You’re sending invoices, waiting days (or weeks) for clients to pay, and spending way too much time chasing money instead of doing actual work. Sound familiar?

Getting paid shouldn’t be this hard. A payment gateway handles the messy parts: encrypting card details, processing transactions, and putting money in your account without you having to lift a finger after the initial setup.

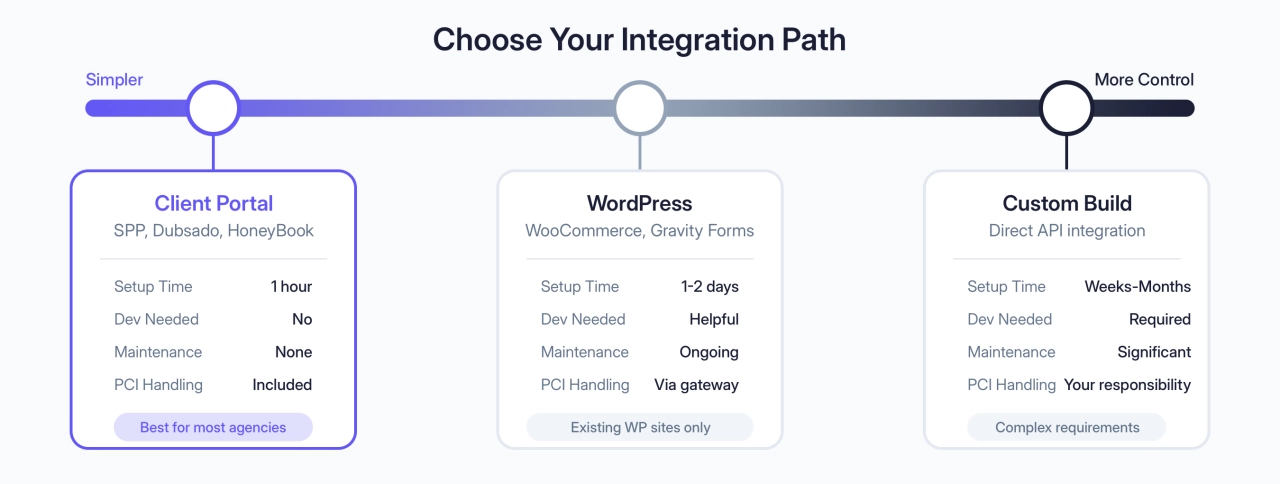

In this guide, I’ll walk you through exactly how to set one up, whether you’re running a WordPress site, using client portal software like SPP.co, or building something custom. We’ll cover the real costs, the security stuff you actually need to know, and how to avoid the expensive mistakes agencies make building custom solutions.

Why agencies need a payment gateway

You might be thinking, “I’ve been invoicing clients for years, why change now?” Fair point. But here’s what manual invoicing actually costs you.

According to QuickBooks research, 65% of businesses spend 14 hours per week on collections and chasing late payments. That’s nearly two full workdays gone every week.

A payment gateway automates almost all of that. Clients pay when they’re ready (even at 2am), the money hits your account in a day or two, and you get notified when it happens. No chasing. No awkward “just checking in on that invoice” emails.

There are a few other reasons this matters for agencies specifically:

Security isn’t your problem anymore: Payment gateways like Stripe and PayPal handle all the sensitive card data. They’re PCI compliant, they encrypt everything, and if something goes wrong, it’s on them. You really don’t want to be storing credit card numbers on your own server.

You can actually scale: When you’re manually invoicing 10 clients, it’s manageable. When you hit 50 or 100, it becomes a full-time job. Automated payments grow with you without adding admin overhead.

Clients expect it: Nobody wants to write a check or set up a bank transfer anymore. If your checkout process feels clunky, you’re losing sales to agencies that make it easy.

Once you’ve set one up, you’ll wonder why you waited so long.

