- Target 70% delivery margin on every project—50% sounds healthy but leaves nothing after overhead and unutilized time eat their share.

- Calculate your minimum price before you quote: Delivery Cost ÷ 0.3 + Pass-throughs. Below that number, you’re paying to work.

- Track Average Billable Rate at proposal and project close. The gap between expected and actual is where your margin disappears.

Most agency owners price their services the same way. Look at what competitors charge, estimate some hours, add a buffer, and hope for the best. Then a month later, the project wraps up and the margins aren’t there.

The problem is that pricing without a framework is just guesswork. And guesswork catches up with you—usually in the form of break-even months despite a full pipeline, or that sinking feeling when you realize you’ve been undercharging your best client for two years.

This guide walks you through the fundamentals of agency pricing strategy, from calculating what you actually need to charge to choosing the right pricing model for different types of work. I’ll also cover the most common pricing mistakes and when it makes sense to raise your rates. By the end, you’ll have a practical framework you can apply to every proposal that crosses your desk.

Understanding this topic involves several interconnected concepts:

- Agency Gross Income (AGI)

- Average Billable Rate (ABR)

- Delivery Margin

- Overhead

- Pass-Through Expenses

- Scope Creep

- Rate Card

- Profitability Analysis

Each of these concepts plays a crucial role in the overall topic.

Why pricing strategy matters for agency profitability

No amount of operational efficiency will save you from bad pricing. You can tighten your project management, reduce scope creep, and get your team running like clockwork—but if you priced the work wrong from the start, you’re still going to lose money.

Marcel Petitpas, who runs Parakeeto and has worked with hundreds of agencies on profitability, breaks down the math on The Agency Profit Podcast:

No matter how good your project management is and your scope management and how quick and efficient you are at delivering things—if you’re setting yourself up for failure from the start, you’re going to suffer. And the only way to fix that is to get clear on it.

Marcel Petitpas,

Parakeeto

Marcel Petitpas,

Parakeeto

That clarity comes from understanding one metric above all others: delivery margin.

The delivery margin formula

Delivery margin tells you how much money is left over after you deliver what the client paid for. Not after overhead, not after taxes—just after the direct cost of doing the work. It’s the most important number in agency profitability because everything else flows from it. This is different from traditional cost-plus markup, which adds a percentage to your costs. Delivery margin measures what percentage of revenue you keep after delivery—a higher bar.

The formula is straightforward:

(Agency Gross Income − Delivery Costs) ÷ Agency Gross Income = Delivery Margin

Agency Gross Income (AGI) is what the client pays you minus any pass-through expenses. Pass-throughs are costs that go straight to a third party—ad spend you’re managing, stock footage you’re purchasing, a contractor you’re bringing in. That money was never really yours, so we strip it out.

Delivery costs are what it actually costs your agency to do the work. Mostly, that’s your team’s time multiplied by their cost per hour. If someone earns $100,000 fully loaded and works 2,080 hours per year, their cost per hour is about $48. Put them on a project for 80 hours and your delivery cost for their portion is $3,840.

Here’s an example: a client pays you $15,000 for a project. You have $5,000 in pass-through expenses going to a video production partner. That leaves $10,000 in AGI. Your team spends $4,000 worth of time delivering the work. Your delivery margin is ($10,000 − $4,000) ÷ $10,000 = 60%.

That 60% is what you have left to cover overhead, pay yourself, and hopefully turn a profit.

Why 70% is the target

So what’s a good delivery margin? The short answer is 70% or higher.

That number isn’t arbitrary. Marcel Petitpas breaks down where agency money actually goes:

You’re generally going to spend 20–30% of your agency gross income on overhead, another 10–20% on indirect delivery expenses—your Figma subscription, Adobe Creative Cloud, hosting licenses, stock footage. Then there’s delivery overhead, like your account manager who spends half their time running status meetings across 20 clients. And unutilized time, because your team won’t be billable every hour of every day.

Marcel Petitpas,

Parakeeto

Marcel Petitpas,

Parakeeto

Add that up. If 30% goes to overhead and 20% goes to indirect costs and unutilized time, you need at least 50% delivery margin just to break even. Want 20% profit? Now you need 70%.

Consider an agency aiming for 50% delivery margin—which sounds reasonable until you do the math. They end up closer to 30% on their P&L after all the indirect costs hit. That 30% gets eaten by overhead. No profit, no buffer, no room for a slow month. They’re running at break-even and wondering why growth feels impossible.

