- Customer concentration is a metric that measures how spread out a company’s revenue is among its clients.

- High customer concentration can pose significant financial and operational risks to an agency, including revenue volatility and cash flow issues.

- To assess customer concentration and mitigate its associated risks, agencies should analyze their revenue streams regularly.

When agency owners think about what KPIs are, they rarely consider this one: customer concentration. It’s one they should pay a lot of attention to, though, because it can easily make or break their business in ways many don’t anticipate until it’s too late.

Imagine this: you’re running a successful agency, or so you think, that relies on a few big clients. Then suddenly, your largest client (representing 40% of revenue) decides to cut their budget. Within weeks, you’re scrambling to cover payroll while your profit margins vanish. Scary, right?

This is what high customer concentration is all about—and it comes with very real dangers:

you could lose a massive chunk of revenue literally overnight

your cash flow could collapse before you have time to replace the lost client

your business decisions become hostage to your biggest clients' demands

you might have to lay off talented team members with little warning

your agency valuation plummets if you ever want to sell

With that said, let’s look at exactly what customer concentration means and how you can protect your agency from this common but devastating risk.

What is customer concentration?

Customer concentration is a metric that shows the spread of a company’s revenue among its clients. If a few customers account for a large portion of the revenue, the company has high customer concentration.

Conversely, if revenue is spread more evenly among many customers, the company has low customer concentration. Understanding this metric is crucial for assessing financial stability and planning strategic actions.

Types of customer concentration

Understanding the types of customer concentration is essential for evaluating business risks and opportunities.

High customer concentration

High customer concentration occurs when a few customers make up the bulk of a company’s revenue. This can lead to several risks and benefits:

Risks:

Revenue loss if a top customer leaves.

Downward pricing pressure as major customers demand better terms.

Reduced creditworthiness, making it harder to obtain loans or investment.

Benefits:

Strong relationships with key clients, fostering loyalty and trust.

Potential for long-term partnerships, which can be more predictable and stable.

Focused customer service, leading to higher satisfaction among key clients.

Low customer concentration

Low customer concentration means revenue is spread across many clients. This scenario has its own set of risks and benefits:

Risks:

Managing many smaller clients can be complex and resource-intensive.

Benefits:

Less revenue impact if a client leaves, reducing dependency on a few customers.

Increased market stability as a diversified client base provides a buffer against industry-specific downturns.

Examples of customer concentration

Examples help illustrate what customer concentration looks like in practice.

A link building agency generates 70% of its revenue from just three clients. This is a classic example of high customer concentration. If one of these clients leaves, the company would lose a significant portion of its revenue.

A video editing agency relies on a single customer for 50% of its sales. This is an extreme case of high customer concentration. The risks here are even more pronounced because losing this one client could cut the company’s revenue in half.

Impact of customer concentration

Why do agencies rarely give insights into their revenue stream? For one, they don’t want competitors to know why they are successful. Another reason could be that they rely on a handful of clients driving their success.

In the agency world we talk a lot about churn but a lot less about customer concentration. Even though many have this problem! To me, it seems like a bit of an agency dirty secret. No one wants to admit their eggs are in one or two baskets. But for many this is a grim reality. A super dangerous position to be in, so maybe we need to talk about it more.

Emina Demiri-Watson,

Vixen Digital

Emina Demiri-Watson,

Vixen Digital

So, let’s talk about it. Here’s why customer concentration is so dangerous, and how it can impact your agency.

Financial risks

Customer concentration can significantly affect a company’s financial stability, making it difficult to grow an agency.

Revenue volatility: A critical issue for businesses with high customer concentration. For example, if a company derives 60% of its revenue from two clients, losing one could result in a significant drop in revenue. According to Stephen Schiera, a company’s optimal customer concentration is less than 10% of sales from a single customer and less than 25% from the top five customers.

Cash flow issues: They often accompany revenue volatility. When a key client delays payment or defaults, it can create a ripple effect, making it challenging to meet payroll, pay suppliers, or invest in growth opportunities.

Operational challenges

Beyond financial risks, customer concentration also poses several operational challenges.

Over-dependence on a few clients: The company’s resources, including staff and production capacity, are heavily aligned with the needs of these clients. This alignment can make the business less flexible and slower to adapt to market changes.

Negotiation power imbalance: With high customer concentration, clients gain significant leverage in negotiations. They might push for longer payment terms, bulk discounts, or other concessions that can erode profit margins.

Increased business risk

Customer concentration inherently increases business risk. The loss of a major client can lead to a domino effect, impacting various aspects of the business.