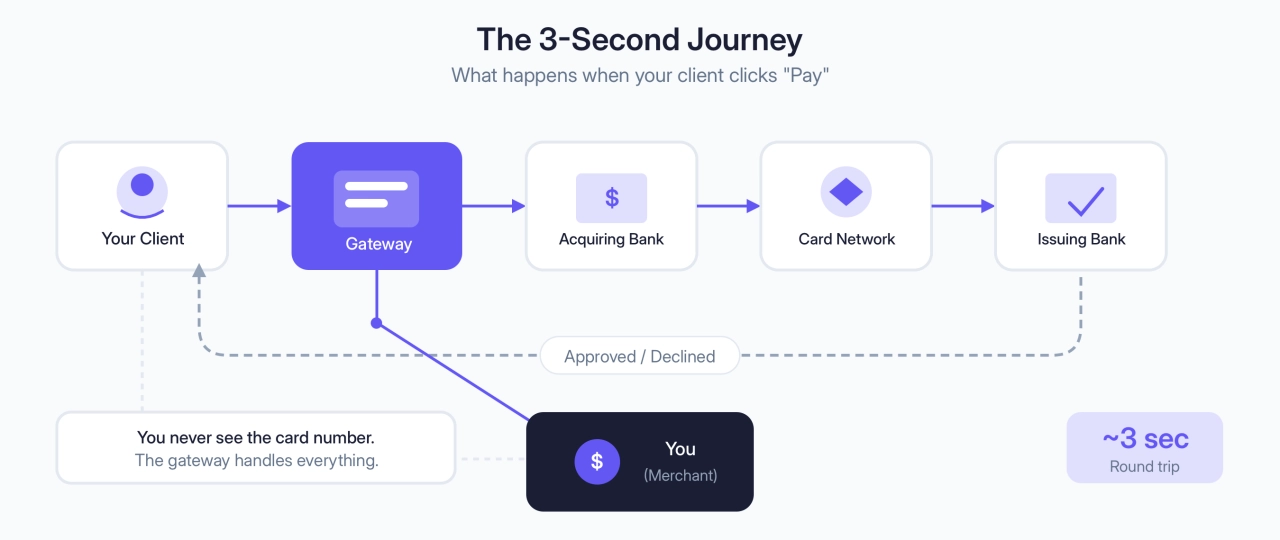

How payment gateways work

You don’t need to understand every technical detail here. But knowing the basics helps when something goes wrong or when you’re comparing providers.

When a client pays you online, there are actually six parties involved in that single transaction:

you (the merchant)

your client (the one paying)

the payment gateway (Stripe, PayPal, etc.)

the acquiring bank (the gateway’s banking partner)

the issuing bank (your client’s bank)

the card network (Visa, Mastercard, etc.)

Here’s what happens in about 3 seconds: Your client enters their card details. The gateway encrypts that info and sends it to the acquiring bank, which pings the card network, which checks with the issuing bank. The issuing bank says yes or no, and that answer travels all the way back to your checkout page.

You never see the card number. You never store it. The gateway handles all of that.

