- Structure tiers around real value gaps—volume, speed, access, depth—not arbitrary markups.

- Price with 1.5×–2.5× spacing between tiers so clients see meaningful choices, not noise.

- Build boundaries into tier descriptions upfront to prevent scope creep conversations later.

How many times have you quoted a project, won the client, and then realized three months in that you’re basically working for free? Custom scoping every deal is exhausting—and it’s killing your margins.

Tiered pricing fixes this. Instead of reinventing your pricing for every prospect, you package your services into clear options that clients can choose from. Three tiers. Defined deliverables. Predictable revenue.

But knowing why tiered pricing works isn’t the hard part. The hard part is figuring out what goes in each tier, how to price them so clients don’t all pile into the cheapest option, and what to say when someone on your Standard plan starts asking for Premium-level work.

That’s what this guide covers. I’ll walk you through how to structure tiers that actually make sense for your agency, the math behind tier spacing, and the conversations you’ll need to have—with prospects who push back on price, with existing clients you’re transitioning, and with scope creepers who want more than they’re paying for.

Understanding this topic involves several interconnected concepts:

- Service Tier

- Scope Creep

- Value-Based Pricing

- Retainer Model

- Productized Service

- Delivery Margin

- Service Bundling

- Monthly Recurring Revenue (MRR)

Each of these concepts plays a crucial role in the overall topic.

What is tiered pricing?

Tiered pricing for agencies means offering services at multiple price points, with each tier including a different set of deliverables, turnaround times, and support levels. Clients pick the option that fits their needs and budget. You stop custom-quoting every project.

If you’ve ever bought software, you’ve seen this model. Basic, Pro, Enterprise—each level adds features and costs more. The same structure works for agencies, except you’re packaging services instead of features.

Here’s a simple example for a design agency offering monthly retainers:

Starter | Growth | Scale | |

|---|---|---|---|

Design requests | 10/month | 20/month | Unlimited |

Requests at a time | 1 | 2 | 3 |

Turnaround | 48 hours | 24 hours | Same day |

Dedicated account manager | — | — | ✓ |

Monthly pricing | $2,500 | $4,500 | $8,000 |

The middle tier—Growth in this case—should be your best value offer. That’s where most clients land, and that’s by design. We’ll get into the psychology of why this works later.

This pricing model pairs naturally with productized services. When you’ve standardized what you deliver, packaging it into tiers is straightforward. When every project is custom, tiered pricing becomes harder to implement—but not impossible.

Why tiered pricing works for agencies

You’ve probably heard the generic benefits—flexibility, upselling, customer loyalty. All true, but abstract. Let me make it concrete with what actually changes when agencies adopt this model.

You capture more of the market: A single price point means you’re either too expensive for smaller clients or leaving money on the table with larger ones. Tiers let a startup sign up for your basic package while an enterprise client pays for the premium experience. Same agency, different entry points.

Sales conversations get simpler: Instead of building custom proposals for every prospect, you’re walking them through options. “Based on what you’ve described, Growth would cover your needs. Scale adds same-day turnaround if that matters for your launches.” The conversation shifts from negotiating scope to selecting a package.

Upsells happen naturally: When a client on your Starter tier consistently bumps against limits—requesting faster turnaround, asking for more revisions—the upgrade conversation writes itself. You’re not pushing; you’re pointing to the tier that fits their actual usage.

Margins become predictable: Custom projects hide profit margin problems until you’re three weeks in and underwater. With tiers, you know exactly what you’re delivering and what it costs you. If Tier 2 isn’t profitable, you fix the packaging or pricing. No more project-by-project surprises.

The numbers back this up. Ronald Osborne, a business coach who works with agencies, helped a boutique marketing agency restructure from flat-rate to three tiers. The result: 45% revenue increase within six months.

With that said, these results don’t happen automatically. The agencies that win with tiered pricing get three things right: tier structure, pricing math, and the conversations around scope. Let’s start with structure.

How to structure your tiers

This is where most agencies get stuck. You know you want three tiers, but what actually goes in each one? How do you bundle services so clients see clear value differences without cannibalizing your premium tier or making your basic tier useless?

Sort your services into three buckets

Start by listing everything you deliver—not your service categories, but the actual deliverables. For a marketing agency, that might be: blog posts, social media management, email campaigns, SEO audits, paid ad management, strategy calls, reporting, and so on.

