- Premium agencies charge 2–3× more because they can point to documented results, not because they decided to raise prices.

- Five clients at $6,000 generates the same revenue as twenty at $1,500, but frees up 75% of your client management overhead.

- Test new rates on prospects first, track close rates for 10–15 conversations, then transition existing clients with 60–90 days notice.

Most agencies compete on price. They match competitor rates, discount to close deals, and grind through low-margin projects hoping volume will make up the difference.

It doesn’t.

Premium pricing takes the opposite approach. You charge more because your work delivers more—and you build the positioning, sales process, and client experience to back it up. Fewer clients, higher margins, better projects.

This guide covers how to make that shift: the psychology behind why clients pay premium rates, how to calculate your price point, the sales conversations that close high-value deals, and how to transition existing clients without burning relationships you’ve spent years building.

Understanding this topic involves several interconnected concepts:

- Client Lifetime Value (CLV)

- Scope Creep

- Value-Based Pricing

- Retainer Model

- Productized Service

- Service Tier

- Niching

- Churn Rate

Each of these concepts plays a crucial role in the overall topic.

What is a premium pricing strategy?

Premium pricing means positioning your agency’s services at a higher price point than competitors—and backing it up with the expertise, results, and client experience to justify that price.

Most agencies price based on hours, competitor rates, or what they think clients will pay. Premium pricing flips this. You price based on the value you create: the revenue generated, the problems solved, the outcomes delivered.

Jason Hennessey, CEO of Hennessey Digital, structures his entire agency around this principle:

The ideal client prioritizes partnerships, so our pricing model rewards long-term commitments. We build retainer models that allow clients to plan budgets while receiving consistent, high-quality work. Clients who invest in partnerships benefit from compounding growth over months, not one-off wins.

Jason Hennessey,

Hennessey Digital

Jason Hennessey,

Hennessey Digital

The difference shows up in how clients perceive you. When you price like a commodity, clients treat you like one—comparing your rates to cheaper alternatives, negotiating every invoice, questioning every hour.

When you price like a strategic partner, the conversation shifts from “how much does this cost?” to “what results can we expect?”

Challenges of premium pricing

Premium pricing works. But it’s not a switch you flip overnight, and it comes with real obstacles.

Clients who paid lower rates may push back. Prospects will compare you to cheaper competitors. Economic downturns put pressure on premium services first. And if your delivery doesn’t match your pricing, you’ll damage your reputation faster than a discount agency ever could.

The agencies that succeed with premium pricing don’t ignore these challenges—they build systems to handle them. Here’s what you’re up against.

Adapting to market volatility

Premium pricing requires constant recalibration. What justified your rates last year might not hold up today.

Economic downturns hit premium services first. When budgets tighten, clients scrutinize their highest line items—and that’s you. During these periods, your value narrative needs to shift from “we’re the best” to “here’s the ROI you’ll lose if you cut us.”

Industry standards move too. Basic analytics dashboards commanded a premium five years ago. Now they’re table stakes. If your premium offering doesn’t evolve, you’ll find yourself charging top rates for commoditized work.

Then there’s the budget cycle problem. Q4 planning season puts every vendor under a microscope. Premium agencies that coast through the year often face hard conversations in October when procurement asks why they’re paying 3x market rate for “the same thing.”

The fix isn’t rigid pricing—it’s regular reassessment. Add new high-value components before clients ask. Adjust your messaging to current priorities. Stay ahead of what “premium” means in your market, because it’s a moving target.

The expectation gap risk

Charge premium rates and clients expect premium everything. Response times. Strategic thinking. Results. The smallest gap between what you promise and what you deliver gets magnified.

This shows up in three ways.

Your team might not fully understand the premium promise you’re making. Your sales deck talks about white-glove service, but your project managers are juggling fifteen accounts and responding to emails three days late. That disconnect erodes trust fast.