The 70% target gives you breathing room. It accounts for the reality that not every hour gets billed, not every project goes perfectly, and you need actual profit to reinvest in the business.

How to calculate your minimum price

Once you know your target margin, you can work backwards to find the minimum price for any engagement. The formula flips the delivery margin calculation:

Delivery Cost ÷ (1 − Margin Target) + Pass-through Expenses = Minimum Price

Say you’re scoping a website project. You estimate 100 hours of work across design and development. Your blended cost per hour is $50, so delivery cost is $5,000. You’re targeting 70% margin, which means dividing by 0.3 (that’s 1 minus 0.7). $5,000 ÷ 0.3 = $16,667. Add $2,000 in hosting setup and stock photography, and your minimum price is $18,667.

That’s the floor. Below that number, the project doesn’t make financial sense for your agency. You can still choose to take it—maybe it’s a foot in the door with a client you really want, or you need the work to keep your team utilized. But you’re making that decision with full clarity on what you’re giving up.

The minimum price formula also helps you scope more honestly. When a client says their budget is $12,000 for that same website project, you immediately know the math doesn’t work at your current cost structure. You either reduce scope, bring in cheaper resources, or walk away. No more hoping it’ll work out.

Once you’ve got your margin targets sorted, the next question is which pricing model to use—retainers, hourly, project-based, value-based, or some hybrid. That decision depends on how predictable your delivery costs are and how much value the client perceives.

For now, let’s focus on where agencies actually lose money: the mistakes that undermine even a solid pricing strategy.

The 6 most common pricing mistakes

These are the pricing patterns Marcel and the Parakeeto team see tanking margins over and over again.

Mistake #1: Pricing based on guesswork

Marcel calls this vibe pricing and it’s exactly what it sounds like. You look at what competitors charge, think about what the client can probably afford, and stick your finger in the air. Maybe you apply a rate card from your old agency job without questioning whether those rates ever made sense.

The problem isn’t that you’ll always get it wrong. Sometimes you’ll land in the right ballpark. The problem is you won’t know whether you got it right or wrong until months later when you’re reviewing the project P&L and wondering where the margin went.

Kristen Kelly, who works with agencies at Parakeeto, puts it simply:

Pricing is one of those things that tends to get overcomplicated because most agencies don’t have a framework for it. Without a framework, there isn’t an anchor and it’s easy to arrive at a price that doesn’t set the agency up for success.

Kristen Kelly,

Parakeeto

Kristen Kelly,

Parakeeto

Mistake #2: Undercharging and over-delivering

Most agencies don’t realize how much margin they actually need. They aim for 50% delivery margin thinking that sounds healthy, then wonder why there’s nothing left at the end of the year.

Marcel has seen this play out repeatedly: “I spoke to a firm where they were essentially aiming for a 50% direct delivery margin. Immediately I knew that’s a problem—if you’re aiming for 50%, you’re probably ending up at closer to 30% on the P&L, which means probably all of that is going to paying for overhead. And that is exactly what was going on—they were running at break even.”

The over-delivering part compounds the problem. Scope creep happens on every project. The question is whether you’re tracking it and having conversations about it, or just absorbing it into your already-thin margins.

One practical fix comes from Jason Swank: the $0 change order. When you do something extra for a client, create a change order showing what it would have cost, cross out the number, mark it as zero, and get them to sign it.

Do that a few times and you’ve established that extras are extras—not just part of the deal. It also forces you to actually notice when scope is expanding.

Mistake #3: Confusing pricing and scoping

These are two different questions. Pricing asks: what will the client pay? Scoping asks: what will it cost us to deliver? They should inform each other, but they’re not the same exercise.

The mistake happens when they get linked too tightly. A client says they can only pay $8,000 instead of $10,000. Instead of reducing scope, the agency just lowers the hours in the estimate without changing what they’re actually going to deliver. Marcel sees this constantly: “They lie to themselves. They give the client what they want, and a month later when they’ve gone over budget, they’ve forgotten that decision was made consciously at the start.”

If you’re going to discount, discount. But don’t pretend the work will magically take fewer hours because the client has a smaller budget. Either reduce scope to match the price, or acknowledge that you’re taking a lower margin on this one and document why.

