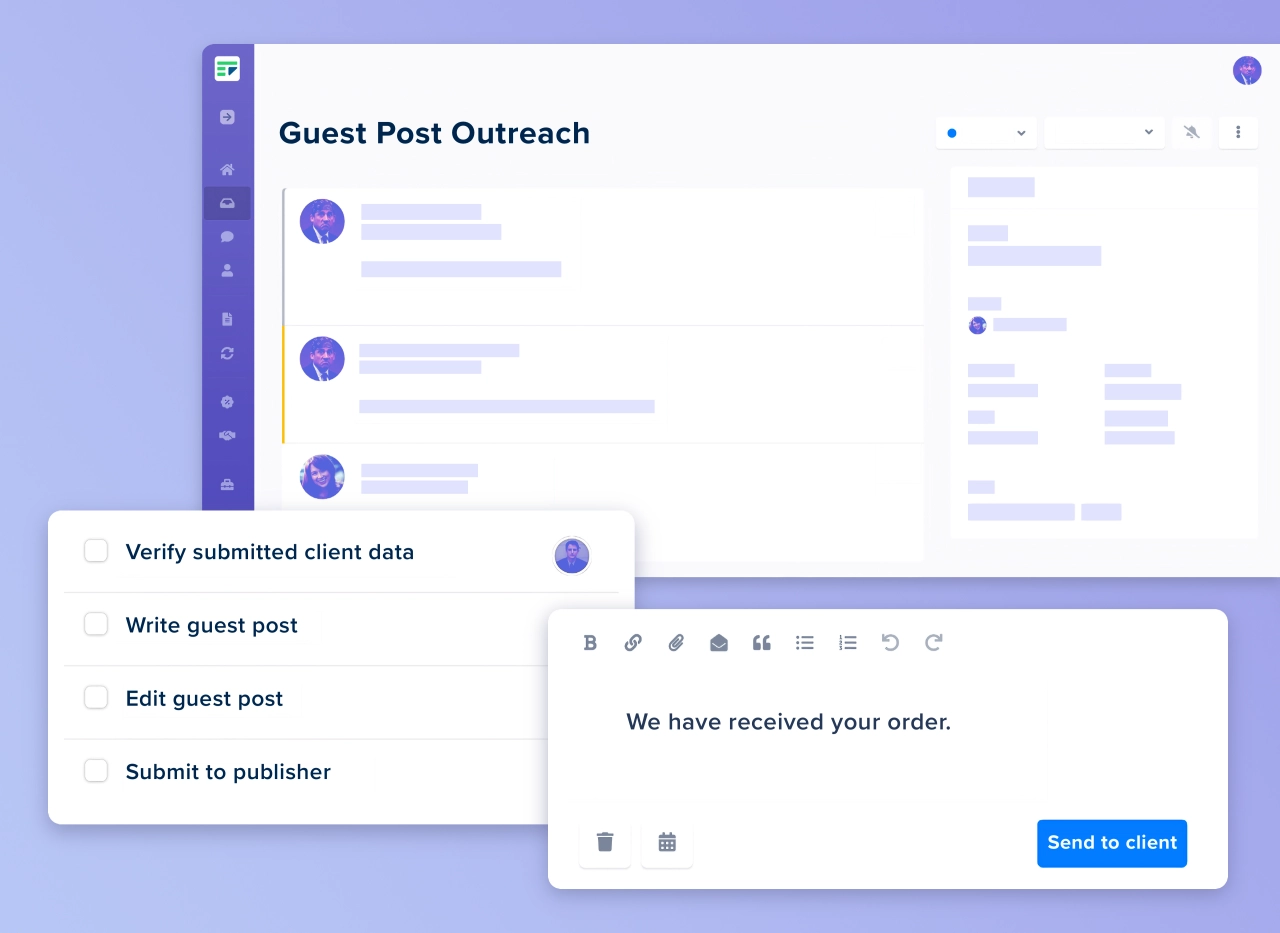

Automated communication

Many disputes come from clients forgetting what they bought or missing status updates. Automation fixes this:

Order confirmation emails: sent immediately, reiterating what was purchased

Payment reminders: sent automatically if overdue

All of these can be customized in SPP under Settings → Emails.

Implementing a preventative system

Here's a four-week rollout:

Week 1: Service definition audit

review and update all service descriptions

create detailed scope documents for each service

update terms and conditions to address common dispute triggers

Week 2: Client communication templates

develop standardized onboarding messages

create project kickoff questionnaires via onboarding forms

set up templated messages for faster communication

Week 4: Testing and refinement

test the system with a new client

gather feedback on clarity and expectations

refine based on results

Measuring success

Track these metrics to know if it’s working:

Dispute rate: Percentage of invoices disputed

Time to resolution: How long disputes take to close

Resolution type: Resolved in your favor vs. compromise

Client satisfaction: Post-resolution feedback

When resolution fails

Sometimes you do everything right and the client still won’t pay. You’ve documented the work, sent polite follow-ups, offered compromises—and nothing. At some point, you need to decide: escalate or move on.

When to involve legal counsel

Most invoice disputes don’t need a lawyer. But some do. Consider legal involvement when:

the amount is significant (typically $10,000+)

the client is making claims that could damage your reputation

you suspect fraud

the dispute involves contract terms that are genuinely ambiguous

For smaller amounts, the legal fees often exceed what you’d recover. A demand letter from an attorney might shake something loose, but beyond that, you’re usually better off with small claims court or writing it off.

