- Invoicing clients internationally can be a major problem for small businesses because of the amount of information they need to provide.

- Sending invoices manually and dealing with unresponsive clients takes a lot of time away from more important tasks.

- Client invoicing software makes it easier for all parties to pay invoices, track payments, and stay compliant with invoicing standards.

If you run a small business, are a freelancer, or run an agency, every single invoice matters—so it’s only natural if you feel that client invoicing (and the entire invoicing process) gives you the jitters. Even worse if it’s past the due date, and you haven’t received any news from your customers.

Why are there so many ways to bill your client, and what can you do once you send the invoice to make sure you get paid on time?

In this article, I’ll introduce you to the topic of client invoicing, show you how to use a billing tool, as well as how to make sure clients pay (on time).

Why do you and your clients need invoices?

Invoices are a necessity in accounting in order to register sales or outstanding payments. They list services to be rendered or products to be delivered. In most cases, invoices also list payment terms, and serve as a paper trail for past transactions.

For most companies, invoicing customers is a rather difficult topic. Luckily, there is software that takes care of this task. Before we look at invoicing programs, let‘s first find out what kind of requirements exist to issue a proper client invoice.

How to create a professional invoice template

Billing is not just a matter of sending invoices and getting paid. Obviously, that’s the main goal behind it—but when you’re a service provider, your invoices belong to your brand. They are part of the message you put out in the world; you want them to look professional and properly formatted, and you want your invoice to meet all legal requirements too.

One of the first hurdles you’ll encounter is that invoicing laws differ from country to country. Some countries require a VAT or business number, while others don’t. There are even countries that need you to keep paper invoices on file. Others will accept digital invoices and even PayPal invoices as legal documents. Since you and your clients might be legal entities in different countries, it’s important to make sure you are aware of both the invoicing legislation on your end and on theirs.

Your invoice should include

- Your business contact information

- Your clients’ business information

- Invoice date and number

- A list of each product or service you’ve sold

- The total amount due

- Payment terms

Although this is not a legal requirement, adding your branding (logo, colors, etc.) can make an invoice look more professional; it might even position you as more authoritative, knowledgeable, and trustworthy when it comes to the service you provide.

Nice to have: show gratitude towards the client by thanking them once you’ve received the payment. Ideally, automate marking invoices as paid and notifications to the client.