Now sort them:

Everyone needs this: The core deliverable clients hire you for. For an SEO agency, that’s keyword research and on-page optimization. For a design agency, it’s the design work itself. This goes in every tier.

Most clients need this: Valuable additions that improve results but aren’t essential. Analytics reporting, monthly strategy calls, competitor monitoring. These differentiate your middle tier.

Few clients need this: High-touch services that matter for larger accounts. Dedicated account managers, same-day turnaround, custom integrations, quarterly business reviews. Premium tier only.

The goal is creating real gaps between tiers. If your Basic and Standard tiers look almost identical, clients will always choose Basic. If your Premium tier doesn’t offer something genuinely valuable, no one will pay for it.

Decide what changes between tiers

You have more levers than just “more deliverables.” Consider varying:

Volume: 5 blog posts vs. 10 vs. 20 per month

Speed: 72-hour turnaround vs. 48 vs. 24

Access: Email support vs. Slack channel vs. dedicated account manager

Depth: Basic reporting vs. custom dashboards vs. strategic recommendations

Scope: Single channel vs. multi-channel vs. full-funnel

The price difference between tiers should reflect meaningful additions, not arbitrary markups. Clients will pay 2x for genuine value. They won’t pay 2x for a slightly longer report.

Name your tiers intentionally

Tier names signal more than you think. Compare these:

Generic | Value-focused | Client-stage |

|---|---|---|

Basic | Starter | Launch |

Standard | Growth | Scale |

Premium | Enterprise | Dominate |

Generic names (Basic/Standard/Premium) are clear but uninspired. Value-focused names (Starter/Growth/Enterprise) hint at outcomes. Client-stage names connect to where the buyer sees themselves.

Avoid names that make lower tiers sound inadequate. “Basic” can feel like “not good enough.” “Starter” or “Essentials” positions the same tier as a smart starting point.

Casey Meraz, CEO at Juris Digital, recommends keeping it simple: “Three distinct pricing packages—basic, standard, and premium. The key is defining clear deliverables and outcomes for each tier, ensuring clients understand what their investment brings.”