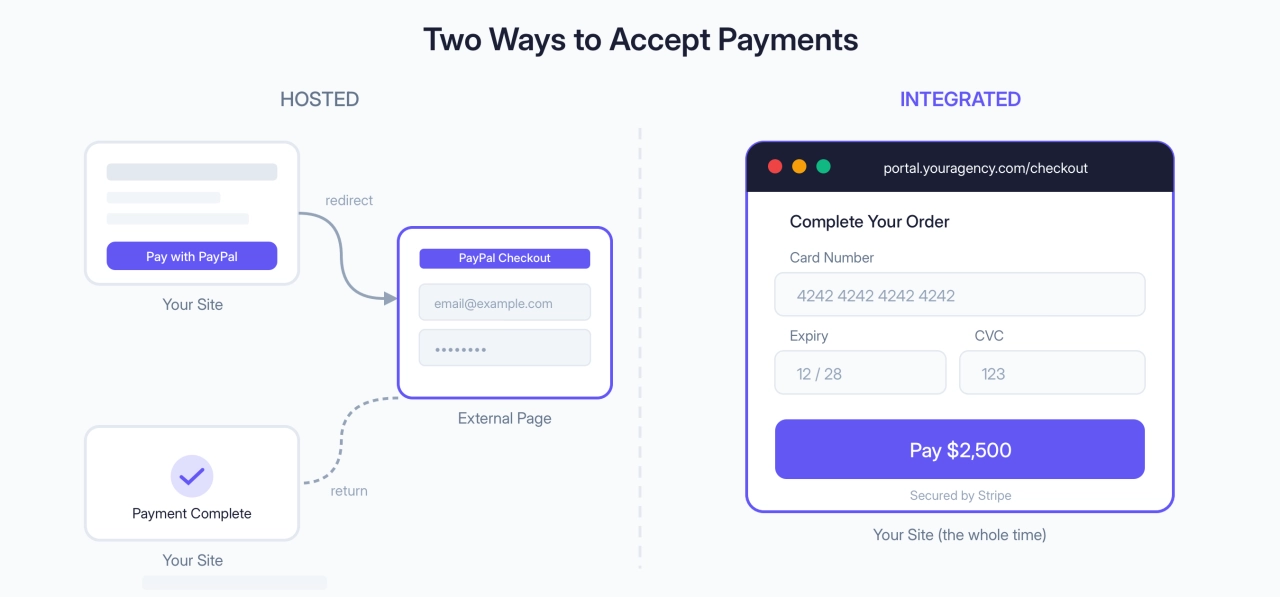

Hosted vs. integrated gateways

There are two main approaches here, and which one you choose depends on how much control you want.

Hosted gateways redirect your client to another site to pay. Think of the classic “Pay with PayPal” button that takes you to PayPal’s site. The upside? You don’t have to worry about PCI compliance because you’re never touching card data. The downside? Clients leave your site, which can hurt conversions.

Integrated gateways keep everything on your site. The payment form looks like part of your checkout, even though the gateway is still handling the sensitive stuff behind the scenes. Better experience for clients, but slightly more setup work.

An integrated approach through client portal software gives you the best of both worlds.

Choosing the right gateway for your agency

The gateway you pick depends on where your clients are, how you bill them, and what volume you’re doing. There’s no single best option, but there is a best option for your situation.

The questions that actually matter

Before you compare fee tables, answer these four questions. They'll narrow your options faster than any feature comparison.

Where are your clients? If you’re billing internationally, you need multi-currency support. Stripe handles 135+ currencies. Braintree (owned by PayPal) is strong here too.

What currency should you bill in? Oliver Meakings switched his landing page roasting service from British Pounds to US Dollars and saw his conversion rate jump. His take: “U.S. customers convert better.” If you’re unsure: bill in your home currency when most clients are local, bill in USD if targeting the US market, or let clients pay in their currency while you settle in yours (Stripe handles the conversion for about 1–2% on top of transaction fees).

How do you bill? One-time projects, recurring retainers, or both? According to the 2025 Digital Agency Industry Report, 88% of agencies offer both project work and retainers. This means you probably need a gateway that handles one-time payments and recurring billing equally well. Stripe is stronger on subscriptions. PayPal is simpler for one-off payments.

What volume are you doing? Under $100k/year, standard rates are fine. At $100k+/month, Stripe offers custom pricing. High-volume agencies ($500k+ annually) might benefit from enterprise options like Adyen or Worldpay with negotiable rates.

Comparing the main gateway options

Once you know your requirements, here’s how the major gateways stack up.

Gateway | Transaction Fee | Best For | Watch Out For |

|---|---|---|---|

Stripe | 2.9% + $0.30 | Recurring billing, 135+ currencies | Limited phone support |

PayPal | 2.9% + $0.30 + fees | Client recognition, quick setup | 21-day holds on new accounts |

Braintree | 2.9% + $0.30 | PayPal + cards unified, international | More complex setup |

Authorize.net | 2.4% - 3.5% + $25/mo | Legacy system integration | Dated interface, monthly fees |

Adyen | 1.4% - 3.4% | High-volume ($500k+) | Requires technical resources |

A warning about PayPal: New accounts often face 21-day holds on incoming payments. PayPal holds funds until you build transaction history. This can mean weeks without access to money you’ve already earned. It eases over time, but factor this into your cash flow planning for the first few months.

If you’re looking for more gateways such as Worldpay, Verifone, and others, check out our full list of payment gateways for agencies.

Why not both?

Here’s the practical reality: connect Stripe and PayPal, then let clients choose.

