- Recurring billing works when your services are productized, your costs are understood, and your delivery is systematized.

- Know your true delivery cost before pricing—miss overhead and your so-called profitable retainer bleeds money.

- The goal isn’t a specific recurring/project ratio, but generating enough recurring revenue that losing one client doesn't create a crisis.

You closed a $12,000 project last month. Then nothing for six weeks.

That’s project-based revenue. One quarter you’re turning away work, the next you’re wondering how you’ll make payroll. Every month resets to zero, and you’re only as good as your last sale.

Recurring payments work differently. A $5,000 monthly retainer means $60,000 you can count on before you send a single proposal. You start each month with revenue already locked in.

But recurring billing isn’t universally better. It works beautifully for some agencies and becomes a slow-motion disaster for others. The difference comes down to whether your business is actually built for it.

This guide covers the business model side—when recurring payments make sense, when they backfire, and how to price them without losing money.

Understanding this topic involves several interconnected concepts:

- Monthly Recurring Revenue (MRR)

- Churn Rate

- Delivery Margin

- Dunning Management

- Overhead

- Productized Service

Each of these concepts plays a crucial role in the overall topic.

What recurring billing actually means for agencies

Recurring billing is any payment that happens automatically on a set schedule—monthly, quarterly, or annually. For agencies, this usually takes one of three forms:

Monthly retainers: Clients pay a fixed amount each month for ongoing services like SEO management, paid ads, or content production.

Tiered packages: Clients choose from predefined service levels (Starter, Growth, Scale) with set deliverables and pricing at each tier.

Productized subscriptions: Clients sign up for a specific, repeatable recurring service—link building packages, social media management—with clear scope and pricing.

The common thread: clients pay on a schedule without you sending invoices and chasing payments every time.

This shift from project billing to recurring revenue changes how you think about your business. Projects focus on “what will this deliverable cost?” Retainers focus on “what’s the ongoing value we provide?” That’s a meaningful difference when it comes to pricing, delivery, and client relationships.

When recurring payments work

Recurring billing makes sense when three things are true about your agency.

Your services are productized

Custom everything doesn’t work on retainers. If every client gets a completely different scope, timeline, and deliverable set, you can’t predict costs—which means you can’t price accurately.

As Evripides Gavriel, an automation consultant, shared on the Agency Engine Room podcast:

Your services need to be productized. Like you cannot have super custom packages and use a customer portal because it becomes strange and clunky.

Evripides Gavriel,

FlowFix

Evripides Gavriel,

FlowFix

Productization means defining what’s included (and what isn’t) before the client signs. A “monthly SEO retainer” with no boundaries becomes a nightmare. A “monthly SEO retainer that includes X keyword targets, Y blog posts, and Z hours of technical fixes” gives you something to price against.

Dav Nash, Head of Marketing at Fat Joe, puts it this way:

Just by simply productizing, you’re solving a huge amount of issues because actually then staff get predictable workloads. You start understanding how much things are going to cost internally. You start to understand how much your margin is. Everything becomes more predictable.

Dav Nash,

FatJoe

Dav Nash,

FatJoe

When your team knows what’s expected each month, they can plan their time. When you know your costs, you can price accurately.

Your work compounds over time

Some services get better the longer you do them. SEO builds authority over months. Content libraries grow. Paid ad accounts accumulate data that improves targeting.

These compound-effect services fit recurring billing naturally because clients see increasing value over time—which justifies ongoing payments.

Magee Clegg, CEO at Cleartail Marketing, shared an example:

A family law firm grew website traffic 278% and increased qualified calls over 400% within 2 years. Their retainer increased to $18,000/month as we expanded into paid advertising and content marketing.

Magee Clegg,

Cleartail Marketing

Magee Clegg,

Cleartail Marketing

The client didn’t start at $18,000. They started smaller, saw results compound, and expanded the relationship.

You’ve built systems for delivery

Retainers fall apart when your delivery is inconsistent. If Client A gets great work and Client B gets forgotten, you’ll churn through clients faster than you can sign them.