Employee morale: High customer concentration can also affect employee morale. The constant pressure to meet the demands of a few key clients can lead to burnout and job dissatisfaction. This can result in higher turnover rates, which in turn can disrupt operations and increase hiring and training costs.

Cyclical dependency: As businesses become more dependent on a few clients, they may find it increasingly difficult to diversify their client base. This cyclical dependency can trap companies in a high-risk situation, making it challenging to break free from the risks associated with customer concentration.

How to measure customer concentration

To properly assess your customer concentration risk, you need a systematic approach—not just a gut feeling about which clients are important. Let’s break down exactly how to measure this critical metric in your agency.

Gather your revenue data

First, you'll need to compile your revenue data from the last 12 months. This gives you a more accurate picture than just looking at a single month or quarter, which might be skewed by seasonal projects.

Export your revenue report from your accounting software or client management system

Make sure the data is organized by client/company (not by project)

Include all forms of revenue: retainers, project fees, and additional services

Does your agency depend on a handful of clients? If so, you should implement strategies to mitigate the customer concentration risk right away.

Calculate individual client percentages

With your data ready, calculate what percentage each client contributes to your total revenue:

add up your total revenue for the period (e.g., $1,200,000 annual revenue)

for each client, divide their total spend by your overall revenue

convert to a percentage (Client A: $300,000 ÷ $1,200,000 = 25%)

Create a simple spreadsheet with these columns:

client Name

annual Revenue from Client

percentage of Total Revenue

sort by highest percentage to lowest

Analyze your concentration levels

Once you have your percentages, it’s time to evaluate your risk levels:

High Risk Zone: Any client representing more than 20% of your revenue

Caution Zone: Clients representing 10-20% of revenue

Healthy Zone: Clients under 10% of your total revenue

Also calculate these important metrics:

percentage from your top client

combined percentage from your top 3 clients

combined percentage from your top 5 clients

Set up ongoing monitoring

Measuring once isn’t enough—you need to track this consistently:

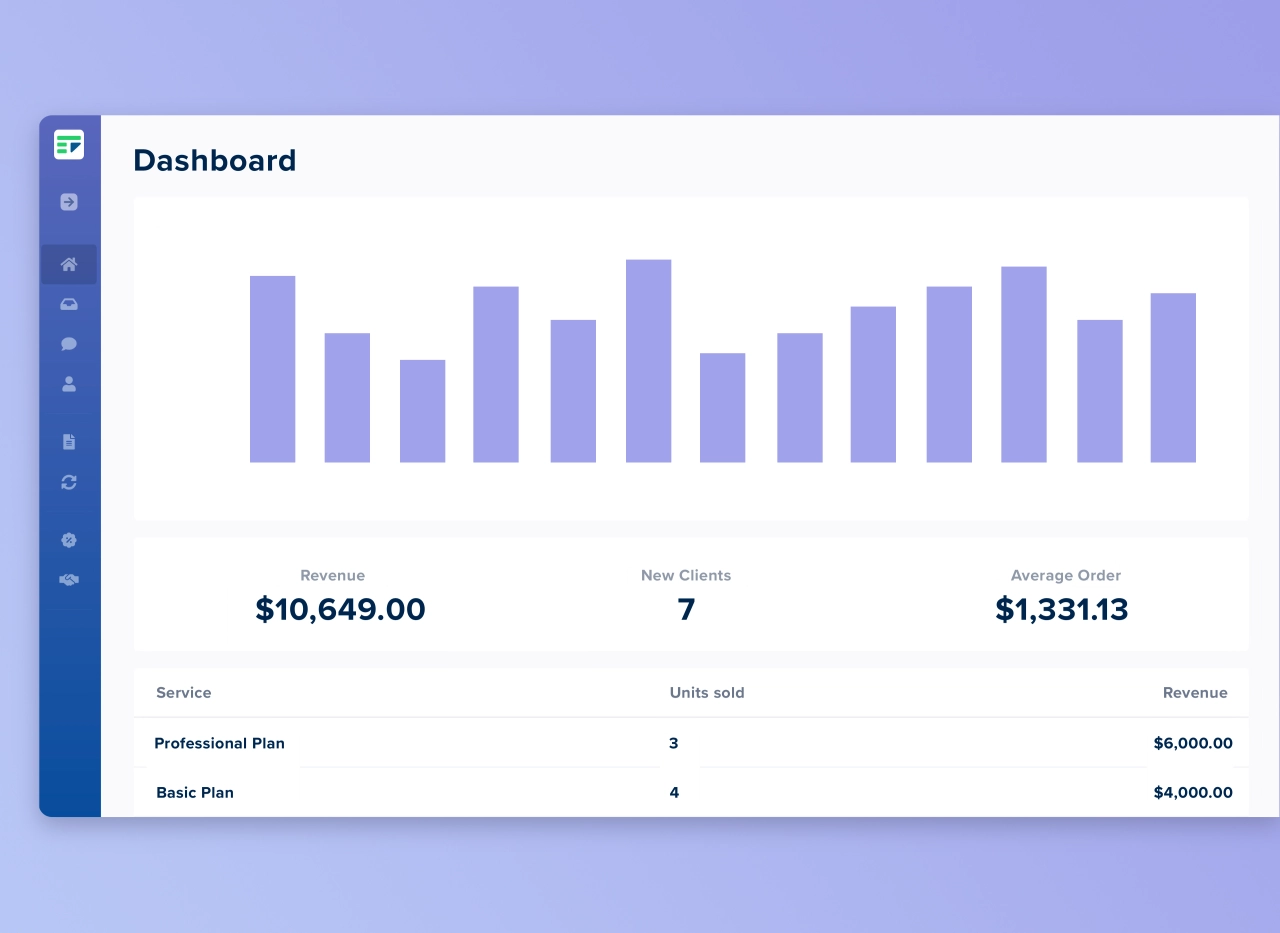

create a monthly dashboard in your analytics tool that automatically updates

set up alerts if any client exceeds 20% of trailing 3-month revenue

schedule quarterly reviews with your leadership team to assess concentration trends

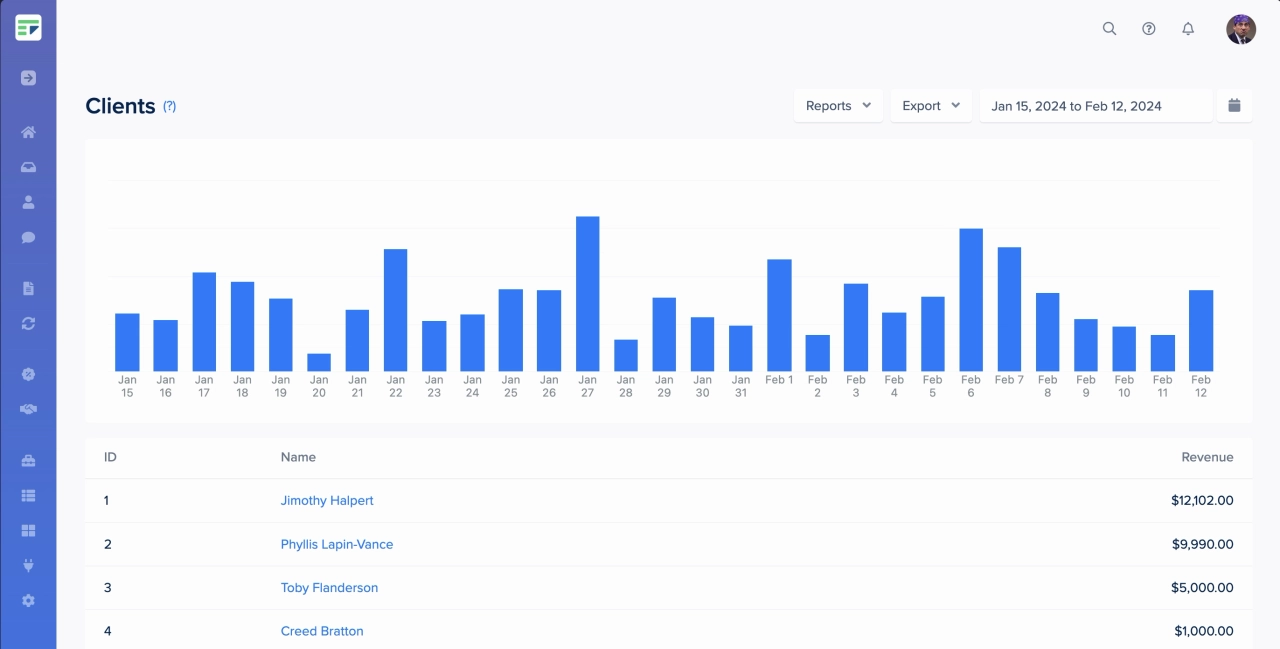

If you’re running your agency through Service Provider Pro, this process becomes much simpler. Just navigate to the Reports section and open the Revenue per Client report. This will instantly give you a breakdown of your revenue by client, showing you exactly where your concentration risks lie.