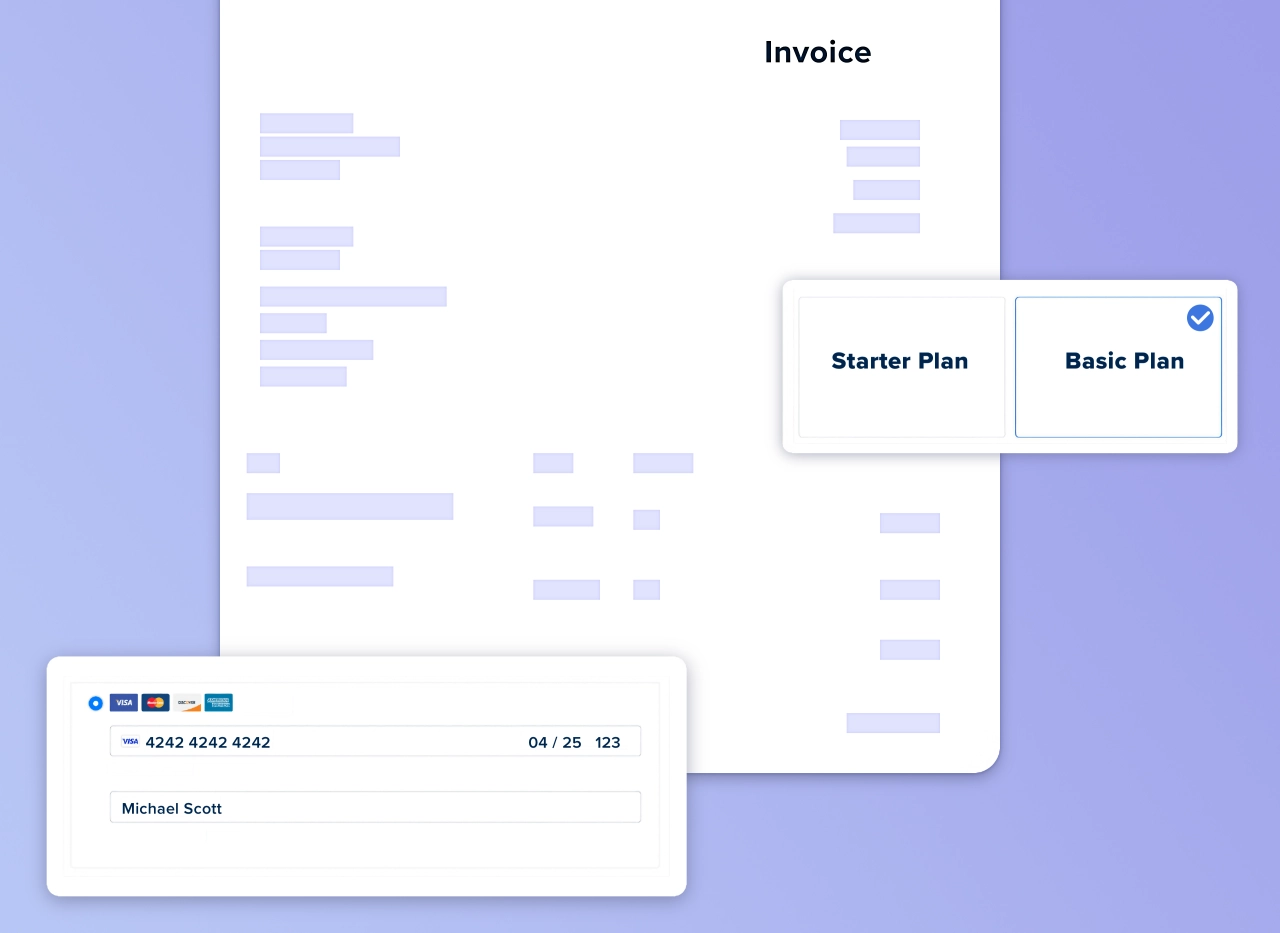

Finally, make sure your invoice format professional. A great way of achieving this is by using an invoice template:

You can create your invoice template in a Google Sheets or Excel file (and then download it as a PDF, so you can send email invoices)

You can create your invoice template in a Google Doc or Microsoft Word/Apple Pages document (and download it as a PDF); keep in mind that, in this case, the document will not do the math for you, so you will have to do it manually

Use accounting software (which, as you will see, comes with a series of advantages)

You can use a client portal software such as SPP with integrated invoice generation

Invoice and collect payments automatically and on time.

How to bill a client for the first time

First-time billing is often a make-or-break moment in client relationships. You want to appear professional, establish clear expectations, and set the tone for future payments. So, what’s the right approach when you’re invoicing a new client for the very first time?

Establish payment terms upfront

Before you even create that first invoice, make sure payment terms are clearly documented in your contract or service agreement. This includes:

Payment timeline: Define whether you require upfront deposits (recommended), milestone payments, or payment upon completion

Accepted payment methods: Specify which payment options you accept (credit cards, bank transfers, PayPal)

Late payment policies: Outline any late fees or interest charges

Currency: Especially important for international clients

Having these conversations early prevents awkward situations later when the invoice arrives in their inbox.

Create a detailed first invoice

Your first invoice sets the standard for all future transactions with this client. Make it count by including:

your complete business details (including registration numbers)

clear itemization of all services provided

service descriptions that match your contract language

any reference numbers from proposals or agreements

a personal note thanking them for their business

Remember that your first invoice is also a brand touchpoint—format it professionally with your logo and brand colors to reinforce your credibility.

Consider a welcome packet approach

With first-time clients, I’ve found it helpful to send a welcome packet along with the initial invoice. This can include:

a brief overview of your invoicing schedule

instructions for each payment method you accept

contact information for billing questions

FAQs addressing common payment concerns

a simple guide to reading your invoice format

This extra touch demonstrates your professionalism and helps avoid confusion or payment delays.

Implement upfront payments for new clients

Let’s be frank—when working with a client for the first time, requiring at least partial payment upfront is simply good business practice. With new relationships, you haven’t yet established trust regarding payment reliability.

A 50% deposit before work begins and 50% upon completion is standard practice in many service industries. For ongoing services, consider requesting the first month’s payment in advance.

Follow up professionally

After sending the first invoice, a gentle follow-up call or email can help ensure everything is clear and address any questions. This proactive approach accomplishes two things, it:

demonstrates your professionalism and attention to detail

reduces the likelihood of payment delays due to confusion

A simple message like “I wanted to check if you received the invoice and if you have any questions about the payment process” can go a long way.