Small claims court basics

Small claims court is designed for disputes like unpaid invoices. No lawyer required, filing fees are low, and cases typically resolve within a few months.

The catch: every state has a dollar limit on what you can claim.

State | Limit | State | Limit |

|---|---|---|---|

California | $12,500* | New York | $5,000–$10,000** |

Texas | $20,000 | Florida | $8,000 |

Illinois | $10,000 | Georgia | $15,000 |

Pennsylvania | $12,000 | Colorado | $7,500 |

Washington | $10,000* | Minnesota | $20,000 |

California: $12,500 for individuals, $6,250 for businesses. Washington: $10,000 for individuals, $5,000 for businesses. *New York: $10,000 in NYC, $5,000 in most other courts.

For the full list, check Nolo's state-by-state guide.

Small claims works best when:

the amount owed is under your state's limit

you have clear documentation (contracts, approvals, communications)

the client is in your state or you can travel to theirs

Keep in mind: winning is one thing, collecting is another. A judgment doesn’t guarantee payment.

Arbitration vs. mediation

If your contract includes a dispute resolution clause, you might be required to go through arbitration or mediation before court.

Mediation | Arbitration | |

|---|---|---|

What it is | Facilitated negotiation | Private judge makes a decision |

Binding? | No—either party can walk away | Yes—decision is final |

Cost | $100-$500/hour, split between parties | $1,000-$5,000+ depending on complexity |

Timeline | 1-2 sessions | Weeks to months |

Best for | Relationship disputes, ongoing clients | Clear-cut cases where you want a ruling |

Mediation is worth trying if you want to preserve the relationship or if the dispute is genuinely ambiguous. Arbitration makes sense when you're confident in your case and want a decision.

When to write off an invoice

Sometimes the best business decision is to stop chasing the money. Consider writing off an invoice when:

collection costs exceed the invoice amount

the client has gone out of business or is insolvent

you’ve been chasing for 90+ days with no response

the amount is small enough that your time is worth more

Stephanie Fehrmann, co-founder at Redefine, has a clear policy: “We pause working on an account as soon as the account is late on 2 invoices." At some point, you have to cut your losses and move on.

For tax purposes, you can deduct bad debt if you use accrual accounting. Keep documentation of your collection attempts—the IRS requires proof that the debt is genuinely uncollectible.

What if the client refuses to compromise?

You’ve tried negotiation, offered payment plans, bent over backwards—and they’re still not budging.

Here’s the escalation path:

Send a formal demand letter: State the amount owed, the deadline, and what happens next if they don’t pay. Keep it factual, not threatening.

Stop all work: If you’re still delivering services, stop. Faiza Aijaz, co-founder at Ecazon, uses a 30-day rule: “If we don't hear from the client for more than 30 days, we consider the project abandoned.”

Report to credit bureaus or BBB: Some agencies report non-payment to business credit bureaus. Others file BBB complaints. Both create leverage.

File in small claims: If the amount justifies it and you have documentation, file. The filing alone sometimes prompts payment.

Engage collections: For larger amounts, a collections agency will pursue the debt for a percentage (typically 25–50%). Only worth it for significant invoices.

Josh Cremer, founder of Redfox Visual, advises patience before going nuclear:

One thing I avoid is pressure tactics that could backfire, like jumping to legal threats too quickly. Flexibility, coupled with firm yet respectful communication, is the way to drive cooperation, not confrontation.

Josh Cremer,

Redfox Visual

Josh Cremer,

Redfox Visual

A note on international disputes

Chasing payment across borders is hard. Different legal systems, currency complications, and the practical reality that you probably can't sue someone in another country for a $5,000 invoice.

For international clients:

collect upfront whenever possible (SPP's model helps here)

use payment processors with built-in dispute resolution (Stripe, PayPal)

accept that small amounts may not be worth pursuing

If a significant amount is at stake and the client is in a country with enforceable judgments (UK, EU, Canada, Australia), consult an international collections attorney. Otherwise, treat it as a lesson and tighten your upfront payment requirements.

Frequently asked questions

What are the legal implications of invoice disputes?

Most disputes are business disagreements, not legal matters. They become legal when the client breaches the contract or refuses to pay despite clear documentation. For amounts over $10,000 or situations involving false public claims, consult an attorney.

When should I write off a disputed invoice?

Write it off when collection costs exceed the invoice amount, the client is unresponsive for 90+ days, or the client is insolvent. For tax purposes, document your collection attempts—the IRS requires proof the debt is uncollectible.

How do I handle invoice disputes with international clients?

Require upfront payment and use processors with dispute resolution (Stripe, PayPal). If a dispute arises, your options are limited—small claims doesn't cross borders, and international collections rarely makes sense for amounts under $20,000.

What if the client refuses to compromise on an invoice dispute?

Send a formal demand letter with a deadline. If they ignore it, your options are small claims court, a collections agency, or writing it off. Stop delivering work immediately and document everything.

Building a dispute-resistant agency

Disputes will happen. The goal is to make them rare and resolve them fast when they do.

Set clear expectations upfront. Document everything. Collect payment before you start work. When a dispute does come in, diagnose the type, gather your evidence, and respond without getting defensive.

Most agencies lose money on disputes not because they’re wrong, but because they’re disorganized. Fix the system and the disputes take care of themselves.