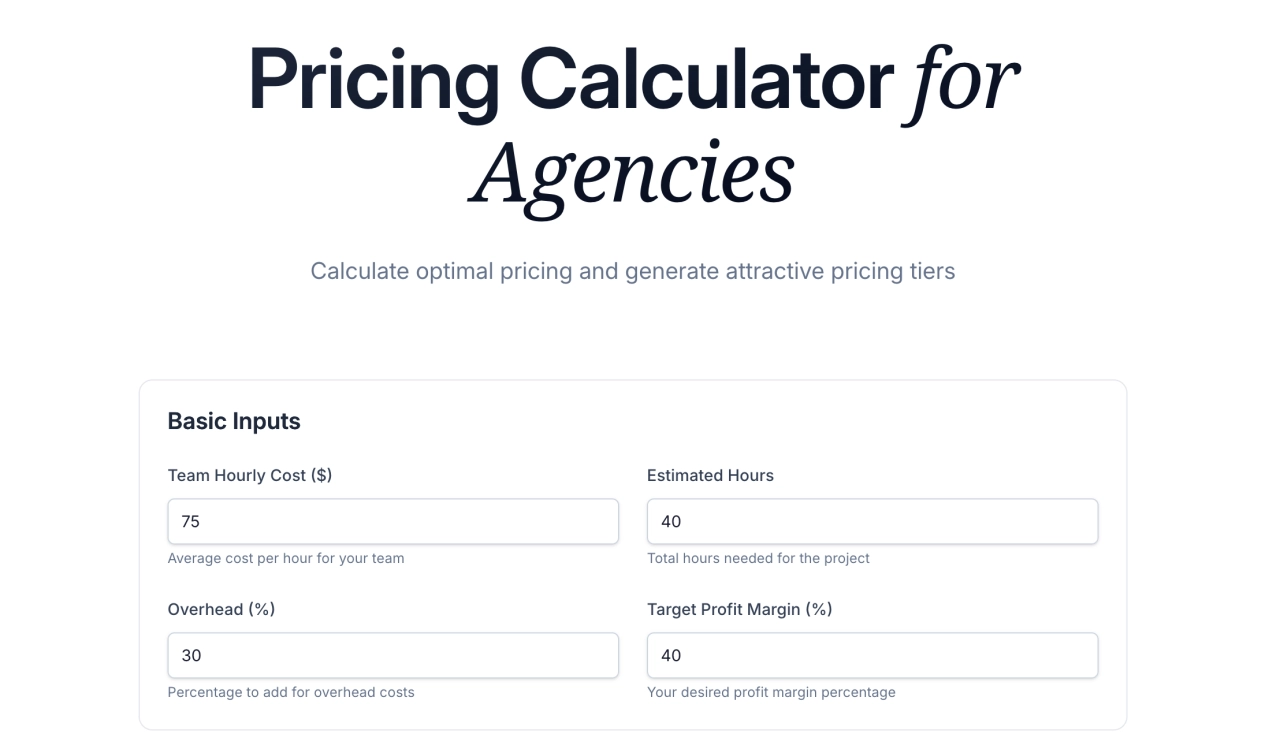

If you’re starting from scratch, the agency pricing calculator can generate a baseline three-tier structure based on your services.

Calculate optimal pricing for your agency

Use it as a starting point, then customize based on what you’ve learned about your clients.

Real agency tier examples

Seeing how other agencies structure their tiers can shortcut a lot of trial and error. Here are three models from different agency types:

Design retainer (DGecko Design):

Starter | Slick | Boss | |

|---|---|---|---|

Hours reserved | 8/month | 30/month | Unlimited |

Turnaround | 5-7 business days | 2-3 business days | Priority queue |

Rollover | 1 hour | 3 hours | N/A |

Monthly price | $300 | $900 | $4,900 |

Notice the levers: hours, speed, and rollover all change between tiers. The jump from Starter to Slick is 3x the price for nearly 4x the hours plus faster turnaround—clear value gap. Boss is a different category entirely: unlimited requests for clients who need always-on creative support.

Marketing agency (Kiwi Creative):

Ignite | Accelerate | Rocket | |

|---|---|---|---|

Points included | 60 | 120 | 200+ |

Best for | High-impact priorities | Multi-channel execution | Aggressive growth |

Monthly price | $4,500 | $9,000 | $15,000+ |

Kiwi uses a points system instead of hours—one point equals $75, and different deliverables cost different point amounts. This decouples pricing from time spent, which protects margins on work you’ve gotten efficient at delivering.

SEO agency (typical structure):

Foundation | Growth | Enterprise | |

|---|---|---|---|

Keywords tracked | 50 | 150 | 500+ |

Content pieces | 2/month | 4/month | 8+/month |

Link building | Basic | Active outreach | Custom campaigns |

Reporting | Monthly | Bi-weekly | Weekly + strategy calls |

Monthly price | $1,500-2,500 | $3,000-5,000 | $7,500-15,000 |

SEO tiers typically vary by keyword volume, content velocity, and reporting frequency. The enterprise tier often includes dedicated strategist time and custom integrations—services that genuinely cost more to deliver.

What these examples share: each tier jump offers something meaningfully different, not just “more of the same.” Study agencies in your space, but don’t copy their exact structure—what works for a design studio won’t necessarily fit a PPC agency. Use these as starting points for your own tier design.

How to price your tiers

Structure determines what’s in each tier. Pricing determines whether clients choose the right one—and whether you make money.

The spacing rule

Tiers priced too close together don’t create real choices. If your tiers are $997, $1,097, and $1,197, the price difference is noise. Clients will overthink small gaps or just pick the cheapest option.

A good rule: each tier should cost 1.5× to 2.5× the previous tier. This creates meaningful separation while keeping each option within reach.

Tier | Conservative (1.5×) | Moderate (2×) | Aggressive (2.5×) |

|---|---|---|---|

Starter | $2,000 | $2,000 | $2,000 |

Growth | $3,000 | $4,000 | $5,000 |

Scale | $4,500 | $8,000 | $12,500 |

The right multiplier depends on how much value each tier adds. If your Growth tier includes significantly more than Starter, 2× is justified. If it’s mostly the same with minor additions, even 1.5× might feel steep.

Three ways to calculate tier prices

Once you’ve settled on spacing, you need actual numbers. Here are three approaches depending on what data you have.

Method 1: Work backwards from profit margin

Decide what margin you need, then calculate pricing from your delivery costs.

Here’s the formula: Price = Cost ÷ (1 - Target Margin)

If delivering your Growth tier costs you $2,500 in labor and overhead, and you want a 40% margin:

$2,500 ÷ (1 - 0.40) = $2,500 ÷ 0.60 = $4,167

Round to $4,200 or $4,500 depending on your market positioning.