Consistency breaks down as you scale. The founders delivered exceptional work when the agency was five people. Now you’re at twenty, and the new hires don’t instinctively understand what premium means at your shop. Without documented standards and training, quality drifts.

Scope boundaries blur. Premium clients often expect exceptional treatment on everything—including work outside your contract. Without clear limits, premium pricing becomes a recipe for constant scope creep, where you’re delivering $15,000 of work on a $10,000 retainer.

The risk isn’t just losing one client. A disappointed premium client tells their network. And the reputation damage takes years to repair.

Competitive undercutting

Someone is always willing to do it cheaper. That pressure never goes away—it just changes shape.

The first wave comes from feature-matching competitors. They study your service packages, reverse-engineer your deliverables, and offer something that looks similar at 60% of your price. Clients forward you their proposals and ask why they’re paying more for “the same thing.”

The second wave is offshore. Development shops in Eastern Europe, design teams in Southeast Asia, content agencies in South America—all offering comparable execution at a fraction of your rates. For delivery-heavy work, this pressure is relentless.

The third wave is AI. Tools that automate pieces of what you sell are getting better every quarter. Clients see demos and wonder why they’re paying your rates for work a $50/month subscription could handle.

None of this means you can’t charge premium rates. But it does mean you can’t coast on the same positioning forever. The agencies that maintain premium pricing stay ahead by deepening expertise, not just polishing deliverables. They make direct price comparisons irrelevant by solving problems competitors can’t even diagnose.

The psychology behind premium pricing

Price signals quality before you’ve delivered anything. The number you charge shapes how clients perceive your work, your expertise, and whether you’re worth their time.

Two principles matter most: anchoring and the price-quality signal.

The anchoring effect

The first number a client sees becomes their reference point. Show a $50,000 option first, and your $25,000 package feels reasonable. Show them the $25,000 option first, and they’ll negotiate for $15,000.

Lloyd Pilapil, founder of Pixelmojo, uses this deliberately:

When presenting pricing proposals, I’ve learned to first introduce a premium-tier option that includes extensive, high-value deliverables and comprehensive support, which sets a high anchor point. Immediately afterward, I offer the mid-tier package—my actual target—that appears significantly more attractive by comparison.

Lloyd Pilapil,

Pixelmojo

Lloyd Pilapil,

Pixelmojo

This is why three-tier pricing works. The top tier isn’t just for big-budget clients—it’s an anchor that makes your middle tier look like smart value. Always present your highest-priced option first.

The price-quality signal

Price communicates quality before you’ve delivered anything. Charge too little and clients assume something’s wrong.

Keith Brooks, CEO of B2B Whisperer, puts it bluntly:

You can charge a finance company more than a school for the same work. That is not meant to mean take advantage of people, but understand, your cheap price for the school is too cheap for the financial institution to take you seriously.

Keith Brooks,

B2B Whisperer

Keith Brooks,

B2B Whisperer

Too cheap to take seriously. For certain clients, a low price isn’t attractive—it’s disqualifying. They assume premium results require premium investment.

High prices attract clients who expect quality. Low prices attract clients who prioritize cost—and they’ll leave the moment someone undercuts you.

Why use premium pricing?

The psychology explains why it works. But why make the shift?

For most agencies, it’s math. Charging more per project means fewer clients, better work, and higher revenue without the volume treadmill. But the benefits go beyond numbers.

Higher margins, fewer clients

A $10,000 project is more profitable than a $2,000 one—even if you spend more time on it. Fixed costs stay the same. Acquisition cost per client stays roughly the same. The extra revenue flows to your bottom line.

According to SE Ranking’s 2025 survey of 260 agencies, 64% charge below $1,000 per month. Only 2% charge above $5,000. Dylan Cleppe, co-founder of OneStop Northwest, operates in that top tier:

We’ve found the most success with retainers 2–3 times industry averages by delivering proven ROI.