Reliable delivery builds trust. Clients don't leave when they know what they're getting each month. Systems make that reliability possible—documented processes, clear handoffs, and capacity tracking that prevents overcommitment.

Before switching to recurring billing, ask yourself: can you deliver consistent quality to 10 clients at once? 20? If the answer is "maybe," fix your systems first.

When recurring payments backfire

Not every agency should switch to retainers. Here’s when recurring billing causes more problems than it solves.

You don’t know your true costs

Most agencies underestimate what their services actually cost to deliver. They look at the hourly rate they’re charging and assume they’re profitable, without accounting for all the hidden costs.

Dav Nash sees this constantly:

I think a lot of agencies don’t really understand the true cost of business. They tend to look through rosy goggles and things like how long certain deliverables take and stuff like that. So they don’t realize that they’re making a loss on their services.

Dav Nash,

FatJoe

Dav Nash,

FatJoe

The hidden costs add up fast. “If you hire somebody in the UK on minimum wage, which I think it’s about 27k or something, if you actually add up all of the costs associated with that, it’s almost like 20k a year more of overhead on that staff member,” Dav explained.

That’s £20,000 in overhead—taxes, benefits, equipment, office space, management time—on top of salary. Miss that in your pricing, and your allegedly profitable retainer is actually bleeding money.

If you haven’t done the math on your actual delivery costs—including overhead, management time, software, and revisions—you’re not ready to price recurring services.

Your services don’t fit the model

Some work genuinely belongs in project buckets. One-time deliverables with a clear endpoint don’t need to be forced into retainers.

Website redesigns, brand identity projects, one-time audits—these make more sense as projects. Trying to stretch them into monthly payments often frustrates clients and creates scope confusion.

The test: Is there ongoing work that provides ongoing value? If yes, consider a retainer. If no, keep it as a project.

You’re selling retainers but delivering chaos

Some agencies adopt retainer pricing without changing how they operate. They’re still running around putting out fires, overservicing some clients while neglecting others, and scrambling to figure out what’s due this week.

Marcel Petitpas from Parakeeto describes this pattern:

It’s unsurprising that a lot of them end up with indigestion problems in their business. A lot of times it starts with what they’re eating. In other words, what they’re selling to clients is fundamentally setting themselves up for failure, but they’re just not aware of it.

Marcel Petitpas,

Parakeeto

Marcel Petitpas,

Parakeeto

Calling something a retainer doesn’t make it one. If you haven’t productized your delivery and built systems to support consistent output, you’re just project work with a different payment schedule—and eventually that catches up with you.

What a mature recurring revenue model looks like

Most advice about retainers focuses on why you should switch, not what you’re building toward. Here’s what agencies look like after they’ve made the transition work—and how their model evolved once they committed to recurring revenue.

The 85/15 endpoint

One agency owner scaled from $500K to $6.5M over five years while building toward a specific mix: 85% retainer revenue, 15% project work.

As u/ThatGuytoDeny165 (verified 7-figure agency owner on r/agency) explained: “Our growth is very much dependent on the fact 90% of our revenue is on retainer. This means we are always scaling as long as we aren’t churning clients. If you are heavily project based, the issue is you constantly are replenishing pipeline to backfill your current levels.”

Project-heavy agencies run on a treadmill—every month starts from scratch. Retainer-heavy agencies compound—every month starts with revenue already locked in.

That said, 85% isn’t the only valid target. Some agencies thrive at 50/50 or 60/40—especially those where project work (web builds, brand identity, one-time audits) feeds naturally into retainer relationships. The goal isn’t a specific ratio; it’s having enough recurring revenue that losing one client doesn’t create a crisis. For most agencies, that floor is somewhere around 40–50%.

How long does this take? Honestly, it varies too much to give a number. Some agencies shift in 18 months, others take 3+ years. What matters more than timeline is direction—each month, is your recurring percentage going up or down?

The safety net effect

When most of your revenue is recurring, you get options.