Method 2: Anchor to average order value

Look at what your clients currently spend. If your average project runs $5,000, that’s likely your middle tier. Build up and down from there.

This method works well when you have existing revenue data. If most clients cluster around a certain spend level, that’s market validation for your anchor price.

Method 3: Competitive analysis

Research what comparable agencies charge. Not to match their prices—but to understand the market range. If SEO agencies in your niche charge $3,000-$8,000 monthly, pricing your Growth tier at $15,000 requires serious differentiation.

Check competitor pricing pages, ask in agency communities, or simply talk to prospects about what they’ve seen elsewhere.

When to blend tiered and value-based pricing

Tiered pricing works best for standardized, repeatable services. But some clients—particularly larger accounts—need custom scopes that don’t fit neatly into tiers.

The solution isn’t choosing one model over the other. It’s knowing when to apply each.

Harmanjit Singh at Origin Web Studios explains the shift: “Our average project value increased by 65% because conversations shifted from ‘how much time will this take?’ to ‘what results can we expect?’”

A practical hybrid approach:

Engagement Type | Pricing Model | Example |

|---|---|---|

Monthly retainers, standard deliverables | Tiered | Content packages, design retainers |

Large strategic projects with clear ROI | E-commerce redesign, brand overhaul | |

Complex enterprise needs | Custom / “Contact us” | Multi-department, custom integrations |

Justin Herring at YEAH! Local runs this exact hybrid:

I charge smaller clients project-based fees starting at $2,500, while offering custom packages for larger brands based on their potential ROI.

Justin Herring,

YEAH! Local

Justin Herring,

YEAH! Local

Tiered pricing attracts volume. Value-based flexibility captures upside.

Why clients pick the middle tier

You’ve probably noticed that most clients land on your middle option. That’s not an accident—it’s behavioral economics at work.

Anchoring sets the reference point

When clients see your pricing, the first number shapes how they evaluate everything else. If you lead with your premium tier at $8,000, the $4,000 middle tier feels reasonable by comparison. Lead with $2,000, and $4,000 feels like a big jump.

This is why the order on your pricing page matters. Many agencies list tiers left-to-right from cheapest to most expensive. But starting with your premium tier—even if it’s on the right—anchors clients to the higher number first.

The decoy effect guides the choice

Three tiers work better than two because the third option makes the decision easier.

With two options, clients weigh trade-offs: cheaper but limited, or expensive but comprehensive? That tension creates friction.

Add a third tier, and something shifts. The middle option becomes obviously better than the basic (more value) while seeming more reasonable than premium (lower cost). It wins both comparisons.

Your premium tier doesn’t need to be your bestseller. Its job is making the middle tier look like the smart choice.

Design for the middle

If most clients will choose Growth (or whatever you call your middle tier), that’s the package to optimize. Make sure:

It delivers your best work: This is what most clients experience, so it’s what most referrals come from.

The margin is healthy: Volume lives here. If your middle tier is thin on profit, you’ve got a structural problem.

It has room to grow: Clients on Growth should eventually hit limits that make Scale attractive.

The psychology gets clients to the middle tier. What you deliver there determines whether they stay, upgrade, or refer others.

Common mistakes that narrow your margins

Tiered pricing looks simple on paper. Three packages, clear deliverables, done. But I’ve seen agencies make the same mistakes repeatedly—mistakes that undermine the whole model.

Too many tiers

Decision paralysis is real. When prospects face five or six options, they stall. The mental effort of comparing that many packages often ends in “I’ll think about it and get back to you.”

Three tiers is the sweet spot; four can work if you have genuinely distinct client segments. Five or more usually means you haven’t figured out your positioning yet.

Romana Kuts at SaaStorm explains how they landed on their structure:

Over time, we realized that trying to fit SaaS companies into just one or two packages simply doesn’t work. Every company’s growth stage, goals, and internal resources are different. That’s why we created 4 clearly defined, flexible tiers—Breeze, Gale, Tempest, and Hurricane—ranging from €4k/month to €10k+.

Romana Kuts,

SaaStorm

Romana Kuts,

SaaStorm

Four works for them because each tier maps to a different growth stage. If your tiers don’t have that kind of clear logic, stick with three.