Mistake #4: Ignoring overhead in your calculations

Some agencies try to get sophisticated and load overhead into their hourly cost calculations. They figure out their rent, software subscriptions, and admin salaries, divide it all up, and add it to what each team member “costs” per hour.

Marcel recommends against this approach. It’s time-consuming, the numbers are constantly changing, and it creates noise that makes it harder to evaluate individual project performance. Did this project underperform because of delivery issues, or because overhead spiked that month for unrelated reasons?

A better approach is to bake overhead into your margin target. If you know overhead typically runs 25–30% of AGI and you want 15–20% profit, then you need 70%+ delivery margin on your projects. That single target number accounts for everything without requiring you to recalculate loaded costs every month.

Mistake #5: Using the wrong pricing model for the work

Hourly billing on a high-value strategy engagement leaves money on the table. Fixed pricing on an open-ended R&D project exposes you to unlimited risk. The pricing model needs to match the nature of the work.

This one is worth its own deep dive—our guide to agency pricing models covers the framework for matching pricing models to different situations.

Mistake #6: Fear of raising prices

This one’s psychological. You know your rates are too low. Your best client has been on the same pricing for three years while your costs have gone up. But raising the issue feels risky, so you avoid it.

Marcel reframes the math:

If you lose 10% of clients but raise price by 30%, you’ve still gained 20% upside. In the vast majority of pricing increase studies, there’s just massive upside to increasing price.

Marcel Petitpas,

Parakeeto

Marcel Petitpas,

Parakeeto

Agencies that avoid the conversation end up with a portfolio of legacy clients on outdated rates, subsidized by the margin from new business. Eventually the math catches up. The best time to have the conversation is when you’re busy. When you have more demand than capacity, a price increase conversation is low-risk. If that client decides to leave, you’ve freed up capacity for work at better rates. If they stay, you’ve improved your margins on existing business. The worst time to raise prices is when you need the client to keep the lights on. If you’re in that position, focus on new business at better rates first, then revisit legacy pricing once you have some cushion.

How to track whether your pricing is working

You can set the right price and still lose money if you’re not tracking what actually happens on each project. The gap between quoted price and actual delivery cost is where margin disappears—and most agencies don’t catch it until the quarterly P&L arrives.

Average billable rate

Average Billable Rate (ABR) is the simplest metric that tells you if your pricing is healthy. The formula: Agency Gross Income divided by hours worked.

Calculate ABR for every project at the proposal stage. If your team costs $50/hour on average and you need 70% margin, your ABR floor is around $165/hour. Any project that comes in below that number is a red flag worth examining.

Then calculate it again when the project closes. Compare expected ABR to actual ABR. If there’s a gap, figure out why. Did scope expand? Did the work take longer than estimated? Did you quote too low from the start? Each answer points to a different fix.

The quick margin check

Marcel calls this Kirkland brand delivery margin—a fast approximation when you don’t have time for detailed analysis.

Take your average cost per hour and compare it to your average billable rate. If your cost is $50 and your ABR is $150, you’re at roughly 67% delivery margin. Close to the 70% target but not quite there. If your ABR is $120, you’re at 58%—that’s a problem.

This isn’t precise enough for financial reporting, but it’s precise enough to catch pricing problems before they compound across multiple projects.

Know your floor

Every agency should know the ABR below which they won’t take work. Not as a loose guideline—as an actual number that everyone involved in scoping and pricing knows by heart.

When a potential project comes in below that floor, you have three options: negotiate the price up, reduce scope until the math works, or walk away. What you don’t do is take it anyway and hope for the best. That’s how agencies end up busy and broke.

Frequently asked questions

Is hourly pricing bad for agencies?

No. Billion-dollar consulting firms run on time and materials. The key is maintaining 70% margin on every hour you sell, not the pricing model itself.

How often should I raise prices?

Review pricing annually at minimum. The best time to raise rates is when you’re busy—you have leverage, and losing a client frees capacity for better-margin work.

How do I handle price objections from clients?

Know your numbers cold. When you’ve calculated delivery margin and minimum price beforehand, you’re stating what the work costs—not negotiating. If budget doesn’t match, reduce scope rather than price.

Should I always offer three pricing tiers?

Only if you genuinely have different service levels. Padding options just to make the middle one look good often backfires—clients see through it. If you do offer tiered pricing, make sure each tier delivers distinct value.