“Having a steady stream of revenue covers up a lot of blemishes,” u/ThatGuytoDeny165 shared. “Bad client? Fire them, you have others waiting. Screwed something up and client is pissed? That’s okay, if they leave it won’t sink you. Need to hire? That’s okay our pipeline is built out to utilize capacity.”

That kind of breathing room doesn’t exist when you’re scrambling between projects. Recurring revenue gives you leverage—to fire bad clients, raise prices, and make decisions from strength instead of desperation.

How the model evolves

Most agencies don’t jump straight to retainers. They evolve through stages.

u/ThatGuytoDeny165 described their progression: “It started as deliverable base. You pay us X a month and you get Y of these deliverables. This means we’d be committed to 2 blogs, 1 email, 4 google ad campaigns, etc. per month for a fixed fee.”

That works at first. But it creates a problem. “At some point we decided the problem with selling services were they weren’t always aligned with expectations or needs. Clients wanted growth and they assumed since that’s what we were selling that it would equal growth which wasn’t always true. Contractually though, those are the things we had to deliver.”

Their solution: pivot from selling deliverables to selling flexible capacity. “We ended up pivoting to a retainer in various iterations, but essentially now we sell a bunch of hours to someone. Our job is then to utilize those hours in the best way possible to hit the expectations in terms of growth our clients have.”

Notice what they’re actually selling: hours, not outcomes, but the framing is outcomes-focused. They’re not promising specific results (dangerous), but they’re also not locked into specific deliverables (limiting). The hours give them flexibility to chase whatever’s working.

The evolution typically looks like:

Stage | What You Sell | What You Bill | Common Issues |

|---|---|---|---|

Stage 1 | Projects | Per-project | Feast-or-famine cash flow |

Stage 2 | Deliverable packages | Monthly fixed | Scope lock-in, misaligned incentives |

Stage 3 | Flexible capacity | Monthly fixed | Requires trust and track record |

Each stage builds the muscle for the next. You can’t sell flexible capacity until you’ve proven you can deliver results with it.

The pricing inflection point

One of the most counterintuitive moves during the transition: raising prices significantly.

“We at one point doubled our price with no change to our offering,” u/ThatGuytoDeny165 shared. “In a single year we were able to cut our number of clients down from 80+ to about 45 while still growing the business all through a change in our pricing model.”

Fewer clients; same (or higher) revenue; better margins; less chaos.

This only works once you have a pipeline strong enough to absorb short-term losses. But the math is compelling: 45 clients at 2X pricing is easier to serve than 80 clients at 1X pricing—and often more profitable.

Raising prices on existing clients

New pricing is easy—you just quote the new rate. Existing clients are harder. You’ve got 15 clients at $3K and want to move to a $5K minimum. What do you do?

u/ThatGuytoDeny165 has been through this: “At some point you have to have an ‘Up or Out’ conversation. It doesn’t mean they need to come all the way up to your current rates, but you need to slowly bring them up to something that is worth your time.”

The trigger is usually capacity. “You only have so much capacity and when you have capacity it’s fine but as you start facing hiring decisions, knowing some of your capacity is going to lower margin work that decision becomes a lot clearer.”

His approach: “As your sales dictate it, and as your capacity necessitates it, start seeding these clients very nicely with the idea that ‘While we appreciate our time working together we have outgrown each other. We are happy to help facilitate a transition or you can come up.’”

Some will leave. That’s the point. You’re trading low-margin clients for capacity to serve higher-margin ones.

The numbers behind a mature model

After the transition, what does a healthy retainer-based agency look like? Based on the same agency’s metrics:

Metric | Their Number | What It Means |

|---|---|---|

Retainer/Project split | 85% / 15% | Majority predictable revenue |

Retention rate | 88-90% | Low churn, compounding growth |

Average client tenure | 12 months | Strong relationships, proven results |

Profit margin | 24-25% | After paying owners market-rate salaries |

Minimum retainer | $9K-$11K/month | Self-selects for serious clients |

CAC to LTV ratio | 5:1 | Acquisition investment pays back 5X |

These numbers took years to reach, but they give you a target.

What makes forecasting work

The biggest operational shift with recurring revenue: you can actually plan.

