- Net 30 often becomes Net 45–60 in practice. For new clients or large projects, require a deposit before starting work—it's not unreasonable, it's good business.

- Never move to the next project phase until the current one is paid. This protects both sides and keeps your cash flow aligned with the work you've actually delivered.

- 42% of agencies pause services when clients are late on payment. Have a policy, put it in your contract, and actually enforce it.

97% of marketing and creative agencies deal with late payments. The average cost? $39,000 per year in cash flow damage—and 63% say it makes their cash flow “unpredictable” (PYMNTS Intelligence, 2025).

Most billing advice out there targets freelancers or generic small businesses. Agency billing is different. You’re juggling retainers and project milestones, sending invoices to multiple contacts at the same company, and setting payment terms that actually need to stick when you’re three months into a relationship.

This guide covers how to set payment terms, structure deposits, and automate your invoicing so clients pay on time. We’ll focus on getting it right from the start—not chasing overdue payments after the fact.

Understanding this topic involves several interconnected concepts:

- ACH Payments

- Retainer Model

- Scope of Work (SoW)

- Productized Service

- Milestone Tracking

- Client Onboarding

- Dunning Management

Each of these concepts plays a crucial role in the overall topic.

How to set payment terms that get you paid

Payment terms are the first thing clients test. Get them right upfront, and you avoid awkward conversations later.

Net 30 vs Net 15 vs due on receipt

Net 30 is the industry standard—about 60% of B2B transactions use it (CreditPulse, 2025). But here’s the agency reality: 25% of businesses wait 20–30 days past the due date to pay. Your Net 30 often becomes Net 45 or Net 60 in practice.

Your options:

Due on Receipt: Best for small projects or new clients you haven’t vetted yet.

Net 15: Works well for retainer clients where you want faster cash flow.

Net 30: The default; most clients expect it.

2/10 Net 30: A 2% discount if they pay within 10 days; surprisingly effective.

For retainer clients you trust, Net 15 keeps cash flowing. For new clients or larger projects, due on receipt with the deposit isn’t unreasonable—it’s just good business.

Deposit requirements by project size

How much should you collect upfront? It depends on the project size:

Project Size | Recommended Deposit | Milestone Structure |

|---|---|---|

Small (<$5K) | 50-100% upfront | 50/50 or full upfront |

Medium ($5K-$25K) | 50% | 50% / 25% / 25% |

Large ($25K+) | 20-33% | Multiple milestones |

Based on Karl Sakas (Sakas & Company) agency consulting recommendations

One thing to avoid: 50/50 splits on large projects. If a client delays final approval, you’ve done 80-95% of the work but only received half the payment. Structure milestones so payment keeps pace with progress.

With SPP.co, you can collect a deposit and the remainder later—all in one easy flow that creates 2 invoices automatically.

Milestone payment structures

For project work, tie payments to deliverables.

Payment issues require proactive prevention. We structure our payment terms like building blocks—each phase must be paid before beginning the next. This approach reduced our payment issues by 80%.

Harmanjit Singh,

Origin Web Studios

Harmanjit Singh,

Origin Web Studios

Here’s what a milestone structure looks like for a $50K website project:

25% ($12,500) — Contract signed, project kickoff

25% ($12,500) — Design approval

25% ($12,500) — Development complete, staging review

25% ($12,500) — Launch + 2-week support period

The key: never move to the next phase until the current one is paid. It protects both sides—clients see progress tied to payment, and you’re never too far ahead of what you’ve collected.

Preventing late payments

Payment terms only work if clients actually follow them. A few things help:

Accept multiple payment methods: More options means fewer excuses. 86% of agencies accept credit cards, 78% accept ACH, and 51% still take checks.

Offer early payment incentives: A 2% discount for paying within 10 days costs you a little but saves you from chasing invoices. Some agencies offer 5% off for annual retainer prepayment.

Have a pause policy—and use it: 42% of agencies pause services until payment is received. That’s not being difficult; it’s protecting your business.

Stats from AgencyAnalytics 2025 benchmarks report

“The policy at our company is that we pause working on an account as soon as the account is late on 2 invoices.” — Stephanie Fehrmann, Co-founder at Redefine

If prevention isn’t enough, see what to do when a client won’t pay.