How do I price productized services?

The same delivery margin math applies—target 70%+ margin per package. Calculate it once when designing the package rather than per client. See our guide to productized services for the full framework.

How do I present pricing to a client?

State the number clearly and stop talking. If they push back, ask whether it’s budget constraints or value skepticism—each requires a different response.

What if a project goes over the hours I quoted?

Three options: absorb it and learn, discuss additional budget for remaining scope, or reduce deliverables to fit the original quote. The worst choice is silently eating the overrun.

Getting your pricing right

Agency pricing doesn’t have to be complicated. Calculate your delivery margin before you send the proposal. Target 70% or higher. Know your minimum price and don’t go below it without a conscious decision about why.

The agencies that struggle with profitability aren’t usually bad at delivery. They’re bad at pricing. They set themselves up to fail before the project even starts, then blame execution when the margins aren’t there.

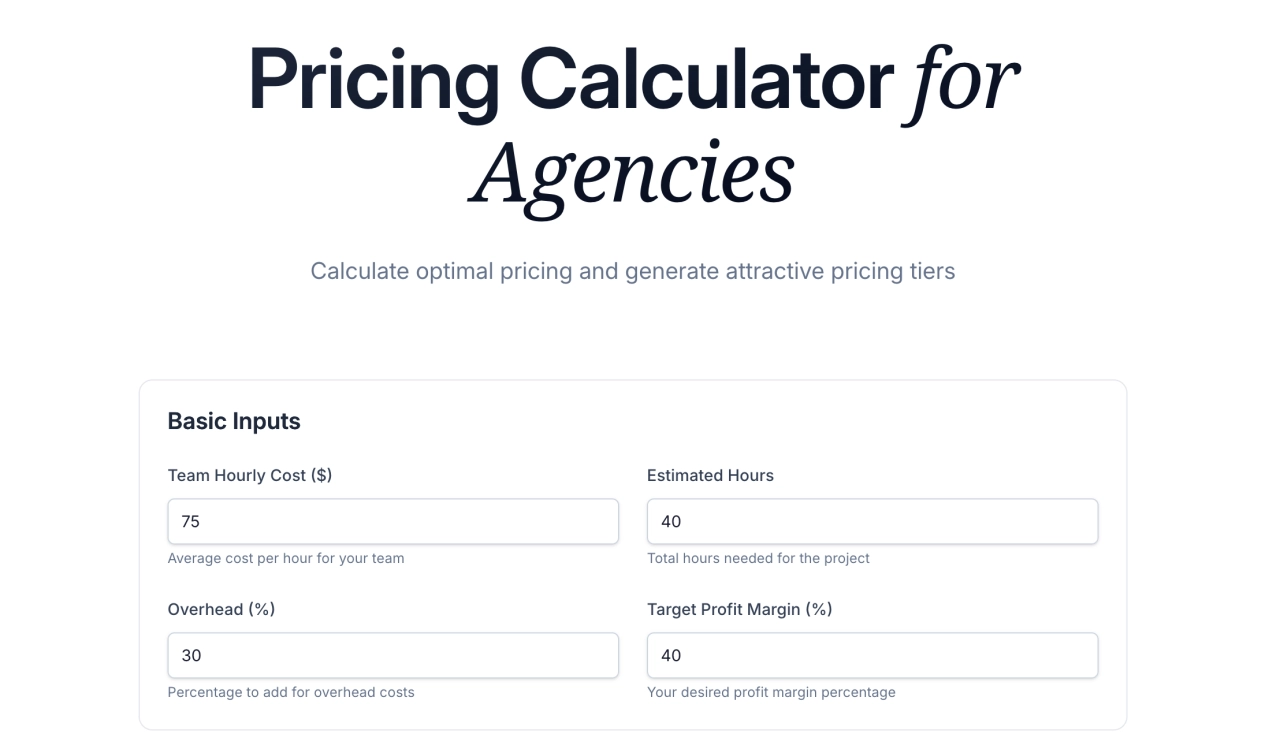

Calculate optimal pricing for your agency

You can fix that with a calculator and a bit of discipline. Our agency pricing calculator does the delivery margin math for you—plug in your numbers and see whether your next proposal hits the 70% target. Compare expected margin to actual margin when those projects close. Adjust your pricing until the math works.