Get an overview of all your metrics with our powerful reporting.

Take a regular look at this report—I recommend monthly reviews at minimum—to identify not just your best clients, but also dangerous dependency patterns before they become critical. Remember, client concentration isn’t just about who’s paying you the most now, but about how vulnerable those revenue streams make your business.

Customer concentration benchmarks by agency type

Agency Type | Max % Single Client | Warning Signs | Industry Average |

|---|---|---|---|

Content/SEO | 20% | >30% from one client | 28% top client |

Web Development | 25% | >40% from two clients | 32% top client |

Link Building | 15% | >35% from three clients | 22% top client |

Video Production | 30% | >50% from three clients | 35% top client |

Full-Service | 15% | >35% from one client | 25% top client |

Adjustment factors:

increase acceptable thresholds by 5% if using trade credit insurance

decrease thresholds by 5% for agencies with fewer than 5 employees

decrease thresholds by 10% if clients are all in the same industry

Client concentration calculator

Enter your client names and their annual revenue to calculate each client’s percentage of your total revenue. This helps identify concentration risks in your agency.

| Client Name | Annual Revenue ($) | Percentage ↓ | Visualization | Actions |

|---|

Revenue Summary

Risk Analysis

Clients representing >20% of revenue

0

Clients representing 10-20% of revenue

0

Clients representing <10% of revenue

0

Recommendations:

- Enter your client data to see personalized recommendations

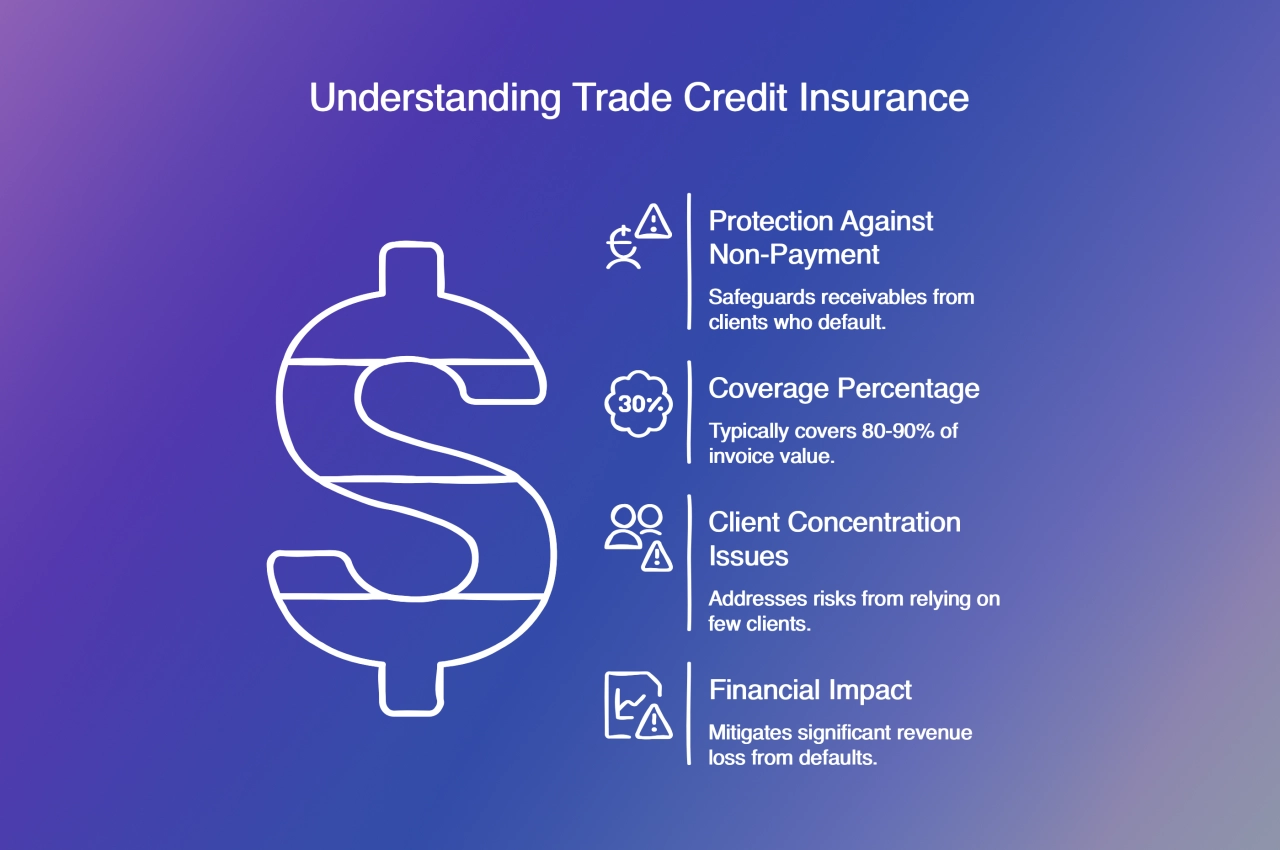

Trade credit insurance as a safety net

When your agency relies on a handful of major clients for most of your revenue, you’re essentially running on a tightrope without a safety net. Trade credit insurance might sound like boring financial jargon, but for agencies with high client concentration, it’s a strategic tool that can literally save your business during unexpected client disruptions.

What exactly is trade credit insurance?

Simply put, trade credit insurance protects your accounts receivable from non-payment. If a major client goes bankrupt, faces financial difficulty, or simply refuses to pay, the insurance covers a significant portion of what you’re owed—typically 80–90% of the invoice value.

For agencies with client concentration issues, this creates an essential buffer against disaster. Imagine losing a client that represents 40% of your revenue and not getting paid for your last three months of work. That’s the kind of double-hit that sinks otherwise successful agencies.

How it transforms your concentration strategy

With trade credit insurance in place, you can actually leverage your concentration rather than just worry about it:

Safer client expansion: Take calculated risks on larger clients in new industries or markets

More competitive payment terms: Offer net-30 or net-60 terms to win bigger contracts when competitors require payment upfront

Better financing options: Many lenders offer improved terms when receivables are insured

Early warning system: Insurers monitor client financial health and alert you to potential issues before they become critical

The most strategic agencies don’t just use trade credit insurance as a passive protection policy—they actively incorporate it into their growth strategy. When properly structured, the cost of coverage (typically 0.2–0.5% of insured revenue) becomes a worthwhile investment rather than an expense.

Implementation without complexity

Setting up trade credit insurance is simpler than most agency owners assume:

identify an insurance broker specializing in trade credit (general business insurance brokers often lack expertise here)

provide your client list, concentration percentages, and payment history

receive quotes from insurers specializing in your industry

select coverage matching your risk tolerance and client portfolio

For agencies using SPP as their client portal, the process is even more straightforward, as you can generate comprehensive client concentration reports directly from your dashboard to share with potential insurers.

The agencies that navigate concentration risk most successfully recognize that complete diversification isn't always desirable or possible. Instead, they implement protective measures like trade credit insurance that allow them to capitalize on major client relationships while mitigating the inherent risks.