Stripe for clients who want to pay by card. PayPal for the ones who feel safer with a name they recognize. The flexibility matters more than optimizing for the absolute lowest fee.

On a $2,000 retainer, the difference between Stripe and PayPal is about $12. Over a year with 20 clients, that’s roughly $2,800. Worth considering, but probably not the deciding factor. Pick based on what your clients prefer and what integrates cleanly with your workflow.

That said, don’t overdo it. Lori Appleman from Redline Minds saw a client offering 8 different wallet options thinking more choice was better.

Their conversion rate was suffering. We cut it down to just PayPal, Apple Pay, and standard credit card processing—conversion jumped 15%.

Lori Appleman,

Redline Minds

Lori Appleman,

Redline Minds

Stripe plus PayPal covers most clients. Adding more options creates decision fatigue.

How to integrate a payment gateway

There are a few different ways to get set up, ranging from “click a few buttons” to “hire a developer.” Let’s walk through each one.

Client portal software

If you’re running a service business and want to be accepting payments today, this is the fastest path.

With SPP.co, you connect your Stripe or PayPal account in the integrations settings, create an order form, and link it to a button on your pricing page. That’s it. No code, no plugins to maintain, no security configurations to mess with.

For agencies with appointment-based bookings, you can connect scheduling and payments so clients book and pay in one step.

The nice thing about this approach is that your order form can include everything you need: client name, email, service selection, custom fields, payment. When someone pays, you get notified and the order shows up in your dashboard ready to fulfill.

Adam Steele from Loganix put it well: “I realized the power of processes and systems when I started getting PayPal payment notifications and there was nothing more for me to do.” His agency does nearly $3M a year now. Before switching to our billing software, they’d spent over $80k building custom payment dashboards that did less.

WordPress options

Running your site on WordPress? You have options, but let’s be direct about tradeoffs.

WooCommerce is built for ecommerce, so products, inventory, shipping. You can make it work for services, but you’ll fight the tool.

Gravity Forms with Stripe is more flexible for custom order forms. Better for services, though you’re managing plugins, updates, and potential conflicts.

The main issue with any WordPress payment setup: maintenance. Plugins need updates, they can conflict with themes, and you’re trusting third-party developers for security.

If you just need simple payments on an existing WordPress site, Gravity Forms works. But many service agencies find dedicated client portal software easier. It handles payments, order forms, and client communication without plugin headaches.

Direct gateway integrations

Both Stripe and PayPal offer ways to accept payments without any third-party tools.

Stripe Checkout lets you create payment links and hosted checkout pages. You set up a product in your Stripe dashboard, get a link, and add it to a button on your site. Simple, but limited. Works fine for fixed-price services, not so great if you need custom quantities or upsells.

PayPal buttons work similarly. Generate a button in PayPal, embed the code on your page, done. Same limitations though. Fine for simple stuff, clunky for anything more complex.

If you need flexibility beyond basic payment links, you’re looking at custom API work, which brings us to…

Custom development

Sometimes none of the off-the-shelf options fit. Maybe you have a complex pricing model, or you need to integrate with systems that don’t have standard plugins.

Custom development makes sense when:

you have very specific payment flows that off-the-shelf tools can’t handle

you need to connect to legacy systems

But be realistic about the costs. Beyond the initial build, you’re looking at:

PCI compliance audits ($5,000 to $50,000 per year)

ongoing security updates

developer time for maintenance and fixes

You’re now going to tell me: “But Chris, I can just vibe-code it.” Sure, good luck not leaking sensitive data.

For the vast majority of agencies, neither custom development nor vibe-coding is worth it. Loganix learned that lesson the expensive way before switching to SPP. Unless you have very specific requirements and the budget to match, start with an existing solution and only go custom if you truly have to.

What it actually costs

Let’s talk real numbers. Payment gateways take a cut of every transaction, and those fees vary more than you’d expect.