“We have always been a recurring revenue model agency so our retainers allow for easy forecasting,” u/ThatGuytoDeny165 noted. “If you are project heavy hiring is tough because of the ebbs and flows of revenue. Once you have fulltime employees your payroll becomes a fixed cost unless you want to hire and fire constantly.”

When revenue is predictable, decisions get clearer. You know whether you can afford that next hire. You know when capacity will run out. You can plan 12 months ahead instead of scrambling month-to-month.

That predictability—knowing what’s coming—makes every other business decision clearer, from financial predictions to hiring timelines.

How to price recurring services without losing money

Pricing retainers wrong is worse than not offering them at all. Here’s how to set prices that actually work.

Start with your actual costs

Before you pick a price, figure out what it costs you to deliver the work. Not what you hope it costs. What it actually costs.

Marcel Petitpas recommends a specific target: “Generally speaking, you want to have a delivery margin when you sell something of 70% or more. I know that sounds high, but when you consider that you have all kinds of indirect delivery costs… usually between 10 and 20% of that. Then you have overhead, which is often gonna eat up another 30%.”

Here’s what that means in practice:

Revenue | Delivery cost (30%) | Indirect costs (15%) | Overhead (30%) | Profit (25%) |

|---|---|---|---|---|

$5,000/mo | $1,500 | $750 | $1,500 | $1,250 |

$3,000/mo | $900 | $450 | $900 | $750 |

If your delivery costs more than 30% of revenue, you’re already behind. Every extra hour you spend, every revision cycle, every quick call eats into that margin.