Dylan Cleppe,

OneStop Northwest

Dylan Cleppe,

OneStop Northwest

The workload math matters too. Twenty clients at $1,500 generates the same revenue as five clients at $6,000. But twenty clients means twenty onboarding calls, twenty revision cycles, twenty invoices. Five clients means focus and depth.

One content agency documented this publicly: they cut 75% of their client base to focus on high-value engagements. Revenue tripled to $60,000 per month.

Stronger market positioning

Price shapes perception. Charge $500/month and prospects file you with every budget option. Charge $5,000 and they assume you deliver something others can’t.

Danielle Birriel, founder of D&D SEO Services, saw this when she raised her minimum:

I stopped accepting clients who wanted $99/month SEO and started requiring a minimum $1,500/month commitment. This single change filtered out tire-kickers instantly. When I positioned myself as the AI-driven local SEO specialist rather than a general SEO provider, my close rate jumped to 80%.

Danielle Birriel,

D&D SEO Services

Danielle Birriel,

D&D SEO Services

Premium positioning repels bad-fit prospects and attracts clients who already expect to pay more.

Compete on value, not price

When you’re the cheapest option, every conversation becomes a negotiation. You win on price—and lose on price when someone undercuts you.

Premium pricing moves you out of that race. Instead of competing on rates, you compete on problems solved. Agencies that sustain premium rates specialize in problems generalists can’t solve.

Specialization creates differentiation that makes price comparisons irrelevant.

More resilient during downturns

When budgets get cut, cheap vendors go first. Premium partners stay.

The $800/month retainer with vague deliverables? Gone. The $6,000/month partner tied to revenue growth? Harder to cut.

Premium pricing forces measurable value. That accountability becomes a moat when times get tough—your clients can justify keeping you on the books. And premium clients tend to be more financially stable in the first place.