Transaction fees

The big two charge per transaction with no monthly minimums:

Gateway | Online Card Payment | Notes |

|---|---|---|

Stripe | 2.9% + $0.30 | Custom rates available at $100k+/month |

PayPal | 3.49% + $0.49 | Standard checkout rate |

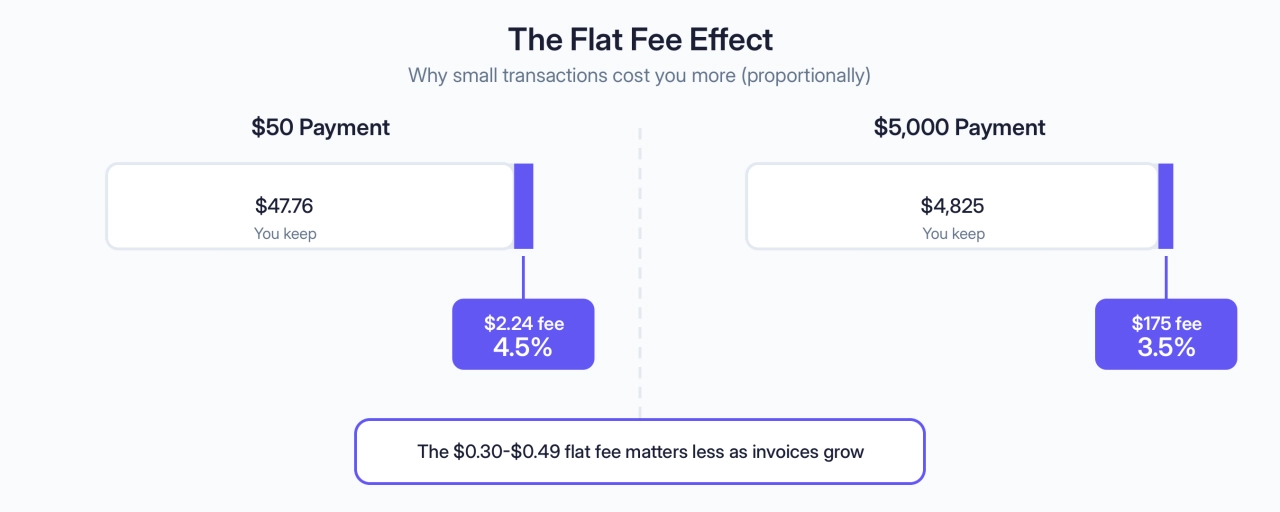

On smaller transactions, that flat fee hurts more. A $50 payment through PayPal costs you $2.24 (4.5%). A $5,000 retainer costs you $175 (3.5%). Keep this in mind when pricing your services.

For larger invoices, consider ACH bank transfers. Stripe charges just 0.8% capped at $5 per transaction. On a $5,000 retainer, that’s $5 instead of $175. The tradeoff: transfers take 3-5 business days to clear, and some clients find bank transfers less convenient than cards. But for big-ticket recurring work, the savings add up fast.

Hidden costs to watch for

The percentage fees are just the start. Depending on your setup, you might also run into:

Currency conversion: If you’re billing in USD but your client pays in Euros, someone’s paying a conversion fee. Usually 1–2% on top of the transaction fee.

Premium features: Stripe Billing (for subscription management) adds 0.5–0.8% on top of standard fees. Worth it for some agencies, overkill for others.

Chargeback fees: Stripe charges $15 per dispute, win or lose. PayPal is similar. One angry client who files a dispute costs you the fee plus the hassle of proving you delivered the work.

Chargebacks usually come from miscommunication: clients don’t recognize your business name on their statement, forget the service happened, or feel surprised by the amount. Prevention is straightforward: match your billing name to your brand, invoice immediately while work is fresh, and handle refund requests quickly. A $500 refund beats a chargeback plus fees plus hassle.

The ROI math

Here’s where it gets interesting. Yes, you’re paying 3% on every transaction. But what are you saving?

Ardent Partners research found that manual invoice processing costs around $9.40 per invoice when you factor in time spent creating, sending, tracking, and reconciling. Automated payments through a gateway drop that close to zero.

Let’s say you process 50 invoices a month. At $9.40 each, that’s $470 in processing costs, mostly your time. Even if you’re paying $500 in gateway fees on $15k of monthly revenue, you’re coming out ahead because you can spend those hours on billable work instead.

