Stripe Integration

SPP is powerful as a client portal but using it together with Stripe payments takes your client experience to the next level.

To connect Stripe go to Settings → Integrations → Stripe and click the Connect button. You’ll be taken to stripe.com where you can select your existing Stripe account or create a new one.

If Stripe doesn’t let you choose your existing account to connect, that means your Stripe account is currently managed by another platform. In that case use the API integration option from SPP – it works just as well.

Tip: We recommend disabling receipt emails in Stripe because those emails will also be sent from SPP.

Importing Stripe Data

You can import Stripe customers and subscriptions that have been set up outside of SPP. Once you’ve connected Stripe, you’ll see an “Import Data” button on the top right.

Import customers only

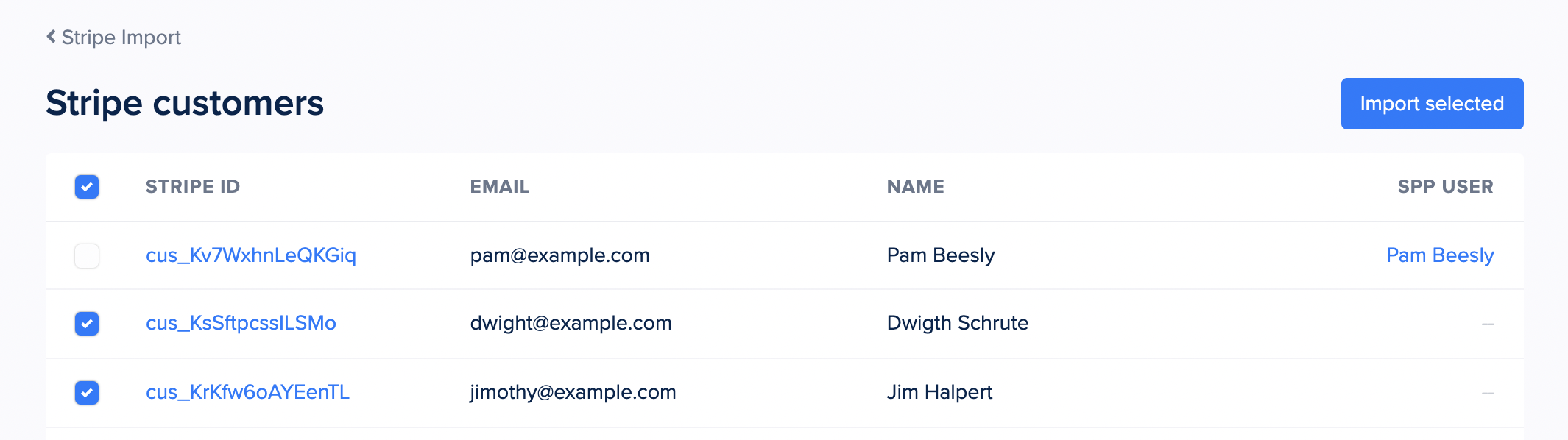

The benefit of importing your existing customers from Stripe is they will be able to use their saved payment methods in SPP.

We’ll scan your Stripe customers and let you choose which ones you’d like to import. Any customers already found in your workspace will be not be selectable:

Import subscriptions

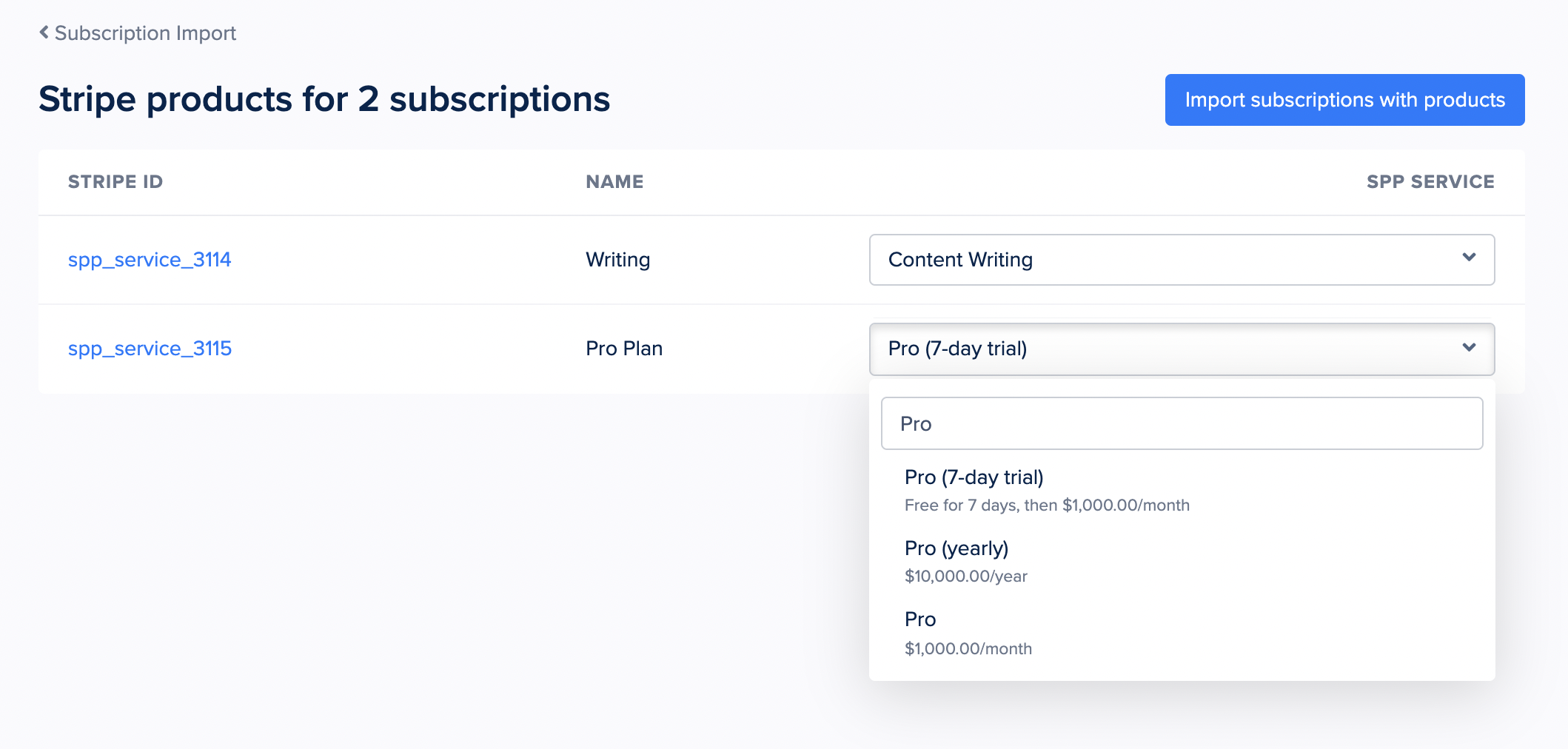

Similar to customers, you’re able to select which subscriptions will be imported.

On the next page you’ll need to match the Stripe plans with their corresponding SPP services:

Click Import and you’re done. This will run the import from Stripe in the background and send you an email once the process is complete, at which point all your selected subscriptions will be in SPP.