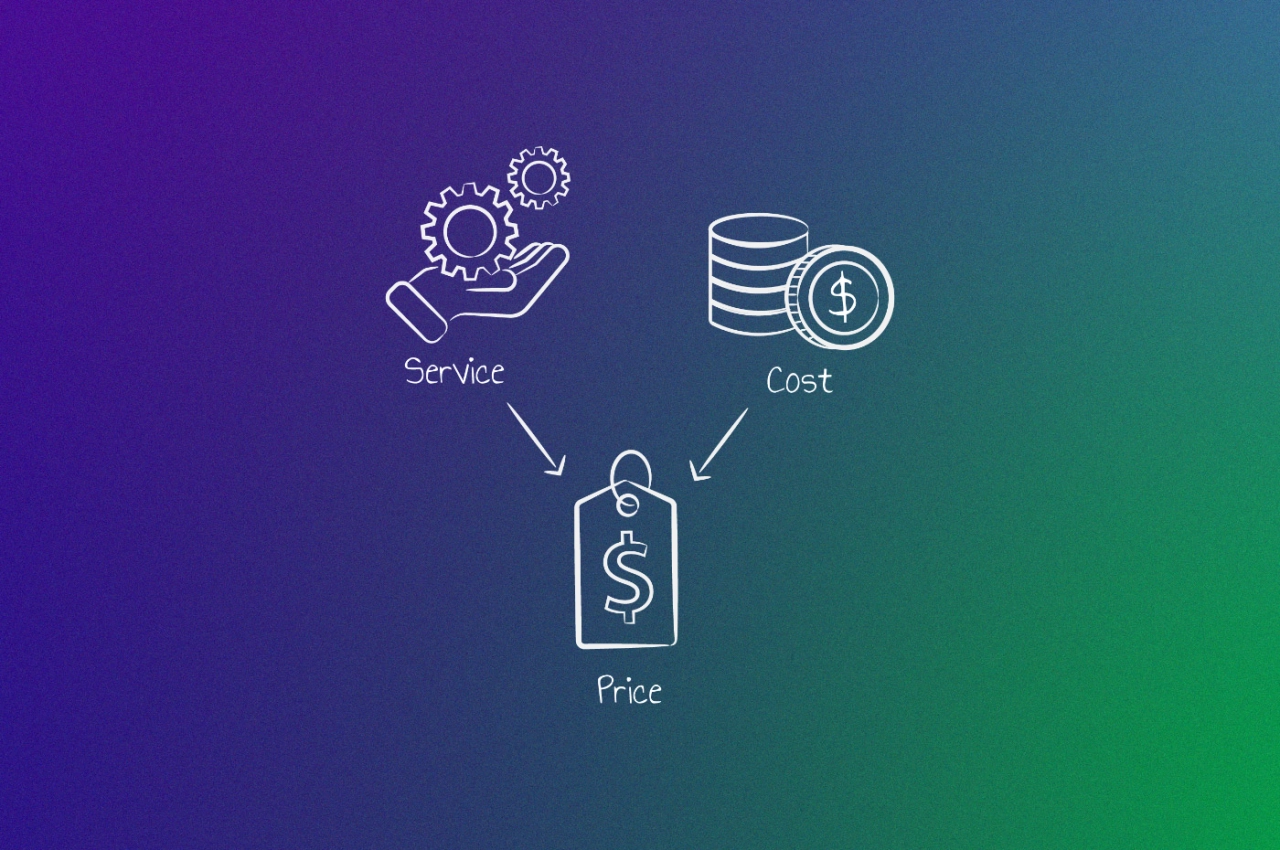

How to calculate your premium price point

Knowing you should charge more is one thing. Knowing exactly how much more is harder.

Most agencies guess. They look at what competitors charge, add a margin that feels right, and hope clients say yes. This works until a prospect pushes back—and suddenly you’re discounting because you can’t explain why your rate makes sense.

A defensible premium price starts with understanding three things: what results you deliver, what those results are worth to the client, and what alternatives they’re comparing you against. Get these right and your pricing conversations shift from negotiation to explanation.

The impact can be significant. One agency documented a 66% increase in profits within a year of shifting to value-based pricing—not by working more hours or adding clients, but by restructuring how they priced and sold their existing services.

Here’s how to build that justification from the ground up.

Start with the client’s definition of success

Most agencies pitch their services before understanding what success looks like for the client. This is backwards—and it’s why pricing conversations turn into negotiations.

Before you quote a number, you need to know what outcome the client is actually buying. Not deliverables. Outcomes. A website redesign isn’t the outcome—more qualified leads is. An SEO retainer isn’t the outcome—ranking for terms that drive revenue is.

Joe Kevens, founder of B2B SaaS Reviews, uses a direct approach in discovery calls: “I ask prospects directly what they’d be willing to pay for certain outcomes. This helps me understand their budget and perceived value, allowing me to tailor my pricing accordingly.”

That question—what would you pay for this outcome—reframes the entire conversation. You’re no longer selling hours or deliverables. You’re selling a result the client has already told you they value.

From there, your pricing has a foundation. Roman Agency used this approach with HealthVibe, a subscription box company doing $6M annually. Instead of quoting a flat fee, they first analyzed the business: 10,000 subscribers at $50/month. Then they projected specific outcomes—30% growth in new subscribers plus 15% retention improvement—worth $2.7M in additional annual revenue. Their fee? 10% of the value created: $270,000. The client still netted $2.43M they wouldn’t have had otherwise.

Benchmark against what premium actually looks like

Knowing your value is half the equation. You also need to know where premium sits in your market—not to match competitors, but to position yourself deliberately.

Here’s what agency retainers look like across different client sizes and goals:

Client Size | Monthly Retainer | Typical Outcome |

|---|---|---|

Small firms (brand awareness) | $3,500–$5,000 | Improved online presence, local visibility |

Mid-size firms (20–30% lead growth) | $10,000–$15,000 | Targeted ads, optimized landing pages |

Large firms (significant revenue growth) | $25,000+ | Full-funnel campaigns, dedicated resources |

Enterprise (market leadership) | $50,000+ | Multi-channel dominance, measurable ROI |

These aren’t arbitrary ranges. Nicole Farber, CEO of ENX2 Marketing, shared that one AmLaw 100 client investing $50,000/month increased new leads by over 50% in six months—doubling their revenue.