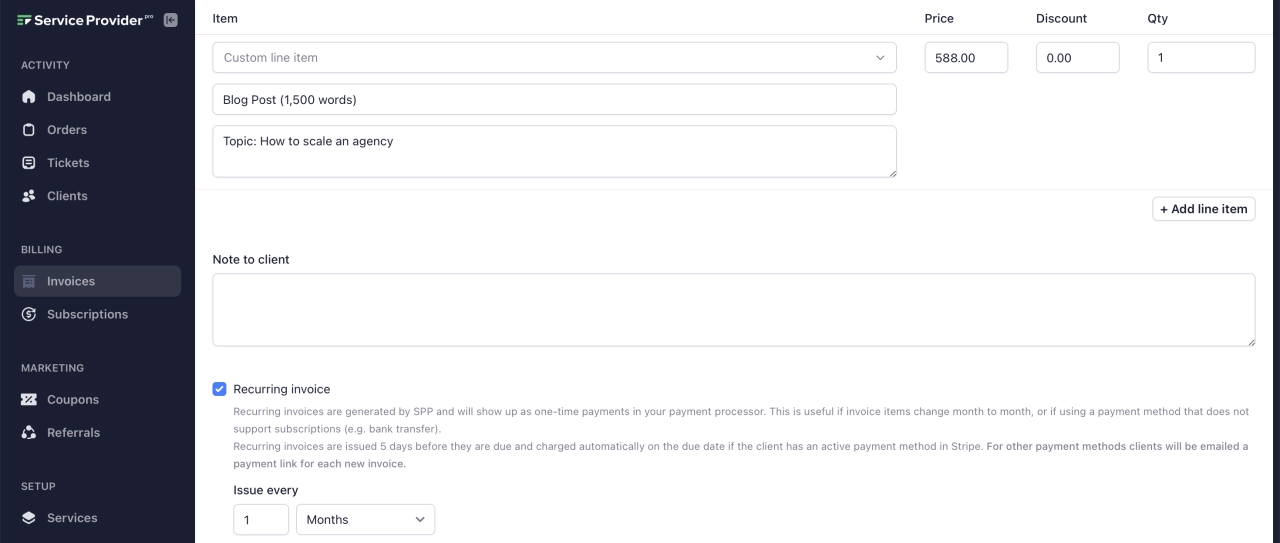

Use automation from the start

Even with your very first invoice, leveraging client portal software can streamline the process. Platforms like SPP allow you to:

set up recurring billing for ongoing services

automate payment reminders

track invoice status in real-time

provide clients with a self-service payment portal

Starting with automated systems from the first invoice establishes efficient processes that scale as your client relationship grows.

Remember, first impressions matter—and your initial billing experience sets the tone for your entire financial relationship with a new client. By being clear, professional, and systematic from the start, you’ll minimize payment issues and position yourself as a trustworthy service provider.

Challenges & solutions of invoicing clients

Sending invoices is not always a piece of cake. On one hand, you want customers to pay what they agreed to (and do it on time.) On the other hand, you understand these business owners you work with are your partners, and you want to foster good relationships with them.

One major challenge is understanding how clients prefer to pay their invoices. This could be via a bank transfer, a certain period of time, or even in installments.

Instead of waiting until the end of a project to send an invoice, break the work into clearly defined stages. Once a stage is completed, send an invoice for that portion of the project. Clients appreciate seeing progress tied to payments, and it helps with agency cash flow because you’re getting paid consistently as work is completed. This method also serves as a checkpoint for both you and the client to make adjustments along the way, ensuring the project’s scope and budget remain aligned.