Fuzzy value gaps

Clients should understand why Tier 2 costs more than Tier 1 without studying a comparison chart. If the difference is “more hours” or “additional support,” that’s too vague.

Make the gaps tangible:

Weak: “Priority support” vs. “Standard support”

Strong: “Dedicated Slack channel with 4-hour response time” vs. “Email support within 24 hours”

Weak: “Advanced reporting”

Strong: “Custom dashboard with weekly performance calls”

Quantify where you can. “5 revisions” means something. “Generous revisions” means whatever the client decides it means—usually more than you intended.

Tiers that don’t match your clients

Your tier structure should reflect how your actual clients buy, not how you wish they bought.

If 80% of your clients need roughly the same scope, you don’t have three segments—you have one segment and some outliers. Forcing a tiered model onto that reality creates packages no one wants.

Before finalizing tiers, look at your last 20 projects:

What did clients actually buy?

Where did they cluster on scope and budget?

What add-ons did they request most often?

If you see natural groupings, tiers make sense. If every project looks different, you might need to productize your services first before tiered pricing will work.

How to sell tiered pricing

Having tiers on your website is one thing. Handling the sales conversation is another. Prospects push back, negotiate, and ask for customizations. Here’s how to handle the common objections without caving on price or losing the deal.

“Can’t you just do X for less?”

The prospect wants part of a tier without paying for the whole thing. Maybe they only need the blog posts from your content package, not the social media management.

The instinct is to say yes and create a custom deal. Resist it.

Custom deals defeat the purpose of tiered pricing. You’re back to scoping every project individually, and you’ve just told this client that your tiers are negotiable.

Instead, redirect to value:

“The content and social components work together—the social distribution is what gets your content seen. Clients who’ve tried content-only usually come back for the full package within a few months. I’d rather start you there and save you the hassle of switching later.”

If they genuinely can’t afford your lowest tier, they might not be your client right now. That’s okay. A bad-fit client on a stripped-down package creates more problems than an empty slot.

“Your competitor charges half that”

Price comparisons are inevitable. Some agencies do charge less—and deliver less.

Don’t get defensive or trash the competitor. Focus on what they’re actually getting.

“I can’t speak to their process, but here’s what’s included in our Growth package: dedicated account manager, 48-hour turnaround, and monthly strategy calls. We’ve found those make the difference between content that sits there and content that actually drives leads. Do you know if they include those?”

This shifts the conversation from price to scope. Often, the cheaper quote is missing things the prospect assumed were included.

“We only need the basic stuff”

Sometimes this is true. A startup with limited budget genuinely belongs in your Starter tier.

But sometimes prospects underestimate their needs. They say “basic” because they don’t understand what they’re giving up.

Ask questions to test the fit:

“What’s your timeline for seeing results? How much bandwidth does your team have to manage this internally? Have you tried handling this in-house before?”

If their answers reveal they need more support than Starter provides, say so: “Based on what you’ve described—the tight timeline and limited internal resources—Starter would probably leave you frustrated. Growth includes the strategy calls and faster turnaround that would actually set you up to hit those goals.”

You’re not upselling. You’re helping them avoid a mistake.

When budget is genuinely the blocker

Some prospects want to work with you but legitimately can’t afford your middle tier. You have options:

Start them on Starter with a clear upgrade path: “Let’s begin here, and we’ll revisit in 90 days once you’ve seen initial results.”

Adjust payment terms: Quarterly prepay at a discount, or monthly billing to ease cash flow.

Reduce scope within the tier: This is different from custom pricing. You’re keeping them in the tier structure but removing a component. “We could do Growth without the paid ad management—that drops it to $3,500.”

What you shouldn’t do: invent a new tier on the spot. That creates a pricing precedent you’ll regret when they refer other clients who expect the same deal.

The scope creep conversation

You’ve sold a client on your Growth tier. Three months in, they’re asking for things that belong in Scale. More revisions. Faster turnaround. Strategic work you didn’t scope.

This is the conversation most agency owners dread—and the one that determines whether tiered pricing actually protects your margins.

Name the boundary clearly

The worst thing you can do is quietly absorb the extra work, resent the client, and let your margin erode. The second worst thing is getting defensive or making the client feel like they’re being nickel-and-dimed.

There’s a middle path: name what’s happening without judgment.

“That’s a great idea. Quick heads up—custom landing pages aren’t included in Growth. I can add them as a one-off project at $X, or if this is becoming a regular need, Scale might be a better fit. Want me to send over what that would look like?”