Don’t just go ahead and copy these numbers; understand that premium pricing exists at every tier, and the gap between “standard” and “premium” is often 2–3× what most agencies charge.

If you’re charging $1,500/month and wondering why clients treat you like a vendor instead of a partner, this is why. Premium isn’t just about revenue—it’s about the relationship dynamic that comes with serious investment.

When to use premium pricing

Premium pricing isn’t for every agency or every situation. It works when specific conditions are in place—without them, you’re just overcharging and hoping clients don’t notice.

Here are five conditions that support a premium pricing strategy.

You have documented results worth paying for

Premium pricing requires proof. Not testimonials about how nice you are to work with—measurable outcomes tied to business impact.

If you can show that your SEO work generated $400K in pipeline for a B2B client, or that your paid media campaigns maintained a 4:1 ROAS across 18 months, you have something to anchor premium rates against. If your best case study is “increased traffic by 50%,” you’re not ready.

The agencies charging $15K–$25K/month have one thing in common: they can draw a direct line from their work to revenue. Build that documentation before you build premium pricing.

You’ve specialized deeply enough to be the obvious choice

Generalist agencies compete on price because there’s nothing else to compete on. Specialists compete on expertise.

Chris Roy, Product and Marketing Director at Reclaim247, made this shift deliberately:

Getting recognised as the expert on automotive and claims-sector search was one of the best SEO consulting ‘tactics’ I ever implemented. A lot of agencies say they can help with ‘anything’, but most were completely missing an in-depth understanding of how an increasingly intelligent and competitive landscape was affecting the organic performance of claims and mis-sold financial services.

Chris Roy,

Reclaim247

Chris Roy,

Reclaim247

Specialization doesn’t limit your market—it eliminates your competition. When prospects can’t find anyone else who understands their industry as well as you do, price becomes secondary.

Your capacity is limited and you need to filter

Every agency has a capacity ceiling. At some point, you can’t take on more clients without diluting quality or burning out your team.

Premium pricing is a filter. Raise your rates and the volume of inquiries drops—but the quality rises; the tire-kickers disappear. The clients who remain are the ones who value outcomes over cost and respect boundaries over bargains.

Your attention is finite. Price it that way.

Your target market values results over cost

Some markets are price-driven. Others are outcome-driven. Premium pricing only works in the second category.

Keith Brooks, CEO of B2B Whisperer, puts it directly: “You can charge a finance company more than a school for the same work. That is not meant to mean take advantage of people, but understand, your cheap price for the school is too cheap for the financial institution to take you seriously.”

If your ideal clients have real budgets, measure ROI, and have been burned by cheap providers before, premium pricing aligns with how they already think. If they’re shopping for the lowest bid, no amount of positioning will change that.

You’ve built relationships that compound

Premium pricing is easier to sustain when you’re not constantly replacing churned clients. A loyal base of long-term engagements creates stability that supports higher rates.

Jason Hennessey, CEO of Hennessey Digital, structures his agency around this principle: “Our pricing model rewards long-term commitments. Clients who invest in partnerships benefit from compounding growth over months, not one-off wins.”

If your average client tenure is under six months, focus on retention before you focus on pricing. Premium rates mean nothing if you’re spending half your time replacing lost revenue.

How to implement premium pricing

Deciding to charge more is the easy part. Actually making the shift requires changes to your positioning, your sales process, and your service delivery.

Here’s what that looks like in practice.

Identify what makes you worth more

Premium pricing needs a foundation. Before you raise rates, you need to articulate—clearly and specifically—what justifies the increase.

This isn’t your tagline. It’s the concrete answer to “why should I pay you 2–3× what other agencies charge?”

Start with your results. Pull your best case studies and quantify them: revenue generated, costs saved, rankings achieved, time reduced. If you don’t have hard numbers, get them before you raise prices.