Casey Meraz,

Juris Digital

Casey Meraz,

Juris Digital

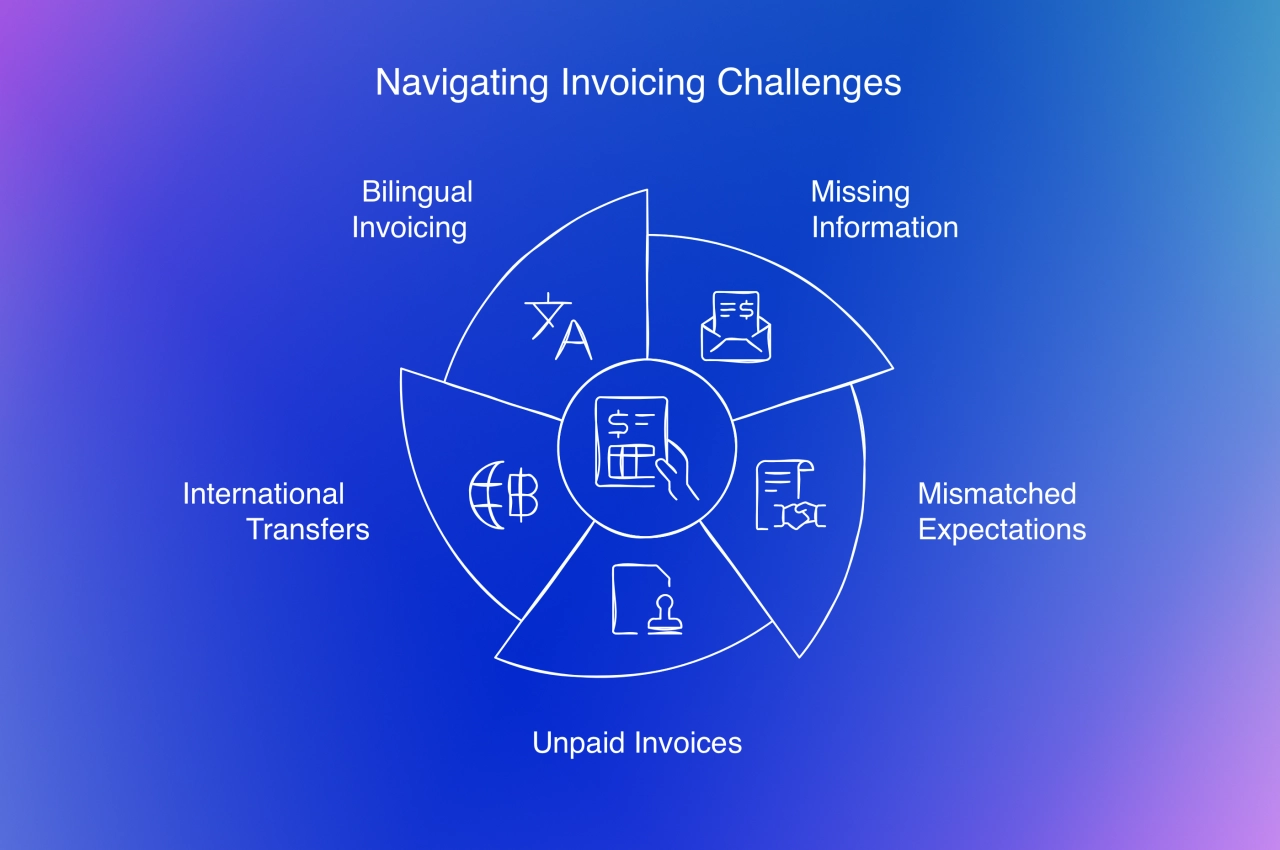

A hundred small issues can show up from the moment the invoice is paid. Let’s look at some of the more common problems.

Missing information: If a new client requests additional business information (like a VAT number), promptly address their needs and send an updated invoice.

Mismatched expectations: Problems occur when expectations differ. You may believe a project is complete, while the client thinks they received only half, delaying payment. Therefore, a clear contract is essential for both parties.

Unpaid invoices: In some cases, a client simply might not have the money to pay you on time. It happens, especially to small businesses and startups that are still in the process of building a client base. They often don’t have cash flow reserves to cover unexpected financial bumps in the road.

International transfers: International bank issues can occur due to the lack of transfer systems, causing delayed payments or currency exchange problems.

Bilingual invoicing: If you’re invoicing a client in another country, chances are the language will be different from your own. Unless someone on your team is fluent in your clients’ language, this might lead to a series of misunderstandings. The most viable solution here would be to either use a translation service to have the invoice translated into your client’s language, or to use client invoicing software that will do this automatically for you.

In our digital marketing agency (with around 200+ clients) one of the issues we face is invoices not reaching the appropriate contacts in the client team. This can cause confusion and delays in payment. For this concern, you could create a system that ensures invoices get to the right people.

Aaron Whittaker,

Thrive Digital Marketing Agency

Aaron Whittaker,

Thrive Digital Marketing Agency

Tip: In SPP, your clients can add a contact from the billing department as a team member, and give them access to view invoices.

Legal implications for not paying invoices

Businesses can certainly take legal action if a client is not paying their invoice.