You’ve acknowledged their request, explained the boundary, and offered two paths forward. No drama. No apology. Just clarity.

Build boundaries into your tier descriptions

Half of scope creep conversations can be avoided by being explicit upfront. Vague tier descriptions create ambiguity that clients fill in with their own assumptions.

Instead of listing what’s included, consider also stating what’s not:

Included in Growth: Up to 8 blog posts/month, 2 rounds of revisions each, keyword research, and monthly analytics report.

Not included: Social media graphics, website updates, rush delivery, or strategy consulting.

This feels awkward to write, but it prevents awkward conversations later. When a Growth client asks for social graphics, you’re pointing to the agreement—not inventing a rule on the spot.

The pause-and-reset protocol

Some clients test boundaries repeatedly. Not maliciously—they’re just pushing because no one’s pushed back.

In practice, that looks like:

Pause the request: “Let me flag this before we proceed.”

Reference the scope: “This falls outside what we scoped for Growth.”

Reset expectations: “We can either add this as a separate project, or we should talk about whether Scale makes more sense going forward.”

The key is doing this early. If you absorb out-of-scope requests for months and then suddenly enforce boundaries, the client feels blindsided. Consistent from day one is easier than corrective later.

When to flex (and when not to)

Not every request outside the tier needs a formal conversation. Small asks from good clients—a quick revision, a minor tweak—build goodwill.

The question is whether it’s occasional or pattern.

Occasional one-off from a respectful client: Handle it quietly. Mention it if it comes up again.

Repeated requests that would belong in a higher tier: Have the conversation. This client needs to upgrade or adjust their expectations.

Requests that signal a mismatch: If a client on Starter constantly needs Enterprise-level strategy, the tier isn’t the problem. They may not be the right fit.

Protecting your tiers isn’t about being rigid. It’s about making sure the structure works for both sides.

Transitioning existing clients to tiers

New clients are easy—they see your tiers and pick one. Existing clients are harder. They’re on custom deals, legacy pricing, or handshake agreements that made sense two years ago but don’t anymore.

Moving them to a tiered structure without triggering an exodus takes planning.

Decide who gets grandfathered

Not every client needs to transition immediately. Consider grandfathering:

Long-term clients with tight margins: If they’ve been with you for years at a rate that no longer works, forcing an immediate change might end the relationship. A slower transition preserves it.

High-referral clients: Some clients are worth less on paper but send you consistent business. Factor that in before disrupting their arrangement.

Clients already aligned with a tier: If their current scope and rate roughly match your new Growth tier, just relabel it. No conversation needed.

Who shouldn’t be grandfathered: clients whose custom deals are actively costing you money, or clients who use the legacy arrangement to justify constant scope expansion.

Give adequate notice

Surprising clients with new pricing destroys trust. The transition needs runway.

A reasonable timeline:

3 months minimum: Enough time for clients to budget and evaluate.

6 months for major changes: If someone’s rate is jumping significantly, they need time to adjust—or decide to leave.

Align with contract renewals: The natural moment to introduce new pricing is when the existing agreement ends.

Niclas Schlopsna, Managing Partner at spectup, emphasizes timing:

I always approach legacy clients early, ideally before the year fully ramps up, so it doesn’t feel reactive or forced.

Niclas Schlopsna,

spectup

Niclas Schlopsna,

spectup

Frame it as evolution, not extraction

The message matters as much as the timeline. Clients who feel like they’re being squeezed will leave. Clients who feel included in your growth will stay.

What works:

“Over the past year, we’ve refined how we deliver [service] and added [new capability]. We’re moving all clients to a tiered structure that better reflects the value and support included. Based on your needs, [Tier] would be the best fit—here’s what’s in it and how it compares to what you’re getting now.”

What doesn’t work:

“We’re raising prices. Here are your new options.”

The difference is context. Explain what’s changed, why the new structure exists, and what they gain from it.

Offer a reason to switch voluntarily

Grandfathered clients might stay on legacy pricing forever if there’s no incentive to move.

Consider:

Early adopter pricing: “Transition to Growth by March and lock in $X/month for the first year.”

Added value at the new tier: “Growth now includes monthly strategy calls—something we weren’t offering before.”

Streamlined service: “Moving to a tier means faster turnaround and a dedicated account manager.”