Then look at your specialization. What do you understand about your clients’ business that generalists miss? What problems can you diagnose that others don’t even see? The more specific your expertise, the harder it is to compare you to cheaper alternatives.

Rebuild your sales materials

Your current proposals, case studies, and pitch decks were built for your current rates. They won’t support premium positioning.

Update your case studies to lead with outcomes, not activities. “Increased organic traffic 150%” becomes “Generated $400K in pipeline from organic search.” The first is a metric. The second is money.

Restructure your proposals around value tiers. Show the premium option first (anchoring), include clear ROI projections, and make the investment feel small relative to the return.

If your website still lists hourly rates or “starting at $500” pricing, fix that. Premium agencies don’t compete on price transparency—they compete on demonstrated value.

Raise rates on new clients first

Don’t start with your existing clients. Start with prospects who’ve never seen your old rates.

Quote the new price confidently. Watch how conversations go. If you’re closing at roughly the same rate, your positioning supports the price. If close rates drop significantly, either the price is too high or your sales process needs work.

Give yourself 10–15 new client conversations before you draw conclusions. One or two rejections don’t mean anything—you’re looking for patterns.

Transition existing clients gradually

Once you’ve validated the new pricing with new clients, turn to your existing base.

The “Moving existing clients to premium pricing” section covers this in detail, but the key is advance notice and direct conversation. Don’t surprise clients with an invoice. Call them, explain the change, and give them 60–90 days to adjust.

Some will leave. That’s expected. The ones who stay are confirming that your work is worth the higher rate.

Track what matters

Three metrics tell you if the shift is working:

Revenue per client: This should increase. If you raised rates 30% and revenue per client only went up 10%, you’re losing too many clients or discounting too often.

Close rate on qualified prospects: Some drop is normal. A collapse means your positioning doesn’t support the price yet.

Client tenure: Premium clients should stay longer. If churn increases after the price change, you’ve got a delivery problem—expectations are higher and you’re not meeting them.

Check these monthly for the first six months. By month six, you should see the patterns stabilizing.

Applying this to productized services

Everything above applies to productized services—but the mechanics differ.

With retainers, you anchor through custom proposals. With productized services, your website does the anchoring. Display three tiers, price the premium tier first in the visual hierarchy, and let the middle tier look like the smart choice.

Price calculation changes too. You’re not pricing per client based on their specific value—you’re pricing per segment. A $5,000 “website in 2 weeks” package needs to be worth it for the entire category of buyers who’d consider it, not just one prospect on a call.

Generate tiered packages for your agency.

Testing is simpler. Instead of quoting higher and watching close rates, you launch a new premium tier alongside your existing packages. If it sells, the market validated it. If it doesn’t, adjust positioning before adjusting price.

The biggest difference: your package positioning does the sales work that custom pitches do for retainer agencies. Invest in how you present the offer—the copy, the comparison, the outcome framing. That’s where premium pricing lives or dies for productized services.

How to sell premium services

Premium pricing fails when the sales process doesn’t match the positioning. You can’t charge $15,000/month and win deals with the same pitch deck you used at $3,000.

Selling premium requires proving value before the contract, not promising it after.

Lead with proof, not promises

Generic pitches get ignored. Personalized demonstrations of competence get attention.

Vincent Carrié, CEO of Purple Media, took an interesting approach with free homepage SEO rewrites. Instead of audits that list problems, his team demonstrated execution:

The service provided specific copywriting improvements, including rewriting H1 headings and meta tags, and creating strategic CTAs and structured headlines to show how proper SEO implementation could transform their website.

Vincent Carrié,

Purple Media

Vincent Carrié,

Purple Media

Their conversion rate jumped from 12% to 38% over six months.

Quantify the cost of choosing cheap

Premium pricing becomes easier to justify when prospects understand what they risk by going with a cheaper option.