Client Side

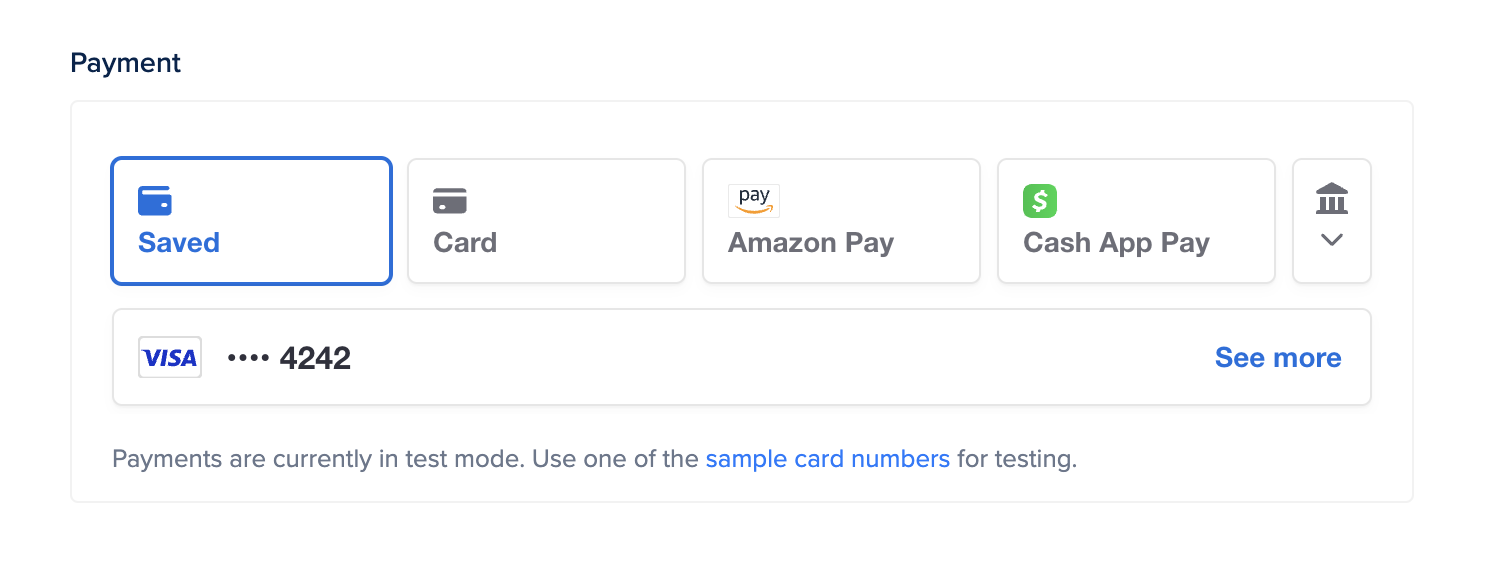

Managing saved cards

Clients can manage their saved payment methods from the /stripe/manage page in your portal.

This link is automatically added to your Client Portal’s sidebar menu when you enable the Stripe module.