Garrett Smith from GMB Gorilla built his entire business model around this math. His services are priced low enough that they only work with automated payments. The result? 95% of clients who try his trial service convert to recurring subscriptions. That kind of conversion rate only happens when the payment experience is frictionless.

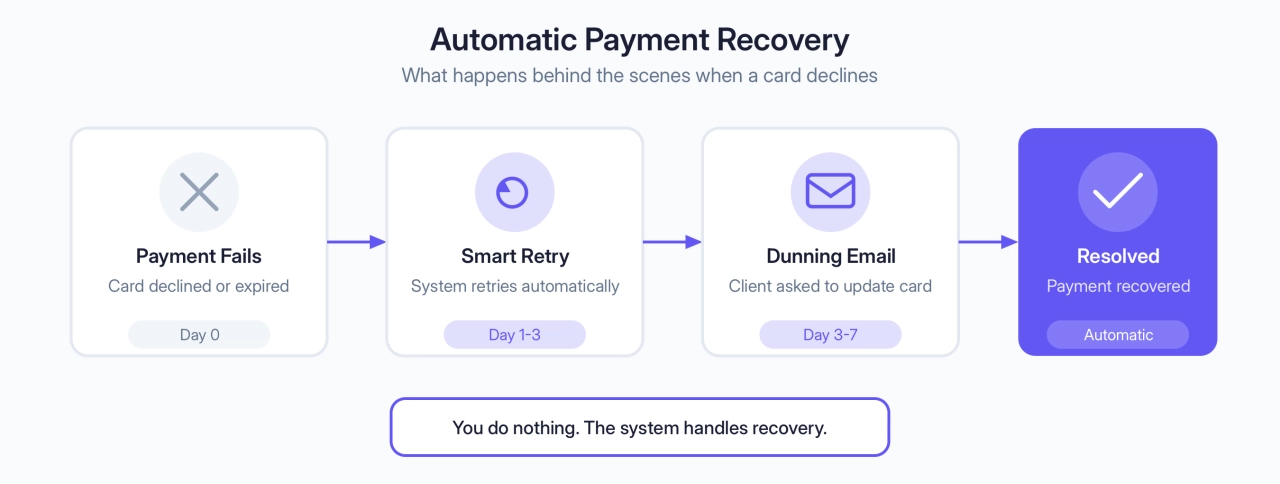

When payments fail

Failed payments are inevitable. Cards expire. Banks flag unusual charges. Clients forget to update billing info or simply won’t pay for other reasons.

According to Recurly’s research, involuntary churn from failed payments accounts for 20–40% of all subscription cancellations. That’s revenue walking out the door through nobody’s fault.

Here’s what good payment infrastructure handles automatically:

Retry logic: When a payment fails, the system waits a day or two and tries again. Often works. Stripe does this with smart retries.

Dunning emails: Automated reminders that payment failed and card needs updating. “Hey, your card on file declined because of {reason}. Here’s a link to update it.” No awkward conversations.

Grace periods: Clients get a few days to fix issues before access cuts off. Prevents losing people over a simple expired card.

SPP.co handles all of this with Stripe. Failed payment? Client gets an email. Card updated? Subscription continues. You don’t have to chase anyone.