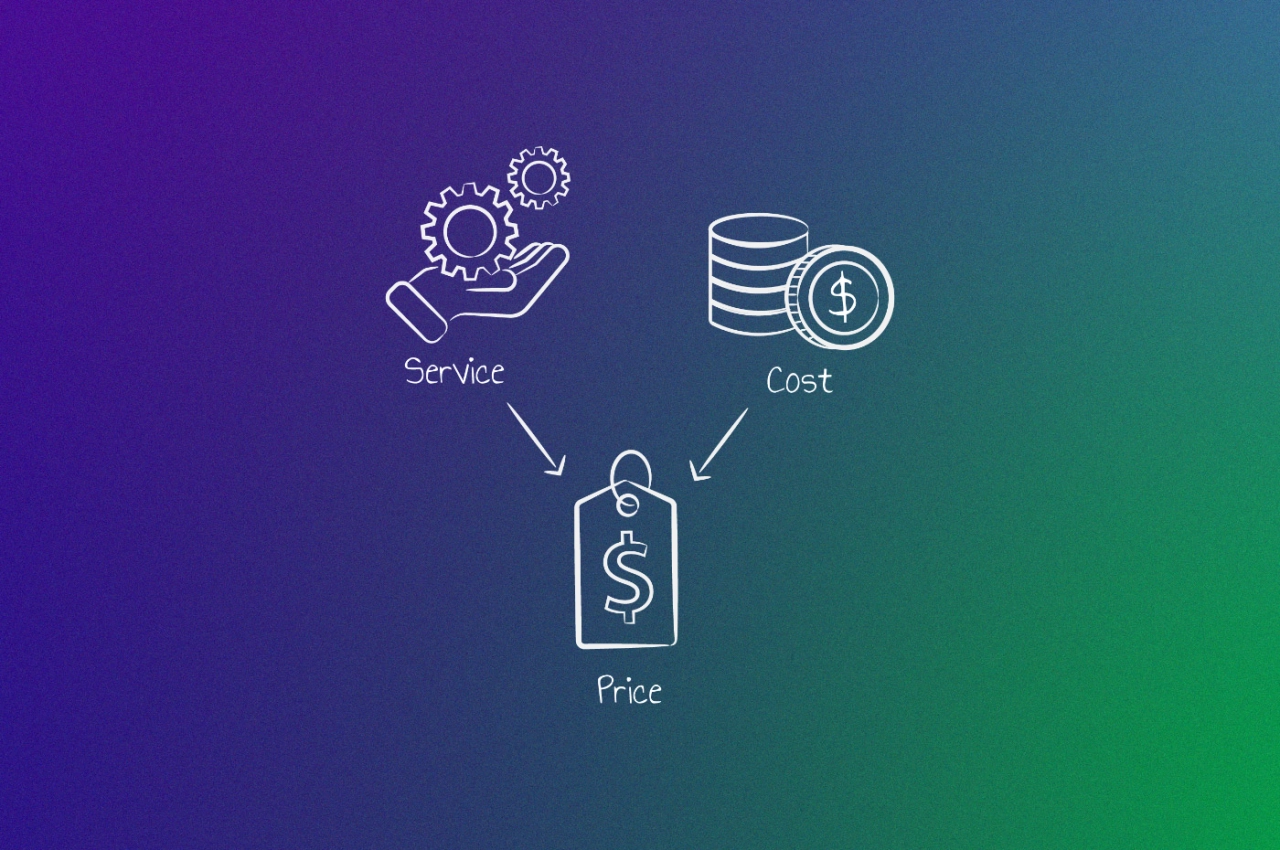

Types of billing for agencies

Your billing model determines your cash flow pattern. Most agencies use a mix of these depending on the client and engagement:

Billing Type | Best For | Cash Flow | Scope Risk | Admin Effort |

|---|---|---|---|---|

Recurring (retainer) | Ongoing services (SEO, social) | Predictable | Low | Low |

Project-based (milestone) | One-time projects (websites, campaigns) | Variable | Medium | Medium |

Hourly | Consulting, ad-hoc requests | Variable | Low | High |

Fixed/flat-fee | Productized services, audits | Predictable | High | Low |

If you’re running productized services with fixed pricing, billing gets simpler—clients know the cost upfront, and you can require payment before work starts.