Managing subscriptions

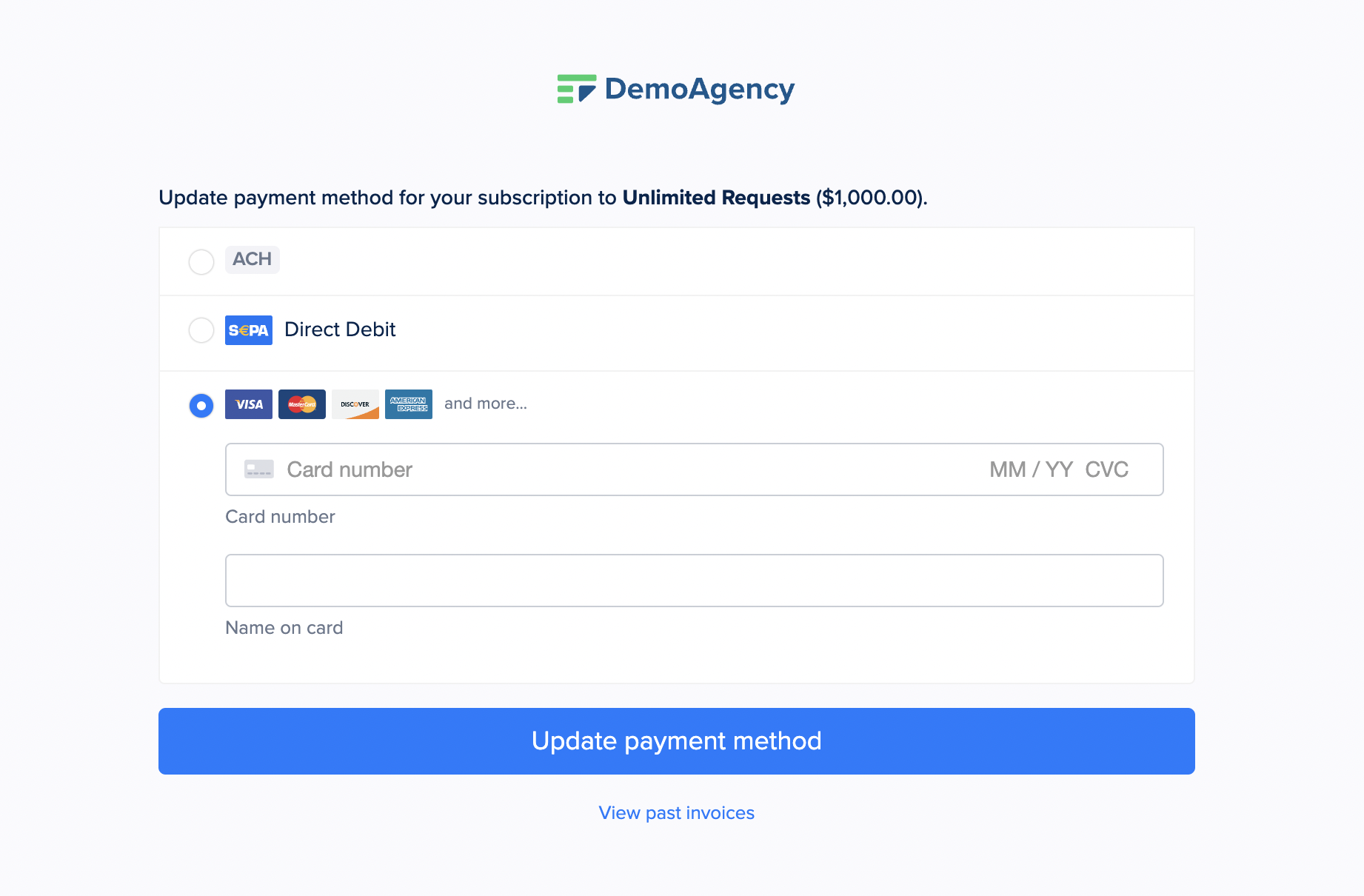

Clients can manage their Stripe subscriptions at /pay/subscription/sub_xyz. We’ll automatically email this link to clients whose subscription payments have failed.

Unlike the payment method page in the portal, this page works even if a client is not logged. That makes it easier for clients to fix their billing.

Payment Methods

You can accept payments from your clients through different methods based on your Stripe account location, like:

Credit Card

ACH

SEPA Debit

Klarna

Google Pay

Apple Pay (Requires adding a Payment Method Domain in Stripe)

You can see all payment methods available to you by visiting this page.

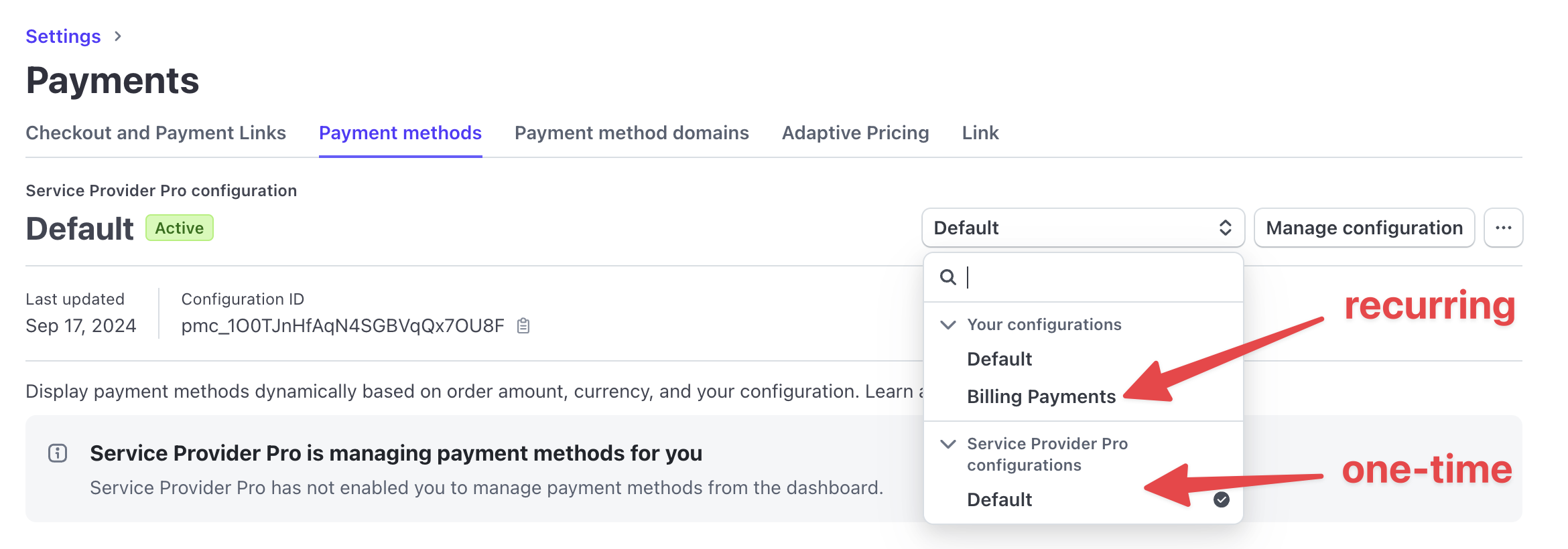

To enable payment methods you need to edit these two payment configurations in Stripe:

A Note About 3D Secure (3DS)

3D secure is a process where customers get redirected to their bank before confirming a card payment. It provides an additional layer of security to the customer, and helps protect you as the merchant from chargebacks.

Strong Customer Authentication is mandatory in Europe and India. We’ve updated our integration to support it via the updated 3D secure 2.0.