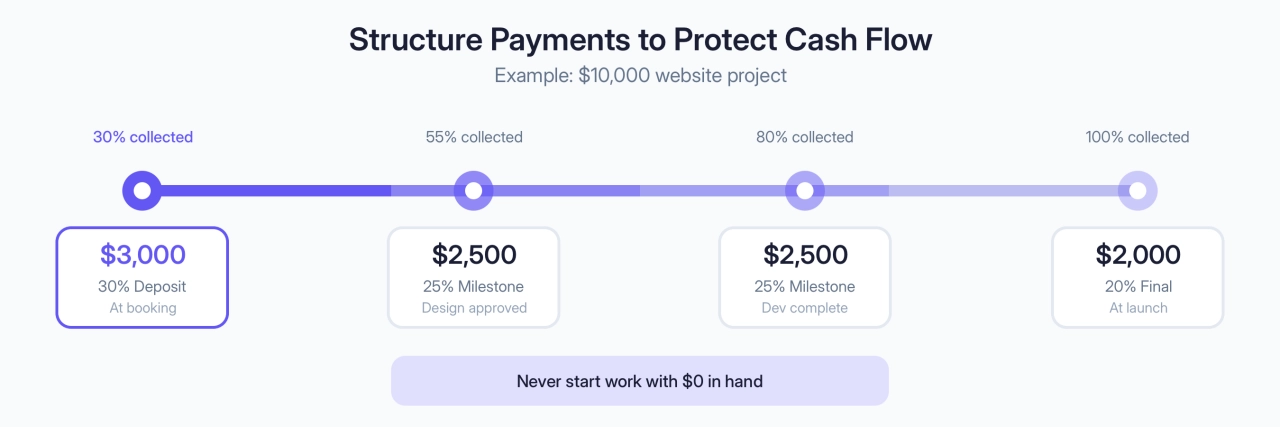

Collecting deposits & milestone payments

Too many agencies learn the hard way that billing after completion kills cash flow.

Michael J. Spitz, a CPA who’s worked with hundreds of service businesses, sees this pattern constantly:

A tech client of mine nearly ran out of cash because they were billing everything on completion, sometimes 90+ days after starting work. We restructured to 30% deposits and milestone billing, and their bank balance went from scary-low to comfortable within one quarter.

Michael J. Spitz,

SPITZ CPA

Michael J. Spitz,

SPITZ CPA

If you’re still figuring out your invoicing process, keep it simple before setting up deposits.

The standard approach that works:

Deposit at booking: 25–50% upfront before you start any work

Milestone payments: Break larger projects into phases, bill at each checkpoint

Final payment on delivery: Remaining balance due when the work is complete

SPP.co makes this easy because you can create an invoice with a partial payment due now, with the remaining balance due at a later date you specify.

Security & compliance

Nobody wants to think about this stuff. But if you’re accepting credit cards online, there are rules you have to follow. The good news? Payment gateways handle most of the hard parts for you.

PCI compliance without the headache

PCI DSS is the security standard that governs how businesses handle card data. If you’re storing credit card numbers on your own servers, you’re on the hook for annual audits, penetration testing, and a lot of documentation. That can cost anywhere from $5,000 to $50,000 a year depending on your transaction volume.

If you’re using Stripe or PayPal properly, you never actually touch the card data. It goes straight from your client’s browser to the gateway’s servers. You just get a confirmation that the payment went through.

This is why hosted and integrated gateways are so popular. Stripe is a PCI Level 1 service provider, which is the highest certification level. When you use their checkout or payment forms, their compliance covers you.

Security features that matter

When comparing gateways, look for these:

Encryption: Card data should be encrypted the moment it’s entered. Both Stripe and PayPal do this automatically.

Tokenization: Instead of storing actual card numbers, gateways store tokens that are useless to hackers. If someone breaks into your system, they get meaningless strings of characters.

3D Secure: That extra verification step where clients confirm the purchase through their bank’s app. Required in Europe, optional elsewhere. Annoying for clients, but it cuts fraud significantly.

Fraud detection: Both major gateways analyze transactions for suspicious patterns. Things like mismatched billing addresses, unusual purchase amounts, or cards that have been flagged before.