When both parties are located within the same legal jurisdiction, things are pretty straightforward. If you have sent your reminder and the client is still unresponsive, a debt collection agency or attorney can resolve the issues in your name However, when a global context is involved, the situation gets a bit more complicated as there might be different legal systems at play.

If you have signed a contract with your clients (and you should’ve), you can take legal action against your debtor. Keep in mind, though, that lawsuits might not be financially worth it, depending on the outstanding amount.

The best way to invoice clients: problems & solutions

Beyond the local/international context, there are a few more factors when it comes to how to invoice a client. Here are some of the more frequent problems and fitting solutions to keep in mind.

The client is unresponsive

If you have sent a reminder and the client is still unresponsive, you can take legal action. Depending on your contract and the legislation covering both your business entity’s jurisdiction and your client’s, there might be a minimum amount of time you need to wait before taking such action.

The best way to avoid this problem is to have a clear contract in place and work with legit, trustworthy clients. Ask for (partial) payments upfront if the customer is a brand new one to be on the safe side.

You forget to send your invoices on time

As silly as it may sound, it happens that you forget to send an invoice. Things can get hectic if you have to send ten invoices every month to five clients each on a different date, following a different billing format. On top of it, every invoice needs to be issued according to a different contract. Let’s not forget you need to actually deliver services on top of all this.

The easiest solution to this issue is to automate client payment reminder emails. Most invoicing software options have a billing function that makes monthly or yearly recurring invoicing (including email reminders) a breeze. Features like these save time, energy, and money in the long run.

You don’t know how to send an invoice

If you’re just starting out, chances are you’ve never had to send an invoice. An accountant or bookkeeper can help you with this. If you need to move fast and send an invoice quickly, you should know there are a lot of legit free invoice templates available such as these ones. One thing to keep in mind about these is that they need to be up-to-date with the latest requirements—so double-check before you hit send.

How to send an invoice to a client

Sending invoices to customers can be tricky, especially if you’re not using one of the tools mentioned above. You’ll have to use a Word template, create duplicates, and keep track of every payment, or worse, chase clients for payment.

If you’re using Service Provider Pro, sending invoice to clients is easy:

go to the Invoices section

click Add invoice

select an existing client or add a new one

you can also not add any client, allowing leads to pay the invoice

select the due date

add the services (or custom line items)

When you issue the invoice to a customer, you can optionally send it via email, collect an upfront payment, or set a custom billing date. If you’re invoicing international clients, you can even choose a custom currency.