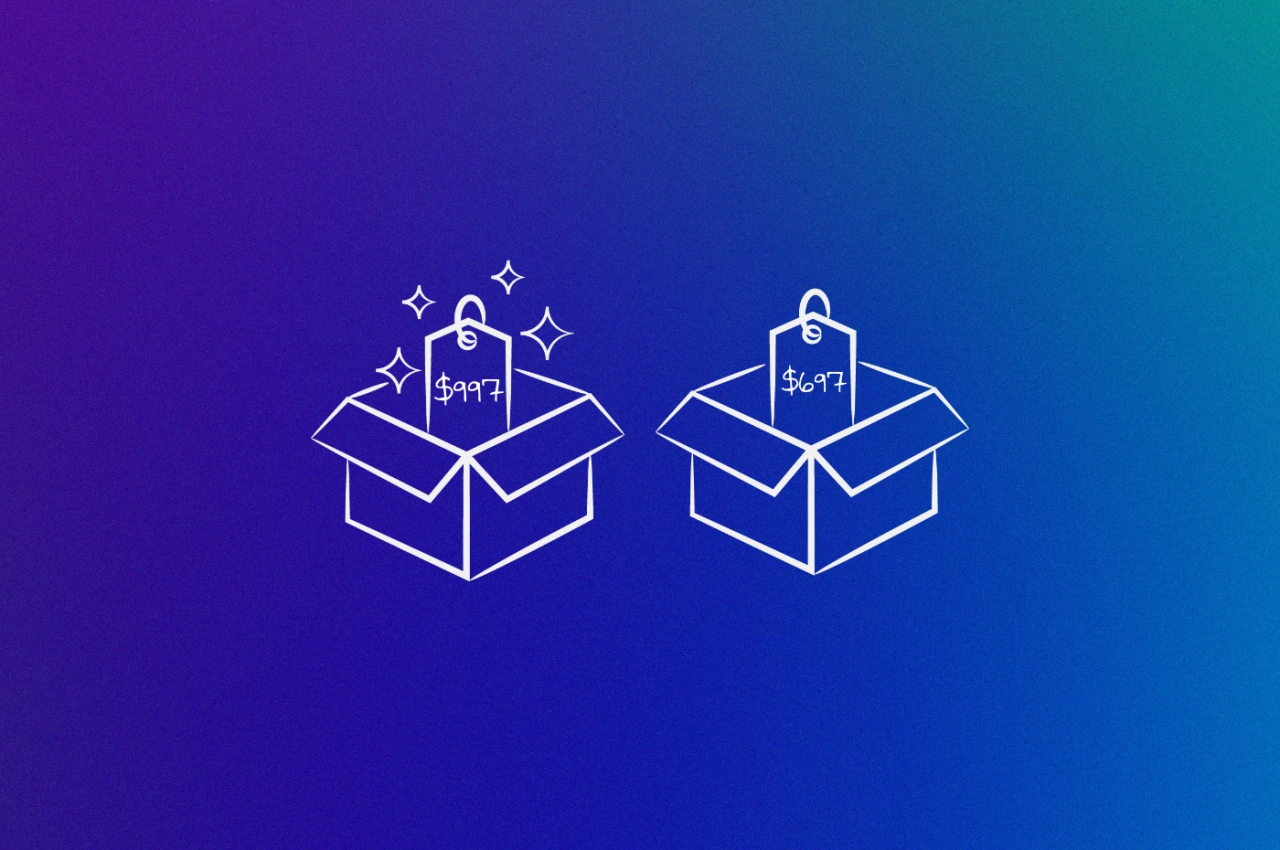

Structure that scales

Many agencies create pricing tiers that grow with client needs. This lets you start relationships at accessible price points while giving clients a clear path to expand.

Alexander Palmiere, Founder at Refresh Digital Strategy, describes how retainers typically evolve:

For small law firms, retainers typically start around $3,000 per month for core digital marketing services. As our partnership grows over time, retainers increase to $5,000 or more per month to account for more advanced strategies and increased performance.

Alexander Palmiere,

Refresh Digital Strategy

Alexander Palmiere,

Refresh Digital Strategy

A typical tier structure might look like:

The key is defining exactly what’s included at each tier. Vague packages lead to scope creep and margin erosion.

When to offer discounts (and when not to)

Discounts make sense in specific situations:

Annual commitments: If a client commits to 12 months upfront, a 10–15% discount can be worth it. You’re trading margin for predictability and reduced churn risk.

Upfront payment: Some agencies offer a small discount (5–10%) for clients who pay quarterly or annually in advance. This improves cash flow and reduces payment administration.

Strategic accounts: For clients who could become case studies or refer significant business, adjusted pricing might make sense as a deliberate investment.

Discounts that don’t make sense:

Matching a competitor’s lower price: If you’re competing on price, you’ve already lost. Someone will always go lower.

“Getting your foot in the door”: Starting cheap with the plan to raise prices later rarely works. Clients anchor to the initial price.

Desperation: Taking underpriced work because you need the revenue creates a client who expects low prices forever.

Why clients stay (or leave)

Clients leave when they can’t see what they’re paying for. Your SEO work might be excellent, but if it’s invisible to them, they’ll question the expense every month.

Justin Herring, Founder at YEAH! Local, solved this with a dashboard:

We used to send clients these messy PDF reports that nobody understood. So we built a simple automated dashboard. Suddenly they could see their search rankings move in real time. This changed everything. Clients stuck around longer and new people got it faster. Just because they could actually see our work, we saw 30 percent more upsells in six months.

Justin Herring,

YEAH! Local

Justin Herring,

YEAH! Local

30% more upsells from visibility alone. When clients can see your work, they stop wondering whether it's worth paying for.

Some churn is healthy. Clients who underpay, demand constant attention, or don’t fit your ideal profile cost more to serve than they bring in. When they leave, you free up capacity for better-fit clients.

Zero churn isn’t the goal—keep the right clients, let the wrong ones go. If good-fit clients are churning, you have a delivery problem. If bad-fit clients are churning, your positioning is getting clearer.

Handling the operational reality

The day-to-day of running recurring revenue includes some predictable headaches. Here’s how to handle them.

Failed payments happen

Credit cards expire; bank accounts run low; payment details change. In a recurring billing model, failed payments are inevitable.

A good dunning process (the term for failed payment recovery) follows a sequence:

Day 0: Payment fails. Automated email notifies the client with a link to update payment details.

Day 3: If still unpaid, second email with slightly more urgency. Many failures are simple oversights.