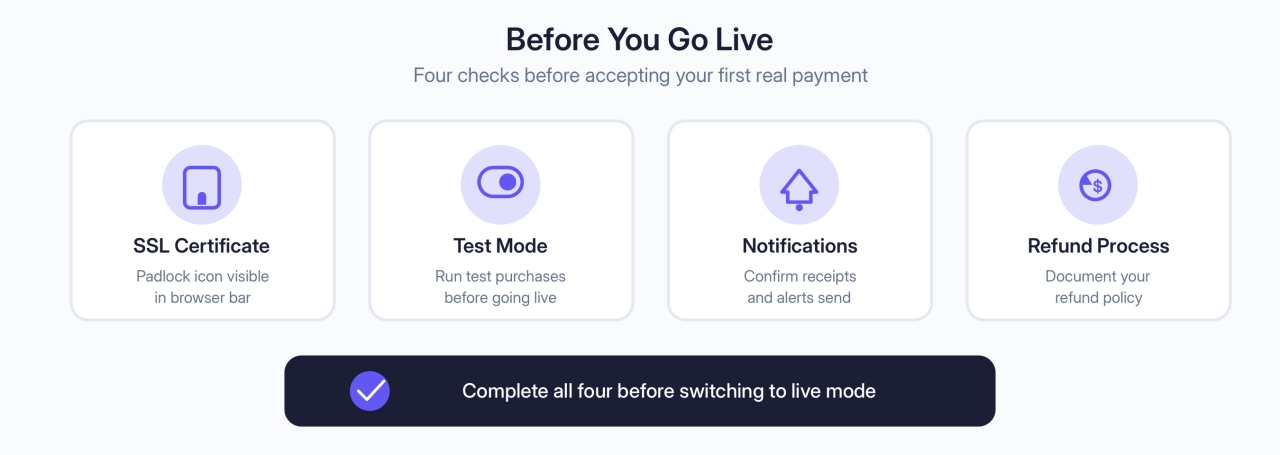

Before you go live

Before accepting your first real payment, run through this checklist:

SSL certificate installed: Your site should show the padlock icon. No exceptions. If you’re not sure whether your hosting qualifies as a secure server, check with your provider before going live.

Test mode completed: Both Stripe and PayPal have sandbox modes. Make test purchases, check that receipts send properly, confirm the money shows up where it should.

Notifications working: When someone pays, your system needs to know. Test that order confirmations and receipts actually send.

Refund process documented: What happens when a client wants their money back? Figure this out before it happens.

SPP.co has a built-in test mode that makes this easy. Enable it in Settings → Company, run through a few fake purchases, then switch to live mode when you’re confident everything works.

Frequently asked questions

How do I add a payment gateway to my website?

Connect your Stripe or PayPal account to client portal software like SPP.co, create an order form, and link it to a button on your pricing page. You can be accepting payments by the end of the afternoon.

Is it hard to integrate a payment gateway?

Not with modern tools. Stripe and PayPal both offer hosted checkout pages that work out of the box. Tools like SPP.co handle the integration entirely. You only need a developer for custom payment flows or legacy system integrations.

Which payment gateway is best for agencies?

Stripe for better recurring billing tools. PayPal for broader name recognition with hesitant clients. Many agencies connect both and let clients choose.

What fees should I expect?

Stripe charges 2.9% + $0.30 per transaction. PayPal charges 3.49% + $0.49. No monthly fees for basic accounts on either platform.

Does WordPress process payments?

No. WordPress is just a content management system. You need a payment gateway like Stripe or PayPal, plus a plugin or external tool to connect them to your site.

Do I need to be PCI compliant?

If you use Stripe or PayPal properly, their compliance covers you. You never touch the card data directly, so you don’t need your own certification.

What happens if a client’s card declines on a recurring payment?

Most gateways retry automatically over the next few days. If retries fail, the client gets a dunning email asking them to update their payment method. SPP.co and Stripe handle this without you lifting a finger.

Can I collect deposits or partial payments?

Yes, and you should. SPP.co lets you collect actual deposits that can be used as balance later, but also invoices with a partial payment.

What if I want to switch gateways later?

You can switch, but card details don’t transfer between gateways. Clients need to re-enter payment info. For subscriptions, turn off auto-renewal on the old gateway and migrate clients as they come up for renewal. Plan for 2–3 months of overlap.

Can clients save their card for future purchases?

Yes. Both Stripe and PayPal support saved payment methods. Client pays once, saves their card, future purchases are one-click. SPP.co stores these securely on Stripe’s end.

Get paid without the hassle

Setting up a payment gateway takes an afternoon. The time you save not chasing invoices pays that back within a week.

Start with Stripe or PayPal. Connect them to whatever system you’re using, whether that’s SPP.co, WordPress, or a simple payment link. Test it. Go live. Then move on to work that actually grows your agency.

If you want the simplest path, SPP.co integrates with both Stripe and PayPal and handles order forms, receipts, and recurring billing in one place. Agencies like Loganix have processed millions through it without building any custom dashboards.

You’ve got better things to do than manually send invoices. Set this up once and stop thinking about it.