Jessica Liew at InCorp Asia found that emphasizing continuity worked well: “Instead of just informing them about the increase, we emphasized how it would enable us to continue delivering high-quality service and support their long-term success.” The result: 85% retention during rate adjustments.

Accept that some clients will leave

Not everyone will make the jump. Some clients signed up for your old rates because that’s all they could afford. Others will use the transition as an excuse to shop around.

This is okay.

Tiered pricing is designed to attract the right clients at sustainable margins. If a client can’t afford your new structure and isn’t willing to adjust scope, they’re no longer your ideal client. Letting them go makes room for clients who fit the model.

Your goal isn’t to reach 100% retention, but to have a healthier client base on pricing that works for both of you.

Measuring tiered pricing success

You’ve launched your tiers. Clients are signing up. But how do you know if the structure is actually working—or quietly bleeding money?

A few metrics tell you most of what you need to know.

Tier distribution

Where are your clients landing?

A healthy distribution looks something like 20% Starter, 60% Growth, 20% Scale. The exact numbers depend on your market, but the middle tier should carry most of the weight.

Red flags:

More than 70% in one tier: Your tiers aren’t differentiated enough, or you’ve mispriced. If everyone picks Starter, your middle tier isn’t compelling. If everyone picks Growth, your premium tier isn’t worth the jump.

Almost no one in Starter: You might not have an entry-level option that matches your market. Or your Starter tier is priced too close to Growth.

Premium tier is empty: Either it’s overpriced, or the value gap between Growth and Scale isn’t clear enough to justify the cost.

Track this monthly. Shifts in distribution often signal market changes before revenue does.

Upgrade rate

What percentage of clients move from a lower tier to a higher one?

Upgrades are the clearest sign that your tiers are working as a ladder. Clients start where they’re comfortable, see results, and want more. A healthy agency sees 10–20% of eligible clients upgrade within their first year.

If no one upgrades:

Your Growth tier might include too much—there’s no reason to move up.

Your Scale tier might not offer enough additional value to justify the price.

You’re not having upgrade conversations when clients bump against limits.

Sahil Kakkar at RankWatch designs for this: “Many customers started with the Starter plan and upgraded as their SEO needs expanded. Design tiers with an eye on customer growth potential and keep upgrade paths seamless.”

Revenue per client

Average revenue per client should increase after implementing tiers—not because you’re charging more for the same work, but because you’re capturing value you were previously leaving on the table.

Track this quarterly. Compare:

Before tiers: What was your average monthly revenue per client?

After tiers: Has it increased? By how much?

If average revenue drops, something’s off. Either clients are clustering in lower tiers than expected, or your tier pricing doesn’t reflect the value you deliver.

Margin by tier

Revenue is vanity. Margin is sanity.

Each tier should be profitable on its own. If your Starter tier runs at 10% margin while Scale runs at 50%, you have a structural problem—you’re subsidizing entry-level clients with premium revenue.

Calculate the true cost to deliver each tier:

Labor: Hours spent per client per month, multiplied by your loaded cost per hour.

Tools: Software and subscriptions allocated to delivery.

Overhead: Account management, reporting, communication.

If any tier is below 30% margin, reconsider the pricing or the scope. Low-margin tiers only make sense as deliberate loss leaders—and even then, only if they reliably convert to higher tiers.

When to revise your tiers

Tiers aren’t permanent. Markets shift, your costs change, and client needs evolve. Review your structure quarterly and look for these signals:

Tier distribution is lopsided: More than 70% in one tier means something’s off.

Upgrade rate flatlines: If no one’s moving up, your ladder is broken.

Margins are compressing: Rising costs without pricing adjustments will catch up with you.

Clients keep asking for the same out-of-scope item: Maybe it belongs in a tier.

Competitors make significant pricing moves: You don’t have to match, but you should know.

When you do revise, make incremental changes. A complete overhaul confuses existing clients and resets all your learnings. Adjust one variable at a time—price, scope, or tier structure—so you know what’s working.

Tiered pricing benchmarks at a glance

Metric | Target | Red flag |

|---|---|---|

Tier distribution | 20% Starter, 60% Growth, 20% Scale | More than 70% in any single tier |

Price spacing | 1.5×–2.5× between tiers | Less than 1.3× (too close) |

Upgrade rate | 10–20% of clients per year | No upgrades after 12 months |

Margin per tier | 30%+ on every tier | Any tier below 25% |

Transition notice | 3–6 months for existing clients | Less than 60 days |

Frequently asked questions

How many pricing tiers should I offer?