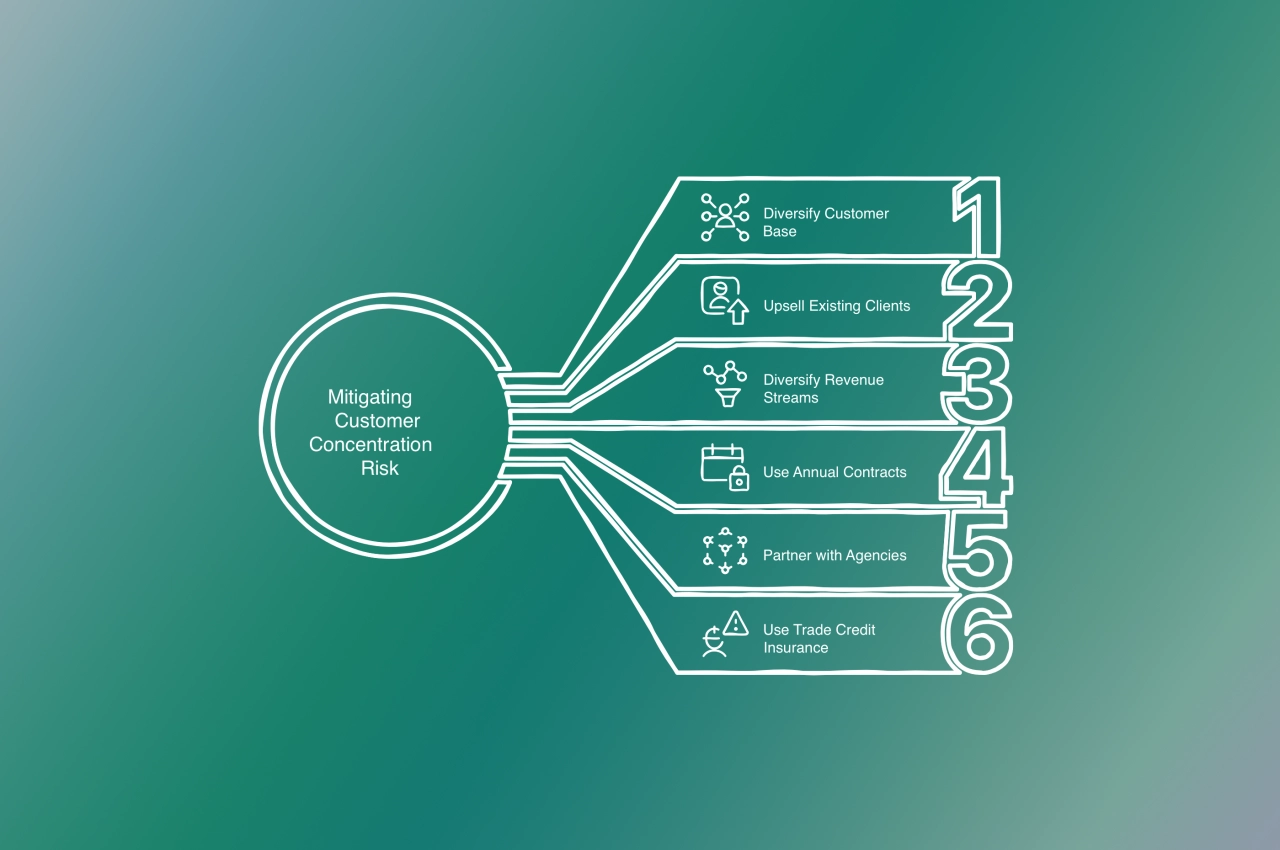

Mitigating customer concentration risk in 6 steps

If you’re already at risk of relying on a handful of customers, here’s how you can mitigate the risk:

Diversify customer base: Are you selling to private customers? It’s easier to find B2B clients, so start focusing on B2B transactions.

Upsell existing clients: Existing customers already love you, so why not upsell them on services they might be interested in?

Diversify revenue streams: Content agencies could diversify their revenue streams by offering a new, but relevant services, such as link building.

Use annual contracts: Pivot to recurring services on an annual basis to hook your clients into long term contracts.

Partner with agencies: Tap into the best white label services of other agencies to offer more services to your clients.

Use trade credit insurance: find an insurance broker and get coverage for your specific industry and concentration risk.

Ready to mitigate customer concentration risk?

High customer concentration can lead to revenue volatility and operational challenges that threaten even the most successful agencies. Now that you understand the risks, it’s time to take decisive action to protect your business.

Here’s your action plan to start reducing concentration risk immediately:

Conduct a concentration audit today: Pull up your last 3 months of revenue data and identify what percentage each client contributes. If any single client exceeds 20–25% of your revenue, you have a clear concentration issue that needs addressing.

Set specific diversification targets: Don’t just aim to reduce concentration—create measurable goals. For example:

Reduce our top client from 35% to under 20% of revenue within 6 months.

Ensure no more than 40% of revenue comes from our top three clients by year-end.

Prioritize sales efforts in new verticals: If most of your clients are in one industry, you’re doubly vulnerable to market shifts. Identify 2–3 new industries where your services translate well, and focus your outreach efforts there.

Create a financial safety net: While you're diversifying, protect yourself with trade credit insurance and establish a cash reserve equal to at least 3 months of the revenue your largest client provides.

Revise your contracts with key clients… Negotiate for longer termination notices, phase-out periods, or early termination fees that give you breathing room if a major client decides to leave.

Remember, addressing concentration risk isn’t just about avoiding disaster—it’s about building a more stable, valuable business. An agency with well-distributed revenue is worth significantly more to potential buyers, attracts better financing terms, and provides you with more strategic freedom.

I’ve hopefully given you a clear roadmap to assess and mitigate your agency’s concentration risk. The best time to start is now, before any warning signs appear. Your future self (and your team) will thank you for taking this important step toward a more resilient business.

Disclaimer: The information provided in this article about customer concentration risk is for general informational and educational purposes only. While we strive to keep the information accurate and up-to-date, business circumstances vary widely, and this content should not be taken as financial, legal, or business advice for your specific situation.