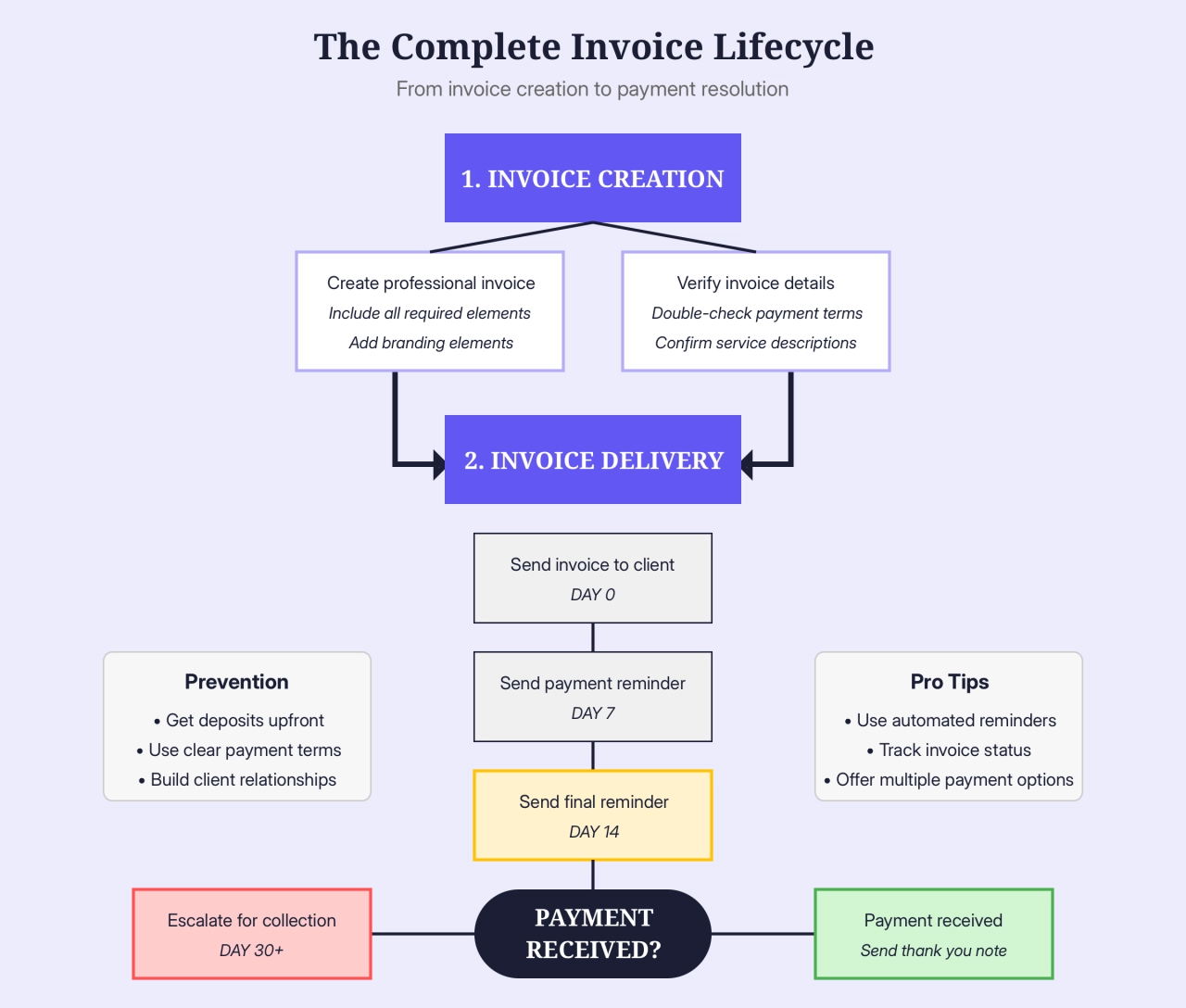

The complete invoice lifecycle

Let’s look at the entire invoice lifecycle to better understand how proper invoicing works from start to finish. Having this bird’s-eye view helps you identify where potential issues might arise in your own invoicing process.

As you can see, the invoice journey involves several critical touchpoints. From creating a professionally formatted invoice to following up with payment reminders, each stage requires careful attention to ensure you receive timely payments. The most successful service providers establish clear processes for handling both payment and non-payment paths.

Notice how prevention strategies like requiring deposits upfront can help you avoid reaching the escalation phase. Similarly, using automated reminders at strategic intervals (7 days, 14 days) keeps your invoices top-of-mind for clients without requiring manual follow-up from your team.

Client invoicing practices FAQ

What is the easiest way to invoice a client?

In order to receive payments, companies should create invoices and send them to clients automatically. They can either use invoicing software, or a payment gateway that creates them automatically upon payment.

What is the difference between billing and invoicing?

Billing usually refers to payment receipts, which are generated upon payment. Invoicing creates a document that can be used to ask for payment, or prove that a product or service was paid.

How does invoicing software support brand management?

Professional software not only allows you to brand your invoices, it also makes it easy for your team to manage everything. Looking professional as a company improves your brand image.

How does invoicing software improve service delivery?

Invoicing software enhances service delivery by automating billing processes, reducing human error, and speeding up payment collections. It enables real-time tracking, clear communication, and streamlined workflows, fostering improved customer satisfaction and operational efficiency.

When should you invoice a customer?

An agency should invoice a customer at agreed intervals, typically upon completion of milestones, monthly for ongoing services, or upon project completion. Clearly outline payment terms in the contract to ensure both parties have a mutual understanding of billing periods.

How does invoicing software improve business customer service?

Invoicing software improves customer service by automating billing processes, ensuring timely and accurate invoices. It allows for easy payment tracking, offers multiple payment options, and reduces disputed invoices, enhancing overall customer satisfaction.

Client invoicing was never this easy

Good, functional, and affordable billing tools are the best way to invoice customers. They ensure that you bill clients correctly, on time, and remove unnecessary manual work that goes into manual invoicing.

While customer invoicing may still be flawed in many ways, modern technology helps SMEs and freelancers like you to get paid on time, and in full. Automating your invoicing process with software is the best way to go about it—whether you’re a one-person operation or have a team of 20 people.

Give this a thought and get the invoicing app that suits your needs.