Three tiers works for most agencies. Four can work if you serve genuinely distinct client segments. More than four creates decision paralysis and usually signals unclear positioning.

What’s the difference between tiered pricing and value-based pricing?

Tiered pricing offers fixed packages at set price points—clients choose a tier and get defined deliverables. Value-based pricing ties your fee to client outcomes or ROI. Many agencies use tiered pricing for recurring retainer work and value-based pricing for strategic projects where results justify premium fees.

Tiered pricing vs hourly billing: which is better for agencies?

Tiered pricing wins for predictability and margins. Hourly billing punishes efficiency—the faster you get, the less you earn. Tiers let you price based on value delivered, not time spent. Clients also prefer knowing costs upfront rather than watching a meter run. Hourly can still work for undefined discovery phases or overflow work, but it shouldn’t be your core model.

Tiered pricing vs project-based pricing: when to use each?

Use tiered pricing for ongoing retainer relationships with recurring deliverables. Use project-based pricing for one-time engagements with clear start and end dates. Some agencies run both: tiers for monthly clients, project pricing for one-off work. The key difference is commitment length—tiers assume an ongoing relationship, projects don’t.

How do I know if my tiered pricing is working?

Track your tier distribution. Healthy distribution is roughly 20% in your entry tier, 60% in the middle, and 20% in premium. If more than 70% of clients land in any single tier, your pricing or packaging needs adjustment. Also monitor upgrade rates—10–20% of clients should move to a higher tier within their first year.

How do I handle scope creep within tiered packages?

Name the boundary early and clearly. When a client requests something outside their tier, respond with: “That’s not included in your current package—I can add it as a one-off at $X, or we could look at upgrading if this is becoming a regular need.” Build explicit exclusions into your tier descriptions so you’re pointing to the agreement, not inventing rules on the spot.

How do I communicate price increases to existing clients?

Give 3–6 months notice. Frame the change as evolution, not extraction—explain what’s improved, why you’ve restructured, and what they gain. Offer incentives for voluntary transitions and accept that some clients won’t make the jump.

Should I display pricing on my website?

For productized services with clear deliverables, yes. Public pricing builds trust and pre-qualifies leads. For complex or high-ticket services, “Starting at” pricing or a contact form works better—you need a conversation to scope properly.

Can I offer custom pricing alongside tiers?

Yes, but limit it. Add a “Contact us” or “Enterprise” tier for clients who genuinely need custom solutions. This preserves your structure while accommodating outliers. Avoid creating custom deals for clients who could fit an existing tier—that defeats the purpose.

What if everyone picks the cheapest tier?

Your middle tier isn’t compelling enough relative to its price. Either the value gap between your entry and middle tier is too small, or your middle tier is priced too high for what it offers. Revisit what’s included in each tier and make the upgrade obviously worth it—more deliverables, faster turnaround, or better access.

How often should I revise my pricing tiers?

Review quarterly. Revise when you see lopsided tier distribution, flat upgrade rates, compressing margins, or repeated requests for the same out-of-scope item. Make incremental changes—one variable at a time—so you can isolate what’s working.

What if a client wants to downgrade?

Handle it case by case. If a client’s needs genuinely shrunk—they lost a product line, scaled back marketing—a downgrade makes sense. But if they’re downgrading because they’re unhappy or trying to negotiate, that’s a different conversation. Ask what changed. Sometimes a downgrade request reveals a service problem you can fix.

Should I offer monthly or annual tier pricing?

Offer both, with a discount for annual. A typical structure: monthly rate as the default, 10–15% off for annual prepay. Annual commitments give you predictable revenue and reduce churn—clients who pay upfront are more committed. Monthly gives clients flexibility and lowers the barrier to starting.

Make your pricing work for you

You don’t need a perfect tier structure on day one. You need tiers that reflect how clients actually buy, pricing that creates real choices, and the confidence to hold boundaries when someone pushes.

Start with three tiers. Price them far enough apart that the decision is obvious. Be explicit about what’s included—and what’s not. When clients outgrow their tier, have the upgrade conversation instead of absorbing the extra work.

The agencies that get this right stop trading time for money on every deal. They build predictable revenue, healthier margins, and client relationships that aren’t constantly renegotiated.