Your first invoice: what to include and how to set it up

Before you send that first invoice, make sure the groundwork is in place. Fixing billing issues mid-engagement is awkward for everyone.

Before you send anything

Four things need to happen before any invoice goes out:

Signed contract or MSA: A clear contract with payment terms spelled out.

Defined scope of work: So there’s no ambiguity about what you’re billing for.

Billing contact identified: Ask “Who receives invoices, and who approves payment?” These are often different people.

Payment method confirmed: Card on file, ACH, or whatever they’ll actually use.

What goes on an agency invoice

Beyond the standard elements (contact info, dates, line items, total), agency invoices need a few additions:

Project or retainer reference: “October 2025 retainer” or “Website Phase 2” so clients know exactly what they’re paying for.

Scope reference: Link to the SOW or contract section.

PO number: If the client requires purchase orders (common with enterprise clients).

For invoice numbering, include the year and month—it makes tracking and tax prep easier. Options: sequential (INV-001), date-based (INV-2025-10-001), or client-coded (INV-ACME-001).

First invoice checklist

Before sending invoice #1 to a new client:

contract signed and filed

deposit and payment terms confirmed

billing contact name and email collected

PO requirements checked (enterprise clients)

payment method set up (card on file, ACH, etc.)

invoice includes project reference and service period

due date is clear and realistic

Set expectations during onboarding so nothing surprises them: when invoices go out, how they’ll receive them (email or client portal), what payment methods you accept, and what happens if payment is late.

How to automate agency billing

Manual invoicing doesn’t scale. Once you have more than a handful of retainer clients, you need systems that run without you.

Recurring invoice setup

For retainer clients, set invoices to auto-generate on a fixed date each month (the 1st works for most agencies). Keep the service description consistent so clients know what to expect, and auto-send to the billing contact you identified during onboarding.