Danielle Birriel, founder of D&D SEO Services, sees this pattern constantly: “My highest-paying clients have one thing in common: They’ve already tried cheap SEO and gotten burned. One client came to me after a bargain provider built hundreds of spammy citations that cost $3,000 to clean up. These business owners understand that search visibility directly impacts their bottom line—they’re not shopping for the cheapest option, they’re investing in measurable growth.”

The clients who’ve been burned make the best premium clients. They’ve learned that cheap SEO isn’t free—it’s expensive in different ways: penalty recovery, reputation repair, lost rankings, wasted months. Your job in the sales process is to surface these costs before they hire the cheap option, not after.

Pre-qualify before the first call

Not every lead deserves a discovery call. Premium agencies filter before they pitch.

Taylor Scher, an SEO consultant, builds qualification into his scheduling process:

Before clients jump on a discovery call with me, I have them pick their budget range that includes my minimum budget on my Calendly link. This helps set up calls with leads who are actually willing to spend within my budget before they even meet with me.

Taylor Scher,

Scher Consulting

Taylor Scher,

Scher Consulting

The mechanics vary—minimum budget on intake forms, required questionnaires, “starting at” pricing on your website—but the principle is the same: filter out mismatches before you invest time in a call.

The math is simple: fewer unqualified calls means more time for prospects who can actually afford you.

Build proprietary tools that demonstrate capability

At the highest end of premium pricing, agencies create custom tools that no competitor can replicate.

Paul DeMott, CTO of Helium SEO, faced a specific challenge:

Highly valuable clients are very suspicious of generic SEO promises. They are afraid to make a significant investment of $15,000 to $25,000 that will only get the standard, generalised strategy which will not bring any return.

Paul DeMott,

Helium SEO

Paul DeMott,

Helium SEO

His solution was a proprietary audit system: “The decision-making step taken was the creation of a software tool internally that generates an instant and completely unique 50-page technical audit report. This is an automated system that identifies as many as 25 unique and verifiable ranking defects on the client’s site in just 90 seconds.”

The impact: 35% increase in close rates on six-figure contracts. The tool proved technical capability in a way no pitch deck could match.

Moving existing clients to premium pricing

Raising rates with new clients is straightforward—you just quote higher numbers. The harder problem is transitioning clients who signed at your old rates.

Get this wrong and you lose revenue twice: the client leaves, and they tell others why.

Have the conversation directly

Email is convenient. It’s also the wrong channel for pricing conversations.

Kate Derkach, PR Manager at Alty, explains their approach: “We prefer to discuss rate changes over a call to gauge reactions and address any objections directly. Such news is always better conveyed in person rather than through a cold email.”

A call lets you hear hesitation, answer questions in real time, and gauge whether the relationship can absorb the change. Email forces clients to react alone—and that reaction is usually defensive.

Give enough notice to plan

Surprising clients with a price increase damages trust more than the increase itself.

Derkach continues: “We always notify our clients about rate changes well in advance (1–3 months), so they can plan their budgets accordingly and aren’t caught off guard. This approach has helped us maintain strong client relationships for over 14 years, with many clients returning to us with new projects.”

Cari Twitchell, founder of Custom Content Solutions, recommends building the expectation into your contracts:

Incorporate annual price increases into your business to account for annual rates of inflation and cost of living increases. If you do this, be sure to include clear messaging to that effect in your client contracts.

Cari Twitchell,

Custom Content Solutions

Cari Twitchell,

Custom Content Solutions

When the increase isn’t a surprise, the conversation is easier.

Lead with value, not justification

Most agencies over-explain price increases. They write paragraphs about inflation, rising costs, market conditions. Clients don’t care.

Kinga Edwards, CEO of Brainy Bees, is direct about this: “The worst thing you can do when announcing a price increase is to beat around the bush. Customers appreciate honesty and transparency same as you do. Instead of writing some essays with explanations about inflation and rising costs, focus on the undeniable value your service provides. Highlight your USPs. Sell VALUE, not SERVICES.”