Day 7: Personal email from account manager. “Hey, noticed your payment didn’t go through—anything we can help with?”

Day 14: Phone call or direct message. At this point, determine if it’s a payment issue or if they’re trying to cancel.

Day 21-30: Decision point. Either pause the account or have a conversation about ending the relationship.

Most failed payments get resolved within the first week if you have automated reminders set up. The ones that don’t usually signal a bigger issue—the client is unhappy, their budget changed, or they’re avoiding a cancellation conversation.

The pause request

At some point, a client will ask to pause their retainer instead of canceling. Maybe their budget is tight. Maybe they’re going through internal changes. Maybe they’re testing whether they actually need you.

How you handle pause requests depends on context:

Allow it when the client has been with you long-term, has a legitimate temporary situation (like a seasonal business), or you’d rather keep them on pause than lose them entirely.

Decline it when the client has a history of payment issues, you suspect they’re using the pause to avoid canceling, or your model doesn’t support it.

If you allow pauses, set clear terms:

Maximum pause duration (30–90 days is common)

What happens to their spot when they return

Whether pricing changes if they’ve been gone too long

Some agencies offer a reduced “maintenance” rate during pauses—lower than the full retainer but enough to keep the relationship active.

The numbers you need to track

We showed one agency’s benchmarks earlier. Here’s what to track for your own agency:

Metric | What It Tells You | Target Range |

|---|---|---|

Monthly Recurring Revenue (MRR) | Total predictable monthly income | Growth month-over-month |

Churn Rate | Percentage of clients leaving per month | Under 5% monthly |

Client Lifetime Value (CLTV) | How much a client pays over the full relationship | 12+ months of revenue |

Delivery Margin | Revenue minus cost to deliver | 70% or higher |

Average Revenue Per Client | MRR divided by number of clients | Increasing over time |

Start with MRR and churn. Those two numbers tell you whether your recurring revenue is actually growing or slowly leaking.

Delivery margin (from Petitpas’s framework earlier) tells you whether growth is profitable or just busy. A 50% margin with high growth is worse than a 75% margin with moderate growth.

Setting up the systems

Recurring billing requires infrastructure. At minimum, you need:

A payment processor that handles automatic recurring charges. Stripe is the standard for most agencies—it handles subscriptions, failed payment retries, and integrates with most billing software.

Automated billing that charges clients on schedule without manual intervention. Whether this lives in your payment processor, accounting software, or client portal, the key is removing yourself from the monthly billing process.

Failed payment recovery through automated dunning emails. Most payment processors can handle the first few reminder emails automatically.

A client portal where clients can view invoices, update payment details, and see their subscription status. This reduces support requests and gives clients control over their own account.

For a deeper look at choosing the right recurring payment system or setting up retainer pricing, we have detailed guides on each.

Frequently asked questions

Can I mix project and retainer work for the same client?

Yes. Many agencies land a project (website, rebrand, audit) and convert it to a retainer for ongoing work. Keep the scopes separate—don’t let “we’re on retainer” become an excuse to bundle in project-level work for free.

What if a client wants to cancel mid-contract?

Let them. Fighting to keep unhappy clients rarely ends well. Offer to finish the current billing period, wrap up any in-progress work, and part professionally. A clean exit often leads to referrals later.

Do unused retainer hours roll over?

No. Most agencies don’t roll over unused hours—they expire at the end of each month. Rolling over creates accounting headaches and incentivizes clients to “bank” hours they may never use. If a client consistently underuses their retainer, right-size the agreement.

Should I bill at the start or end of the month?

At the start. Retainers are paid in advance for the upcoming month, not in arrears for work completed. This protects your cash flow and reinforces that the client is paying for access and availability, not just deliverables.

The bottom line

If your services are productized, your costs are understood, and your delivery is reliable, recurring billing creates predictable revenue and stronger client relationships.

If any of those pieces are missing, you’ll trade one set of problems for another.

Start with the fundamentals: know your costs, price for 70% delivery margin, and build systems that let you deliver consistently. Then shift your pricing model.