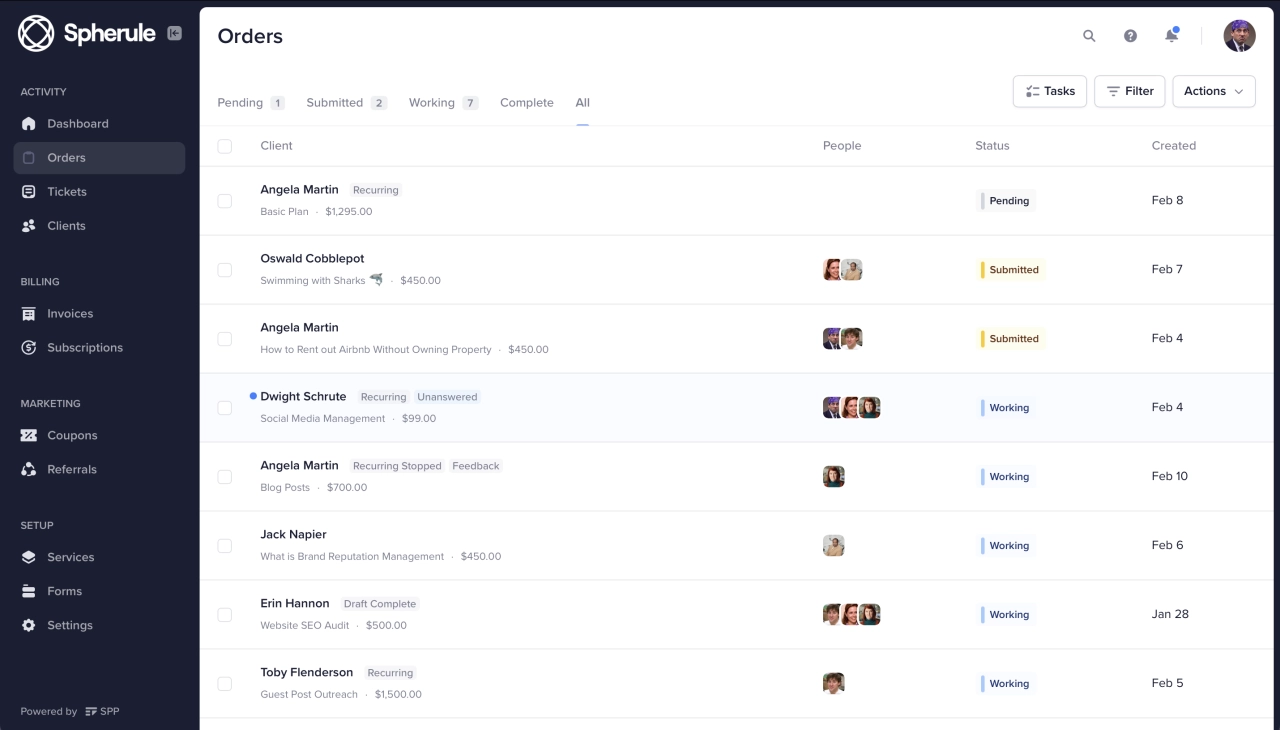

SPP’s recurring billing handles this automatically—you set the billing date and amount, and invoices go out without you touching anything.

Payment reminder automation

Automated reminders reduce your days sales outstanding (DSO) by 8-12 days on average. Sending invoices within 24 hours of service delivery cuts another 5-8 days. Companies with automated AR workflows see 20-35% reduction in DSO overall (CreditPulse, 2025).

Here’s what a reminder sequence looks like in practice:

Josiah Lipsmeyer, founder of Plasthetix (a plastic surgery marketing agency), uses a three-strike system: friendly automated email at 3 days past due, personal check-in call at day 7, and a formal pause notice at day 14. The escalation gets results—most clients pay before the third strike.

Auto-charge vs invoice-and-wait

Two approaches, and most agencies use both:

Auto-charge (card on file): Best for retainers and recurring services. The client agrees during onboarding, and their card gets charged automatically. Eliminates payment delays entirely.

Invoice-and-wait: Best for project milestones or variable amounts where clients expect to review before paying. More friction, but some clients (especially larger ones) require it for internal approvals.

For retainer work, push for auto-charge whenever possible. For project work, invoice-and-wait is usually fine—just make sure those payment reminders are automated.

Frequently asked questions

What if a client asks for Net 60 payment terms?

You can negotiate. Offer Net 30 with a 2% early payment discount, or agree to Net 45 as a middle ground. If they insist on Net 60, require a larger deposit upfront (40–50%) to offset the longer payment window. Some agencies walk away from Net 60 clients entirely—the cash flow strain isn’t worth it.

How do I bring up deposits with a client who’s never paid one?

Frame it as standard practice, not a trust issue. “We require a 50% deposit to secure your spot on our production calendar” works better than “We need payment upfront.” If they push back, explain that the deposit covers your team’s time commitment and gets the project prioritized.

Should I start work before receiving the deposit?

No. Don’t even schedule the kickoff meeting until the deposit clears. If you schedule the meeting first, you create pressure to start when the date arrives—even if you haven’t been paid. Make payment the trigger for scheduling, not the other way around.

How do I handle invoice disputes?

Address disputes quickly and professionally. Document everything in writing. For detailed guidance on resolving disputes without losing the client, see how to handle a client disputing an invoice.

Should I charge late fees?

You can, but enforcement matters more than the fee itself. A typical late fee is 1.5% per month (18% annually) added after 30 days past due. Include the policy in your contract and on every invoice. The real value is leverage—clients take due dates seriously when there’s a cost to missing them.

How do I transition existing clients to stricter payment terms?

Wait for contract renewal—it’s the path of least resistance. If you can’t wait, announce a company-wide policy change (“Starting next quarter, we require deposits on all new projects”). Frame it as your business evolving, not about trust with that specific client.

Start with one change

You don’t need to overhaul everything at once. Pick the gap that’s costing you the most—missing deposits, manual invoicing, unclear terms—and fix that first. The rest gets easier once cash flow is predictable.