The question isn’t “why are you charging more?” It’s “is working with you still worth it?” Answer that question, and the price becomes secondary.

Offer a transition path

Not every client can absorb a 30% increase overnight. Give them options.

Tom Edwards, founder of Bit Quirky Consulting, suggests flexibility: “In the past, I have considered offering options like phased price increases and flexible pricing plans to make the transition smoother. Keep a positive and confident tone, emphasising the value of your services.”

Phased increases work well: move from $3,000 to $3,500 now, then to $4,000 in six months. The client adjusts gradually, you reach your target rate, and the relationship stays intact.

Know when to let go

Some clients won’t make the transition. That’s expected.

If a client’s budget genuinely can’t support your new rates, part professionally. Refer them to an agency that serves their price point. The referral costs you nothing and preserves the relationship for future opportunities.

The clients who stay at your new rate are the ones who value what you do. The ones who leave were always going to leave eventually—the price increase just accelerated the timeline.

Frequently asked questions

How do I know if my agency is ready for premium pricing?

You’re ready when you can point to documented results that justify higher rates—case studies with specific outcomes, not just client logos. If prospects regularly tell you they chose you over cheaper options because of your expertise or reputation, that’s a signal. If you’re still competing primarily on price, build your proof first.

What profit margin should I target with premium pricing?

Most premium agencies target 40–60% gross margins on client work. Below 30%, you’re likely underpricing or over-servicing. The SE Ranking 2025 survey found only 2% of agencies charge above $5,000/month—if your margins support it, there’s room at the top.

Should I display premium prices on my website?

It depends on your sales process. Displaying prices filters out budget mismatches early, saving discovery calls. Hiding prices lets you anchor value before revealing cost. Many premium agencies show starting rates (“engagements start at $5,000/month”) to signal positioning without boxing themselves in.

How do premium agencies handle clients who ask for discounts?

They don’t negotiate on price—they adjust scope instead. If a client can’t afford your full engagement, offer a smaller package with fewer deliverables. Never discount your rate; it signals that your original price was inflated and invites negotiation on every future project.

Can productized services use premium pricing?

Yes. Productized services with fixed scope and clear outcomes can command premium rates when they solve specific, high-value problems. A $5,000 “investor pitch deck in 5 days” package for funded startups is premium pricing applied to a productized offer. The key is matching the fixed deliverable to a client segment that values speed and certainty.

What’s the difference between premium pricing and price skimming?

Price skimming starts high and drops over time to capture different market segments—common with tech products. Premium pricing stays high permanently; the price itself is the positioning. For agencies, premium pricing is almost always right. You’re selling expertise that compounds, not a product that commoditizes. Lowering rates signals desperation.

How long does it take to see results from premium pricing?

Expect 3–6 months before financial metrics stabilize. Initial resistance and some client churn is normal in months 1–3. By month 6, you should see higher-quality leads, improved close rates on aligned prospects, and better profit margins. Full transformation—including brand positioning shifts—typically takes 12+ months.

What if premium pricing doesn’t work for my agency?

If you’ve raised rates and lost most of your pipeline, either your positioning doesn’t support the price or your target market can’t afford it. Revisit your specialization, strengthen your case studies, or adjust your ideal client profile. Premium pricing requires the foundation covered earlier in this guide—without it, higher prices just mean fewer clients.

The real question

You can keep competing on price. Plenty of agencies do. They race to the bottom, win projects they resent, and wonder why growth feels like a treadmill.

Or you can decide that your work is worth more—and then do the hard part of proving it.

Premium pricing changes who you work with, not just what you charge. Fewer clients who trust your judgment, pay on time, and refer others like them. Or more clients who negotiate every invoice, question every recommendation, and leave the moment someone quotes lower.

The math works either way. Twenty clients at $1,500 and five clients at $6,000 generate the same revenue. But they don’t generate the same business.

The first quote at your new rate will feel uncomfortable. Send it anyway.